In a stunning reversal of conventional wisdom and initial market assumptions, gold prices have not experienced a historic tumble, but rather a historic surge, reaching unprecedented record highs as of October 14, 2025. The precious metal has defied expectations of a decline driven by a hawkish Federal Reserve and a resurgent U.S. dollar. Instead, a dovish shift in the Fed's monetary policy, coupled with a weakening dollar and escalating global uncertainties, has propelled gold into an unparalleled rally, profoundly impacting global investors and markets from Asia to Europe.

This unexpected ascent of gold signals a significant re-evaluation of safe-haven assets and investor sentiment, highlighting a pervasive flight to safety amidst a complex global economic and geopolitical landscape. The implications are far-reaching, challenging traditional investment strategies and forcing a recalibration of portfolios worldwide.

The Golden Ascent: Detailing an Unprecedented Rally

The year 2025 has marked a watershed moment for gold, with the yellow metal embarking on an extraordinary and sustained rally that has seen its price soar to all-time highs. On October 14, 2025, spot gold touched an astonishing peak of $4,179.48 per ounce, representing a remarkable 57% gain year-to-date. This monumental achievement saw gold breach the $4,000 per ounce threshold for the first time in history in early October, cementing its status as a premier safe-haven asset.

The primary catalysts behind this historic surge are a decisively dovish Federal Reserve and a weakening U.S. dollar, a direct contradiction to the initially anticipated hawkish stance and dollar resurgence. The Federal Reserve, grappling with rising job market pressures and persistent inflation, has adopted an increasingly accommodative monetary policy. Following an interest rate cut in September 2025, market participants are now pricing in a near-certainty (97-99% probability) of another 25-basis-point reduction in October, with strong indications of further cuts before year-end. This aggressive easing strategy has significantly diminished the opportunity cost of holding non-yielding gold, making it a more attractive investment compared to lower-yielding bonds.

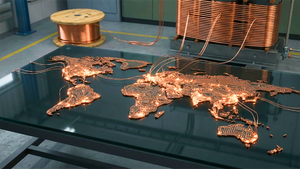

Concurrently, the U.S. dollar has experienced a multi-month decline in strength, further bolstering gold's appeal. As gold is primarily priced in U.S. dollars, a weaker dollar makes the metal more affordable and appealing to international buyers holding other currencies, thereby stimulating global demand. This inverse relationship has been a crucial tailwind for gold's rally. Adding to this, central banks globally are actively diversifying their reserves away from the U.S. dollar, with gold's share of global foreign exchange reserves reaching a record 24%, providing robust institutional support for its price. Beyond monetary policy, escalating geopolitical tensions, particularly renewed U.S.-China trade conflicts and ongoing global strife, coupled with persistent inflation concerns and burgeoning global debt, have collectively fueled market anxiety, driving investors en masse to the perceived safety of gold.

Beneficiaries and Shifting Fortunes in a Golden Era

The historic surge in gold prices has created a clear divide between winners and losers in the financial markets, with gold-centric companies and investors in precious metals reaping substantial rewards.

Gold mining companies are undoubtedly among the primary beneficiaries. Firms like Barrick Gold (NYSE: GOLD), Newmont Corporation (NYSE: NEM), and AngloGold Ashanti (NYSE: AU) are reporting record profits and robust cash flows, buoyed by the significantly higher selling price of their primary commodity. This windfall allows them to potentially increase exploration budgets, pay down debt, or return capital to shareholders through dividends and buybacks. Similarly, Exchange Traded Funds (ETFs) that track gold prices, such as SPDR Gold Shares (NYSE: GLD) and iShares Gold Trust (NYSE: IAU), have seen massive inflows and significant appreciation, offering investors direct exposure to the rally without the complexities of physical storage. Investors who had prudently diversified into gold as a hedge against economic uncertainty are also seeing substantial gains, validating their long-term investment strategies.

Conversely, the impact on companies and sectors not directly tied to gold is more nuanced. A weakening U.S. dollar, while beneficial for gold, can have mixed effects on multinational corporations. U.S. companies with significant international operations may see their foreign earnings translate into higher dollar values, boosting reported profits. However, a weaker dollar also makes imports more expensive, potentially impacting businesses reliant on foreign goods. While there are no direct "losers" from a gold surge in the same way there would be from a tumble, the underlying factors driving gold's rally – a dovish Fed, inflation, and geopolitical instability – could signal challenges for sectors sensitive to economic slowdowns or higher input costs. Financial institutions holding significant dollar-denominated assets might face pressure from the weakening currency trend.

