Shanghai - Fashion Exchange officially released its 2022 Fashion IP 100 ranking list produced in partnership with CBNData. This is the fourth consecutive year of collaboration between the two institutes to unveil a professional list spotlighting the overall performance rankings and annual development trends of global fashion IPs in the Chinese market since they first joined hands in 2019. 2022 Global Fashion IP White Paper: Old World and New World: China’s Fashion Consumption in 2022, independently produced by Fashion Exchange is released as well.

The year 2022 marked a more complex and unstable market situation globally as a result of the rise of anti-globalization, sustained inflationary pressures, the European energy crisis, superpower games and regional conflicts. In the wake of the economic downturn and an array of unexpected events, brands, corporate decision makers and practitioners around the world have become more conservative, cautious, and even confused. The current recession has exacerbated the polarization of consumer demand and desire worldwide. Looking back at 2022 and heading into 2023, it might be a crucial year for us to break away from the “old world” and seek new frontiers.

In 2017, Fashion Exchange introduced the concept of Fashion IP, pioneering a fashion collaboration and co-branding system centered on the concept of “Fashion IPs Empower New Business.” "In the past 3 years, a devastating pandemic swept across the globe, accompanied by frequent black swan events. This has led to an upheaval of the world, rendering it unrecognizable to our familiar one. The year 2022 may be a turning point of China's consumption landscape. With the release of the annual Fashion IP 100 list and Global Fashion IP White Paper, we aim to provide valuable insights and food for thought for industry insiders in the face of the rapidly changing Chinese consumer market," said Paul Fang, founder and CEO of Suntchi.

The 2022 Fashion IP 100 is ranked on the basis of the FX INDEX data evaluation system and the online consumption data of Alibaba platforms. By taking into account CBNData’s consumption influence data, popularity on top 3 social media platforms (Weibo, Xiaohongshu and Tik Tok), and Baidu Index, nearly 400 fashion IPs across the globe were quantitatively evaluated. The final result identified 100 IPs with top overall performances in the Chinese market in 2022. This year's list has the following highlights:

l The dark horse Fear of God wins the top spot. Fear of God, the dark horse of the 2021 list, topped the 2022 list. Its diffusion line ESSENTIALS jumped to No. 2 on the list. It is also the first time that 2 of the Top 3 fashion IPs come from the same founder over the past 4 four years since the list's launch.

l TOP10 ranking sees a big reshuffle. Rihanna (Fenty)debut in TOP5. ISSEY MIYAKE, Justin Bieber (Drew House), Bai Jingting (Goodbai) and alexanderwang, all made their debut in the TOP10 list. Among them, BAI JINGTING was a new entry for 2022, and the other four have been on the list for 4 consecutive years. Liu Wen broke Shawn Yue's (Madness) 2-year reign record and became TOP1 in China's fashion IP and celebrity fashion IPs in 2022, ranking 3rd in the overall list.

l After-2010 brands are booming, while old streetwear brands are losing traction. On the overall list, 25 designer brand fashion IPs were founded after 2010, 3 of which have been on the list for 4 consecutive years; 13 were founded after 2015, up over 100% year-on-year. Among the consecutive names on the list for four years, 8 fashion IPs experienced a year-by-year decline in their rankings, including 4 traditional streetwear brands: SUPREME, STUSSY, PALACE, and NEIGHBORHOOD. SUPREME dropped from the top spot in 2019 to No. 2 in 2020, No. 3 in 2021 and No. 13 in 2022.

l Artist fashion IP's proportion declines for the first time, while that of celebrity rebounds. There was a decline in artist fashion IPs on the list for the first time, down to 7 from 11 in 2021. In this category, KAWS held its No. 1 spot for the fourth consecutive year, while Yayoi Kusama became one of the five biggest fallers in 2022. By contrast, celebrity fashion IPs rebounded in proportion, with 15 out of 20 on the list being musicians; Jackson Wang (TEAMWANG design) and Lu Han (U.G.C) both rose more than 30 spots compared to last year.

l The number of fashion IPs consecutively on the list plummets again. In 2022, 47 fashion IPs made the list for four consecutive years, 13 fewer than in 2021, and 38 fewer than in 2020, when there were 85 consecutive names on the list. Data show that since the list's debut in 2019, over 20% of consecutive entrants fell off the list each year.

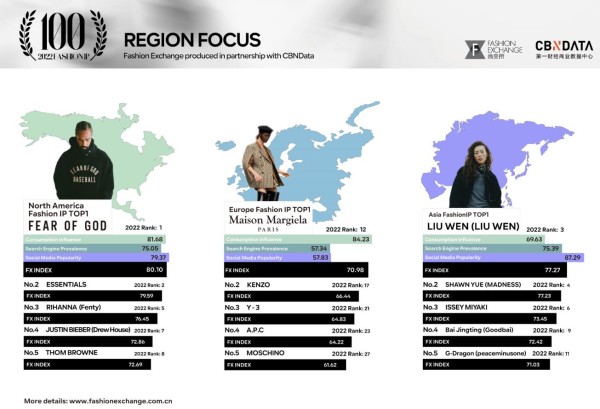

Fashion Exchange's Fashion IP 100 list has been dominated by North America, Europe and Asia since 2021. From the perspective of regions:

l North America's proportion drops sharply while Asia shows robust growth. Since the list’s debut in 2019, the proportion of fashion IPs in North America has shown a year-by-year steep decline while that of Europe has fluctuated. In contrast, Asia's share has consistently grown and surpassed North America for the first time in 2022, becoming the region with the most fashion IPs on the list. Notably, Top 20 saw more fashion IPs from Asia than North America for the first time, at 10 and 8 respectively, leaving only 2 seats from Europe.

l Asia's vibrant design hits Europe and America. There were 17 new Asian entrants to the 2022 list, including Yuhan Wang, RANDOMEVENT, LOW CLASSIC and Ma Siwei (AFGK), nearly double the number of new entrants from North America and Europe combined. This implies that in the constantly advancing Asia with regards to consumer power, aesthetics, creativity and national identity, emerging fashion IPs continue to soar and stir up new trends, challenging the dominant position of European and American fashion worldwide.

