Fashion conglomerate G-III (NASDAQ: GIII) missed Wall Street’s revenue expectations in Q3 CY2024 as sales only rose 1.8% year on year to $1.09 billion. The company’s full-year revenue guidance of $3.15 billion at the midpoint came in 1.5% below analysts’ estimates. Its non-GAAP profit of $2.59 per share was 13.4% above analysts’ consensus estimates.

Is now the time to buy G-III? Find out by accessing our full research report, it’s free.

G-III (GIII) Q3 CY2024 Highlights:

- Revenue: $1.09 billion vs analyst estimates of $1.10 billion (1.8% year-on-year growth, 1.1% miss)

- Adjusted EPS: $2.59 vs analyst estimates of $2.28 (13.4% beat)

- Adjusted EBITDA: $174.4 million vs analyst estimates of $157 million (16% margin, 11% beat)

- The company dropped its revenue guidance for the full year to $3.15 billion at the midpoint from $3.2 billion, a 1.6% decrease

- Management raised its full-year Adjusted EPS guidance to $4.15 at the midpoint, a 3.8% increase

- EBITDA guidance for the full year is $311.5 million at the midpoint, above analyst estimates of $308.8 million

- Operating Margin: 15.3%, down from 17.8% in the same quarter last year

- Market Capitalization: $1.39 billion

Morris Goldfarb, G-III’s Chairman and Chief Executive Officer, said, “I am very pleased with our strong third quarter results, with earnings per diluted share exceeding our expectations, driven by over 30% organic growth of our key owned brands DKNY, Karl Lagerfeld, Donna Karan and Vilebrequin. The power of our transforming business model is delivering margin expansion and bottom-line outperformance. Our teams continue to demonstrate strong execution despite a challenging consumer environment, unseasonable weather and supply chain disruptions. As we have progressed into the fourth quarter, we have experienced strengthening sell-throughs across our brands, and our inventories are well-positioned to support demand for the remaining holiday and early Spring season.”

Company Overview

Founded as a small leather goods business, G-III (NASDAQ: GIII) is a fashion and apparel conglomerate with a diverse portfolio of brands.

