With a market cap of $20.5 billion, ON Semiconductor Corporation (ON) is a leading global semiconductor company based in Scottsdale, Arizona. The company focuses on intelligent power and sensing technologies, supporting key applications across automotive, industrial, communications, computing, consumer electronics, medical, and aerospace and defense markets.

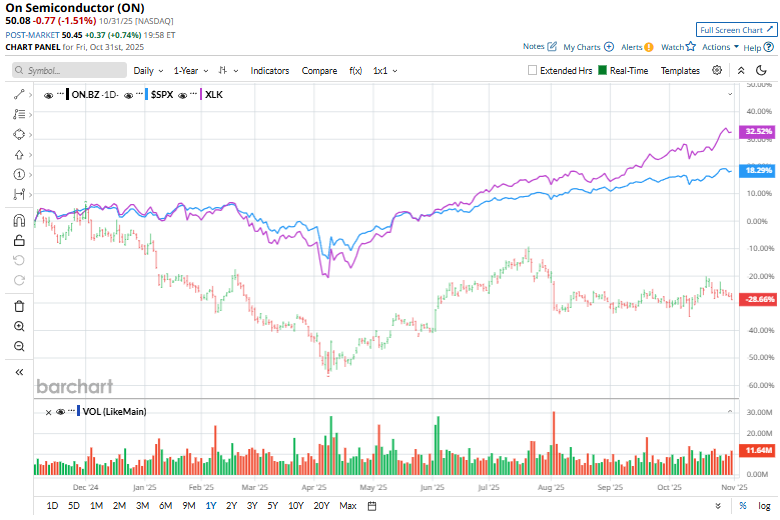

The chip titan has significantly underperformed the broader market over the past year. ON stock has dropped 20.6% on a YTD basis and 32% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 16.3% gains in 2025 and 17.7% returns over the past year.

Narrowing the focus, ON has also underperformed the Technology Select Sector SPDR Fund’s (XLK) 29.3% gains in 2025 and 31% surge over the past 52 weeks.

On Oct. 20, ON’s shares rose 4.8% as the semiconductor sector rallied, pushing the Philadelphia Semiconductor Index to a record high. The broader tech-driven rebound and strong AI optimism lifted chip stocks across the board.

For FY2025, ending in December, analysts expect a 42.5% drop in non-GAAP EPS to $2.30. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates in two of the past four quarters, while missing the projections on two other occasions.

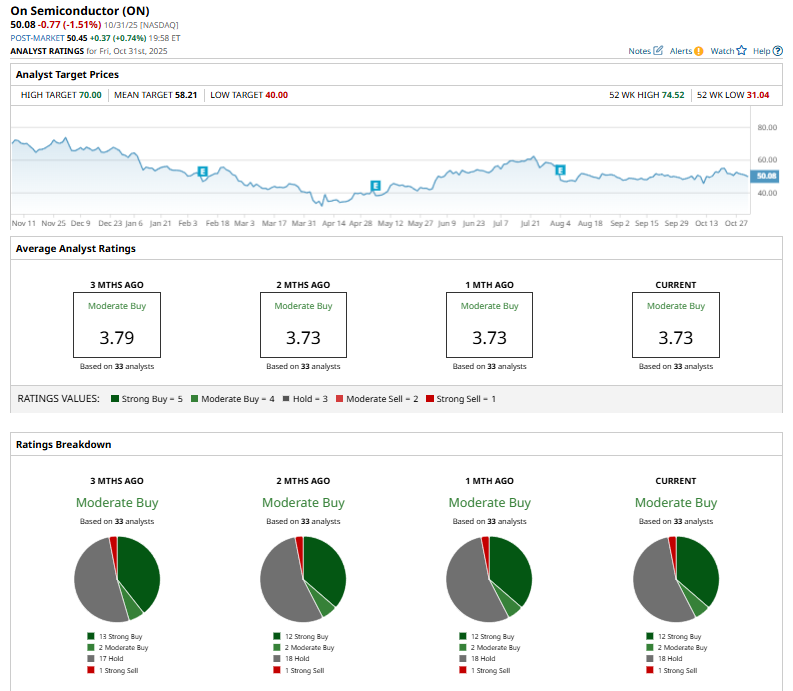

The stock has a consensus “Moderate Buy” rating overall. Of the 33 analysts covering the stock, opinions include 12 “Strong Buys,” two “Moderate Buys,” 18 “Holds,” and one “Strong Sell.”

The current configuration is less bullish than three months ago, when the stock had 13 “Strong Buy” recommendations.

On Oct. 27, UBS analyst Pradeep Ramani reaffirmed a “Neutral” rating on ON Semiconductor and raised the price target from $50 to $55, indicating a modestly improved outlook for the stock.

ON’s mean price target of $58.21 suggests a modest 2.1% upside from current price levels, while the Street-high target of $70 represents a notable 33.1% premium.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart