Valued at a market cap of $46.1 billion, Rockwell Automation, Inc. (ROK) is an industrial automation and digital transformation company that provides hardware, software, and services to help manufacturers improve productivity, efficiency, and sustainability. The Milwaukee, Wisconsin-based company is scheduled to announce its fiscal Q1 earnings for 2026 in the near future.

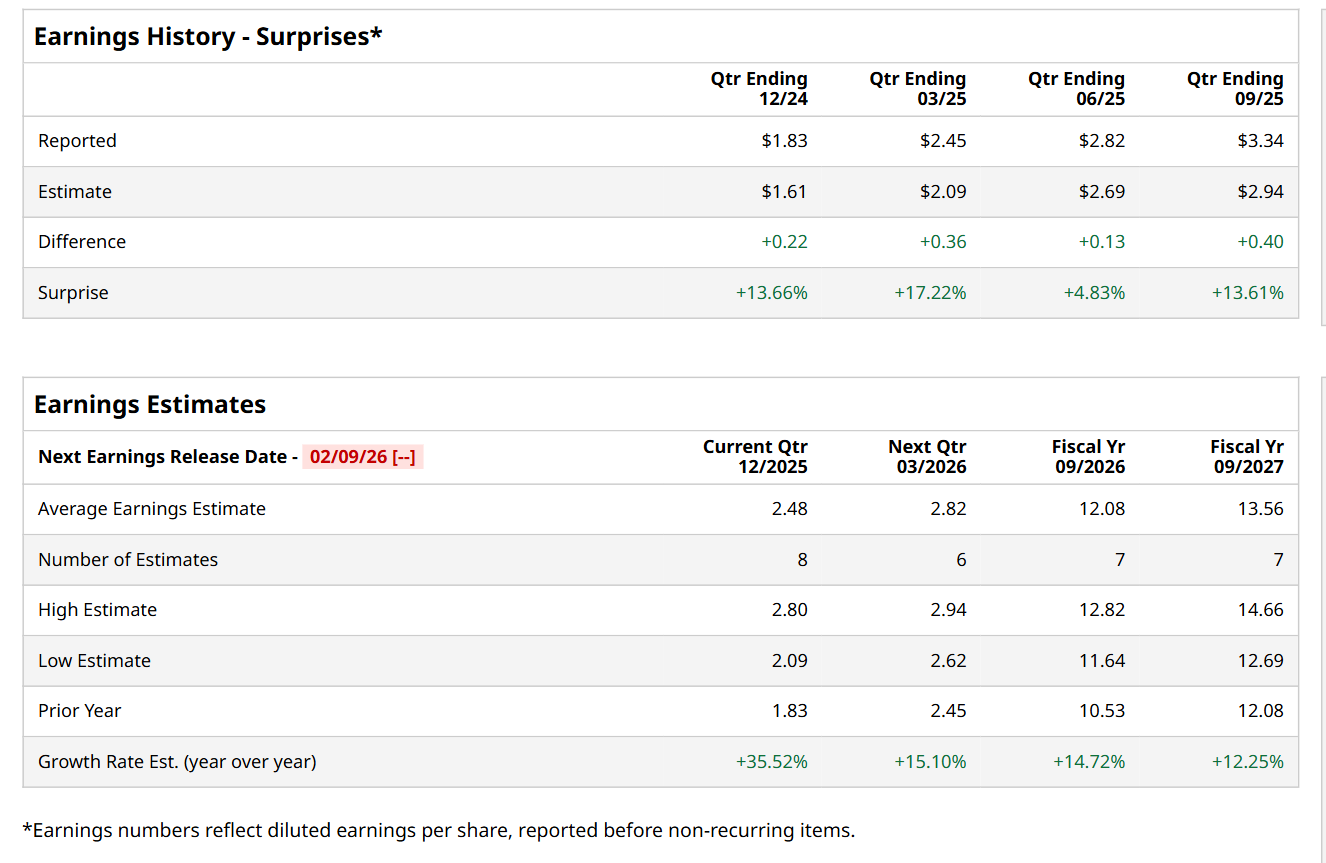

Ahead of this event, analysts expect this industrial company to report a profit of $2.48 per share, up 35.5% from $1.83 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. In Q4, its EPS of $3.34 exceeded the consensus estimates by a notable margin of 13.6%.

For fiscal 2026, ending in September, analysts expect ROK to report a profit of $12.08 per share, up 14.7% from $10.53 per share in fiscal 2025. Its EPS is expected to further grow 12.3% year-over-year to $13.56 in fiscal 2027.

