Solar energy systems company Shoals (NASDAQ: SHLS) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 32.9% year on year to $135.8 million. On top of that, next quarter’s revenue guidance ($145 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $0.12 per share was in line with analysts’ consensus estimates.

Is now the time to buy Shoals? Find out by accessing our full research report, it’s free for active Edge members.

Shoals (SHLS) Q3 CY2025 Highlights:

- Revenue: $135.8 million vs analyst estimates of $131.1 million (32.9% year-on-year growth, 3.6% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.13 (in line)

- Adjusted EBITDA: $31.97 million vs analyst estimates of $32.7 million (23.5% margin, 2.2% miss)

- Revenue Guidance for Q4 CY2025 is $145 million at the midpoint, above analyst estimates of $140.3 million

- EBITDA guidance for the full year is $107.5 million at the midpoint, below analyst estimates of $108.1 million

- Operating Margin: 13.7%, up from 4.4% in the same quarter last year

- Free Cash Flow Margin: 6.6%, down from 13% in the same quarter last year

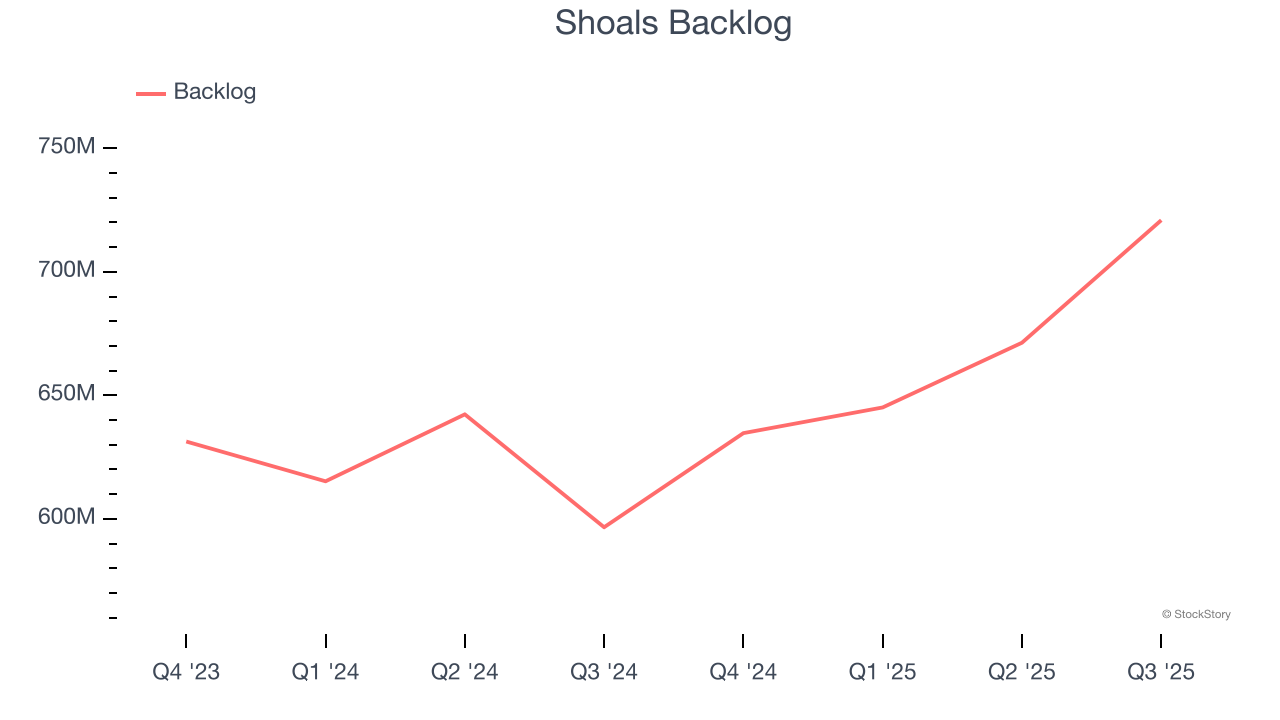

- Backlog: $720.9 million at quarter end, up 20.8% year on year

- Market Capitalization: $1.73 billion

