Nvidia (NVDA) has been the defining company of the current AI megatrend, emerging as perhaps the best way to benefit from this revolutionary tech. However, it is not the sole semiconductor player in the fray, with Palo Alto, CA-based Broadcom (AVGO) making a strong case for itself.

And now, financial services major J.P. Morgan has hailed the company as a must-have in investors' portfolios. Why? Analyst Harlan Sur has pointed towards the continued surge in capital expenditure by the hyperscalers in general and the consequent rise in demand for ASIC, or application-specific integrated circuit, chips in particular, to bode well for Broadcom.

About Broadcom

Despite the stock rising by eight times over the past year and a 44% jump on a year-to-date (YTD) basis, Broadcom, with a market cap of $1.6 trillion, is relatively lesser known than its “Mag 7” peers. The leader in the custom ASICs market, Broadcom, traces its origins to 1961. Broadcom operates two primary business segments currently: Semiconductor Solutions and Infrastructure Software. While the former is predominantly focused on custom silicon for data centers, the latter is geared towards enterprise software.

So, armed with J.P. Morgan's endorsement, is the AVGO stock a strong investment choice, or is the firm's assessment misplaced? Let's find out.

Broadcom's Clean and Strong Financials

Not explicitly put in the spotlight, but Broadcom's enviously robust fundamentals must have increased J.P. Morgan's conviction about the company. Over the past 10 years, Broadcom's revenue and earnings have grown at healthy CAGRs of 25.07% and 32.46%, respectively. Moreover, Broadcom has a long track record of consistent quarterly earnings beats, with no misses for more than two years.

The latest results for Q4 2025 were no different, with both revenue and earnings surpassing estimates, making the sharp fall post-earnings even more baffling. Revenue for Q4 came in at $18.02 billion, which represented an annual growth of 28%. While the chip segment witnessed a 35% year-over-year (YoY) rise to $11.07 billion, the high-margin and rapidly growing enterprise software segment saw its revenues rise by 19% from the previous year to $6.94 billion.

Earnings at $1.95 per share were up 37% over the past year. Not only was this the eighth consecutive quarter of an annual rise in earnings, but it was also the eighth consecutive quarter of earnings beat from the company. The quarter also saw Broadcom paying a cash dividend of $0.59 per share, implying a dividend yield of 0.69%. Notably, one of those rare chip companies that pays a dividend, Broadcom, has been raising dividends consecutively over the past 15 years.

However, Broadcom is a cash-generating juggernaut as well. In Q4 2025, the company's cash flow from operations stood at $7.7 billion, up 37% from the previous year, while free cash flow was also up by 36% in the same period to $7.5 billion. Overall, the company ended the quarter with a cash balance of $16.2 billion, much higher than its short-term debt levels of $3.2 billion.

For Q1 2026, Broadcom expects revenue to be $19.1 billion, which would denote a YoY growth rate of 28%.

Yet, like many of the venerable names in the AI space, Broadcom continues to trade at expensive levels. Its forward P/E, P/S, and P/CF of 33.77, 16.66, and 31.93 are all much higher than the sector medians of 24.34, 3.39, and 20, respectively. Conversely, growth projections remain way ahead of the industry average at 35.30% (vs. 8.03%) for revenues and 107.22% (vs. 10.72%) for earnings.

Exciting Runway for Growth

The analysts may not be that off the mark about Broadcom's future growth assumptions. The global ASIC market is projected to reach about $42.36 billion by 2034, a CAGR of 7.38% from now. And Broadcom, with a market share of 55%-60%, stands tall as the undisputed leader.

Moreover, it seems that Broadcom is poised to remain the dominant player in this space, thanks to its substantial $73 billion hardware backlog and unmatched expertise in building custom silicon XPUs for hyperscalers such as Alphabet (GOOG) (GOOGL) and Meta (META). Furthermore, Broadcom made headlines in October with a major tie-up alongside OpenAI, committing to rolling out 10 gigawatts of custom AI accelerators designed in collaboration. Notably, the two companies are jointly engineering the full stack, incorporating Broadcom's accelerators and Ethernet networking gear for both scale-up clusters and scale-out fabrics. Deployment of these rack systems is scheduled to begin in the second half of 2026 and wrap up by the close of 2029. Analysts peg the multi-year revenue potential from this arrangement in the $150 billion to $200 billion range.

Meanwhile, Broadcom's track record of outperformance and its favorable positioning in the custom ASIC arena trace back to tailored inference chips that routinely deliver multiples of cost efficiency compared with Nvidia's general-purpose GPUs, alongside steady generational leaps in raw capability. Adding to that edge is the company's push to stay at the forefront of high-speed interconnects through the Tomahawk 6 switch, which is the first commercially available 102.4 Tbps Ethernet product. This latest iteration doubles the throughput of its predecessor while providing versatile port configurations (up to 1,024 100G or 512 200G SerDes lanes), which helps customers consolidate hardware and cut overall switch counts in large builds.

Finally, on the software front, VMware remains the centerpiece of Broadcom's strategy. The recent launch of VMware Cloud Foundation 9 introduces a fully unified private-cloud stack that works equally well on-premises or in hosted settings. Built from the ground up to handle any workload, including demanding AI pipelines, in a locked-down setup, VCF 9 gives enterprises a credible alternative to public hyperscalers. For governments and regulated entities requiring data sovereignty, the on-premise flexibility could prove particularly compelling, opening a sizable addressable market across nations prioritizing secure, domestically controlled infrastructure.

Analyst Opinion on AVGO Stock

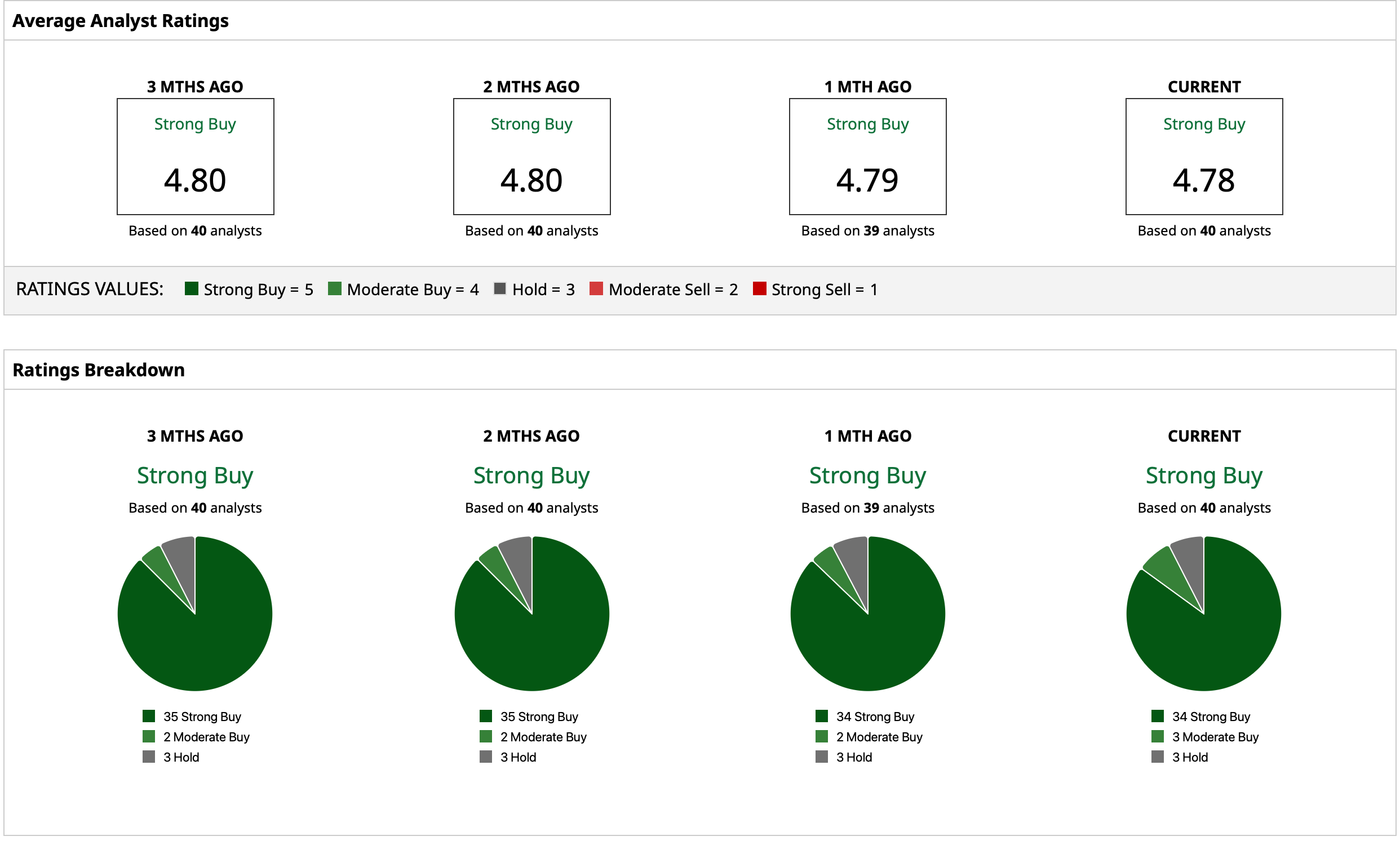

Thus, analysts have attributed a rating of “Strong Buy” for the stock, with a mean target price of $453.95. This denotes an upside potential of roughly 37% from current levels. Out of 40 analysts covering the stock, 34 have a “Strong Buy” rating, three have a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Warren Buffett Warns That During Bubbles, Stock Prices and Earnings Will ‘Diverge,’ But They Can’t ‘Continuously Overperform Their Businesses’

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?