Gaming and hospitality company Boyd Gaming (NYSE: BYD) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 2% year on year to $1.06 billion. Its non-GAAP profit of $2.21 per share was 14.2% above analysts’ consensus estimates.

Is now the time to buy Boyd Gaming? Find out by accessing our full research report, it’s free.

Boyd Gaming (BYD) Q4 CY2025 Highlights:

- Revenue: $1.06 billion vs analyst estimates of $1.02 billion (2% year-on-year growth, 4% beat)

- Adjusted EPS: $2.21 vs analyst estimates of $1.94 (14.2% beat)

- Adjusted EBITDA: $308 million vs analyst estimates of $307.9 million (29% margin, in line)

- Operating Margin: 15.7%, down from 25.1% in the same quarter last year

- Market Capitalization: $6.62 billion

Company Overview

Run by the Boyd family, Boyd Gaming (NYSE: BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Revenue Growth

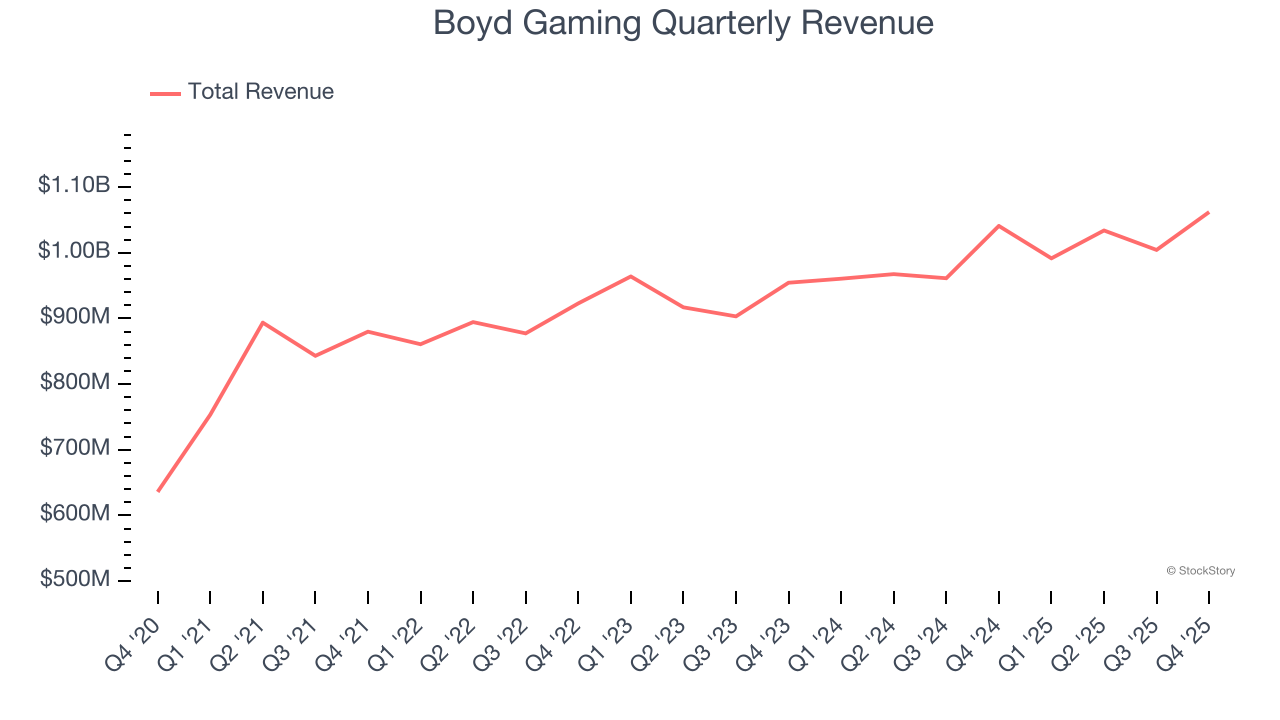

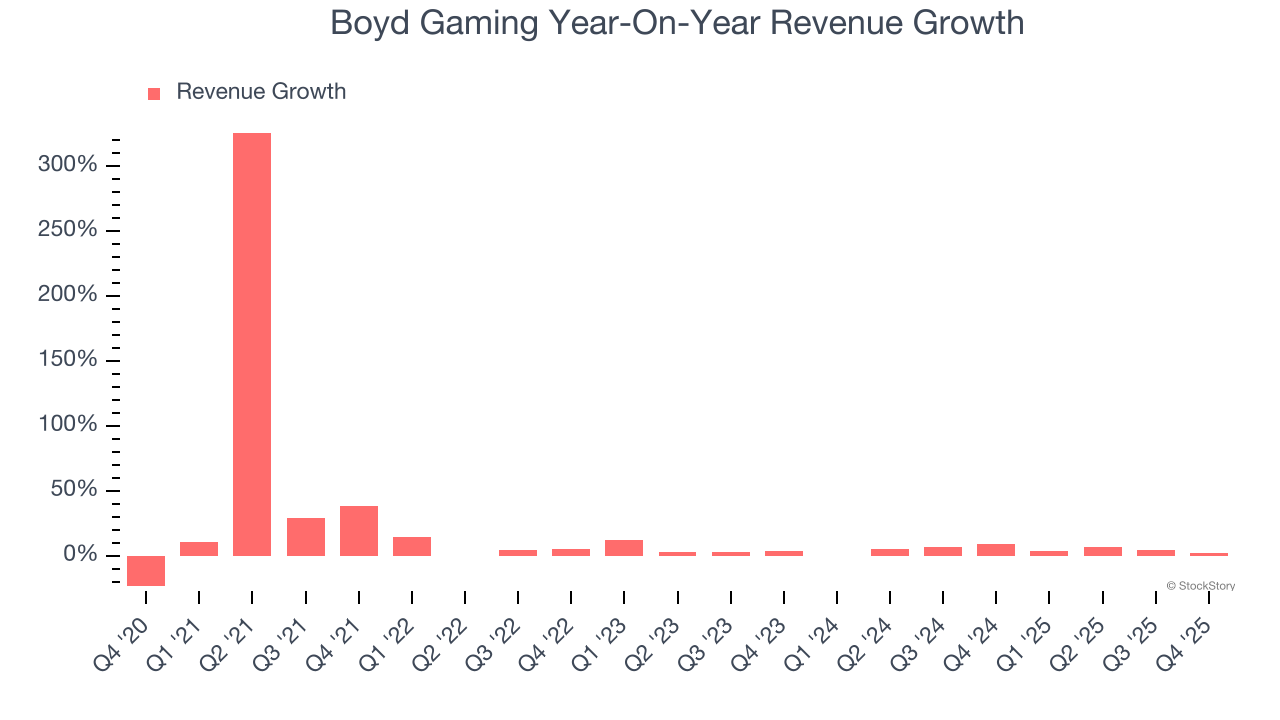

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Boyd Gaming grew its sales at a 13.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Boyd Gaming’s recent performance shows its demand has slowed as its annualized revenue growth of 4.6% over the last two years was below its five-year trend. Note that COVID hurt Boyd Gaming’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

