Sushi restaurant chain Kura Sushi (NASDAQ: KRUS) met Wall Streets revenue expectations in Q4 CY2025, with sales up 14% year on year to $73.46 million. The company’s full-year revenue guidance of $332 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP loss of $0.23 per share was 45.6% below analysts’ consensus estimates.

Is now the time to buy Kura Sushi? Find out by accessing our full research report, it’s free for active Edge members.

Kura Sushi (KRUS) Q4 CY2025 Highlights:

- Revenue: $73.46 million vs analyst estimates of $73.65 million (14% year-on-year growth, in line)

- Adjusted EPS: -$0.23 vs analyst expectations of -$0.16 (45.6% miss)

- Adjusted EBITDA: $2.44 million vs analyst estimates of $3.41 million (3.3% margin, relatively in line)

- The company reconfirmed its revenue guidance for the full year of $332 million at the midpoint

- Operating Margin: -5%, down from -2.3% in the same quarter last year

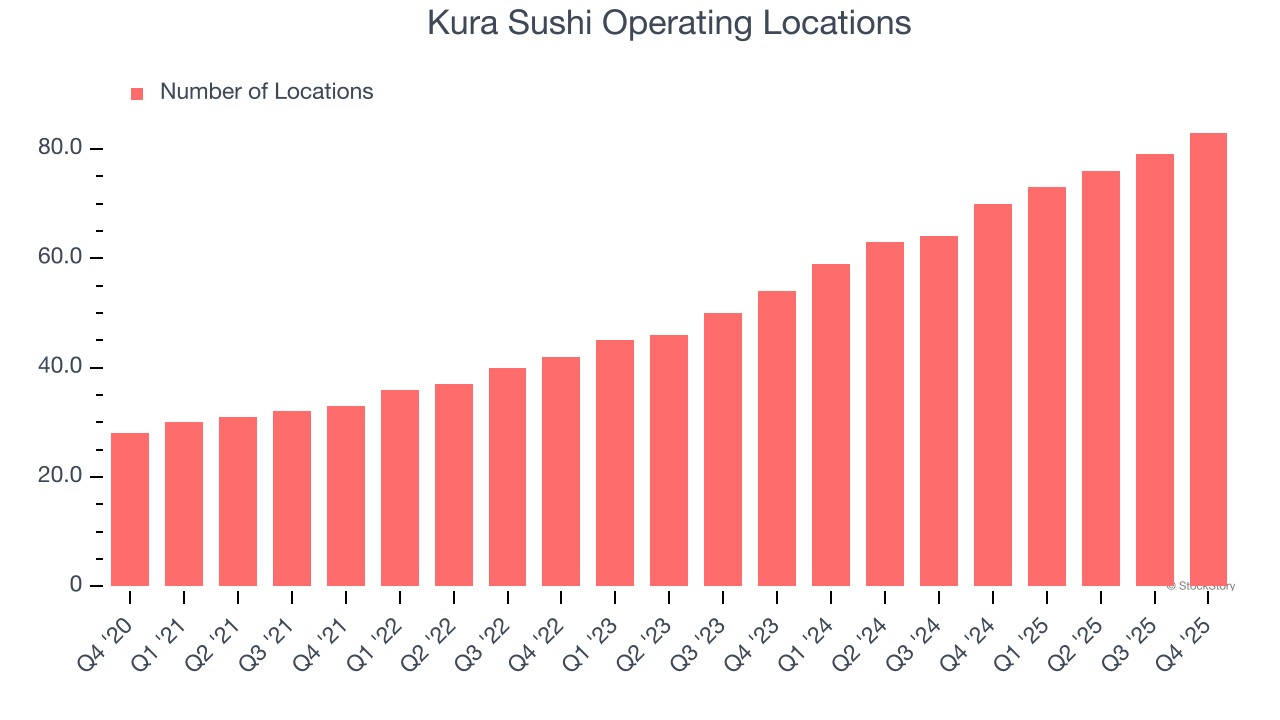

- Locations: 83 at quarter end, up from 70 in the same quarter last year

- Same-Store Sales fell 2.5% year on year (1.8% in the same quarter last year)

- Market Capitalization: $712.5 million

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “We’re making great progress towards the goals we laid out in our annual guidance. Regarding our goal of sixteen new restaurant openings, we have ten units under construction, on top of the four restaurants opened to date. Our commitment to aggressive cost management has leveraged G&A as a percentage of sales. We were also able to lever labor as a percentage of sales, renewing our confidence in our ability to improve labor costs in fiscal 2026. The first quarter has created a strong foundation for us to build on for the remainder of the fiscal year.”

