Healthcare product and device company Abbott Laboratories (NYSE: ABT) met Wall Street’s revenue expectations in Q3 CY2025, with sales up 6.9% year on year to $11.37 billion. Its non-GAAP profit of $1.30 per share was in line with analysts’ consensus estimates.

Is now the time to buy Abbott Laboratories? Find out by accessing our full research report, it’s free for active Edge members.

Abbott Laboratories (ABT) Q3 CY2025 Highlights:

- Revenue: $11.37 billion vs analyst estimates of $11.4 billion (6.9% year-on-year growth, in line)

- Adjusted EPS: $1.30 vs analyst estimates of $1.30 (in line)

- Management reiterated its full-year Adjusted EPS guidance of $5.15 at the midpoint

- Operating Margin: 18.1%, in line with the same quarter last year

- Organic Revenue rose 5.5% year on year vs analyst estimates of 5.3% growth (23.9 basis point beat)

- Market Capitalization: $232 billion

"Our third-quarter results demonstrate our ability to deliver consistent, high-quality performance," said Robert B. Ford, chairman and chief executive officer, Abbott.

Company Overview

With roots dating back to 1888 when founder Dr. Wallace Abbott began producing precise, dosage-form medications, Abbott Laboratories (NYSE: ABT) develops and sells a diverse range of healthcare products including medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals.

Revenue Growth

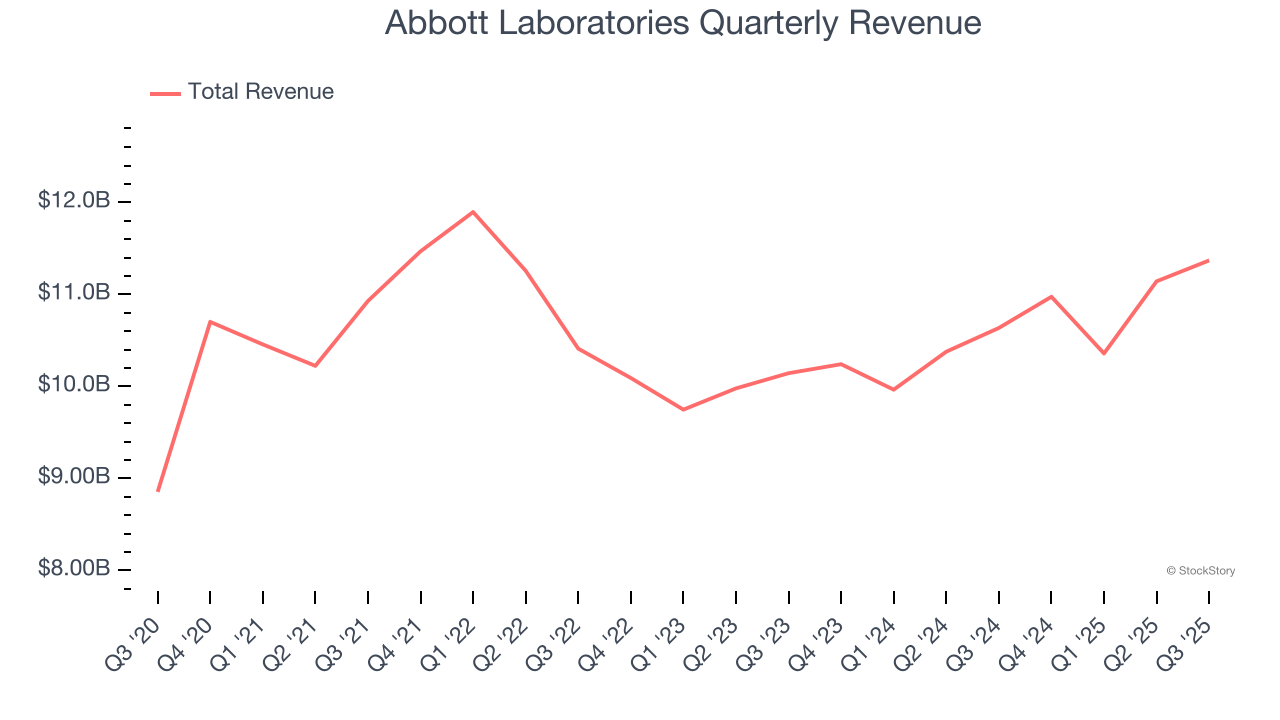

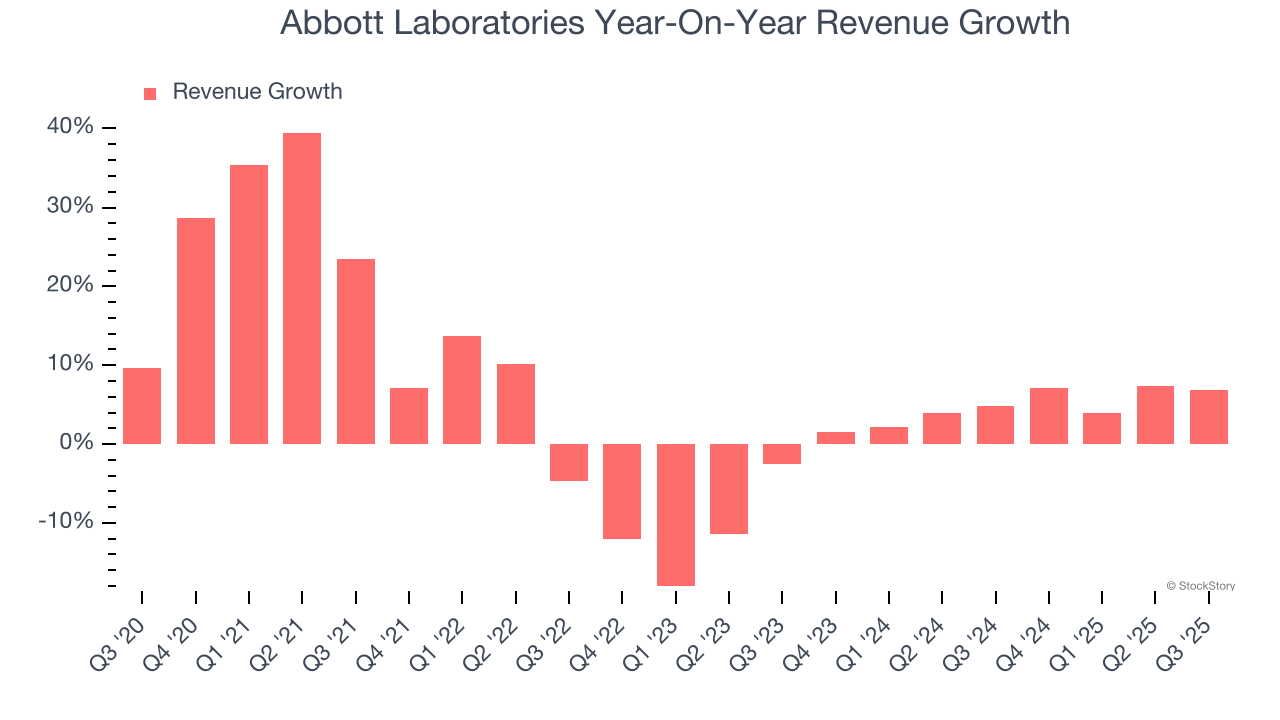

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Abbott Laboratories’s 6.4% annualized revenue growth over the last five years was mediocre. This wasn’t a great result compared to the rest of the healthcare sector, but there are still things to like about Abbott Laboratories.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Abbott Laboratories’s recent performance shows its demand has slowed as its annualized revenue growth of 4.7% over the last two years was below its five-year trend.

