Regional banking company Trustmark (NASDAQ: TRMK) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 5.2% year on year to $207.1 million. Its non-GAAP profit of $0.97 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy Trustmark? Find out by accessing our full research report, it’s free.

Trustmark (TRMK) Q4 CY2025 Highlights:

- Net Interest Income: $165.8 million vs analyst estimates of $166.6 million (6.4% year-on-year growth, in line)

- Net Interest Margin: 3.8% vs analyst estimates of 3.8% (in line)

- Revenue: $207.1 million vs analyst estimates of $204.4 million (5.2% year-on-year growth, 1.3% beat)

- Efficiency Ratio: 62.7% vs analyst estimates of 63.2% (53.2 basis point beat)

- Adjusted EPS: $0.97 vs analyst estimates of $0.91 (6.4% beat)

- Tangible Book Value per Share: $30.28 vs analyst estimates of $30.27 (13.5% year-on-year growth, in line)

- Market Capitalization: $2.45 billion

Duane A. Dewey, President and CEO, commented, “Trustmark achieved record earnings in 2025, reflecting significant achievement across our diverse financial services businesses. Our traditional banking business drove continued loan and deposit growth, a strong net interest margin and solid credit quality. Mortgage banking achieved increased production and significant improvement in profitability while revenue in our wealth management business reached an all-time high.

Company Overview

Tracing its roots back to 1889 in Mississippi, Trustmark (NASDAQ: TRMK) is a financial services organization providing banking, wealth management, insurance, and mortgage services across five southeastern states.

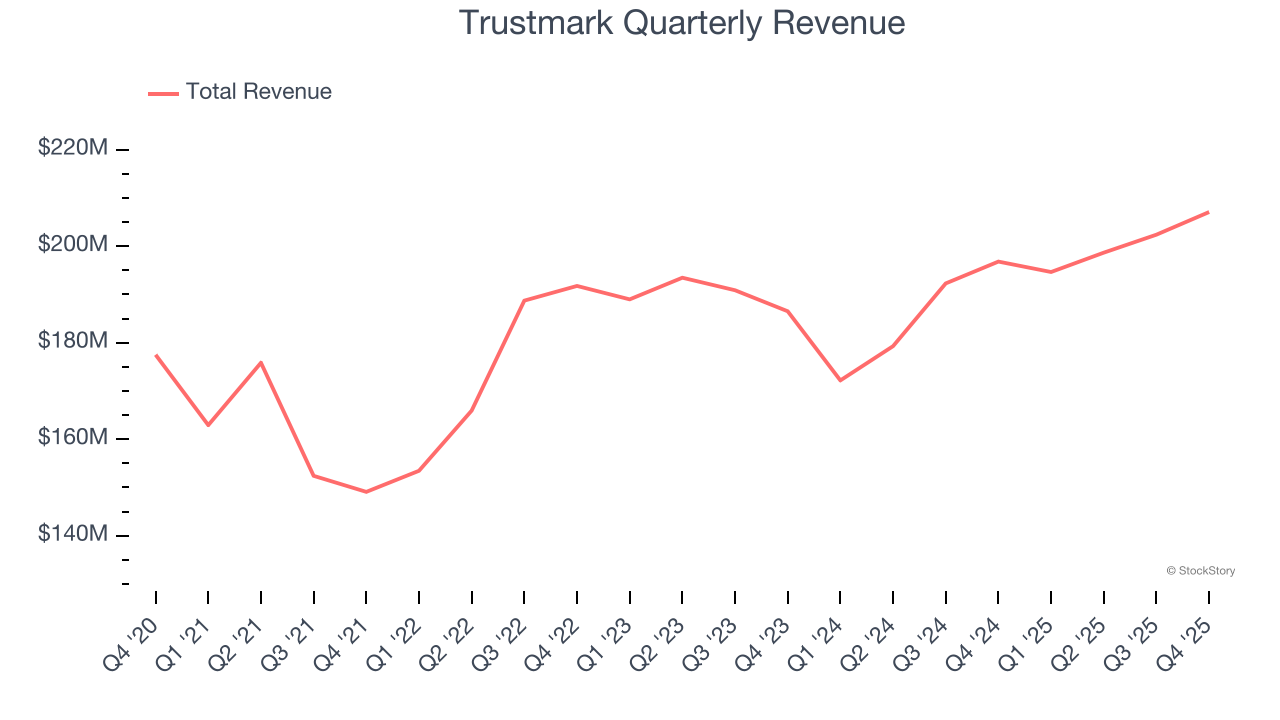

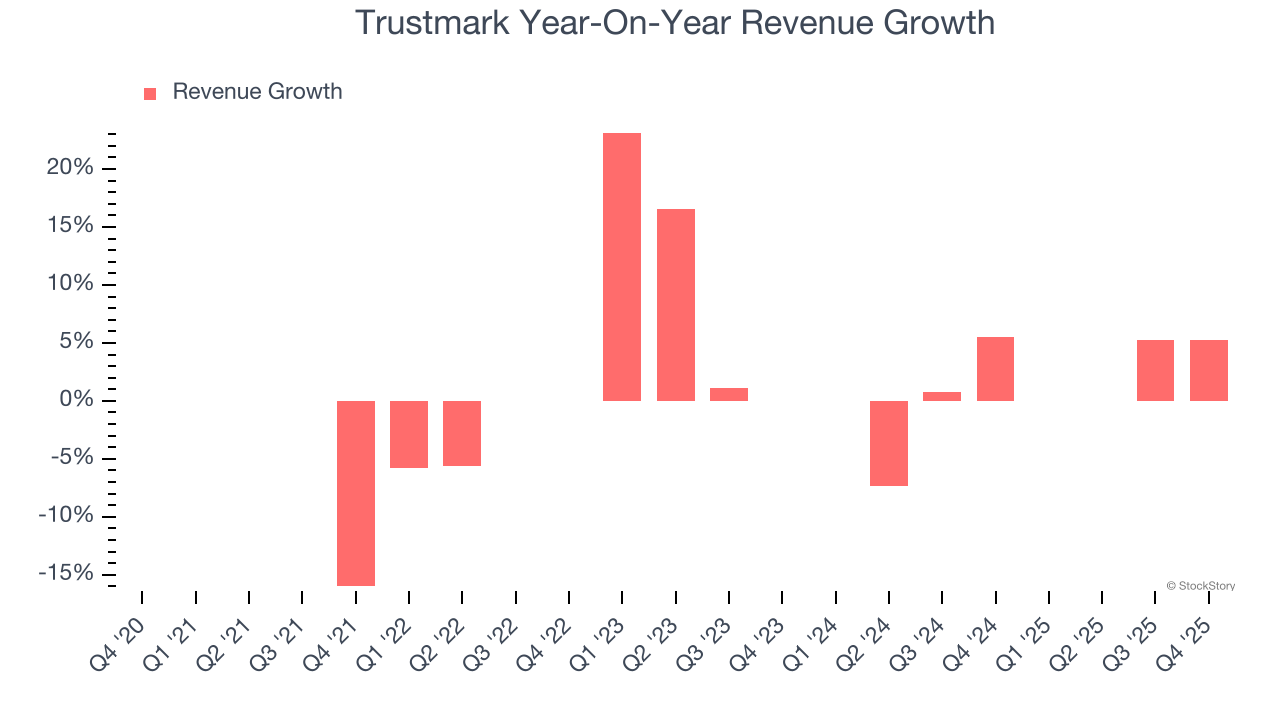

Sales Growth

Two primary revenue streams drive bank earnings. While net interest income, which is earned by charging higher rates on loans than paid on deposits, forms the foundation, fee-based services across banking, credit, wealth management, and trading operations provide additional income. Regrettably, Trustmark’s revenue grew at a sluggish 2.7% compounded annual growth rate over the last five years. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Trustmark’s annualized revenue growth of 2.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Trustmark reported year-on-year revenue growth of 5.2%, and its $207.1 million of revenue exceeded Wall Street’s estimates by 1.3%.

