Dallas, Texas-based Match Group, Inc. (MTCH) is an internet technology company that owns and operates a broad portfolio of leading online dating brands, including Tinder, Hinge, OkCupid, Plenty of Fish, and Match.com. Valued at a market cap of $7.8 billion, the company generates revenue from subscription fees, advertising and in-app purchases across its brands.

Shares of this dating app operator have lagged behind the broader market over the past 52 weeks. MTCH has fallen 8.9% over this time frame, while the broader S&P 500 Index ($SPX) has soared 19.6%. Moreover, on a YTD basis, the stock is marginally down, compared to SPX’s 16.5% uptick.

Narrowing the focus, MTCH has also considerably underperformed the Communication Services Select Sector SPDR Fund’s (XLC) 22.9% return over the past 52 weeks and 17.3% rise on a YTD basis.

On Aug. 5, Match Group delivered mixed Q2 earnings results, and its shares surged 10.5% in the following trading session. The company’s revenue declined marginally year-over-year to $863.7 million, but topped the consensus estimates by 1.2%. Meaningful product progress at Tinder and strong momentum at Hinge supported its top line. However, on the earnings front, its adjusted operating income of $289.9 million decreased 5.4% from the year-ago quarter, while its adjusted operating margin dropped by 100 basis points.

For the current fiscal year, ending in December, analysts expect MTCH’s EPS to grow 16.6% year over year to $2.60. The company’s earnings surprise history is mixed. It surpassed the consensus estimates in two of the last four quarters, while missing on two other occasions.

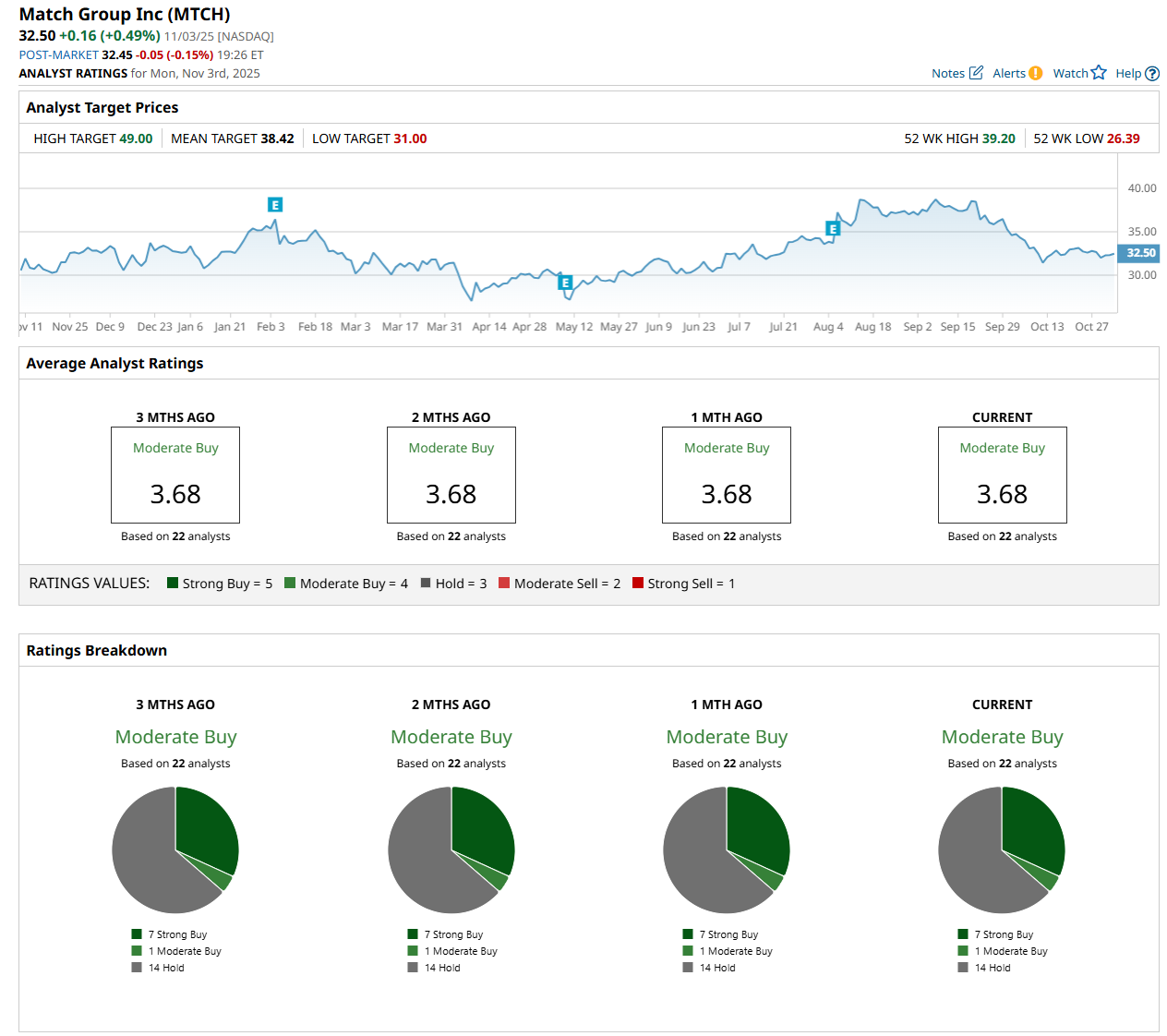

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on seven “Strong Buy,” one “Moderate Buy,” and 14 "Hold” ratings.

The configuration has remained consistent over the past three months.

On Oct. 19, UBS Group AG (UBS) analyst Kunal Madhukar maintained a "Hold" rating on MTCH, with a price target of $36, indicating a 10.8% potential upside from the current levels.

The mean price target of $38.42 represents an 18.2% premium from MTCH’s current price levels, while the Street-high price target of $49 suggests an upside potential of 50.8%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart