U.S. Bank Ranks Highest in Client Satisfaction with Full-Service Investment Advisors

A rising tide lifts all boats, and a strong stock market makes investors feel good about their financial advisors, but what happens when the tide recedes? That’s the central question explored in the J.D. Power 2024 U.S. Full-Service Investor Satisfaction Study,SM which finds a significant 8-point (on a 1,000-point scale) year-over-year increase in investor satisfaction. However, the study also finds pockets of weakness, notably among the rising ranks of affluent Millennial1 investors, with 36% of them saying they “probably will” or “definitely will” switch firms in the next year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240321470966/en/

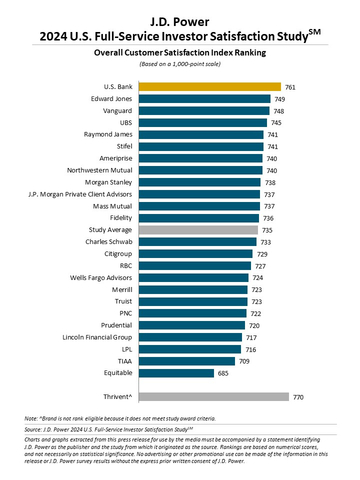

2024 U.S. Full-Service Investor Satisfaction Study (Graphic: Business Wire)

“It is conventional wisdom that investor satisfaction tracks closely with stock market performance, but for advisors who want to build long-term, sustainable relationships that can weather good markets and bad, they will need to build a deeper level of engagement with clients,” said Craig Martin, executive managing director and global head of wealth and lending intelligence at J.D. Power. “This is especially true among the younger segment of investors who show lower levels of client loyalty than investors in other generational groups. Advisors will need to adjust their approach to meaningfully connect with younger investors or risk a major outflow of assets in coming years.”

Following are some key findings of the 2024 study:

- Full-service advisor satisfaction rises on strong markets: Overall investor satisfaction with full-service investment advisors is 735, which is up 8 points from a year ago. This performance is consistent with the long-term trend of investor satisfaction moving in concert with stock market performance and illustrates a potential risk factor for advisors whose perceived value is dependent on market forces.

- Younger affluent clients present greatest flight risk: Intended attrition rates tend to be very low among clients with advisors, especially among Gen X and older clients. Millennials—particularly more affluent Millennials—are a different story. More than one-third (36%) of Millennials with more than $1 million in investable assets say they are likely to change firms in the next year. A potential factor in this lack of loyalty is that 70% of affluent Millennials have a secondary investment firm. This number is significantly lower among older affluent cohorts.

- Technology becomes increasingly important: Technology and digital solutions have become increasingly critical to enabling advisor efficiency and empowering more proactive client engagement. A majority (86%) of advised clients logged into their account on their firm’s site in the past 12 months and 60% logged onto the mobile app. Furthermore, advisors who take the time to help clients understand and engage with digital channels are consistently driving higher levels of investor satisfaction. Advisors who fail to clearly explain digital options are perceived more negatively and get half the number of referrals as their more digitally supportive peers.

- Rapid growth of AI puts spotlight on advisor relationships: As AI-enabled investment advisory solutions rapidly gain traction in the marketplace, advisors need to be clear on what differentiates them. In 2024, 41% of advised clients’ experiences fall into the transactional category on the J.D. Power advice continuum.2 This group is put at the greatest risk by technology-enabled solutions that can effectively compete on price and efficiency. Delivering truly personalized guidance that addresses a client’s unique goals and challenges, major life changes and investment strategies that transcend returns are keys to insulating the business from future competitive threats.

Study Ranking

U.S. Bank ranks highest in overall investor satisfaction with a score of 761. Edward Jones (749) ranks second and Vanguard (748) ranks third.

The U.S. Full-Service Investor Satisfaction Study, now in its 22nd year, measures overall investor satisfaction with full-service investment firms in seven dimensions (in order of importance): trust; people; products and services; value for fees; ability to manage wealth how and when I want; problem resolution; and digital channels.

The 2024 study is based on responses from 9,951 investors who work directly with a dedicated financial advisor or team of advisors. The study was fielded from January 2023 through January 2024.

For more information about the U.S. Full-Service Investor Satisfaction Study, visit https://www.jdpower.com/business/wealth-management-platform.

See the online press release at http://www.jdpower.com/pr-id/2024024.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2006). Millennials (1982-1994) are a subset of Gen Y.

2 The J.D. Power Advisor Continuum measures the efficacy of advice delivery on a scale extending from transactional to comprehensive. It categorizes performance into three tiers—transactional, client-centric and comprehensive—thereby indicating a progression from basic to exceptional service.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240321470966/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com