Broader Implications: Gold's Role Reimagined

Gold's historic rally is more than just a market event; it signifies profound shifts within the global financial landscape, challenging established norms and reflecting deeper systemic anxieties. This surge firmly re-establishes gold's role as the ultimate safe-haven asset, particularly as confidence in traditional financial systems and fiat currencies appears to wane amidst persistent inflation and unprecedented global debt levels exceeding $320 trillion.

The event fits squarely into a broader trend of de-dollarization and diversification away from the U.S. dollar as the world's primary reserve currency. The aggressive gold accumulation by central banks, as evidenced by gold's record share of global foreign exchange reserves, underscores a strategic pivot by nations seeking to de-risk their portfolios from potential U.S. economic and political vulnerabilities. This trend has significant geopolitical implications, potentially altering the balance of power in international finance. The ripple effects extend to other precious metals, with silver hitting an all-time high of $52.9 per ounce, and platinum and palladium also experiencing spillover investment flows, indicating a broader flight to tangible assets. Historically, gold rallies often coincide with periods of high inflation or significant geopolitical instability, such as the 1970s oil crises or the post-2008 financial crisis era. This current surge, driven by a confluence of monetary easing, currency depreciation, and global conflicts, mirrors these historical precedents, reinforcing gold's enduring appeal during times of uncertainty. Regulatory bodies globally will be closely monitoring capital flows and market stability, particularly in emerging markets where currency fluctuations can have more pronounced effects.

The Road Ahead: Navigating a Golden Future

As gold continues its unprecedented rally, the immediate and long-term outlook presents both opportunities and challenges for investors and markets. In the short term, the market will be keenly watching for further signals from the Federal Reserve regarding its monetary policy trajectory. Any indication of a pause or reversal in rate cuts could trigger profit-taking and a temporary correction in gold prices. However, with the current dovish stance firmly entrenched and global uncertainties persisting, the momentum for gold appears strong.

Looking ahead, the long-term possibilities for gold remain robust. Should geopolitical tensions persist or escalate, and if central banks continue their path of monetary easing and dollar diversification, gold could maintain its elevated status. This scenario suggests a sustained period where gold acts as a core component of diversified portfolios, not just as a temporary hedge. For investors, this creates opportunities in gold-backed instruments, mining equities, and potentially other precious metals. However, the rapid appreciation also introduces challenges, including the risk of overvaluation and the potential for sharper corrections should market sentiment shift. Strategic pivots for investors might involve rebalancing portfolios to reflect gold's enhanced role, while companies in the mining sector may need to adapt to sustained high operating costs and potential labor market pressures, even with higher commodity prices. Emerging market economies, particularly those with significant gold reserves or strong trade ties to gold-producing nations, could see their economic fortunes influenced by the metal's trajectory.

A New Golden Age: Market Redefined

The historic surge in gold prices, reaching over $4,179 per ounce, represents a pivotal moment in financial history, fundamentally redefining the metal's role in the global economy. This rally, driven by a dovish Federal Reserve, a weakening U.S. dollar, and a confluence of geopolitical and inflationary pressures, unequivocally establishes gold as the paramount safe-haven asset of our time. It underscores a collective flight to safety and a growing distrust in traditional financial stability, prompting central banks and individual investors alike to re-evaluate their asset allocation strategies.

Moving forward, the market is entering a new era where gold's influence is likely to be more pronounced and sustained. This is not merely a cyclical upturn but potentially a structural shift, reflecting deeper anxieties about currency stability and global economic resilience. Investors should remain vigilant, closely monitoring the Federal Reserve's future policy decisions, global geopolitical developments, and inflation data, all of which will continue to exert significant influence on gold's trajectory. The lasting impact of this surge will likely be a permanent recalibration of gold's perceived value and its indispensable role in safeguarding wealth in an increasingly uncertain world.

This content is intended for informational purposes only and is not financial advice