Company Overview

Known for its conveyor belt that transports dishes to diners, Kura Sushi (NASDAQ: KRUS) is a chain of sushi restaurants serving traditional Japanese fare with a touch of modernity and technology.

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $291.8 million in revenue over the past 12 months, Kura Sushi is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can grow faster because it has more white space to build new restaurants.

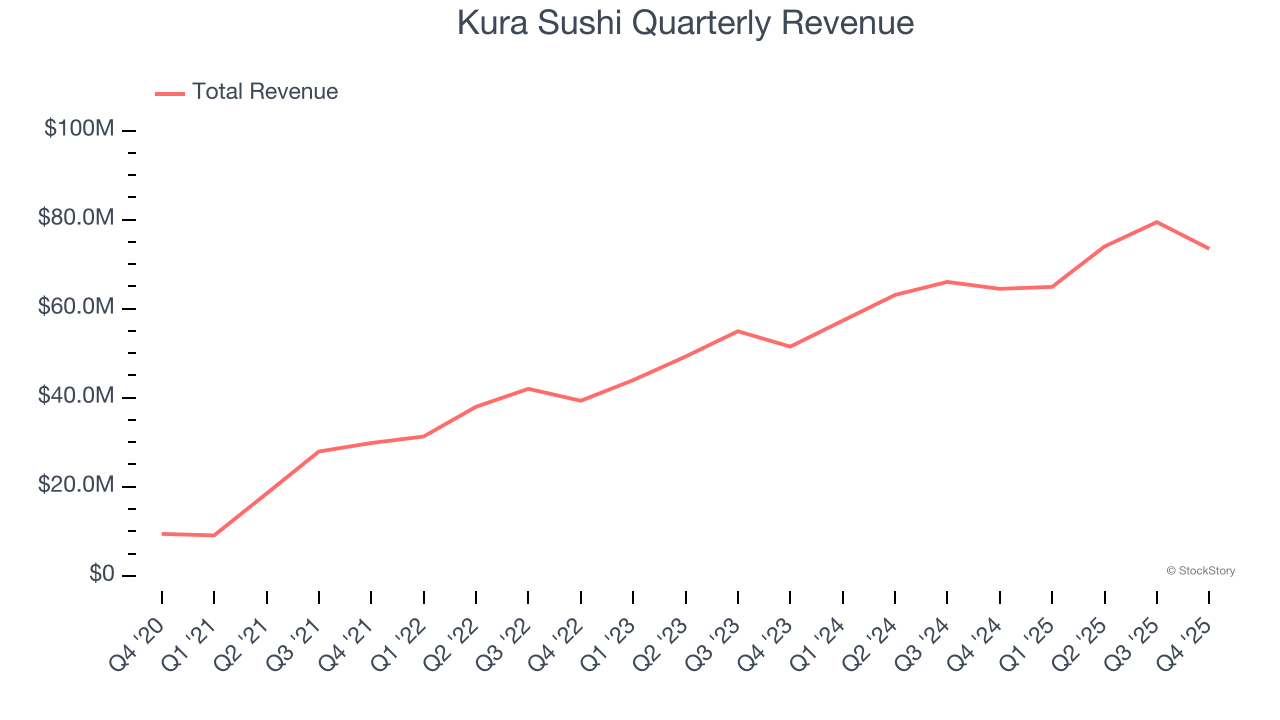

As you can see below, Kura Sushi’s 27.4% annualized revenue growth over the last six years was incredible as it opened new restaurants and expanded its reach.

This quarter, Kura Sushi’s year-on-year revenue growth was 14%, and its $73.46 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 18% over the next 12 months, a deceleration versus the last six years. Despite the slowdown, this projection is admirable and implies the market is baking in success for its menu offerings.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Restaurant Performance

Number of Restaurants

A restaurant chain’s total number of dining locations influences how much it can sell and how quickly revenue can grow.

