As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the engineered components and systems industry, including ESCO (NYSE: ESE) and its peers.

Engineered components and systems companies possess technical know-how in sometimes narrow areas such as metal forming or intelligent robotics. Lately, automation and connected equipment collecting analyzable data have been trending, creating new demand. On the other hand, like the broader industrials sector, engineered components and systems companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 13 engineered components and systems stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 2.8% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 5.1% on average since the latest earnings results.

ESCO (NYSE: ESE)

A developer of the communication systems used in the Batmobile of “The Dark Knight,” ESCO (NYSE: ESE) is a provider of engineered components for the aerospace, defense, and utility sectors.

ESCO reported revenues of $352.7 million, up 18.1% year on year. This print exceeded analysts’ expectations by 15.1%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ revenue estimates and full-year EPS guidance exceeding analysts’ expectations.

Bryan Sayler, Chief Executive Officer and President, commented, “We finished the year strong with another great quarter highlighted by 29 percent sales growth, 100 basis points of Adjusted EBIT margin improvement, and a 30 percent increase in Adjusted EPS from Continuing Operations.

ESCO scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 4% since reporting and currently trades at $218.58.

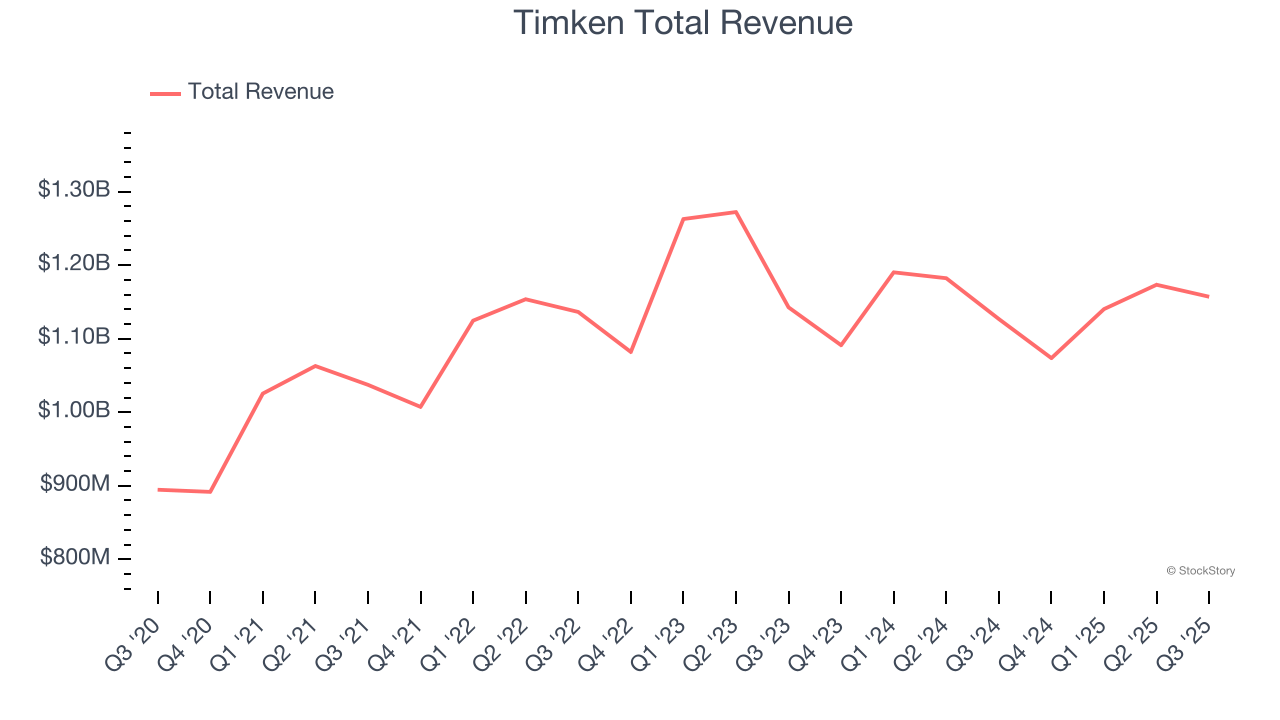

Best Q3: Timken (NYSE: TKR)

Established after the founder noticed the difficulty freight wagons had making sharp turns, Timken (NYSE: TKR) is a provider of industrial parts used across various sectors.

Timken reported revenues of $1.16 billion, up 2.7% year on year, outperforming analysts’ expectations by 3.6%. The business had an exceptional quarter with a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 21.1% since reporting. It currently trades at $93.55.

Is now the time to buy Timken? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Park-Ohio (NASDAQ: PKOH)

Based in Cleveland, Park-Ohio (NASDAQ: PKOH) provides supply chain management services, capital equipment, and manufactured components.

Park-Ohio reported revenues of $398.6 million, down 4.5% year on year, falling short of analysts’ expectations by 4.5%. It was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ revenue estimates.

Interestingly, the stock is up 9.3% since the results and currently trades at $23.03.

Read our full analysis of Park-Ohio’s results here.

RBC Bearings (NYSE: RBC)

With a Guinness World Record for engineering the largest spherical plain bearing, RBC Bearings (NYSE: RBC) is a manufacturer of bearings and related components for the aerospace & defense, industrial, and transportation industries.

RBC Bearings reported revenues of $455.3 million, up 14.4% year on year. This number surpassed analysts’ expectations by 1.1%. Taking a step back, it was a satisfactory quarter as it also recorded an impressive beat of analysts’ Aerospace and Defense revenue estimates but a miss of analysts’ Diversified Industrials revenue estimates.

The stock is up 22.7% since reporting and currently trades at $498.82.

Read our full, actionable report on RBC Bearings here, it’s free.

NN (NASDAQ: NNBR)

Formerly known as Nuturn, NN (NASDAQ: NNBR) provides metal components, bearings, and plastic and rubber components to the automotive, aerospace, medical, and industrial sectors.

NN reported revenues of $103.9 million, down 8.5% year on year. This result missed analysts’ expectations by 7.1%. Overall, it was a softer quarter as it also produced a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EBITDA estimates.

NN delivered the highest full-year guidance raise but had the weakest performance against analyst estimates and weakest performance against analyst estimates among its peers. The stock is down 22.2% since reporting and currently trades at $1.47.

Read our full, actionable report on NN here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.