The soft commodities sector includes futures on world sugar, Arabica coffee, cocoa, cotton, and frozen concentrated orange juice traded on the Intercontinental Exchange. The price of all five soft commodities declined in Q4. In my Q3 Barchart report on the soft sector, I concluded with the following:

I remain bullish on sugar and cotton prices at the current price levels, but will leave plenty of room to add on further declines, as picking bottoms can be dangerous. Meanwhile, expect volatility in the soft commodities sector, which has gone from the leader of the asset class in 2024 to the laggard in 2025. The weather in critical growing areas, crop diseases, trade issues, and geopolitics can cause significant price variance in the tropical commodities. Meanwhile, cotton tends to move to annual highs during Q1 and Q2 as the uncertainty of the annual crop peaks. Given the price level below 66 cents per pound, cotton could be the best candidate for a price recovery from its current level.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis.

The cure for the high soft commodity prices over the past few years was those high prices, as softs moved from upside leader in 2024 to laggard in 2025.

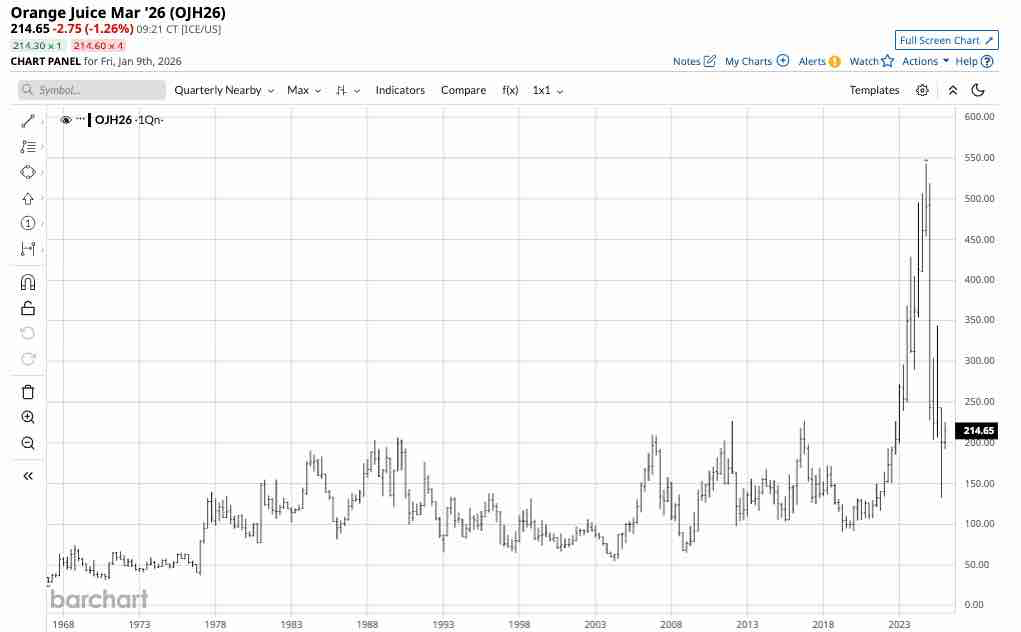

FCOJ led on the downside in Q4 and 2025

Frozen concentrated orange juice, which reached an all-time high of $5.4315 per pound in the final quarter of 2024, was the worst-performing soft commodity in Q4 2025, falling 15.75%.

The quarterly continuous FCOJ chart shows that the soft commodity fell 58.75% in 2025, settling around $2.0520 per pound on December 31, 2025. ICE FCOJ was the worst-performing soft commodity in Q4 and 2025. The soft commodity was higher than the 2025 closing price on January 9, 2026.

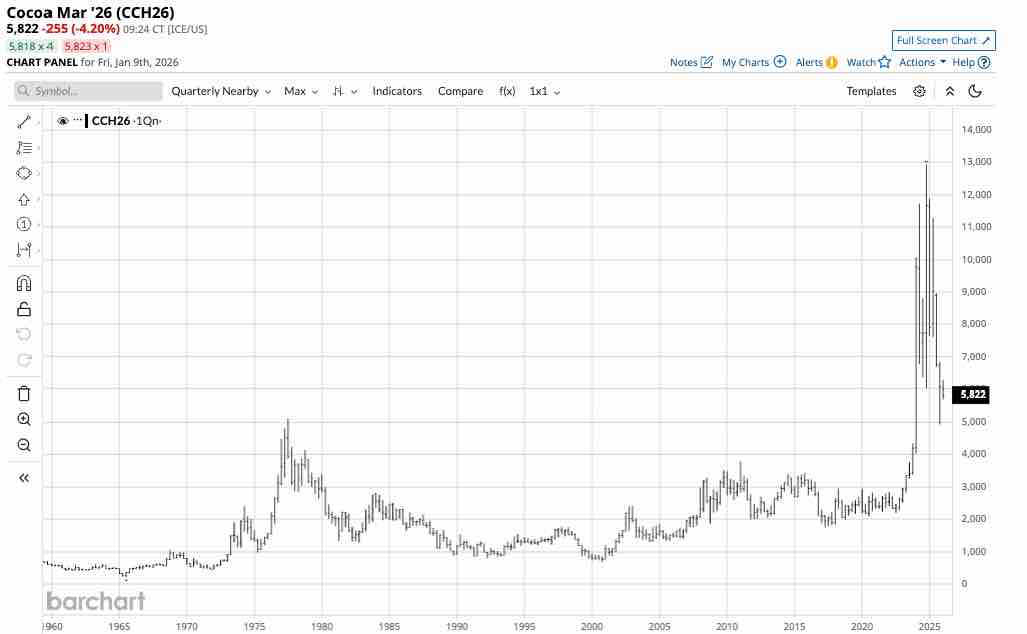

Cocoa was the second-worst performer in Q4 and 2025

ICE cocoa futures also experienced a significant decline in Q4 2025, falling 10.13%.

The quarterly continuous cocoa futures chart highlights that the nearby futures contract settled at $6,065 per ton on December 31, 2025. Cocoa futures declined 48.05% in 2025, making the soft commodity the sector’s second-worst-performing commodity. Nearby cocoa futures were lower than the 2025 closing price on January 9, 2026.

World sugar and cotton fell in Q4 and 2025

World sugar futures #11 declined 6.77% in Q4 2025, settling at 15.01 cents per pound. The world sugar futures fell 22.07% in 2025, making it the third soft commodity to post a double-digit percentage decline. ICE world sugar futures reached a multi-year high of 28.14 cents per pound in Q4 2023 before falling, making lower highs and lower lows throughout 2024 and 2025. The nearby world sugar futures price was slightly lower in early 2026.

ICE cotton futures declined 2.28% in Q4 2025, settling at 64.27 cents per pound. The cotton futures fell 6.04% in 2025. The cotton futures reached a multi-year high of $1.5595 per pound in Q2 2022 before declining. In 2025, the nearby cotton futures traded in a narrow range of 60.80 to 69.75 cents per pound. The nearby cotton futures’ price was marginally higher in early 2026.

Arabica coffee fell in Q4, but recovered in 2025

ICE Arabica coffee futures declined 6.99% in Q4, settling at $3.4865 per pound. The continuous Arabica coffee futures contract posted a 9.04% gain in 2025.

Arabica coffee futures reached a record high of $4.3795 per pound in Q4 2025. In early 2026, the coffee futures market remained bullish. Coffee was the only soft commodity in a bullish trend as of the end of 2025. Adverse weather conditions in Brazil, the world’s leading coffee-producing country, have driven prices higher. Arabica coffee futures prices for March 2026 delivery were higher at above the $3.60 per pound level on January 9.

The prospects for the soft commodities in Q1 and 2026

As with all agricultural commodities, the weather across the critical growing regions will dictate the path of least resistance for prices. Brazilian weather and crop issues will determine the path of least resistance of sugar, coffee, and FCOJ prices. Weather, crop diseases, and political factors in West Africa, namely the Ivory Coast and Ghana, the world’s leading producers, will dictate the path of cocoa prices. While cotton’s price path will be a function of production from China, India, Brazil, the U.S., Pakistan, and Australia.

Rising production costs due to inflation support all commodity prices in early 2026. Meanwhile, cyclicality suggests that prices fall to levels at which production slows, inventories decline, and consumers increase their consumption. The two most likely candidates for rallies, given the price levels at the end of 2025, are cotton and sugar prices, which have been steadily declining over the past two years.

Soft commodities were the best-performing sector of the raw materials asset class in 2023 and 2024, posting gains of 24.04% and 58.14%, respectively. Commodity cyclicality also suggests that prices rise to levels where production increases, inventories build, demand decreases, and prices turn lower. In 2025, the soft commodity sector, excluding world sugar and cotton, experienced cyclical effects. Time will tell if cotton and sugar prices can recover in 2026, but cyclicality favors the upside. Meanwhile, FCOJ, cocoa, and Arabica coffee prices remain historically high, so we should expect continued volatility in the sector over this year.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Soft Commodities in Q4 and 2025- What are the Prospects for Q1 2026 and Beyond?

- Your Coffee Is Getting Cold: 1 Trade to Make as Arabica Prices Stumble

- As Trump Lifts Brazil Coffee Tariffs, Coffee Prices Are Falling. 1 Trade to Make Now.

- Coffee Is Percolating. How Much Higher Will Prices Go from Here?