Memory chips maker Micron (NYSE: MU) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 56.7% year on year to $13.64 billion. On top of that, next quarter’s revenue guidance ($18.7 billion at the midpoint) was surprisingly good and 29.3% above what analysts were expecting. Its non-GAAP profit of $4.78 per share was 20.7% above analysts’ consensus estimates.

Is now the time to buy Micron? Find out by accessing our full research report, it’s free for active Edge members.

Micron (MU) Q4 CY2025 Highlights:

- Revenue: $13.64 billion vs analyst estimates of $13 billion (56.7% year-on-year growth, 5% beat)

- Adjusted EPS: $4.78 vs analyst estimates of $3.96 (20.7% beat)

- Adjusted Operating Income: $6.42 billion vs analyst estimates of $5.34 billion (47% margin, 20.3% beat)

- Revenue Guidance for Q1 CY2026 is $18.7 billion at the midpoint, above analyst estimates of $14.46 billion

- Adjusted EPS guidance for Q1 CY2026 is $8.42 at the midpoint, above analyst estimates of $4.49

- Operating Margin: 45%, up from 25% in the same quarter last year

- Free Cash Flow Margin: 28.6%, up from 0.4% in the same quarter last year

- Inventory Days Outstanding: 125, up from 121 in the previous quarter

- Market Capitalization: $261 billion

“In fiscal Q1, Micron delivered record revenue and significant margin expansion at the company level and also in each of our business units,” said Sanjay Mehrotra, Chairman, President and CEO of Micron Technology.

Company Overview

Founded in the basement of a Boise, Idaho dental office in 1978, Micron (NYSE: MU) is a leading provider of memory chips used in thousands of devices across mobile, data centers, industrial, consumer, and automotive markets.

