Abbott Laboratories has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 17.8% and now trades at $133.43. This performance may have investors wondering how to approach the situation.

Is it too late to buy ABT? Find out in our full research report, it’s free.

Why Does ABT Stock Spark Debate?

With roots dating back to 1888 when founder Dr. Wallace Abbott began producing precise, dosage-form medications, Abbott Laboratories (NYSE: ABT) develops and sells a diverse range of healthcare products including medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals.

Two Positive Attributes:

1. Economies of Scale Give It Negotiating Leverage with Suppliers

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $42.34 billion in revenue over the past 12 months, Abbott Laboratories boasts impressive economies of scale. It may not be as large as heavyweights such as UnitedHealth Group and The Cigna Group from a topline perspective, but its heft is still an important advantage in a healthcare industry that is heavily regulated, complex, and resource-intensive.

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Abbott Laboratories has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.6% over the last five years, quite impressive for a healthcare business.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

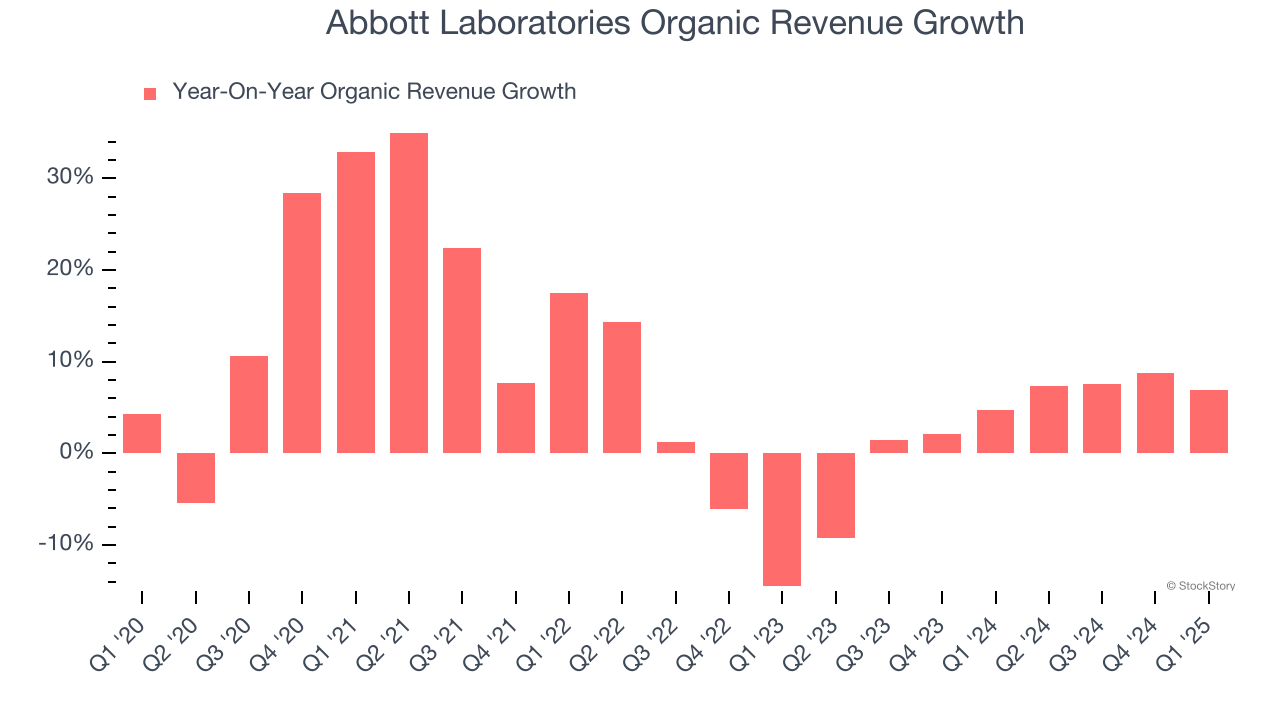

We can better understand Medical Devices & Supplies - Diversified companies by analyzing their organic revenue. This metric gives visibility into Abbott Laboratories’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Abbott Laboratories’s organic revenue averaged 3.7% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Abbott Laboratories has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 25.2× forward P/E (or $133.43 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.