Kura Sushi operated 83 locations in the latest quarter. It has opened new restaurants at a rapid clip over the last two years, averaging 26.5% annual growth, much faster than the broader restaurant sector. This gives it a chance to scale into a mid-sized business over time.

When a chain opens new restaurants, it usually means it’s investing for growth because there’s healthy demand for its meals and there are markets where its concepts have few or no locations.

Same-Store Sales

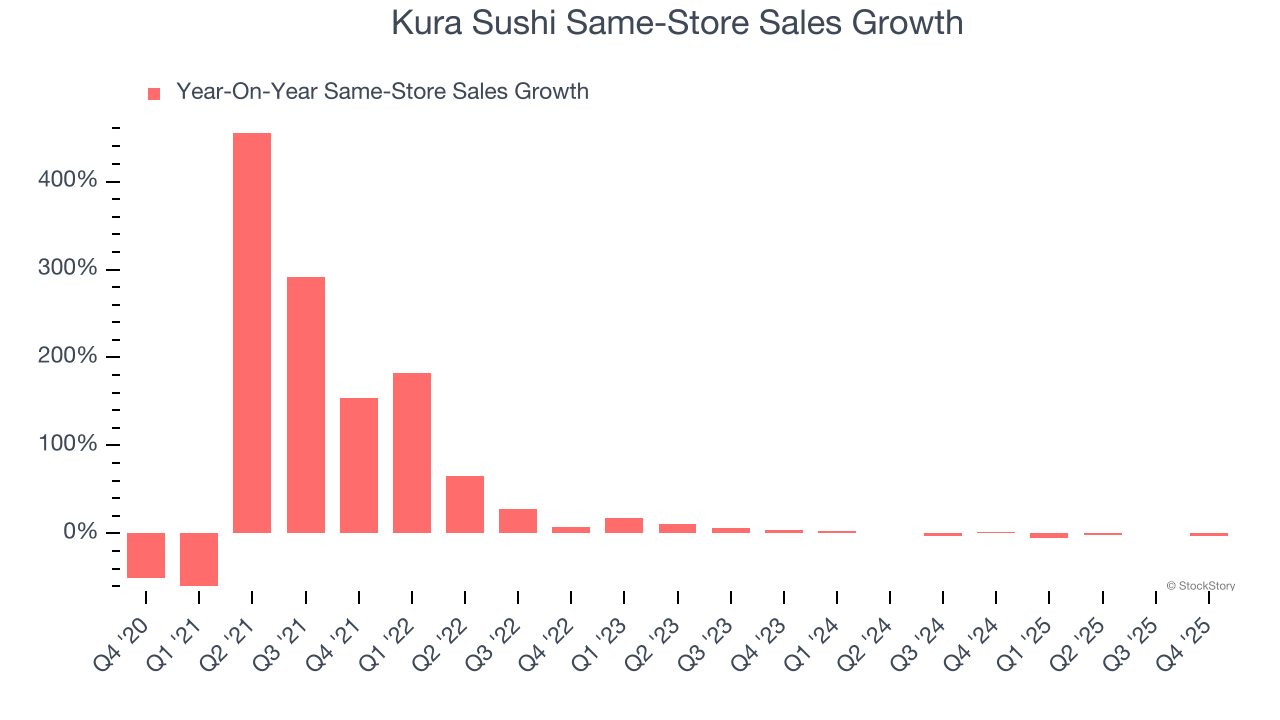

The change in a company's restaurant base only tells one side of the story. The other is the performance of its existing locations, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth at restaurants open for at least a year.

Kura Sushi’s demand within its existing dining locations has barely increased over the last two years as its same-store sales were flat. Kura Sushi should consider improving its foot traffic and efficiency before expanding its restaurant base.

In the latest quarter, Kura Sushi’s same-store sales fell by 2.5% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Kura Sushi’s Q4 Results

We were impressed by how significantly Kura Sushi blew past analysts’ same-store sales expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2% to $54.59 immediately after reporting.

Kura Sushi didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.