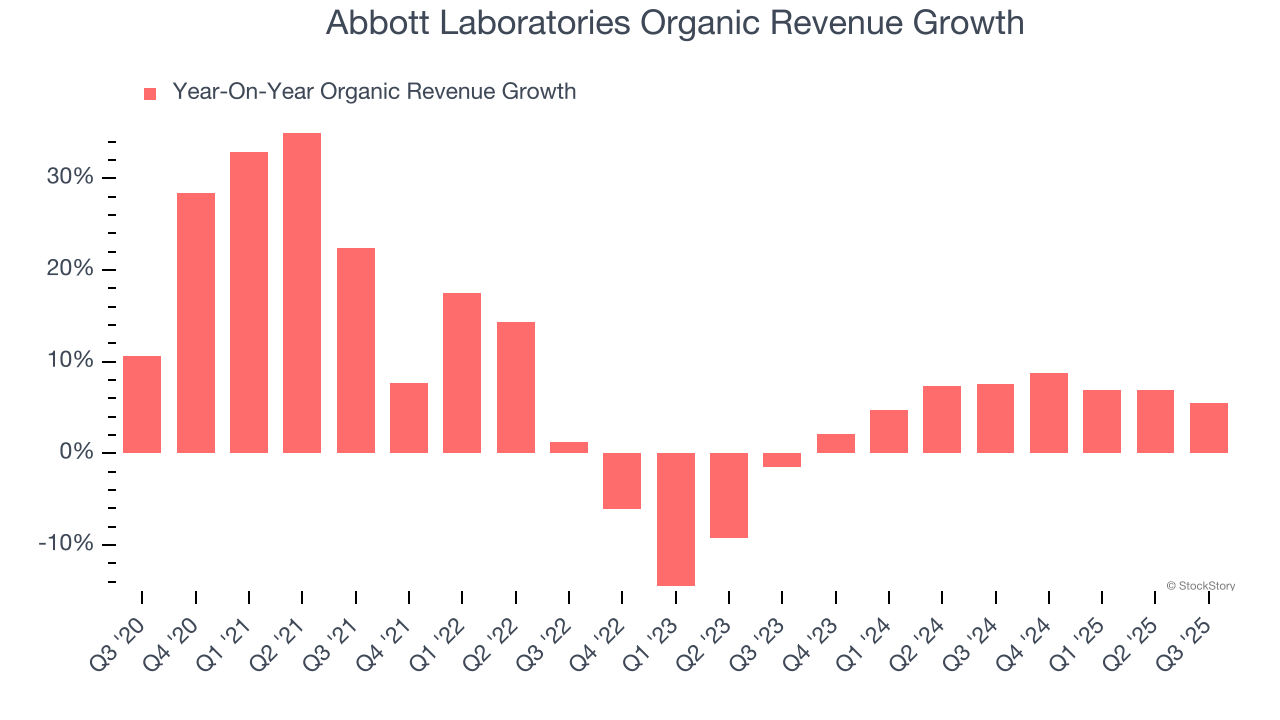

Abbott Laboratories also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Abbott Laboratories’s organic revenue averaged 6.2% year-on-year growth. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Abbott Laboratories grew its revenue by 6.9% year on year, and its $11.37 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, an improvement versus the last two years. This projection is above the sector average and indicates its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