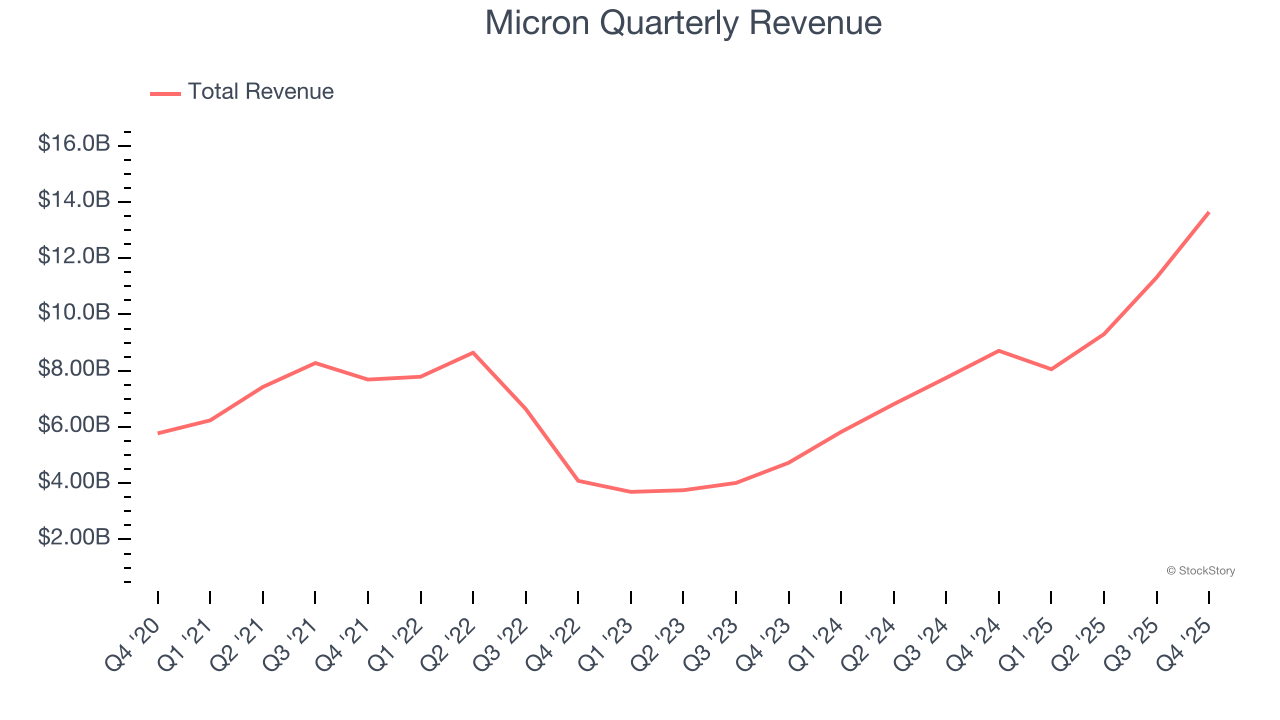

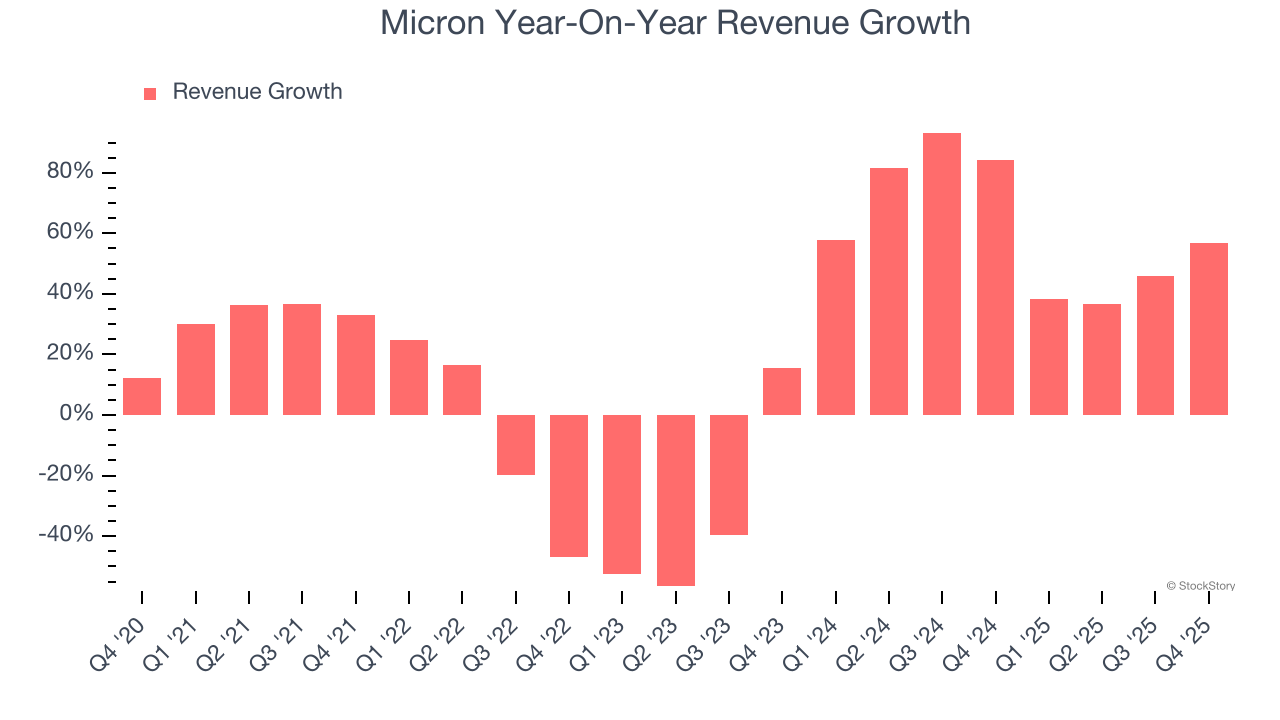

Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Micron grew its sales at an impressive 13.9% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Micron’s annualized revenue growth of 61.7% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Micron reported magnificent year-on-year revenue growth of 56.7%, and its $13.64 billion of revenue beat Wall Street’s estimates by 5%. Beyond the beat, this marks 9 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 132% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 53.7% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and suggests the market sees success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Micron’s DIO came in at 125, which is 23 days below its five-year average. These numbers show that despite the recent increase, there’s no indication of an excessive inventory buildup.

Key Takeaways from Micron’s Q4 Results

It was good to see Micron beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Looking ahead, both revenue and EPS guidance for next quarter beat as well. Zooming out, we think this was a very solid print. The stock traded up 6.1% to $239.54 immediately following the results.

Indeed, Micron had a rock-solid quarterly earnings result, but is this stock a good investment here? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.