Digital operations platform PagerDuty (NYSE: PD) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 6.4% year on year to $123.4 million. The company expects next quarter’s revenue to be around $125 million, close to analysts’ estimates. Its non-GAAP profit of $0.30 per share was 49.3% above analysts’ consensus estimates.

Is now the time to buy PagerDuty? Find out by accessing our full research report, it’s free.

PagerDuty (PD) Q2 CY2025 Highlights:

- Revenue: $123.4 million vs analyst estimates of $123.7 million (6.4% year-on-year growth, in line)

- Adjusted EPS: $0.30 vs analyst estimates of $0.20 (49.3% beat)

- Adjusted Operating Income: $31.41 million vs analyst estimates of $20.81 million (25.4% margin, 50.9% beat)

- The company reconfirmed its revenue guidance for the full year of $495 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $1.02 at the midpoint, a 4.6% increase

- Operating Margin: 2.9%, up from -13.8% in the same quarter last year

- Free Cash Flow Margin: 24.5%, similar to the previous quarter

- Customers: 15,322, up from 15,247 in the previous quarter

- Billings: $113.9 million at quarter end, up 3.3% year on year

- Market Capitalization: $1.49 billion

Company Overview

Born from the frustration of developers being woken up by unprioritized alerts, PagerDuty (NYSE: PD) is a digital operations management platform that helps organizations detect and respond to IT incidents, outages, and other critical issues in real-time.

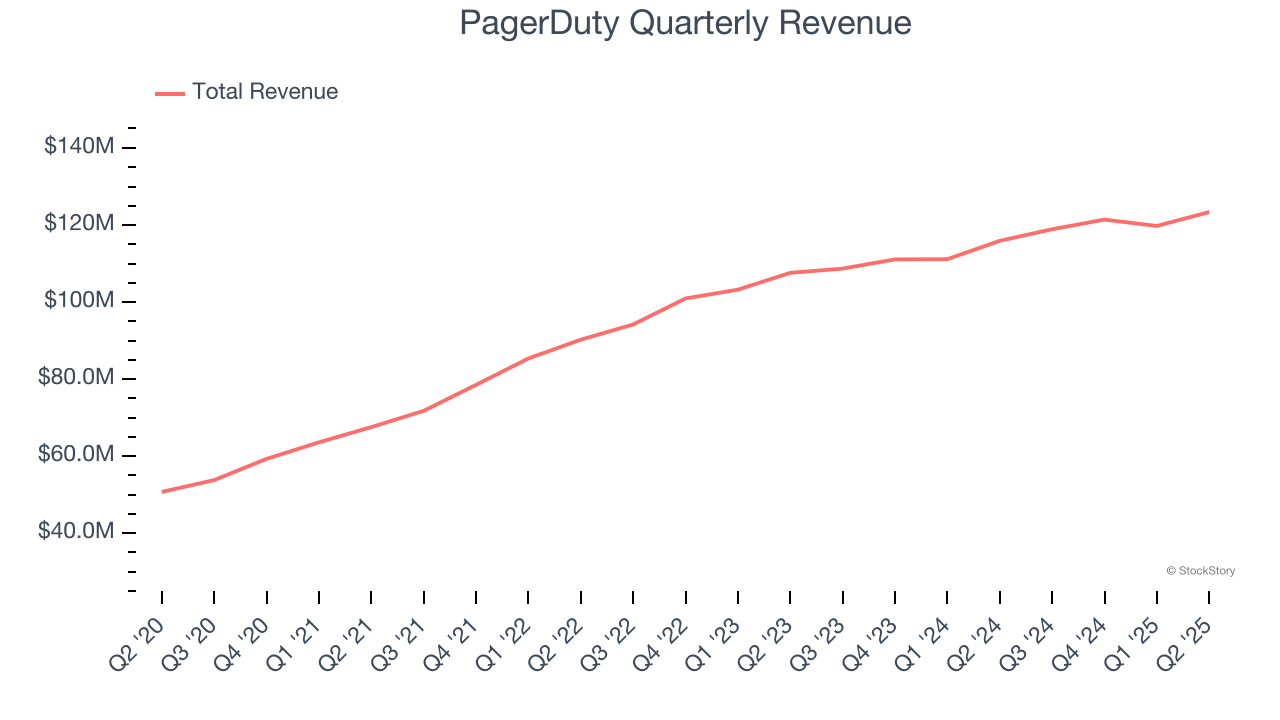

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, PagerDuty grew its sales at a 14.1% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, PagerDuty grew its revenue by 6.4% year on year, and its $123.4 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 5.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.3% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

PagerDuty’s billings came in at $113.9 million in Q2, and over the last four quarters, its growth was underwhelming as it averaged 6% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

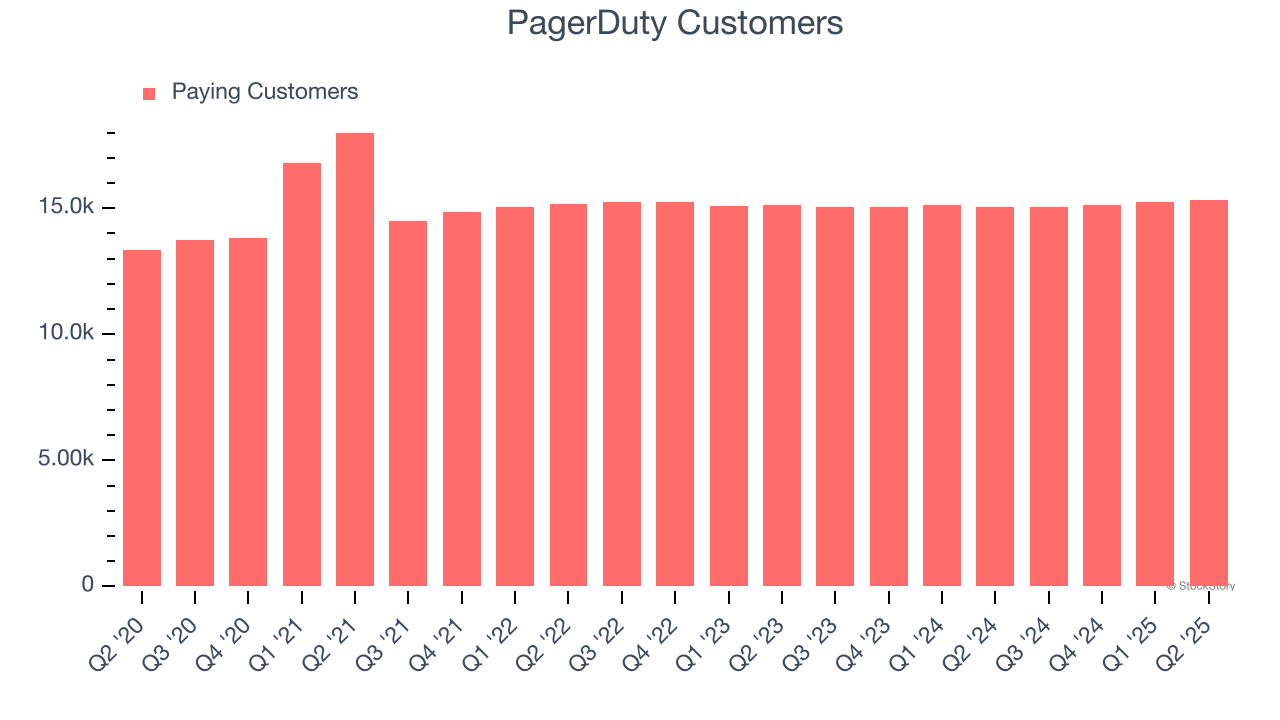

Customer Base

PagerDuty reported 15,322 customers at the end of the quarter, a sequential increase of 75. That’s a little worse than last quarter but quite a bit above what we’ve observed over the last 12 months. We’ve no doubt shareholders would like to see the company accelerate its sales momentum.

Key Takeaways from PagerDuty’s Q2 Results

We were impressed by PagerDuty’s convincing operating profit beat despite just in line revenue in the quarter. On the other hand, billings fell short of Wall Street’s estimates and the company's EPS guidance for next quarter missed. Overall, this was a softer quarter. The stock traded down 6.5% to $14.60 immediately following the results.

PagerDuty underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.