Brunswick has had an impressive run over the past six months as its shares have beaten the S&P 500 by 20.6%. The stock now trades at $74.01, marking a 34.5% gain. This was partly due to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Brunswick, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free for active Edge members.

Why Do We Think Brunswick Will Underperform?

We’re happy investors have made money, but we don't have much confidence in Brunswick. Here are three reasons you should be careful with BC and a stock we'd rather own.

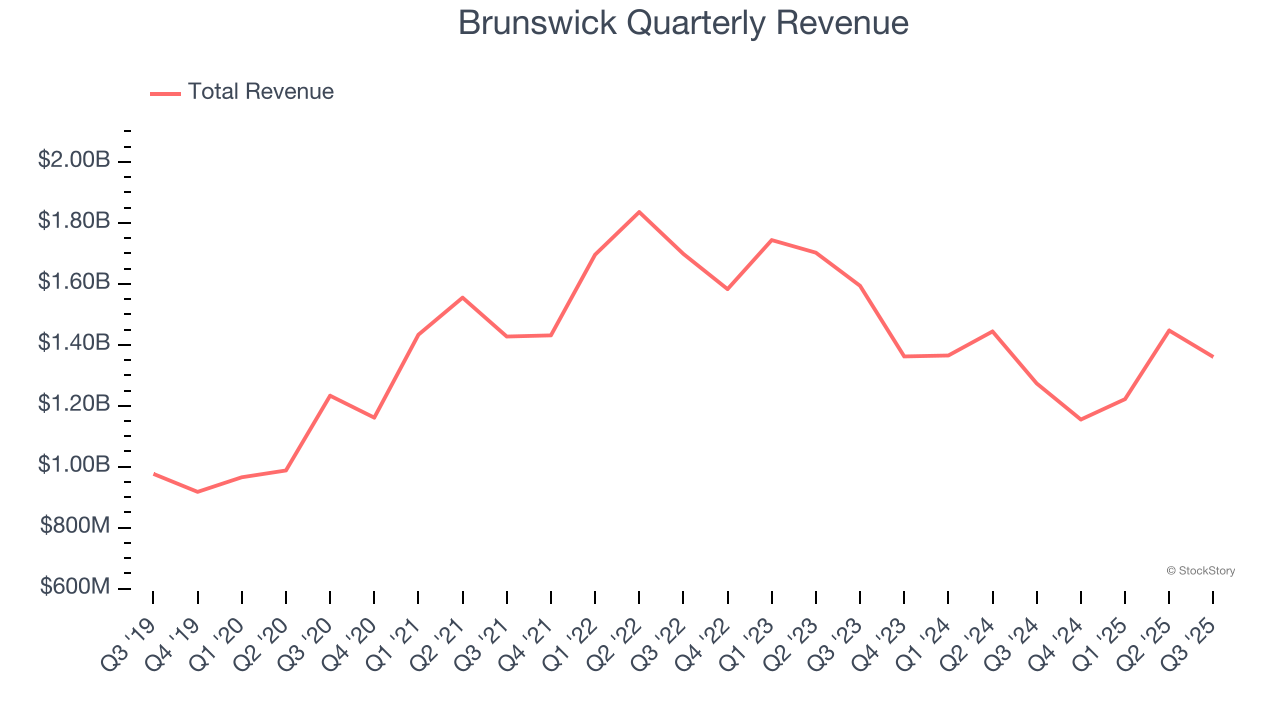

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Brunswick’s 4.8% annualized revenue growth over the last five years was weak. This was below our standard for the consumer discretionary sector.

2. Cash Flow Margin Set to Decline

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the next year, analysts predict Brunswick’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 11.4% for the last 12 months will decrease to 8%.

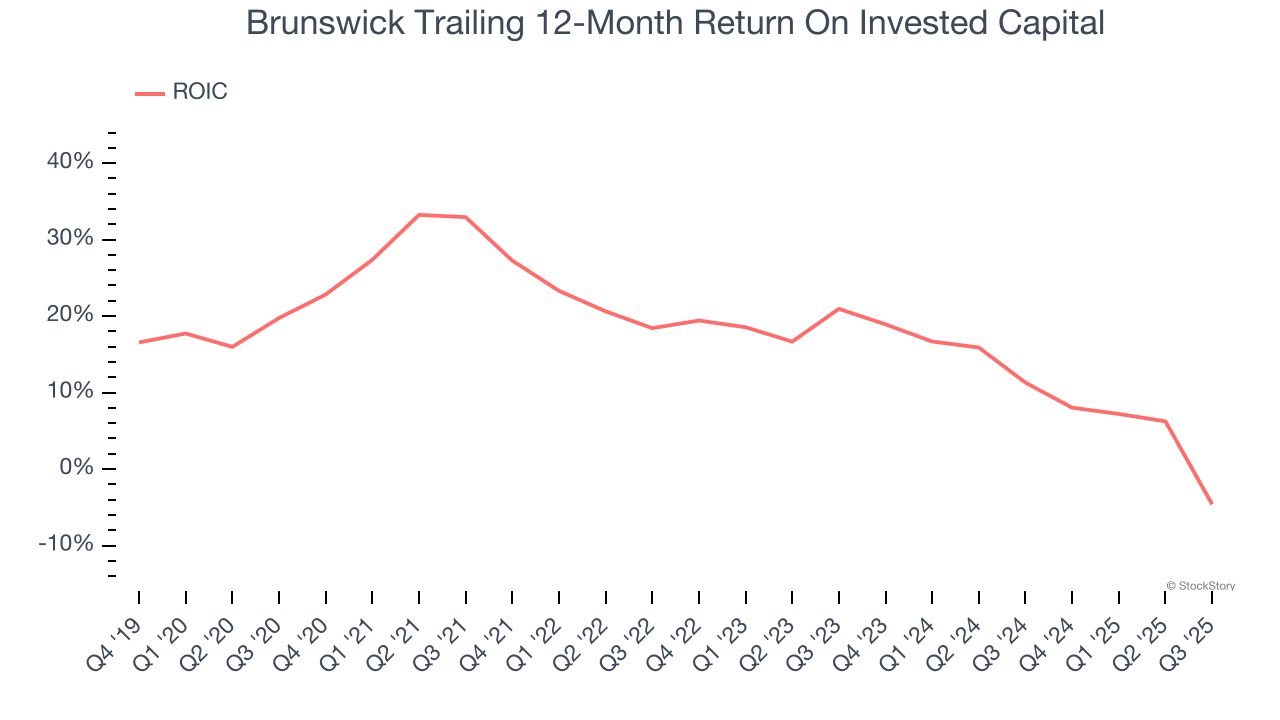

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Brunswick’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We see the value of companies helping consumers, but in the case of Brunswick, we’re out. With its shares topping the market in recent months, the stock trades at 18.6× forward P/E (or $74.01 per share). While this valuation is fair, the upside isn’t great compared to the potential downside. There are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Brunswick

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.