E-commerce leader Amazon (AMZN) plans to cut 14,000 jobs in an effort to reduce costs, while investing aggressively in artificial intelligence (AI). Amazon has been anticipating workforce reductions, as the company has more than 1,000 generative AI services and applications, either in development or already built.

Since 2024, Amazon has invested billions of dollars in building data centers. Earlier reporting had suggested that Amazon was planning to cut 30,000 jobs. While the announced cuts are lower than that, the company may continue its job cut spree.

Is it time to sell Amazon stock?

About Amazon Stock

Tech giant extraordinaire Amazon has evolved from a small online bookstore in 1994 into a global powerhouse in e-commerce and technology. Known for its customer-centric approach and constant innovation, it now leads in retail, logistics, cloud computing, and digital entertainment. Amazon is based in Seattle, Washington. The company has a market capitalization of $2.6 trillion.

AMZN stock has been supported by strong financial performance, favorable analyst sentiment, and a steady stream of innovation and expansion that has maintained its market leadership.

Over the past 52 weeks, Amazon stock has gained 19%, while it is up 29% over the past six months. The stock recently reached a 52-week high of $258.60 on Nov. 3 but is down 4% from that level.

AMZN stock is trading at a premium valuation compared to its industry peers. Its price-to-earnings ratio of 34 times is higher than the industry average.

What’s the News Surrounding Amazon Lately?

Apart from news of the layoffs, there are some developments surrounding Amazon, which have been the case for this industry darling for a long time. In September, it was reported that the company had to pay $2.5 billion to settle with the Federal Trade Commission on allegations of duping customers into joining its Prime membership.

Moreover, while there is a lot of positive talk about AI, Amazon founder Jeff Bezos made an out-of-the-ordinary statement, claiming that AI is currently in an “industrial bubble.” Bezos went on to say that investors are finding it tough to differentiate between good and bad ideas amid all the excitement. Contrarily, he also stated that AI is very real and has transformational qualities, all while Amazon itself is pushing hard into data centers.

Now, coming to the positives, Amazon also unveiled new products during this period. This unveiling comes before the year-end holidays, the perfect time for gift shopping. Earlier this year, CEO Andy Jassy made it clear that the company plans to launch a lineup of devices compatible with AI.

There have also been developments in automation in Amazon warehouses to fulfill orders. Morgan Stanley analysts believe that the company’s plans to deploy 40 next-generation robotics warehouses by 2027 would result in annual savings of approximately $2 billion to $4 billion.

Amazon’s Q2 Earnings Were Better Than Expected

Amazon’s second-quarter period was marked by some notable developments, including the largest Prime Day event, the expansion of its quick delivery services, the addition of brand selection, and the launch of generative AI tools.

Total net sales came in at $167.7 billion, representing a 13.4% year-over-year (YOY) increase. This figure was also higher than the $162.09 billion expected by Wall Street analysts. EPS also increased 33% YOY to $1.68, higher than the expected $1.33 per share. Amazon’s AWS segment, a recent growth juggernaut, reported 17.5% annual growth to reach $30.87 billion.

For the current year, Wall Street analysts expect EPS to be $7.15, indicating a 29% YOY increase, followed by 10% growth to $7.86 in the following year.

What Do Analysts Think About Amazon Stock?

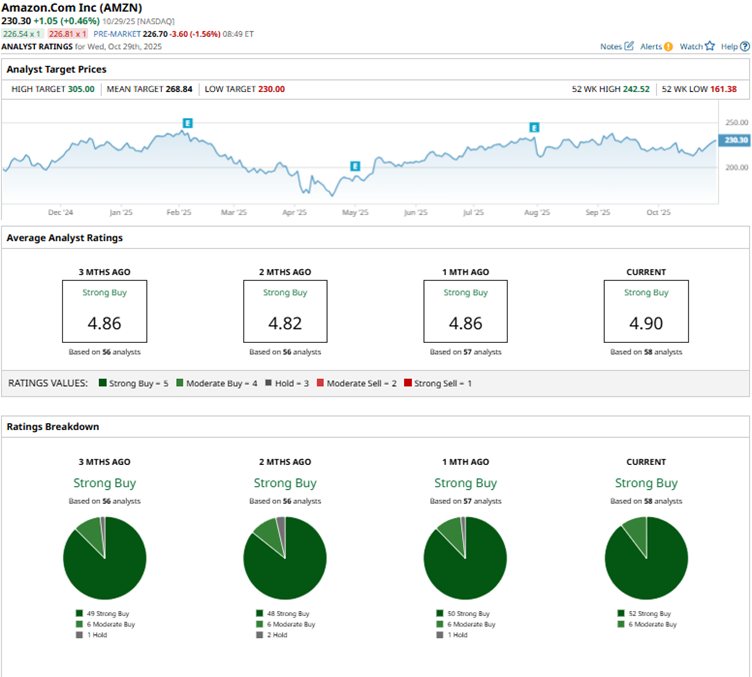

Wall Street analysts are still exceptionally bullish on AMZN stock. Recently, UBS analyst Stephen Ju maintained a “Buy” rating on the stock, while raising the price target from $271 to $279, exhibiting continued confidence in Amazon’s prospects.

Analysts at KeyBanc resumed coverage of Amazon with an “Overweight” rating and a $300 price target. KeyBanc analysts believe that Amazon’s retail business is supported by advertising growth, while its Cloud business could show improving growth in 2026.

Stifel analysts also raised their price target from $260 to $269 and kept a “Buy” rating, citing potential upside next year due to the expansion of Same-Day grocery delivery for Prime members. Benchmark reaffirmed a “Buy” rating as well and kept a $260 price target, citing Amazon’s advertising and Prime Video services, which can produce solid margins.

Amazon has been in the spotlight on Wall Street for some time now, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 58 analysts rating the stock, a majority of 52 analysts give it a “Strong Buy” rating, while six analysts play it safe with a “Moderate Buy” rating. The consensus price target of $294.40 represents 18% potential upside from current levels. Meanwhile, the Street-high price target of $340 indicates 37% potential upside from here.

Key Takeaways

The job cuts reflect Amazon’s efforts to focus its operations on the AI sphere, which may pay off in the future. The company has also been instrumental in innovating to stay ahead of its competitors, which has contributed to its continued market leadership. With continued financial progress and bullish analyst sentiments, Amazon stock might be a solid buy.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Qualcomm Wants to Beat Nvidia in AI Chips, but QCOM Stock Needs to Win Over Wall Street First

- Analysts Say Nvidia Stock Is ‘Dominant’ Amid a Giant Race to ‘Secure Compute.’ Buy Shares Now?

- Cathie Wood Is Buying the Dip in Archer Aviation Stock. Should You?

- 30,000 Reasons It May Be Time to Sell Amazon Stock Now