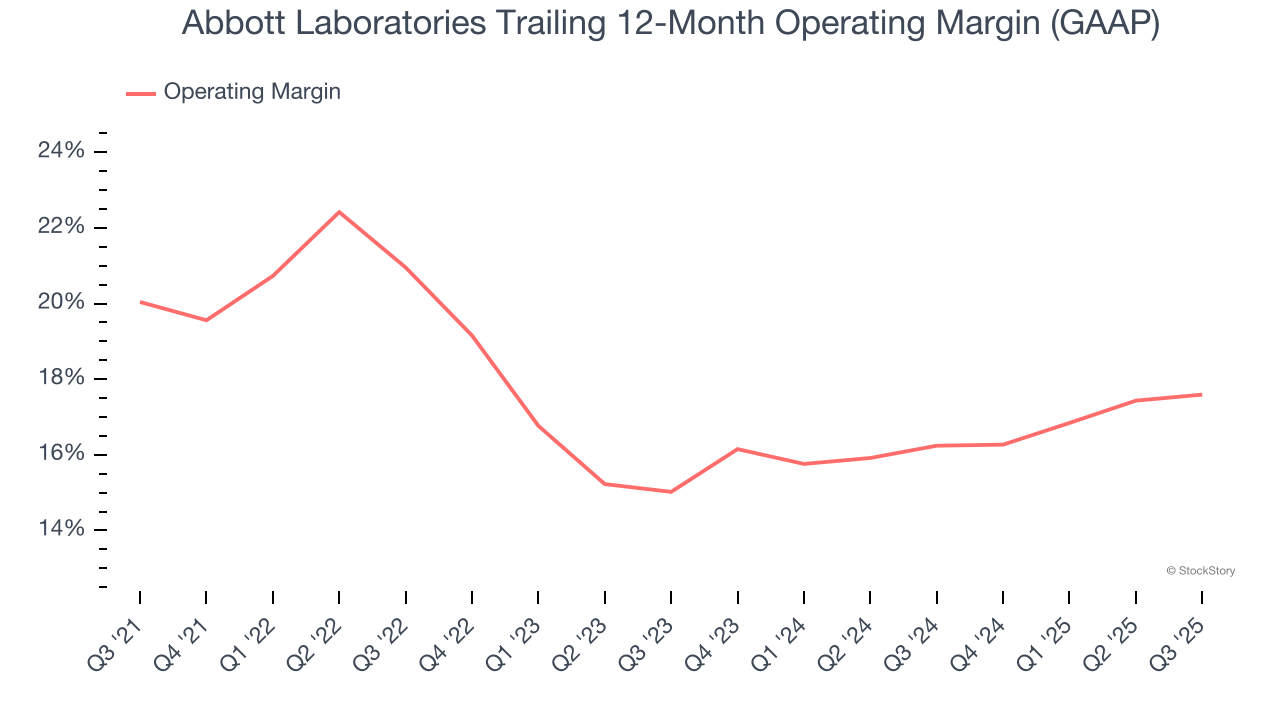

Abbott Laboratories has managed its cost base well over the last five years. It demonstrated solid profitability for a healthcare business, producing an average operating margin of 18%.

Looking at the trend in its profitability, Abbott Laboratories’s operating margin decreased by 2.4 percentage points over the last five years, but it rose by 2.6 percentage points on a two-year basis. We like Abbott Laboratories and hope it can right the ship.

This quarter, Abbott Laboratories generated an operating margin profit margin of 18.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

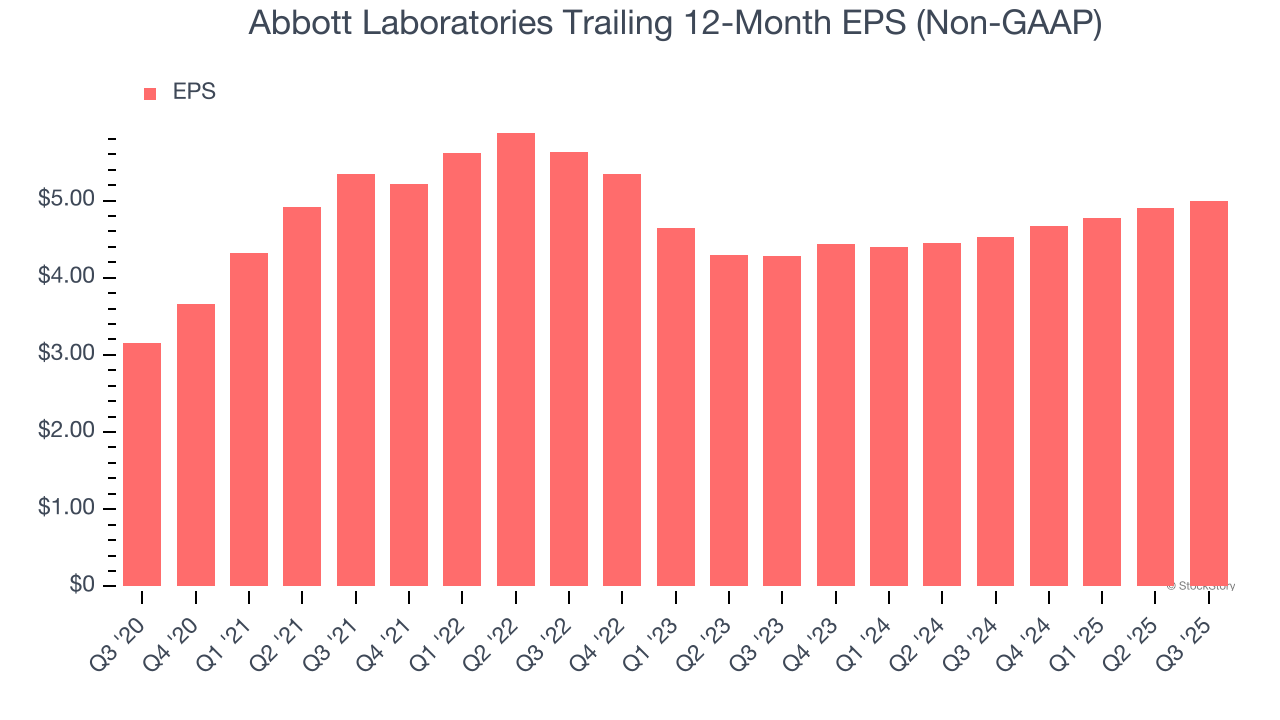

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Abbott Laboratories’s EPS grew at a remarkable 9.6% compounded annual growth rate over the last five years, higher than its 6.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

