Penny stocks, especially in the early-stage biotech sector, often tend to be volatile and highly risky, but they also offer the potential for massive rewards. One such company is BioXcel Therapeutics (BTAI), which stands out right now for its late-stage pipeline progress, rising market potential, and approaching FDA milestone, making it a top penny stock to keep an eye on for 2026.

What Does BioXcel Therapeutics Do?

BioXcel Therapeutics is a biopharmaceutical company that employs artificial intelligence (AI) and machine learning to discover and develop breakthrough treatments, with a focus on neuroscience. By using AI, the company aims to lower the cost and time needed for drug development when compared to traditional methods. Its lead product is IGALMI, which is an FDA-approved sublingual film formulation of BXCL501 used for the immediate treatment of severe agitation in people with schizophrenia and bipolar disorder.

Near-Term Regulatory Catalyst in Sight

BioXcel conducted a Phase 3 SERENITY At-Home trial with 246 patients to assess the safety of BXCL501 in a real-world, home-use environment, collecting data on over 2,600 agitation episodes. The results revealed no discontinuations due to tolerability in the treatment arm, no drug-related major adverse events, and no new or unexpected safety signals. These encouraging results have motivated the business to submit a supplemental New Drug Application (sNDA) to the FDA this month, requesting clearance for IGALMI at-home use. BioXcel expects it will be approved this year and is gearing up for the next round of pre-launch and commercial launch activities.

Beyond bipolar disorder and schizophrenia, BioXcel is moving on with its TRANQUILITY In-Care Phase 3 program, which aims to treat agitation linked with Alzheimer's dementia. The company has received FDA comments on the clinical protocol and is currently examining proposals from contract research organizations in preparation for trial launch.

Currently, BioXcel believes that the at-home agitation market represents between 57 million and 77 million episodes annually in the U.S., exceeding earlier estimates of 23 million episodes. If approved, at-home IGALMI could address a significant unmet need by moving treatment from institutional settings to patients' homes, which benefits the patients.

BioXcel also has a wholly owned subsidiary, OnkosXcel Therapeutics, which is focused on developing innovative immuno-oncology treatments that engage the immune system against aggressive cancers.

In the third quarter, IGALMI generated $98,000 in net revenue, indicating that the company continued to service patients and providers with minimal commercial infrastructure. However, research and development (R&D) spending rose to $8.7 million as the company made significant investments in late-stage clinical trials, resulting in a net loss of $30.9 million. Losses are not uncommon for a biotech startup in its early development stage.

Despite the losses, the company ended the quarter with $37.3 million in cash and restricted cash and raised an additional $4.9 million after quarter-end through its at-the-market program. Management believes a disciplined cost approach will assist the company in maintaining the cash runway to support the scheduled sNDA submission and upcoming milestones.

With late-stage clinical data, a clearly defined regulatory timeline, and exposure to a significantly expanded market opportunity, 2026 is a critical moment for this penny biotech stock. Investors should watch its progress to make a timely decision.

What Does Wall Street Say About BTAI Stock?

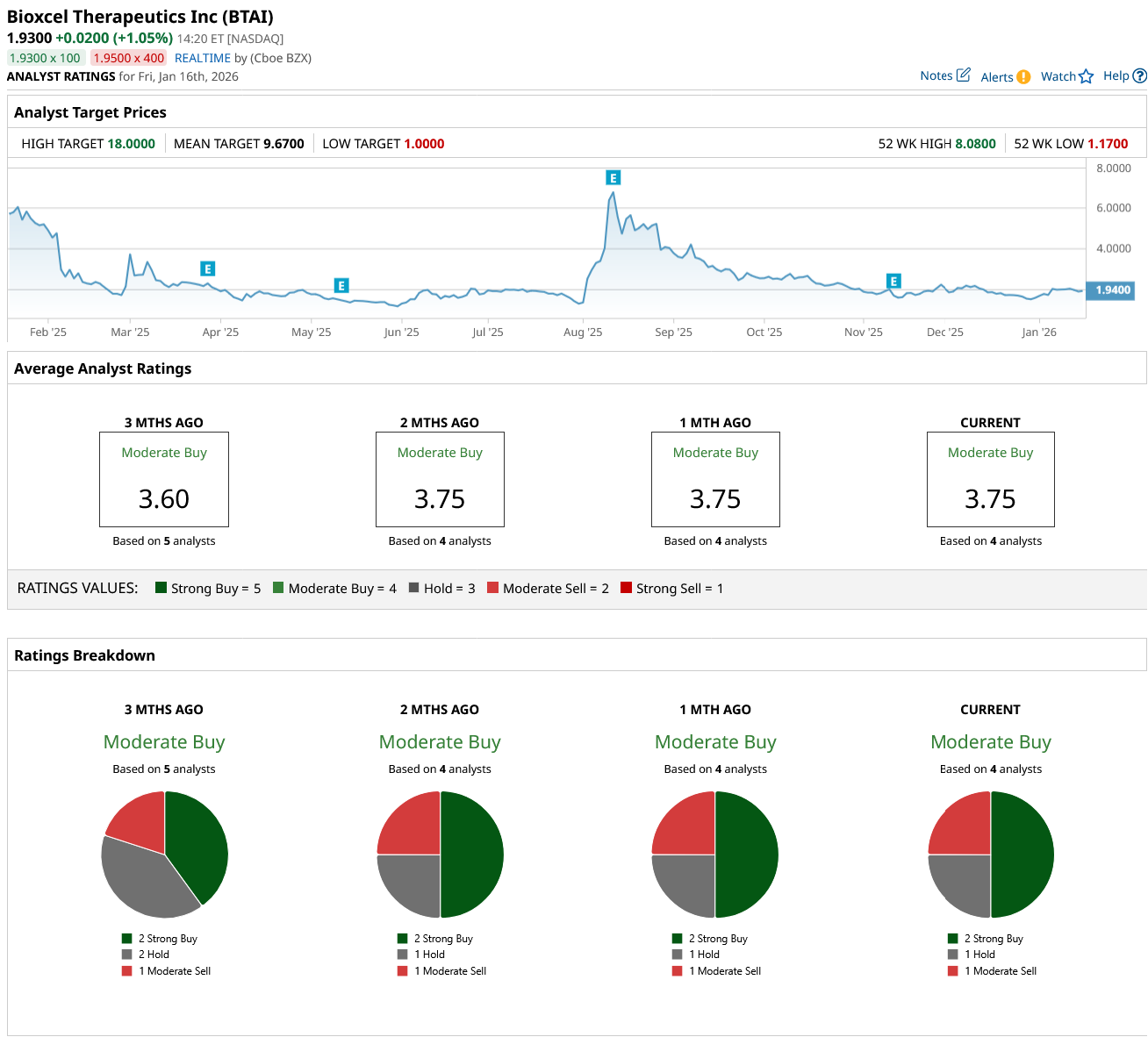

BTAI stock has gained 22% so far this year, outperforming the broader market gain. Overall, on Wall Street, BTAI stock is a “Moderate Buy.” Of the four analysts covering the stock, two rate it a “Strong Buy,” one says it is a “Hold,” and one rates it a “Moderate Sell.” The stock’s average target price is $9.67, which implies an upside potential of 406.2% from current levels. Furthermore, its high price estimate of $18 suggests the stock has an upside potential of 842.4% over the next 12 months.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart