Underscores lack of qualifications of Driver’s nominee including NO prior public company board experience, NO executive experience in a highly regulated business and NO experience at a regional bank

We encourage you to vote FOR your current Board of Directors on the BLUE proxy card

First Foundation Inc. (NASDAQ: FFWM) (“First Foundation” or the “Company”), a financial services company with two wholly-owned operating subsidiaries, First Foundation Advisors and First Foundation Bank, today released a letter it is mailing from the First Foundation Board of Directors to First Foundation’s Stockholders in connection with its 2023 Annual Meeting of Stockholders, which is scheduled to be held on Tuesday, June 27, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230531005846/en/

(Graphic: Business Wire)

+++

Dear Fellow Stockholders,

As owners of First Foundation Inc. (“First Foundation,” the “Company,” “we,” “our,” or “us”), you have a critical decision to make about the First Foundation Board of Directors (the “Board”) in the proxy voting prior to the Company’s upcoming Annual Meeting of Stockholders, which is scheduled to be held on Tuesday, June 27, 2023. Your vote will have a tremendous impact, and we hope that you will reaffirm the steps that we have taken to enhance First Foundation’s business and its Board of Directors.

The Board currently includes diverse, talented, and independent individuals who bring complementary sets of skills, experiences, and expertise to oversee First Foundation. We pride ourselves on seeking varied perspectives and value independent voices, as we believe this is crucial for driving growth for our clients and our company, especially during challenging times. Throughout the unprecedented market volatility for regional banks, and even months before it began, our Board proactively identified areas where changes were needed and worked with management to make difficult decisions and take decisive action. This was to maintain the strength and stability that has allowed First Foundation to successfully navigate shifting economic environments and cyclicality since our founding in 1990.

The speed and magnitude with which the Federal Reserve raised interest rates surprised many observers, as did the after-effects of those rate hikes. Regional banks, in particular, have had to re-evaluate every aspect of their business while maintaining client confidence in deposits, liquidity, security portfolios, and risk management. Because our Board has experience in highly regulated industries with versatile skills in risk management, managing cash flow and safeguarding liquidity, we have navigated the current crisis with agile business strategies that have allowed us to remain responsive to unpredictable market conditions while other regional banks have failed.

A critical decision approved by the Board that we executed prior to the current industry backdrop was to expand into new markets to provide greater opportunities for banking, trust, and wealth management for a diversified group of clients. We were able to access highly desirable markets and improve the diversity of our deposit base, as evidenced by our recent expansions in Texas and Florida, two growing areas outside of California. Additionally, we have reduced uninsured deposits substantially, from 26% of total deposits at the end of 2022 to approximately 13% of total deposits as of May 12, 2023. These actions provide greater confidence to our clients and represent critical steps that should help us continue to weather the current banking environment.

While navigating the current banking environment is crucial in the near-term, we are also making strategic decisions to maintain our long-term success. We recognize that good corporate governance is critical to a high-functioning organization and is an area of great importance to our stockholders. The Board has focused on efforts that bring fresh perspective, diverse views, and experienced insight to benefit our stockholders.

The most recent addition to the Board, Gabriel Vazquez, is a highly qualified executive who brings a compelling set of knowledge and experience relevant to the banking industry and our clients. This underscores the Board’s ability to identify a need for new skills and attract best-in-class, independent nominees.

Mr. Vazquez, who was appointed to the Board in April 2023, has extensive experience in managing and supporting the legal operations of Vistra Corp. (“Vistra”) (NYSE: VST), a Fortune 500 integrated power company based in Texas. As Vice President and Associate General Counsel for Operations, Mr. Vazquez oversees the legal department’s operations and the execution of Vistra’s enterprise crisis management program. His leadership roles in both the Dallas Bar Foundation and the Jesuit College Preparatory School of Dallas Foundation Inc. demonstrate his commitment to community service and his ability to collaborate in one of the growing communities in which we operate. His experience as a senior leader in a highly regulated and publicly traded business made him an excellent addition to the Board. As recent developments within the banking industry have increased the potential for enhanced regulation, we welcome the extensive legal and regulatory experience that Mr. Vazquez offers, which provided immediate value for our stockholders and fresh perspective to our Board.

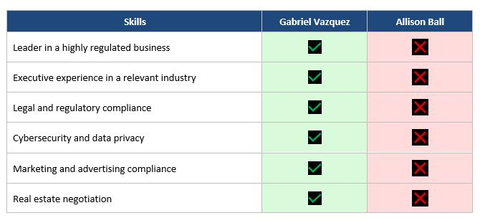

Mr. Vazquez’s strong and unique blend of skills and professional experience stands in stark contrast to the skills of the nominee proposed by Driver Management Company LLC (“Driver”), an activist hedge fund led by Abbott Cooper (“Mr. Cooper”). Driver is known for launching campaigns against other small and mid-size banks and has claimed to beneficially own an aggregate of 354,000 shares of First Foundation common stock, representing approximately 0.6% of First Foundation’s outstanding common stock. Driver’s proposed nominee, Allison Ball, lacks the necessary experience we believe is required of a director of a publicly traded financial services institution. The contrast between Mr. Vazquez and Ms. Ball could not be more clear. (Please see attached chart.)

Not only does Ms. Ball lack experience, but she has caused concern by engaging in selective non-disclosure about certain aspects of her professional background. For instance, Ms. Ball submitted an incomplete nomination questionnaire by failing to disclose her current employment as Chief Product Officer at software firm, Grata, where she serves under a different last name than the one listed in Driver’s proxy statement.1 Driver’s definitive proxy statement failed to include this employment information as well.2 Further, Ms. Ball served3 as Chief Operating Officer of an unrelated, failed health care startup also called Driver or, more formally, Driver, Inc.4 The Board would have liked to inquire about these experiences, but Driver Management, on behalf of Ms. Ball, declined multiple invitations for Ms. Ball to meet with current Board members. Ms. Ball’s refusal to participate in a formal interview process and reluctance to properly represent her true experience and affiliations calls into question her judgment and dedication as a prospective member of our Board. Further, it supports our belief that Ms. Ball’s background offers no incremental value to our current Board and to our stockholders.

The First Foundation Board, on the other hand, has demonstrated a compelling ability to attract highly qualified, diverse independent directors.

In its definitive proxy statement filed with the SEC on May 17, 2023, Driver indicated that it opposes our nomination of incumbent Director John A. Hakopian, the current President of First Foundation’s subsidiary First Foundation Advisors (“FFA”). Mr. Hakopian’s tenure on the Board and his remarkable 33-year tenure with the Company are significant assets to First Foundation and our stockholders, as he has deep knowledge of our business and a proven ability to forge and maintain longstanding relationships with FFA customers. Under Mr. Hakopian’s leadership, FFA has demonstrated strong performance and has also bolstered growth in our banking business, as FFA clients have extended their relationship to include First Foundation Bank. Driver also implied in proxy materials it filed with the SEC on May 22, 2023, that Mr. Hakopian’s recent sale of shares of First Foundation common stock is a reason for him to be replaced on the Board by Ms. Ball. What Driver failed to say is that Mr. Hakopian still owns 656,366 shares--approximately 1.2% of the Company’s outstanding common stock, nearly twice the amount that Driver beneficially owns.5 Mr. Hakopian has extensive executive, wealth management, and investment advisory experience that bring tremendous value to the Board; Ms. Ball lacks such experience.

The First Foundation Board is committed to transparency, diversity, and independence. As demonstrated by the addition of Mr. Vazquez, we are committed to Board refreshment as well. Our willingness to improve and oversee enhancements are clear indications that we are invested in the long-term success of First Foundation and committed to serving the best interests of our stockholders. We are confident that we have the right mix of people with the right skills and experiences working to enable our success as a best-in-class regional bank in today’s complex industry environment.

We urge you to support First Foundation by voting “FOR” your incumbent directors Ulrich E. Keller, Jr., Scott F. Kavanaugh, Max A. Briggs, John A. Hakopian, David G. Lake, Elizabeth A. Pagliarini, Mitchell M. Rosenberg, Ph.D, Diane M. Rubin, Jacob P. Sonenshine, and Gabriel V. Vazquez and selecting “WITHHOLD” for the Driver Nominee on your BLUE Proxy Card.