Apparel and Accessories

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

Sales Growth

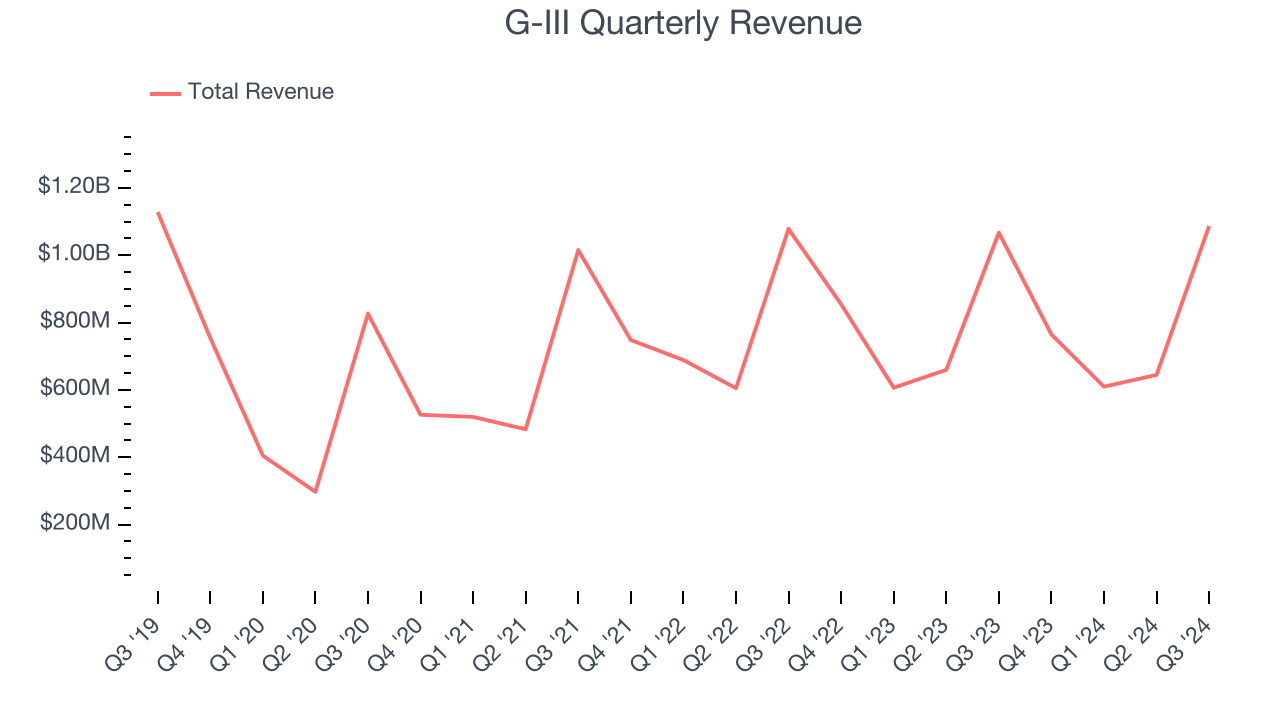

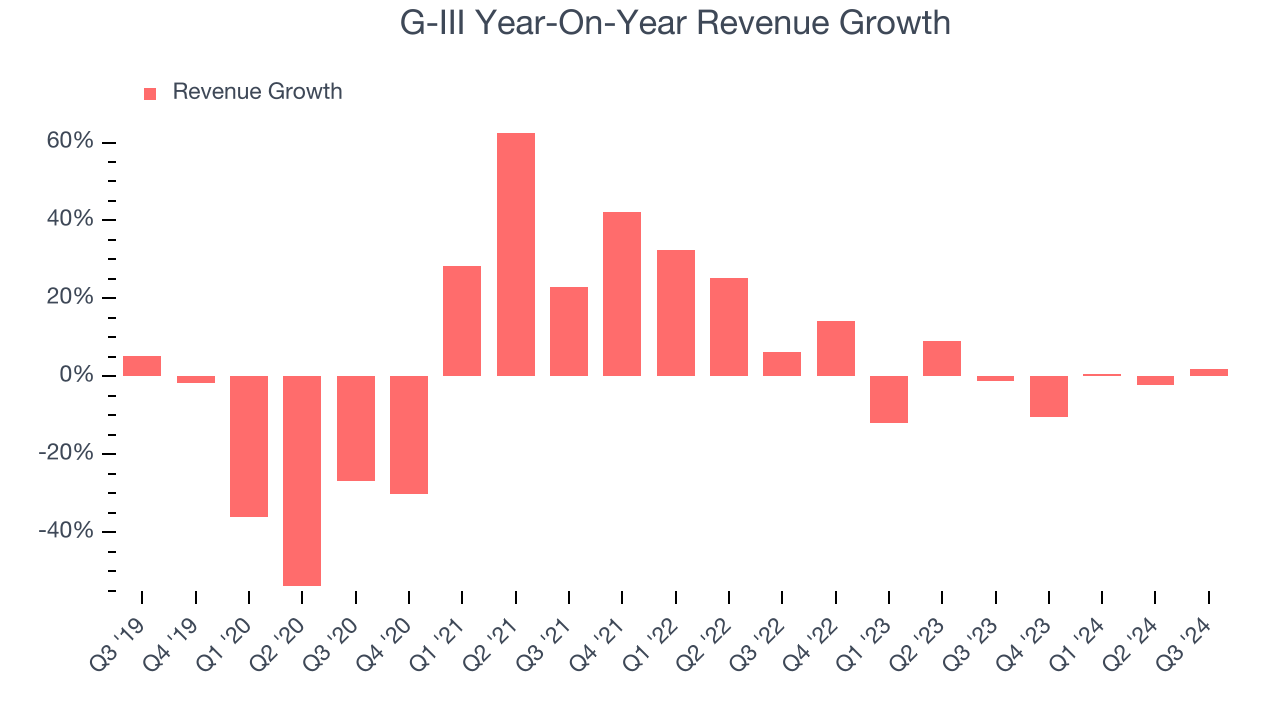

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, G-III struggled to consistently increase demand as its $3.11 billion of sales for the trailing 12 months was close to its revenue five years ago. This fell short of our benchmarks and is a sign of poor business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Just like its five-year trend, G-III’s revenue over the last two years was flat, suggesting it is in a slump.