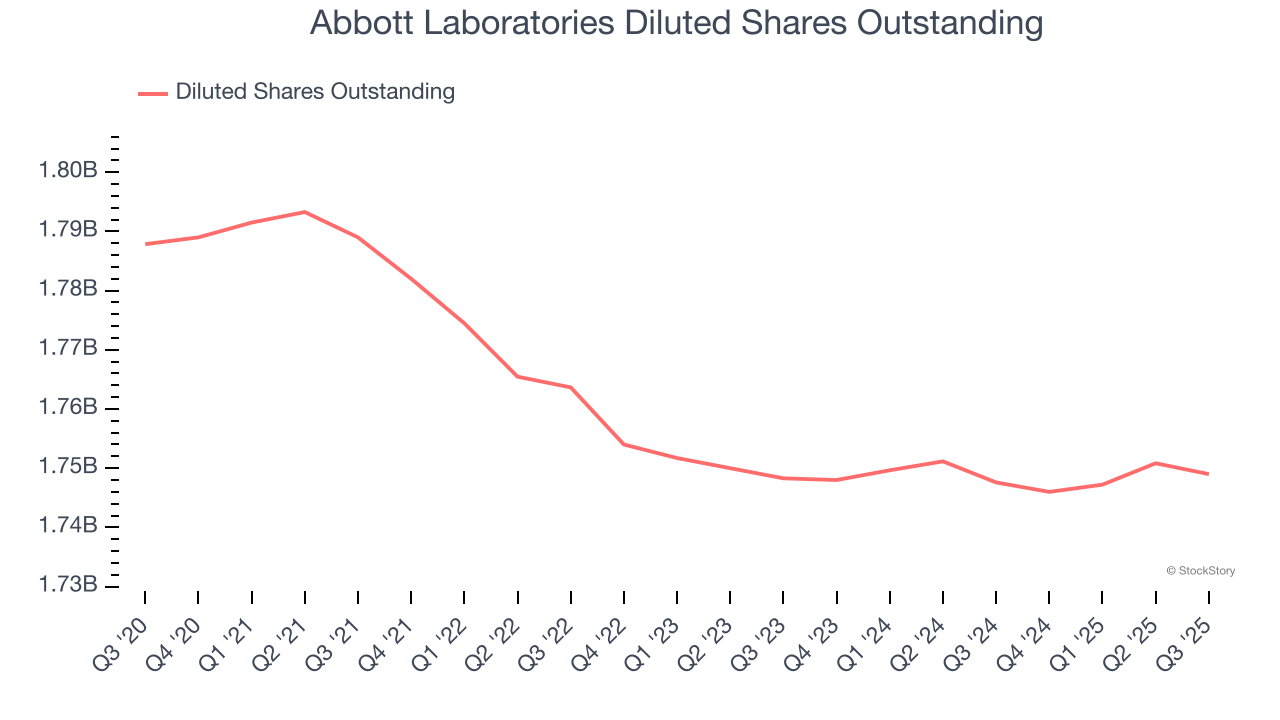

Diving into Abbott Laboratories’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Abbott Laboratories has repurchased its stock, shrinking its share count by 2.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Abbott Laboratories reported adjusted EPS of $1.30, up from $1.21 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Abbott Laboratories’s full-year EPS of $4.99 to grow 11.3%.

Key Takeaways from Abbott Laboratories’s Q3 Results

We struggled to find many resounding positives in these results. Revenue and EPS were in line, and full-year guidance was maintained. Overall, this quarter had few surprises, but it could also have been better. The stock traded down 3.3% to $128.87 immediately after reporting.

Is Abbott Laboratories an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.