We encourage shareholders to disregard any white proxy card or other solicitation materials sent to you by Driver. Only your latest dated proxy card will be counted at the 2023 Annual Meeting of Stockholders.

For more information about Mr. Cooper’s misguided campaign against First Foundation, please visit www.truthfirstfoundationinc.com.

Sincerely,

The First Foundation Board of Directors

+++

About First Foundation

First Foundation Inc. (NASDAQ: FFWM) and its subsidiaries offer personal banking, business banking, and private wealth management services, including investment, trust, insurance, and philanthropy services. This comprehensive platform of financial services is designed to help clients at any stage in their financial journey. The broad range of financial products and services offered by First Foundation are more consistent with those offered by larger financial institutions, while its high level of personalized service, accessibility, and responsiveness to clients is more aligned with community banks and boutique wealth management firms. This combination of an integrated platform of comprehensive financial products and personalized service differentiates First Foundation from many of its competitors and has contributed to the growth of its client base and business. Learn more at firstfoundationinc.com or connect with us on LinkedIn and Twitter.

Forward-Looking Statements

This press release includes forward-looking statements within the meaning of the “Safe-Harbor” provisions of the Private Securities Litigation Reform Act of 1995, including forward-looking statements regarding our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets. Forward-looking statements often include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "outlook," or words of similar meaning, or future or conditional verbs such as "will," "would," "should," "could," or "may." The forward-looking statements in this press release are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this press release and could cause us to make changes to our future plans.

Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as amended, our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023, and other documents we file with the SEC from time to time. We urge readers of this press release to review those reports and other documents we file with the SEC from time to time. Also, our actual financial results in the future may differ from those currently expected due to additional risks and uncertainties of which we are not currently aware or which we do not currently view as, but in the future may become, material to our business or operating results. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this press release, which speak only as of today's date, or to make predictions based solely on historical financial performance. We also disclaim any obligation to update forward-looking statements contained in this press release or in the above-referenced reports, whether as a result of new information, future events or otherwise, except as may be required by law or NASDAQ rules.

Important Additional Information

The Company, its directors and certain of its executive officers are participants in the solicitation of proxies from the Company’s stockholders in connection with its upcoming 2023 Annual Meeting of Stockholders (the “2023 Annual Meeting”). The Company has filed a definitive proxy statement and a BLUE universal proxy card with the Securities and Exchange Commission (the “SEC”) in connection with its solicitation of proxies from the Company’s stockholders. STOCKHOLDERS OF THE COMPANY ARE STRONGLY ENCOURAGED TO READ SUCH PROXY STATEMENT, ACCOMPANYING BLUE UNIVERSAL PROXY CARD AND ALL OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION. Information regarding the identity of the participants and their direct and indirect interests, by security holdings or otherwise is set forth in the definitive proxy statement and other materials filed with the SEC in connection with the 2023 Annual Meeting. Stockholders can obtain the definitive proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC at no charge at the SEC’s website at www.sec.gov. Copies are also available at no charge on the Company’s website at www.ff-inc.com.

1 https://www.gratapro.com/leadership/allison-swope

2 https://d18rn0p25nwr6d.cloudfront.net/CIK-0001413837/d49afc01-edff-4e10-bf8e-b96028b54fbf.pdf

3 https://www.linkedin.com/in/allison-ball-swope-62b48a43/

4 https://www.statnews.com/2018/11/12/driver-startup-shuts-down/

5 According to Driver’s filing dated May 12, 2023, Driver Management, as the general partner of Driver Opportunity and investment manager to certain separately managed accounts (the “SMAs”), may be deemed to beneficially own (i) 133,000 shares of Common Stock directly owned by Driver Opportunity Partners I LP and (ii) 221,000 shares of Common Stock held by Driver Management Company LLC in the SMAs.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230531005846/en/

Contacts

Investor and Media Contact:

Shannon Wherry

Director of Corporate Communications

swherry@ff-inc.com

(469) 638-9642