“I’m very pleased with our third quarter’s performance, delivering revenue above the high-end of our guided range, record backlog and awarded orders of $720.9 million, and a book to bill of 1.4. We are executing our strategic plan of accelerating growth within our core domestic utility scale solar market and expanding our offering into attractive high growth applications. We remain encouraged by the strong customer reception of new products and capabilities, which allows us to continue to both grow share in key segments and diversify our business into new end markets,” said Brandon Moss, CEO of Shoals.

Company Overview

Started in Huntsville, Alabama, Shoals (NASDAQ: SHLS) designs and manufactures products that make solar energy systems work more efficiently.

Revenue Growth

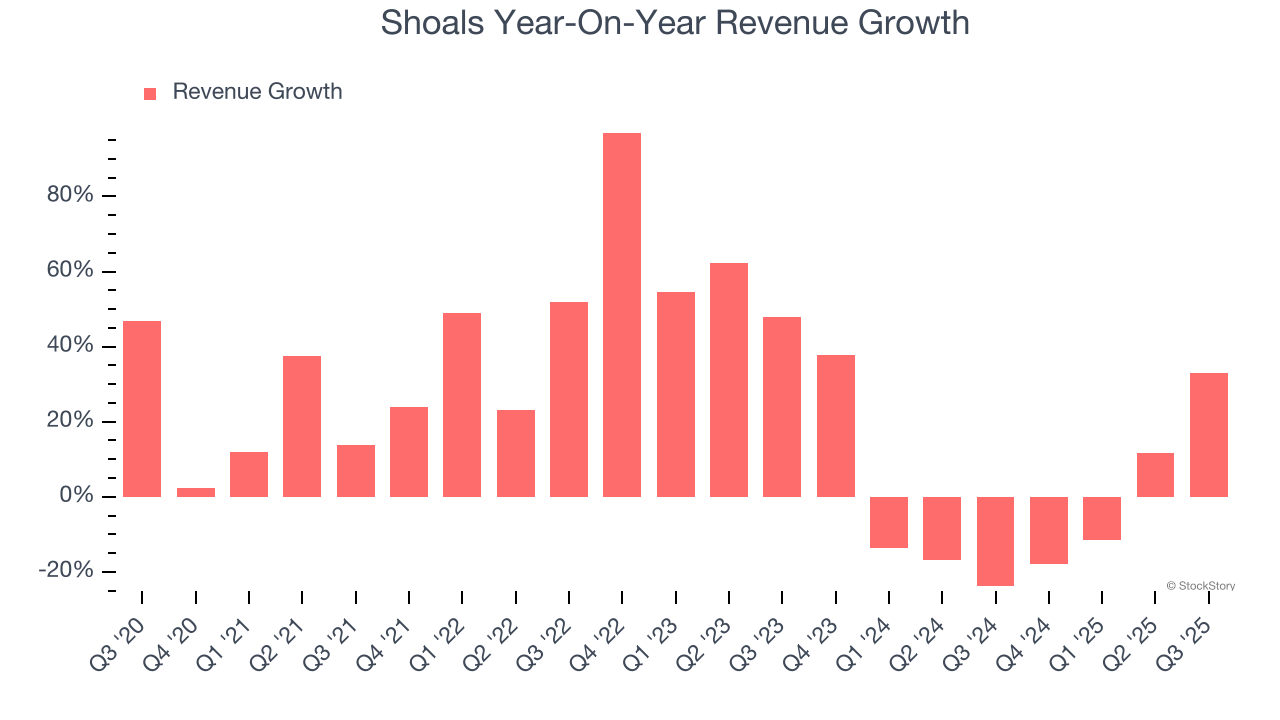

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Shoals grew its sales at an incredible 20% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Shoals’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 2.1% over the last two years. Shoals isn’t alone in its struggles as the Renewable Energy industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. Shoals’s backlog reached $720.9 million in the latest quarter and averaged 7.7% year-on-year growth over the last two years. Because this number is better than its revenue growth, we can see the company accumulated more orders than it could fulfill and deferred revenue to the future. This could imply elevated demand for Shoals’s products and services but raises concerns about capacity constraints.