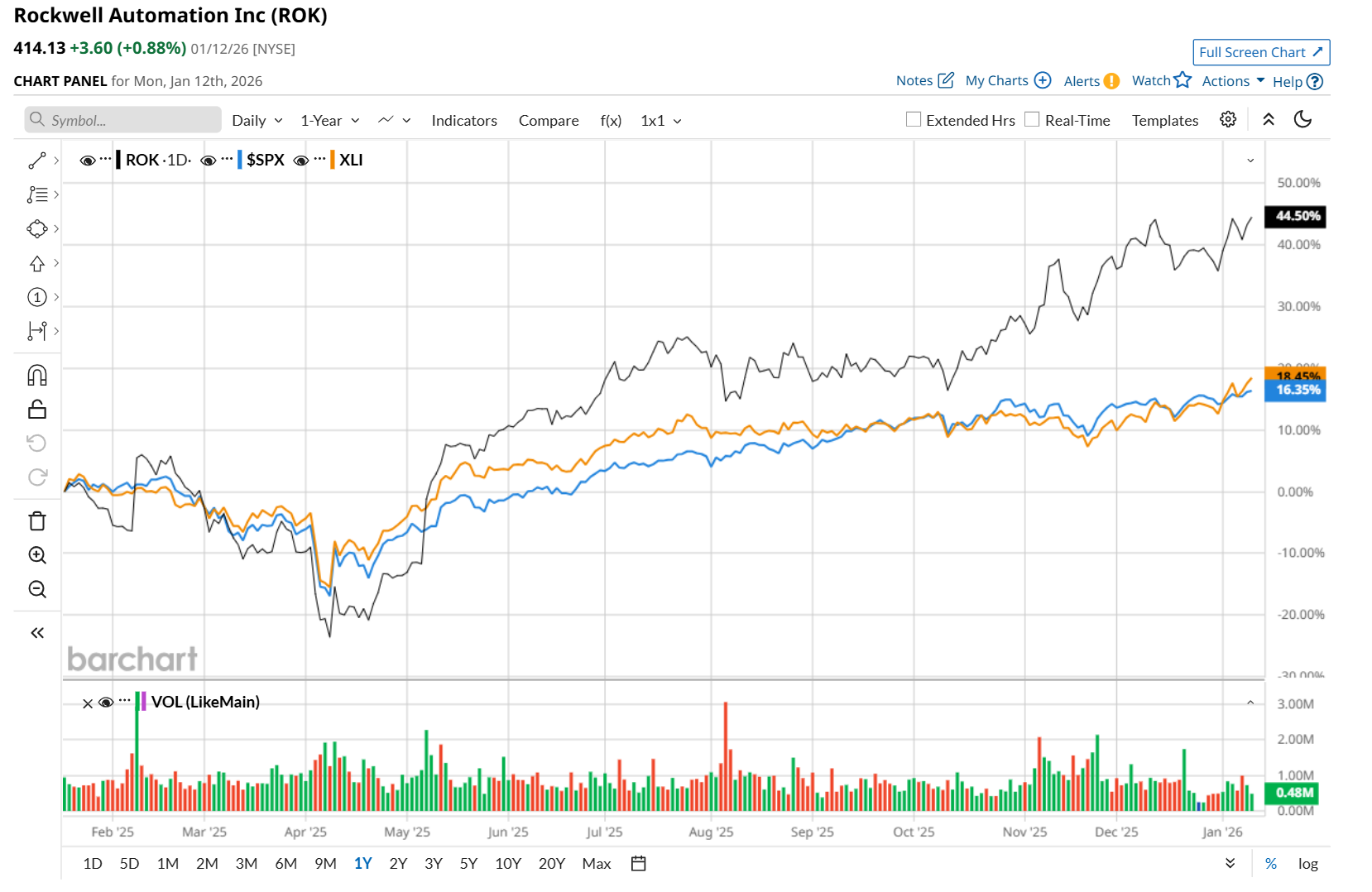

ROK has soared 51.5% over the past 52 weeks, considerably outperforming both the S&P 500 Index's ($SPX) 19.7% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 24.2% uptick over the same time period.

On Nov. 6, shares of ROK gained 2.7% after its impressive Q4 earnings results. Due to solid organic growth, the company’s total revenue increased 13.8% year-over-year to $2.3 billion, surpassing consensus expectations by 5%. Furthermore, its adjusted EPS soared 32% from the year-ago quarter to $3.34, beating analyst estimates by a notable margin of 13.6%.

Wall Street analysts are moderately optimistic about ROK’s stock, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 12 recommend "Strong Buy," and 12 suggest "Hold.” While the company is trading above its mean price target of $409.36, its Street-high price target of $470 suggests a 13.5% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart