Robinhood (HOOD) has become the de facto investment platform for new retail investors, especially those in the younger cohort. This has evolved into a stock market windfall, showing no signs of slowing in the past two years.

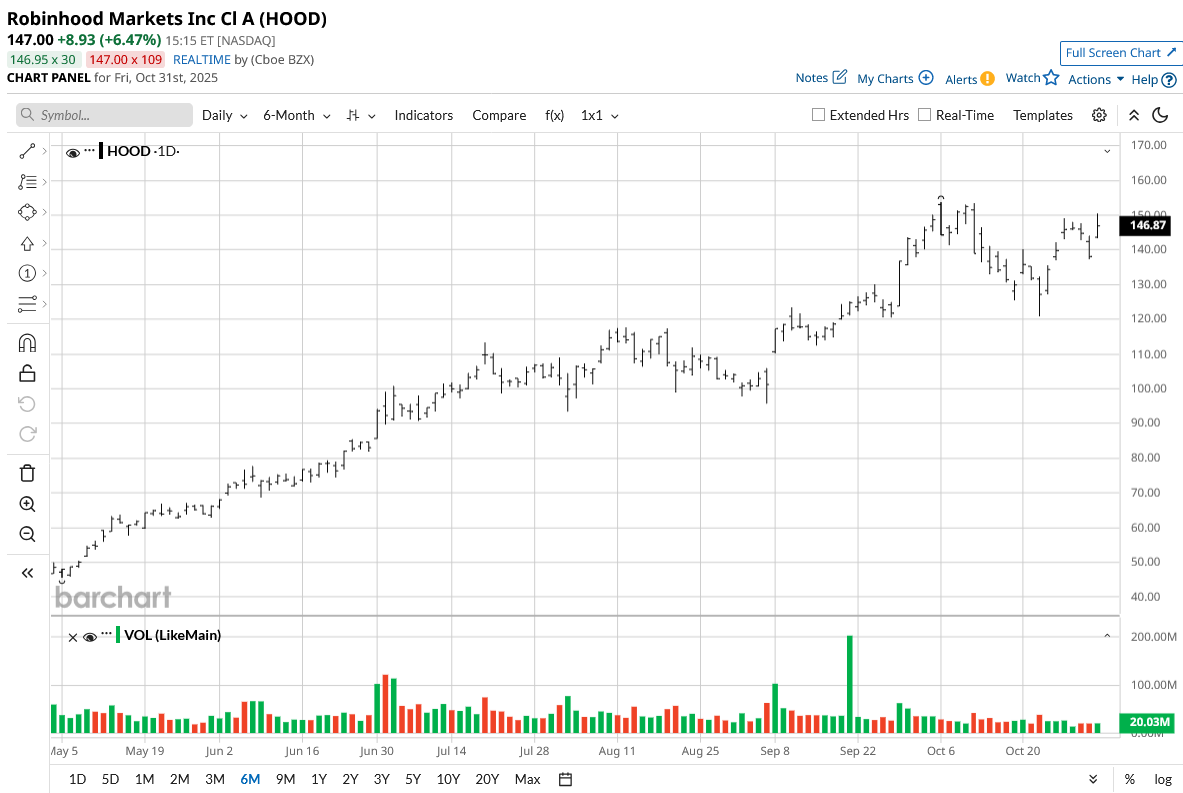

The platform's popularity has been boosted by the broader market's rally, which has lifted HOOD stock by 421% over the past year. Bulls expect the rally to continue. The argument is that Robinhood has established itself as a mainstay in the investing space and will be able to aggressively expand its pricing power. After all, there will only be new entrants to the investing space.

However, one of the two main ingredients behind HOOD stock's rally could be showing signs of fading. That is, of course, the broader market's rally. Robinhood is a stockbroker, and they make the most money when the stock market is red hot and full of volatility.

Bears believe we're late in the cycle, and HOOD stock may disappoint soon.

The company is set to release its Q3 2025 earnings on Nov. 5.

Can Robinhood's Current Trajectory Continue?

If you look at analyst expectations and assume that the AI rally will continue for years, it bodes well for HOOD stock. Analysts expect 64.2% EPS growth this year and 16.8% EPS growth next year. Revenue is expected to grow 44.6% this year and 18.5% next year.

The market isn't writing a blank check to Robinhood, though. HOOD stock already trades at over 81 times forward earnings. Holding that multiple if the stock market slips is a tall order, if not unthinkable.

At the same time, if the market rally does continue, the higher end of estimates can lead to 40-50% annual gains if HOOD stock struts along with earnings.

In Q2, the company reported EPS of $0.42 and beat the consensus estimate of $0.31. Revenue of $989 also trounced the $908 million estimate from Wall Street.

In short, HOOD stock's current trajectory can continue. Previous quarters have delivered exceptional earnings beats.

How Q3 May Pan Out for Robinhood

The company's chief financial officer, Jason Warnick, already hinted at good results in the Q2 earnings call transcript. He said, "As we enter Q3, we're off to a fast start in July. Net Deposits are around $6 billion. It's a really nice pickup from May and June."