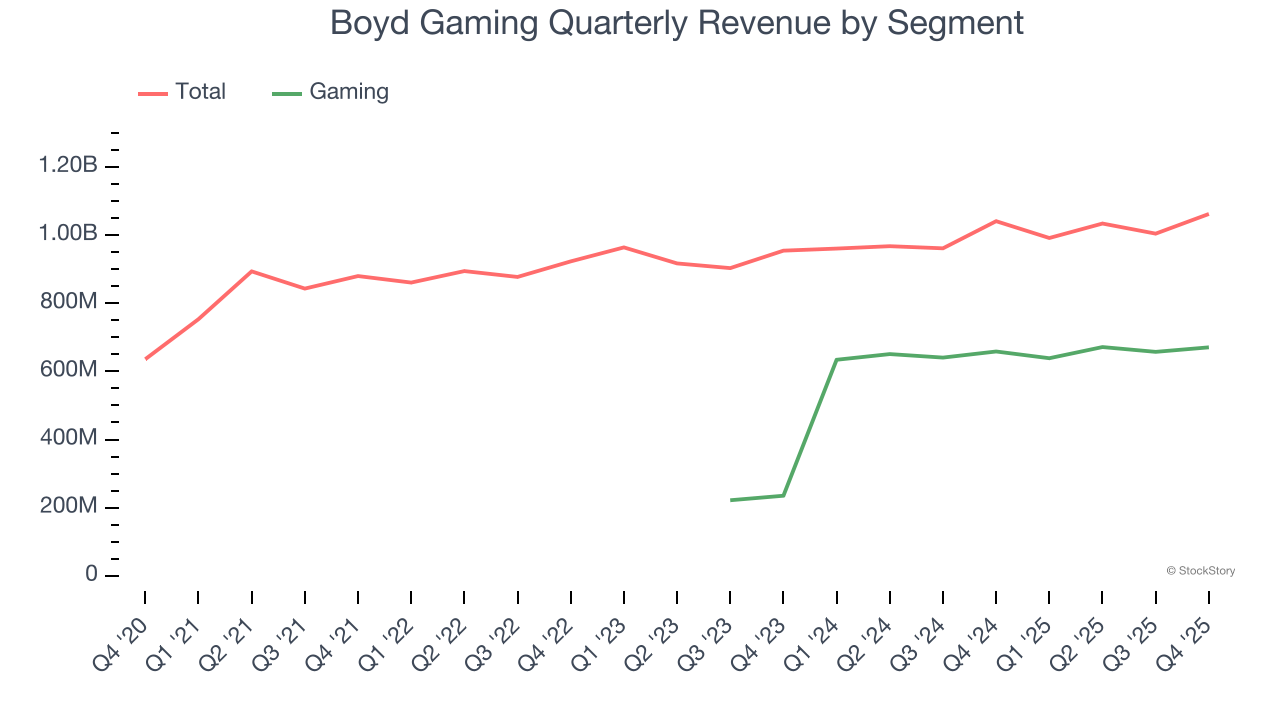

We can dig further into the company’s revenue dynamics by analyzing its most important segment, Gaming. Over the last two years, Boyd Gaming’s Gaming revenue (casino games) averaged 62.9% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, Boyd Gaming reported modest year-on-year revenue growth of 2% but beat Wall Street’s estimates by 4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

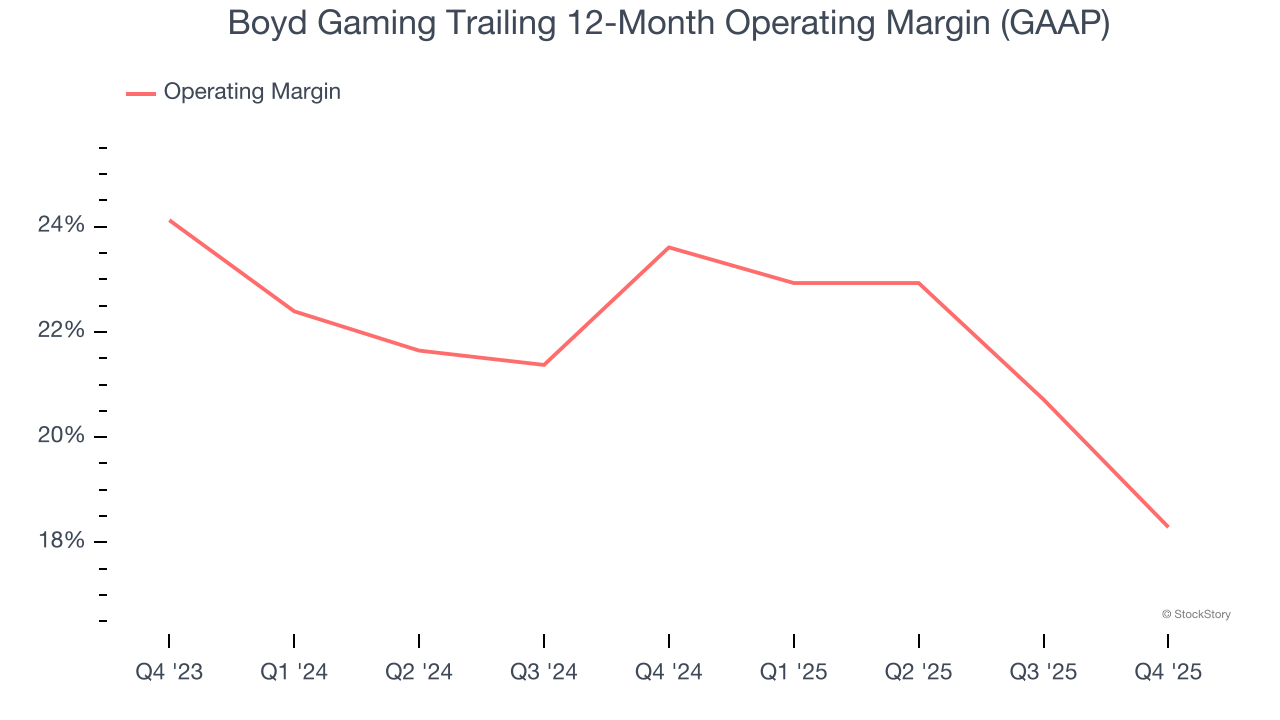

Boyd Gaming’s operating margin has been trending down over the last 12 months and averaged 20.9% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

In Q4, Boyd Gaming generated an operating margin profit margin of 15.7%, down 9.4 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

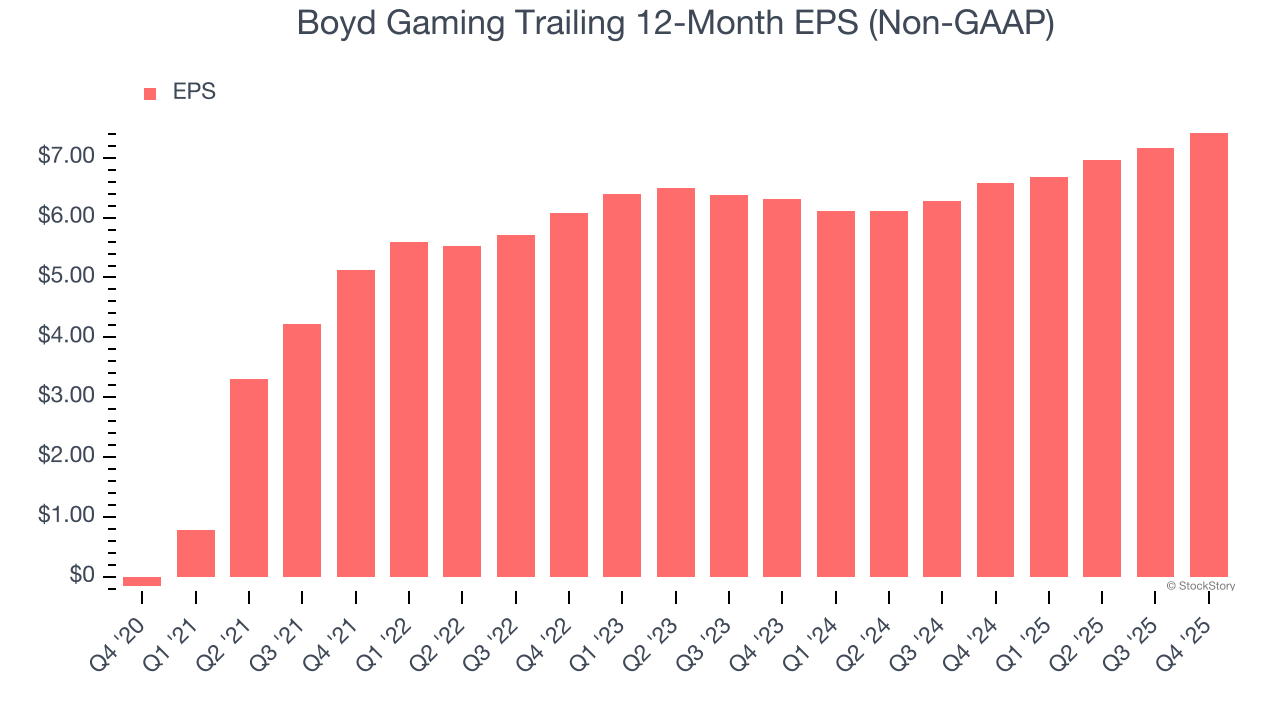

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Boyd Gaming’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Boyd Gaming reported adjusted EPS of $2.21, up from $1.96 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Boyd Gaming’s full-year EPS of $7.42 to grow 5.9%.

Key Takeaways from Boyd Gaming’s Q4 Results

We enjoyed seeing Boyd Gaming beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1% to $84.72 immediately after reporting.

Big picture, is Boyd Gaming a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).