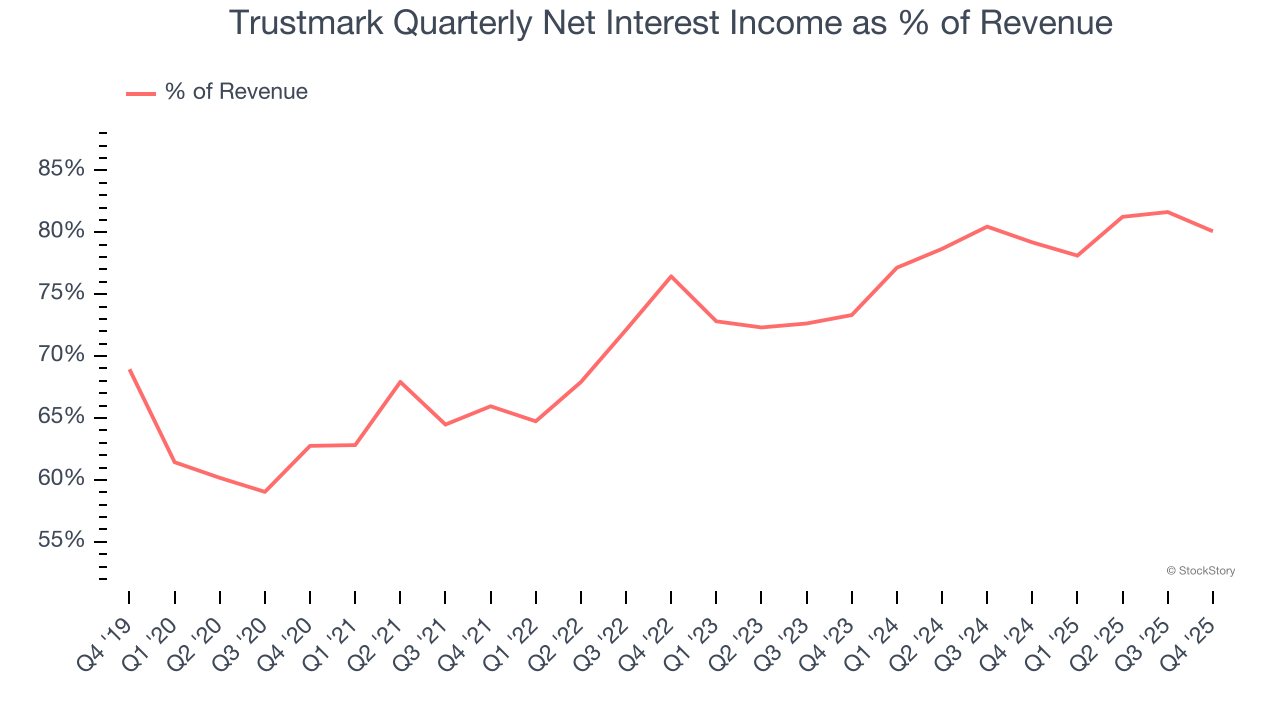

Net interest income made up 73.5% of the company’s total revenue during the last five years, meaning lending operations are Trustmark’s largest source of revenue.

Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

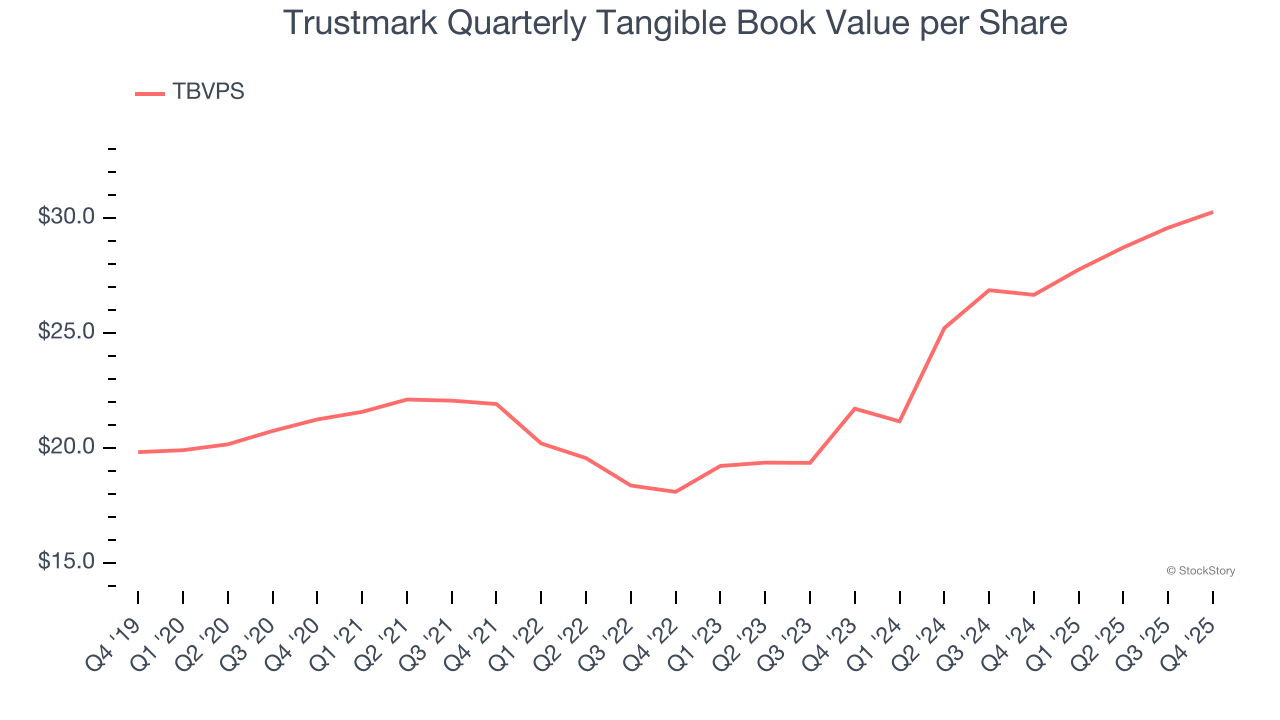

Tangible Book Value Per Share (TBVPS)

Banks are balance sheet-driven businesses because they generate earnings primarily through borrowing and lending. They’re also valued based on their balance sheet strength and ability to compound book value (another name for shareholders’ equity) over time.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Other (and more commonly known) per-share metrics like EPS can sometimes be murky due to M&A or accounting rules allowing for loan losses to be spread out.

Trustmark’s TBVPS grew at an impressive 7.3% annual clip over the last five years. TBVPS growth has also accelerated recently, growing by 18% annually over the last two years from $21.73 to $30.28 per share.

Over the next 12 months, Consensus estimates call for Trustmark’s TBVPS to grow by 9.2% to $33.06, paltry growth rate.

Key Takeaways from Trustmark’s Q4 Results

It was good to see Trustmark narrowly top analysts’ revenue expectations this quarter. On the other hand, its net interest income was in line. Zooming out, we think this was a mixed quarter. The stock remained flat at $41.13 immediately after reporting.

Is Trustmark an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).