This quarter, G-III’s revenue grew by 1.8% year on year to $1.09 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months. Although this projection indicates its newer products and services will spur better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

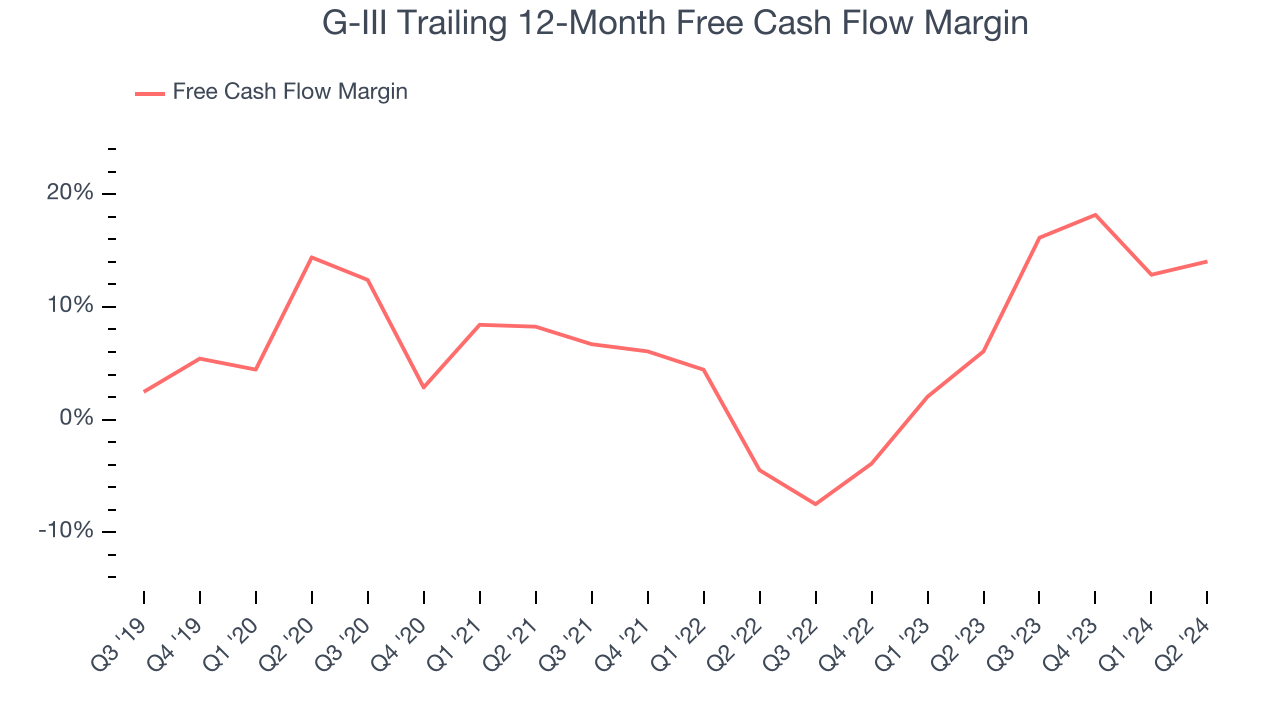

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

G-III has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 18% over the last two years, quite impressive for a consumer discretionary business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Key Takeaways from G-III’s Q3 Results

It was encouraging to see G-III beat analysts’ EPS expectations this quarter. We were also happy its operating profit outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter was mixed but it seems like sentiment coming into the print was weak. The stock traded up 2.8% to $32.46 immediately following the results.

So should you invest in G-III right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.