Fashion IPs from 11 countries made the list in 2022. Except for China, South Korea and France, which had an increasing share of fashion IPs listed, the remaining eight countries all showed a flat or declining proportion. From the perspective of countries:

l China’s fashion IPs soar by 100%. China overtook Japan for the first time as the country with the second most fashion IPs in the overall list, next only to the US. In the Asian region, China also surpassed Japan and South Korea for the first time to become the top contributor to fashion IPs (accounting for over 50%). Of the 11 countries, China's fashion IPs on the list grew from 12 in 2021 to 24 in 2022, a 100% increase.

l China’s local and emerging fashion IPs win more market share. There were 26 new fashion IPs on the 2022 list, with China having the most at 15, followed by the US with 5, France with 4, and South Korea with 2. Among the 13 fashion IPs founded after 2015 on the list, 8 of them, including XU ZHI, XIAO LI, FENG CHEN WANG and SHORT SENTENCE, came from China, with a 6-fold increase year-on-year in proportion.

l US and Japanese fashion IP values are obviously polarized. On the 2022 list, the rising 38 fashion IPs came from 3 countries, including 14 from the US, 7 from Japan and 6 from China. The declining fashion IPs came from 4 countries, including 12 from the US, 8 from Japan, 4 from France, and 3 from the UK. Nevertheless, among the 47 fashion IPs making the list for the fourth consecutive year in 2022, the US and Japan together accounted for over 65%, with 19 and 12 respectively, remaining the two main forces influencing trends.

Fashion Exchange’s 2022 Global Fashion IP White Paper, themed “Old World and New World: China’s Fashion Consumption in 2022”, presents an exploration and observation of the changes in China's fashion consumption amidst the structural processes of complex macroeconomic and social development, after suffering from the three-year pandemic. Through clear insights into China's fashion consumption landscape, the White Paper aims to help brands and enterprises to identify suitable partners and find potential directions for cooperation in the future.

l In terms of collaboration practices, Fashion Exchange selected 10 of the best collaboration for the year from its 43 best collaboration cases of 2022. The 10 projects cover industries of sports, outdoors, home life, 3C electronics, automotive, watches, food and beverage, etc., which have performed outstandingly in product concept, value creation, marketing and promotion, sales results realization and users’ emotional experience. They have unique value highlights and action logic worth learning from in different dimensions such as strategy formulation, IP selection, promotion, sales, etc., which can provide reference for collaboration & co-branding planning of brands and enterprises. Facts have proved that high-quality fashion collaborations and brand partnerships remain the most effective method with high return on investment for brands to launch new products, create viral products, acquire new customers, promote conversion, enhance repurchases, and improve brand awareness.

l In terms of trend research, fashion trends reflect the underlying subcultures and the various choices for beauty and lifestyle among different consumer groups, which are reflected in their consumption of products such as bags, beauty products, home furnishings, 3C products, and even cars, food and beverage. Fashion Exchange has sorted out 10 noteworthy fashion IPs in 2023, as well as 8 style labels, in the 2022 Global Fashion IP White Paper, with the aim of helping brands and enterprises find entry points and partners for high-quality collaborations.

Paul Fang, founder and CEO of Suntchi, shared his views in the preface of the 2022 Global Fashion IP White Paper. "I believe that the most valuable and attractive aspect of high-quality collaborations and brand partnerships lies in the opportunity to engage in professional exchange and intellectual collision with exceptional fashion IPs from different fields. This intellectual stimulation and crossing of industry perspectives enables business leaders and decision-makers to break out of information silos and self-imposed limits, constantly broaden their horizons and enhance their cognitive capabilities." In the midst of the profound change unseen in a century, there arise new challenges for brands and enterprises in the reshuffled new market environment. How can they boost their competitiveness, attract new customers while retain regular ones, and reinvigorate consumption enthusiasm and enhance loyalty of the emerging middle class by collaborating with fashion IPs? How to make the most of the crucial turning point of 2023? This is what Fashion Exchange tries to answer through the 2022 Fashion IP 100 and the 2022 Global Fashion IP White Paper.

About Fashion Exchange

Fashion Exchange is a global fashion IPs collaboration and innovation platform. In 2017, we introduced the concept of Fashion IP, pioneering a fashion collaboration and co-branding system centered on the concept of “Fashion IPs Empower New Business.” Currently, we have successfully launched multiple collaborations, including Alexander Wang x McDonald's, ANGEL CHEN x H&M, Superdry x Clottee, JACK & JONES NEXT x Jeremy Scott, Karl Lagerfeld x Tsingtao Brewery, Mizuno x Hajime Sorayama, ANGEL CHEN x Canada Goose, PEACEBIRD x Shanghai Phoenix, LEDIN x White Rabbit, Alexander Wang x VIVO, ANTA x Opening Ceremony, Bosideng x Maserati, and Jackson Yee x RIMOWA. This is the fourth consecutive year since 2019 that Fashion Exchange has released the Fashion IP 100, a professional list produced in partnership with CBNData that spotlights the overall performance rankings of fashion IPs worldwide in the Chinese market, as well as the Global Fashion IP White Paper Fashion Exchange independently produce that aims to popularize new trends, changes and practices of fashion IPs and global fashion consumption to the public.

Media Contact

Company Name: Fashion Exchange

Contact Person: Kris Zhang

Email: Send Email

Country: China

Website: www.fashionexchange.com.cn