In my latest run through the charts, it’s clear that the “crypto as digital gold” narrative is being stress-tested by a market that doesn’t care about our convictions.

For those looking to play the infrastructure behind the scenes, the GX Blockchain ETF (BKCH) offers a concentrated way to own the “plumbing” of this space without the direct volatility of holding a single coin. Because it holds stocks of companies in the crypto business.

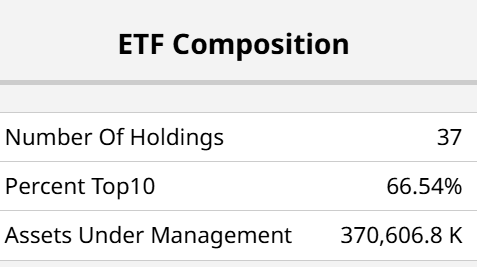

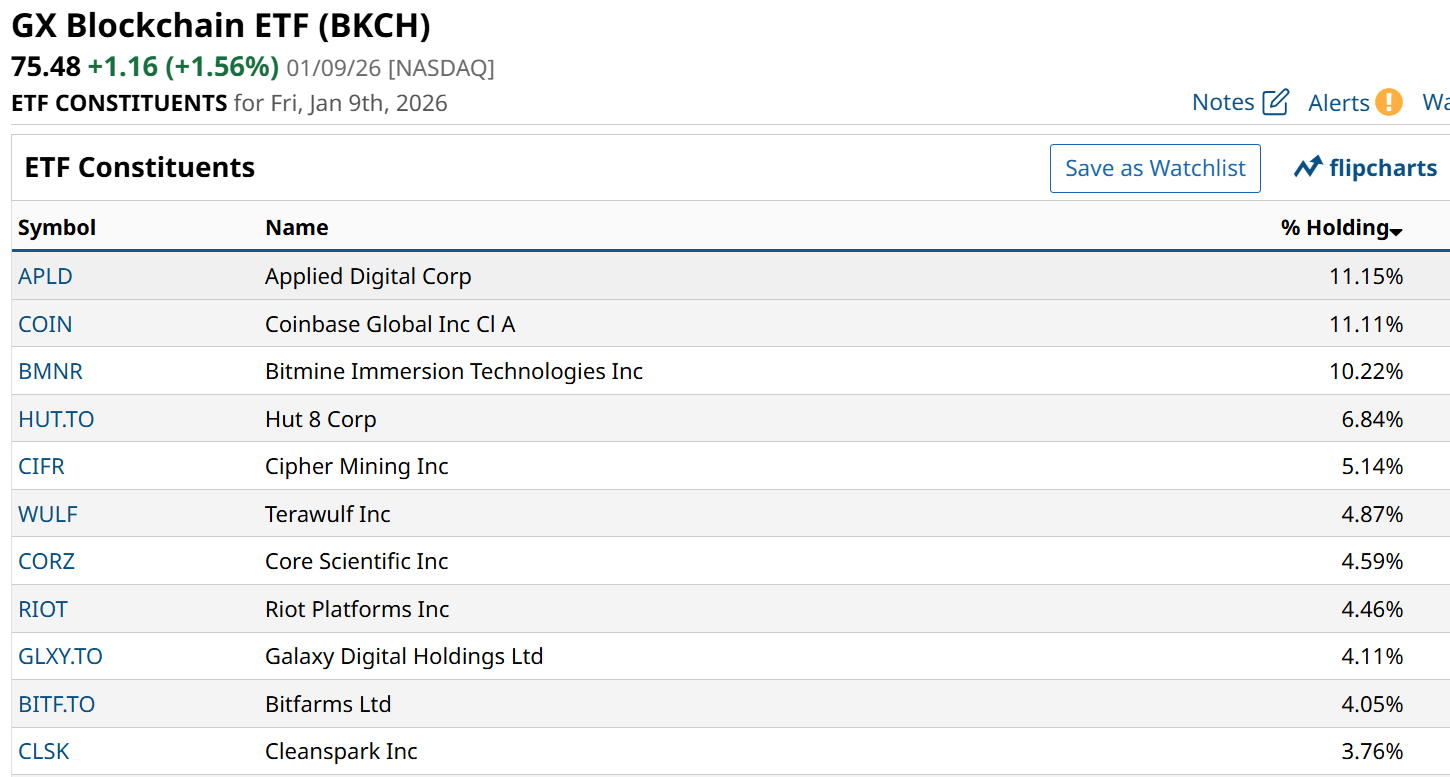

Still there’s not much of a safety component to that difference. BKCH is a high-octane vehicle that requires a strict line in the sand for traders who obey risk limits. Which should be all of us. Here are its top 11 holdings, which comprise 70% of the ETF’s total assets. Those assets stand at about $370 million as of last Friday.

