As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at electrical systems stocks, starting with Powell (NASDAQ: POWL).

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

The 14 electrical systems stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 4.1% while next quarter’s revenue guidance was 1.2% below.

While some electrical systems stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.3% since the latest earnings results.

Powell (NASDAQ: POWL)

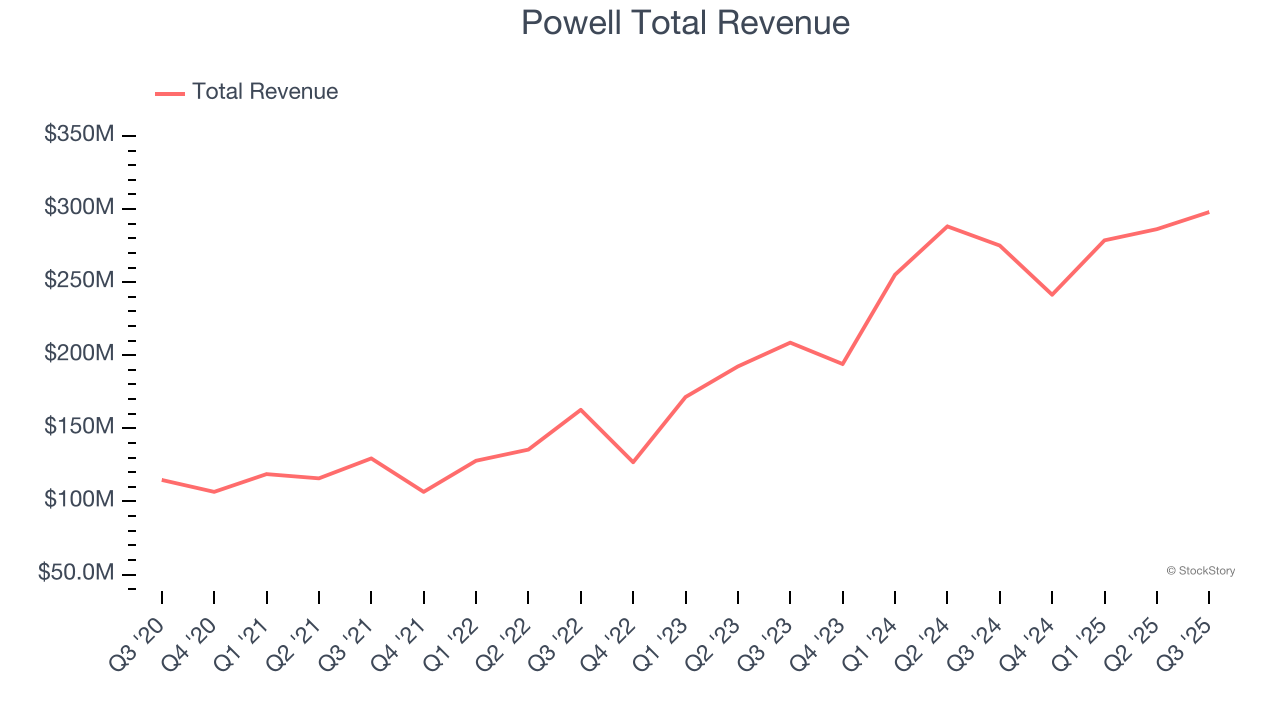

Originally a metal-working shop supporting local petrochemical facilities, Powell (NYSE: POWL) has grown from a small Houston manufacturer to a global provider of electrical systems.

Powell reported revenues of $298 million, up 8.3% year on year. This print exceeded analysts’ expectations by 1.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ revenue and EPS estimates.

Brett A. Cope, Powell’s Chairman and Chief Executive Officer, stated, “Our fourth quarter marked a solid finish to another record year for Powell. We delivered gross profit dollar growth of 16% on revenue growth of 8%, which is a testament to the ongoing high levels of execution across our manufacturing footprint. This culminated in record quarterly earnings per share of $4.22. Our order intake of $271 million was well-balanced across markets and the commercial momentum continues as we enter Fiscal 2026. We also closed our acquisition of Remsdaq, which will allow us to scale a highly competitive and margin-accretive electrical automation solution to meet a growing and underserved demand in the markets where we compete. I’d like to thank the entire Powell team for their commitment to our customers and for another incredible year, helping to further our unique position as a supplier of critical electrical distribution solutions to a growing array of applications.”

Unsurprisingly, the stock is down 1.1% since reporting and currently trades at $318.00.

Read why we think that Powell is one of the best electrical systems stocks, our full report is free.