This quarter, Shoals reported wonderful year-on-year revenue growth of 32.9%, and its $135.8 million of revenue exceeded Wall Street’s estimates by 3.6%. Company management is currently guiding for a 35.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 20.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

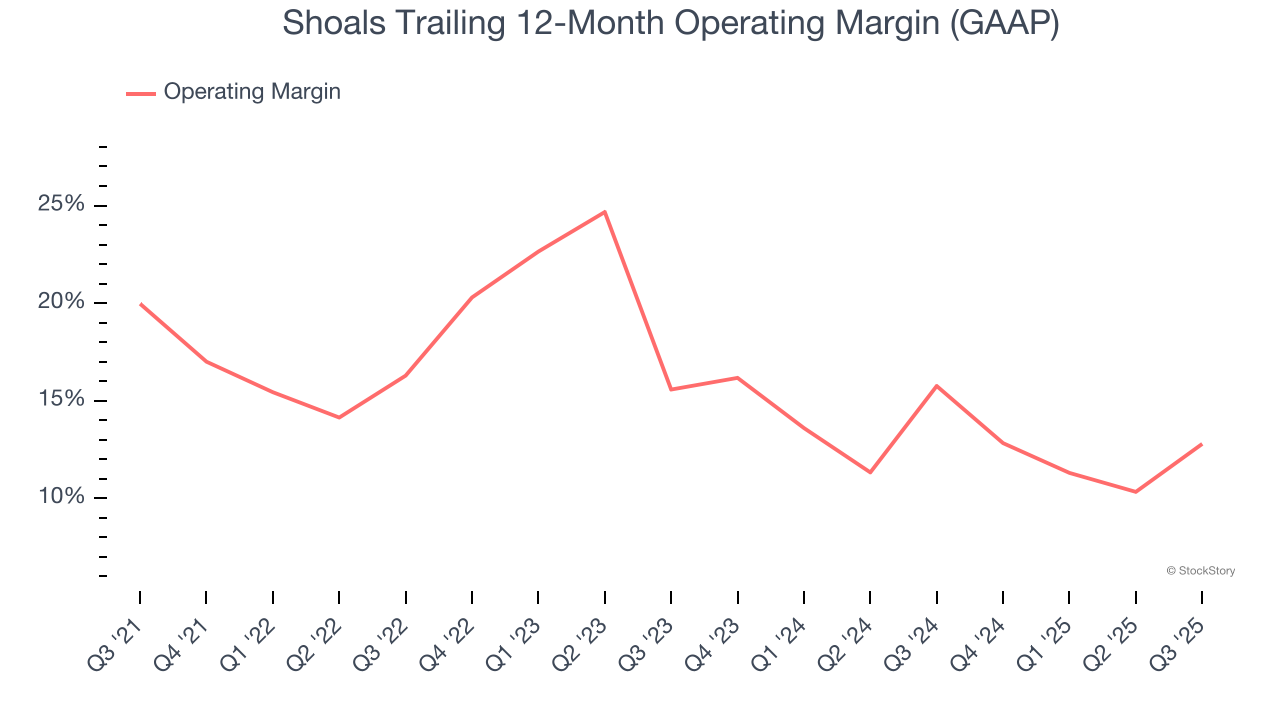

Shoals has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 15.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Shoals’s operating margin decreased by 7.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, Shoals generated an operating margin profit margin of 13.7%, up 9.3 percentage points year on year. The increase was driven by stronger leverage on its cost of sales (not higher efficiency with its operating expenses), as indicated by its larger rise in gross margin.