Chart-wise, BKCH looks pretty good on a near-term basis. That is, it has a fighting chance to rally off of a move that cut it in half from the middle of October through late November.

But those bullish hopes get stale quickly. Sort of like the demand for some meme coins. This weekly chart is at best suspect.

BKCH is dominated by crypto exchanges and miners. These are the companies that get paid regardless of whether Bitcoin is at $100,000 or $40,000, as long as people are trading.

Here’s the chart of Coinbase (COIN), the leader in that category, and one of the biggest holdings in BKCH, at more than 11% of assets. My take: It needs to rally soon, or another downleg is likely.

The daily chart of Applied Digital (APLD) looks better. Frankly, it looks just like that of the full BKCH ETF to me. That’s no coincidence, as it too occupies 11% of the fund. So while COIN might be holding up progress, APLD might at least neutralize it.

How to Trade the BKCH ETF

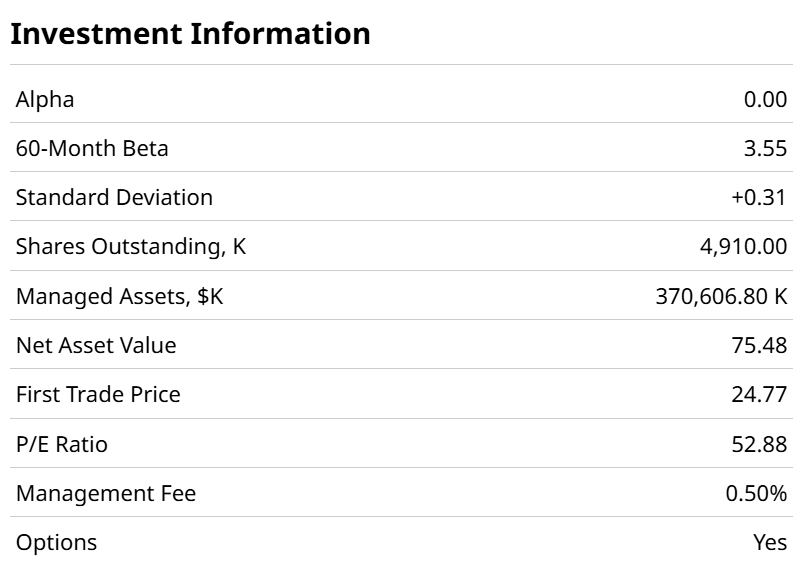

BKCH is not a “set it and forget it” core holding. It’s a tactical satellite for when the momentum is in your favor. In this market, I increasingly prefer to own these high-beta themes with an option collar or a very tight trailing stop.

And these stocks are not cheap. That price-earnings ratio on BKCH is at more than 50x, even after what has amounted to a 40% decline in price.

The objective isn’t to guess if blockchain is the future. I’ll leave that to the futurists. My job is to control the outcome. If BKCH breaks its 50-day moving average, that’s my “uncle point” for this ETF.

Humility wins in this space. Don’t let a “theme” talk you into holding through a 40% drawdown. Or worse.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer. For more of Rob’s research and investor coaching work, see ETFYourself.com on Substack. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How to Trade Venezuela 10 Days Later: Oil Prices, Energy Stocks, and the Biggest Winners and Losers

- The Market Is Stress Testing Crypto. This 1 ETF Is a Tactical, High-Risk Way to Bet on Its Comeback.

- These Were Among the Best-Performing ETFs in 2025. Are They Still Buys for 2026?

- As the US Dollar Index Tests Critical Support, Here’s What a Dollar Breakdown Could Mean for Markets