Best Q3: Thermon (NYSE: THR)

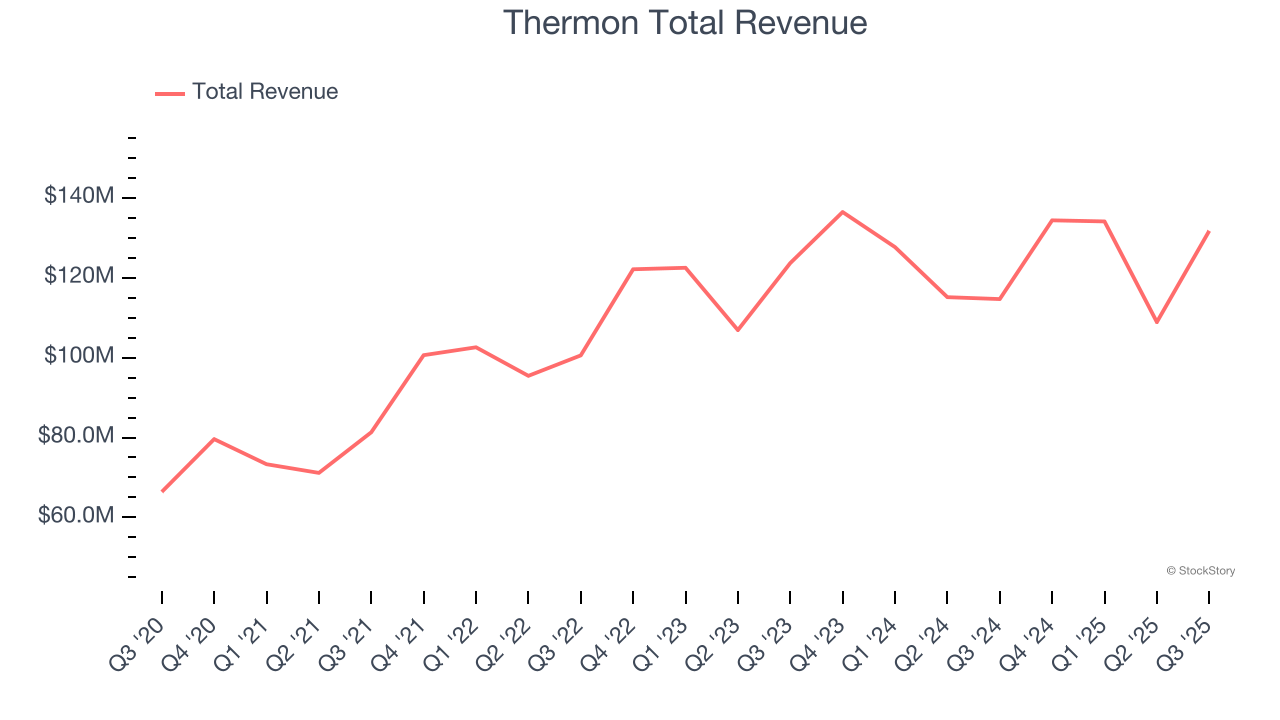

Creating the first packaged tracing systems, Thermon (NYSE: THR) is a leading provider of engineered industrial process heating solutions for process industries.

Thermon reported revenues of $131.7 million, up 14.9% year on year, outperforming analysts’ expectations by 10.3%. The business had a stunning quarter with a beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Thermon pulled off the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 26.2% since reporting. It currently trades at $37.13.

Is now the time to buy Thermon? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Atkore (NYSE: ATKR)

Protecting the things that power our world, Atkore (NYSE: ATKR) designs and manufactures electrical safety products.

Atkore reported revenues of $752 million, down 4.6% year on year, exceeding analysts’ expectations by 2.5%. Still, it was a slower quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 4.9% since the results and currently trades at $63.26.

Read our full analysis of Atkore’s results here.

Methode Electronics (NYSE: MEI)

Founded in 1946, Methode Electronics (NYSE: MEI) is a global supplier of custom-engineered solutions for Original Equipment Manufacturers (OEMs).

Methode Electronics reported revenues of $246.9 million, down 15.6% year on year. This result beat analysts’ expectations by 3.9%. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ revenue estimates.

Methode Electronics had the slowest revenue growth among its peers. The stock is down 23.6% since reporting and currently trades at $6.64.

Read our full, actionable report on Methode Electronics here, it’s free for active Edge members.

GE Vernova (NYSE: GEV)

Born from the energy business of industrial giant General Electric in a 2023 spin-off, GE Vernova (NYSE: GEV) designs, manufactures, and services power generation equipment and grid technologies to help customers build more reliable and sustainable electric systems.

GE Vernova reported revenues of $9.97 billion, up 11.8% year on year. This number surpassed analysts’ expectations by 8.9%. Overall, it was a strong quarter as it also produced a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

GE Vernova had the weakest full-year guidance update among its peers. The stock is up 10.8% since reporting and currently trades at $654.29.

Read our full, actionable report on GE Vernova here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.