Wrapping up Q1 earnings, we look at the numbers and key takeaways for the regional banks stocks, including Fulton Financial (NASDAQ: FULT) and its peers.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 105 regional banks stocks we track reported a mixed Q1. As a group, revenues missed analysts’ consensus estimates by 1.6%.

In light of this news, share prices of the companies have held steady as they are up 1.6% on average since the latest earnings results.

Fulton Financial (NASDAQ: FULT)

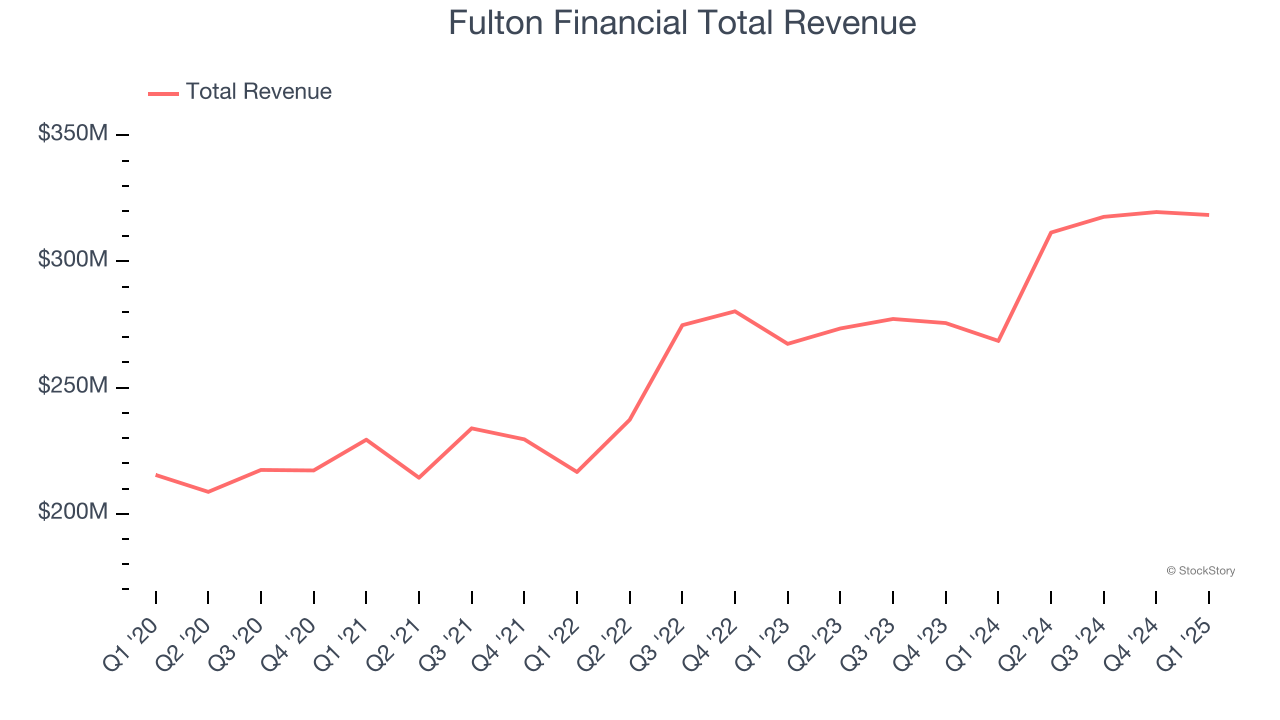

Tracing its roots back to 1882 in the heart of Pennsylvania, Fulton Financial (NASDAQ: FULT) is a financial holding company that provides banking, lending, and wealth management services to consumers and businesses across five Mid-Atlantic states.

Fulton Financial reported revenues of $318.4 million, up 18.6% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EPS estimates and a decent beat of analysts’ tangible book value per share estimates.

"We are pleased with our first quarter operating earnings of $0.52 per diluted share and encouraged by the strong start to the year," said Curtis J. Myers, Chairman and CEO of Fulton.

The stock is up 6.8% since reporting and currently trades at $17.13.

Is now the time to buy Fulton Financial? Access our full analysis of the earnings results here, it’s free.

Best Q1: Butterfield Bank (NYSE: NTB)

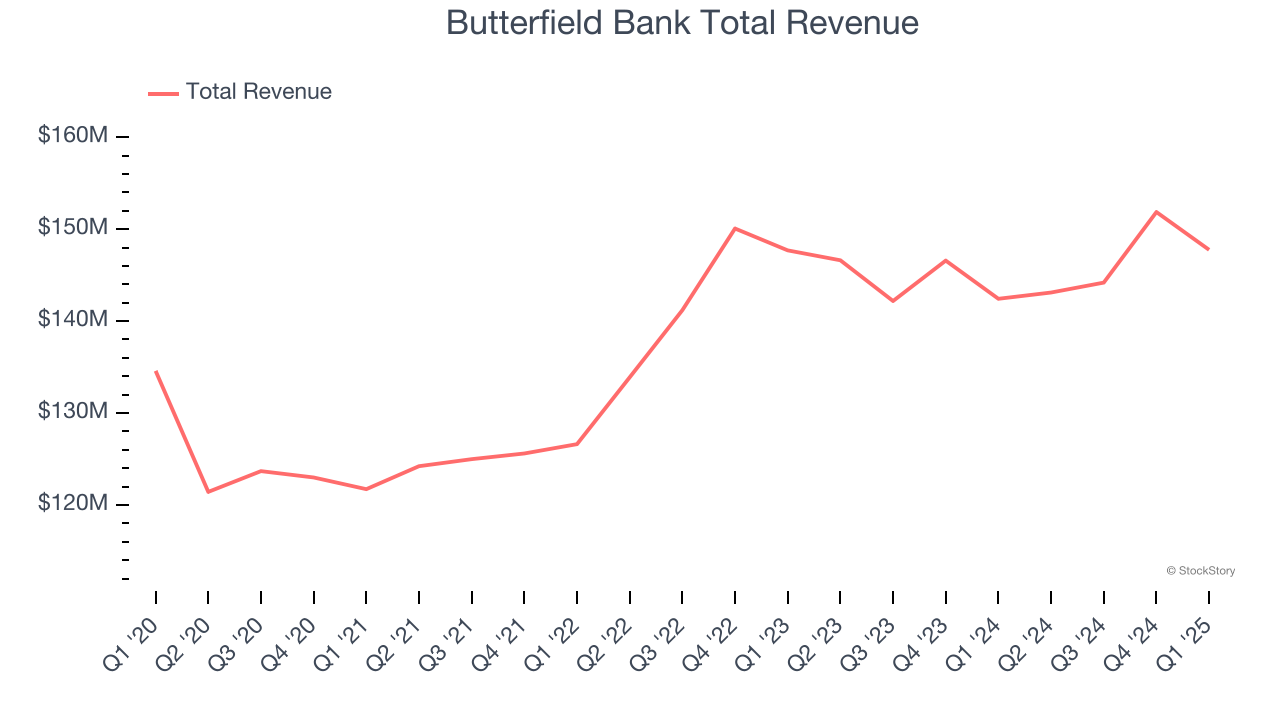

Founded in 1784 as one of the oldest banks in the Western Hemisphere, Butterfield Bank (NYSE: NTB) provides banking, wealth management, and trust services to individuals and businesses in select offshore financial centers including Bermuda, Cayman Islands, and the Channel Islands.

Butterfield Bank reported revenues of $147.8 million, up 3.7% year on year, outperforming analysts’ expectations by 4.4%. The business had a stunning quarter with a solid beat of analysts’ net interest income estimates and an impressive beat of analysts’ EPS estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $42.47.

Is now the time to buy Butterfield Bank? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Triumph Financial (NASDAQ: TFIN)

Originally focused on traditional banking before pivoting to serve the transportation sector, Triumph Financial (NASDAQ: TFIN) provides specialized financial services to the trucking industry, including payments processing, factoring, banking, and data intelligence solutions.

Triumph Financial reported revenues of $100.8 million, flat year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a significant miss of analysts’ tangible book value per share and net interest income estimates.

Interestingly, the stock is up 9.3% since the results and currently trades at $54.43.

Read our full analysis of Triumph Financial’s results here.

Regions Financial (NYSE: RF)

Tracing its roots back to 1971 and operating in a region known as the "heart of Dixie," Regions Financial (NYSE: RF) is a financial holding company that provides banking services, wealth management, and specialty financial solutions across the South, Midwest, and Texas.

Regions Financial reported revenues of $1.78 billion, up 2.1% year on year. This number lagged analysts' expectations by 2.2%. Overall, it was a slower quarter as it also produced a slight miss of analysts’ net interest income estimates.

The stock is flat since reporting and currently trades at $22.24.

Read our full, actionable report on Regions Financial here, it’s free.

Atlantic Union Bankshares (NYSE: AUB)

Tracing its roots back to 1902 when it first opened its doors in Virginia, Atlantic Union Bankshares (NYSE: AUB) is a full-service regional bank providing commercial and retail banking, wealth management, and insurance services throughout Virginia and parts of Maryland and North Carolina.

Atlantic Union Bankshares reported revenues of $213.3 million, up 20.5% year on year. This print came in 1.5% below analysts' expectations. It was a softer quarter as it also logged a significant miss of analysts’ EPS and net interest income estimates.

The stock is down 3.5% since reporting and currently trades at $29.86.

Read our full, actionable report on Atlantic Union Bankshares here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.