Earnings Per Share

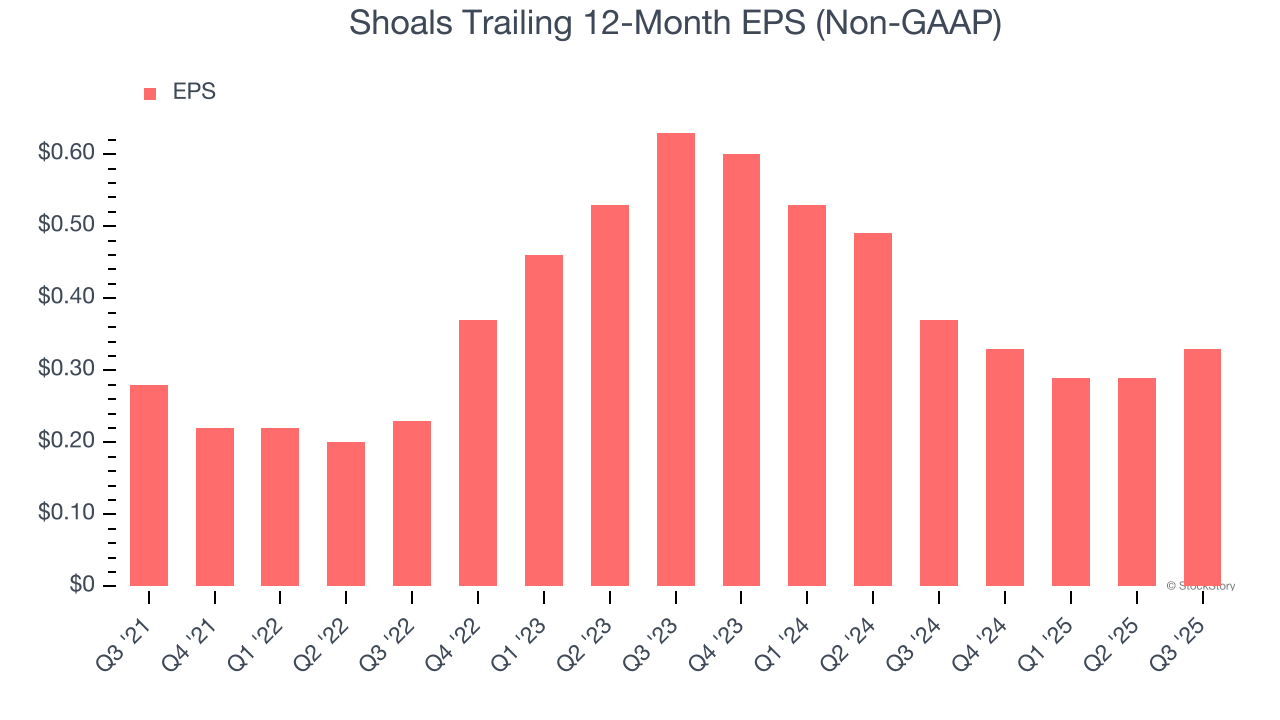

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Shoals’s full-year EPS grew at an unimpressive 4.3% compounded annual growth rate over the last four years, worse than the broader industrials sector.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Shoals, its EPS declined by more than its revenue over the last two years, dropping 27.6%. This tells us the company struggled to adjust to shrinking demand.

In Q3, Shoals reported adjusted EPS of $0.12, up from $0.08 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Shoals’s full-year EPS of $0.33 to grow 46.9%.

Key Takeaways from Shoals’s Q3 Results

We liked that revenue beat expectations this quarter. We were also glad its full-year revenue guidance exceeded Wall Street’s estimates. On the other hand, its EPS was just in line and its EBITDA guidance fell short of Wall Street’s estimates. Overall, this print could have been better. Shares traded down 16.8% to $8.58 immediately after reporting.

Should you buy the stock or not? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.