For Q3, analysts expect EPS of $0.51, up 218.5% year-over-year (YoY). Revenue is expected to grow to $1.21 billion, up 90.6% from the prior-year quarter. The good news doesn't end there: analysts have been revising their prior estimates upward ahead of earnings day.

I'd expect Q3 to be another blockbuster quarter. Some of the most traded stocks on Robinhood have taken an even more aggressive turn in recent months. It would be surprising if the company failed to capitalize on the boon.

Is HOOD Stock a Buy Now?

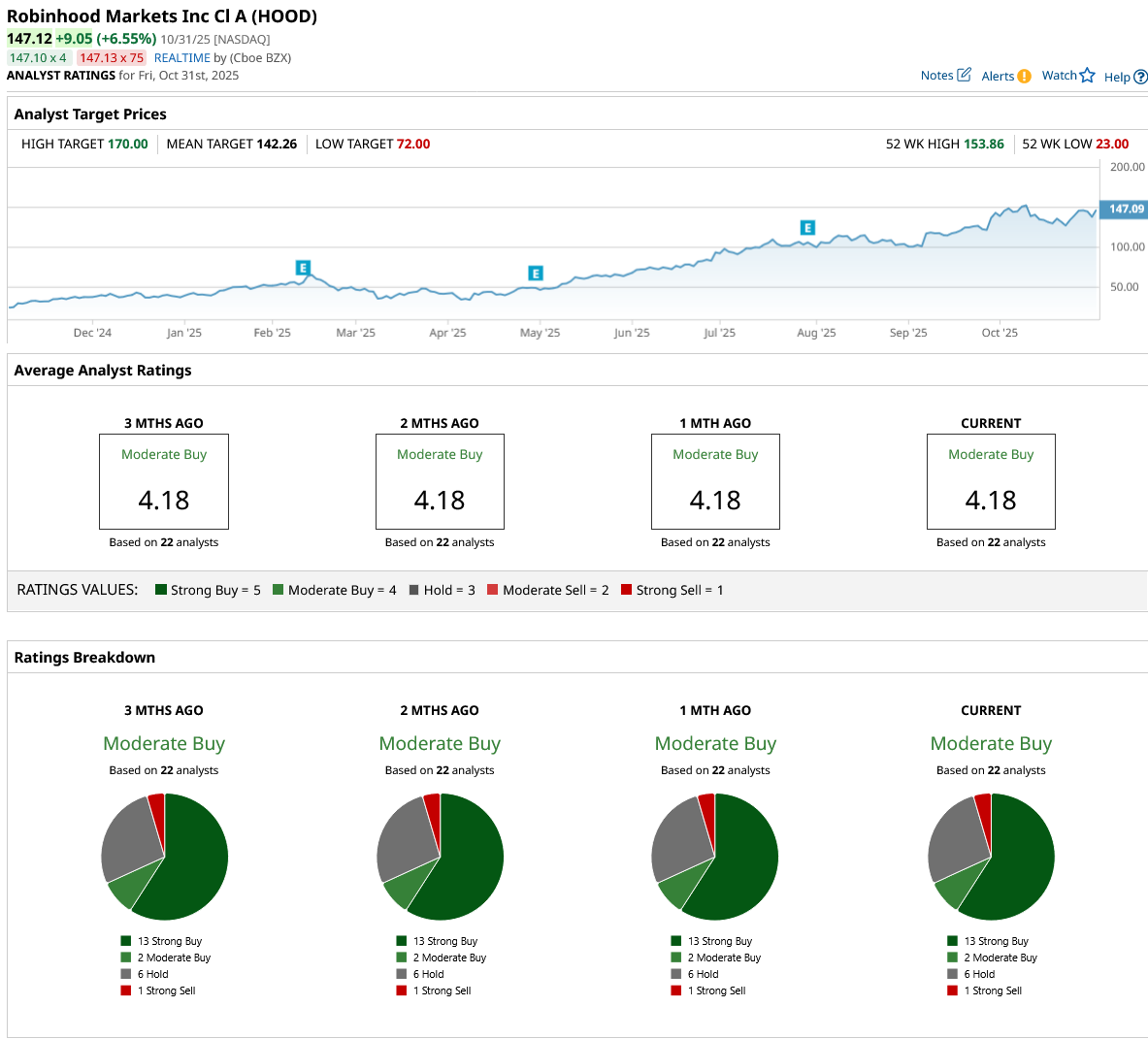

Clues overwhelmingly point to another good quarter for Robinhood. I'd buy ahead of earnings. Analysts seem to agree, with 15 of the 22 covering HOOD stock giving it either a “Moderate Buy” or “Strong Buy.”

That said, it pays to be realistic long-term. Robinhood is a stockbroker, and it is cyclical, just like the market, but with more dramatic swings. Wall Street will bid the stock higher and higher as long as the rose-tinted glasses stay on.

Those glasses will eventually come off, so size your bets sparingly.

On the date of publication, Omor Ibne Ehsan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart