The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Illumina (NASDAQ: ILMN) and the rest of the life sciences tools & services stocks fared in Q4.

The life sciences tools and services sector supports the research, development, and commercialization of biotechnology and pharmaceutical products. These companies offer a broad range of tools, from lab consumables and testing equipment to data analytics platforms and clinical trial support. There is recurring revenue potential from long-term contracts, high margins from specialized products, and the growing demand for precision medicine and data-driven insights. However, challenges include dependence on research and development budgets from large pharmaceutical companies and the boom and bust nature of smaller biotech companies. Looking forward, the life sciences tools and services sector is expected to benefit from strong tailwinds, including advancements in genomics and the rising focus on personalized medicine. Ongoing adoption of artificial intelligence in research and drug discovery, along with the growing need for regulatory compliance and data analytics, should provide longer-term demand support. However, headwinds such as the uncertainty around healthcare and research funding as well as pricing pressures from cost-conscious customers may feed into uncertainty in the sector.

The 21 life sciences tools & services stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 29.1% since the latest earnings results.

Illumina (NASDAQ: ILMN)

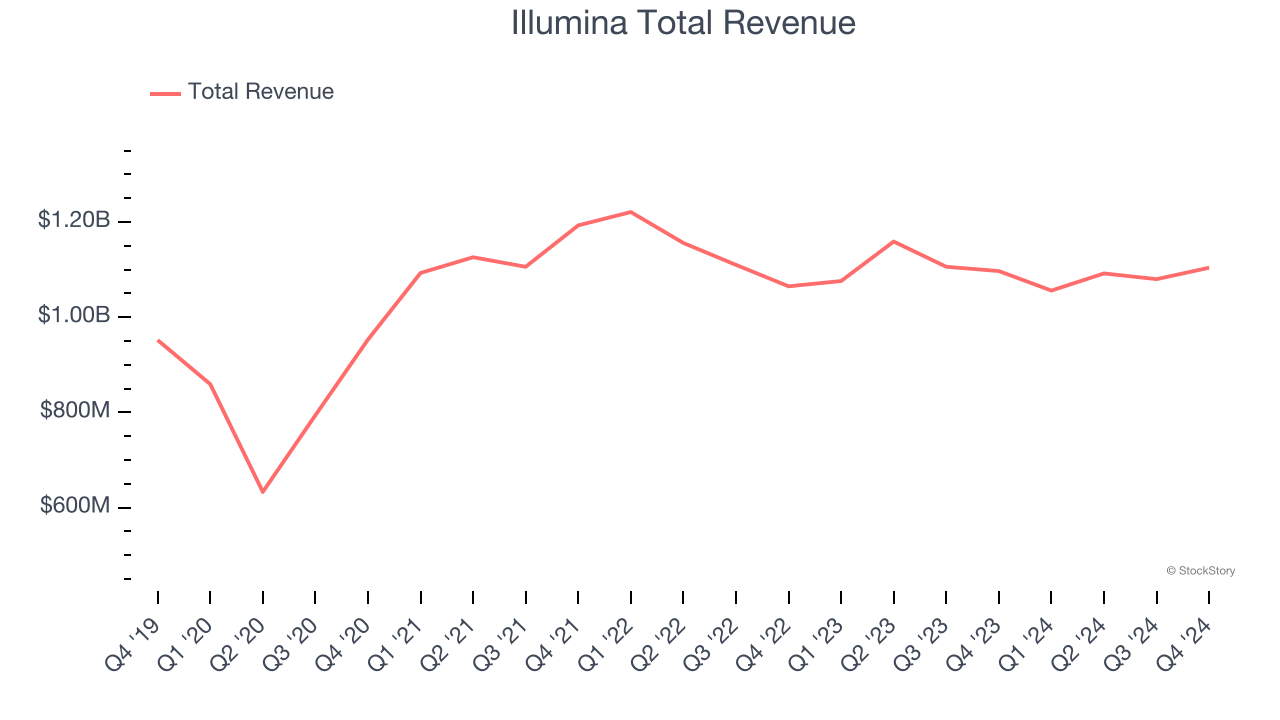

Pioneering the ability to read the human genome at unprecedented speed and affordability, Illumina (NASDAQ: ILMN) develops and sells advanced DNA sequencing and microarray technologies that allow researchers and clinicians to analyze genetic variations and functions.

Illumina reported revenues of $1.10 billion, flat year on year. This print exceeded analysts’ expectations by 2.1%. Overall, it was a strong quarter for the company with a solid beat of analysts’ full-year EPS guidance estimates.

"The Illumina team delivered fourth quarter revenue that exceeded our expectations, and we made significant progress in 2024 toward our goals to drive customer-centric innovation, margin expansion, and EPS growth," said Jacob Thaysen, Chief Executive Officer.

The stock is down 41% since reporting and currently trades at $72.40.

Is now the time to buy Illumina? Access our full analysis of the earnings results here, it’s free.

Best Q4: Bio-Techne (NASDAQ: TECH)

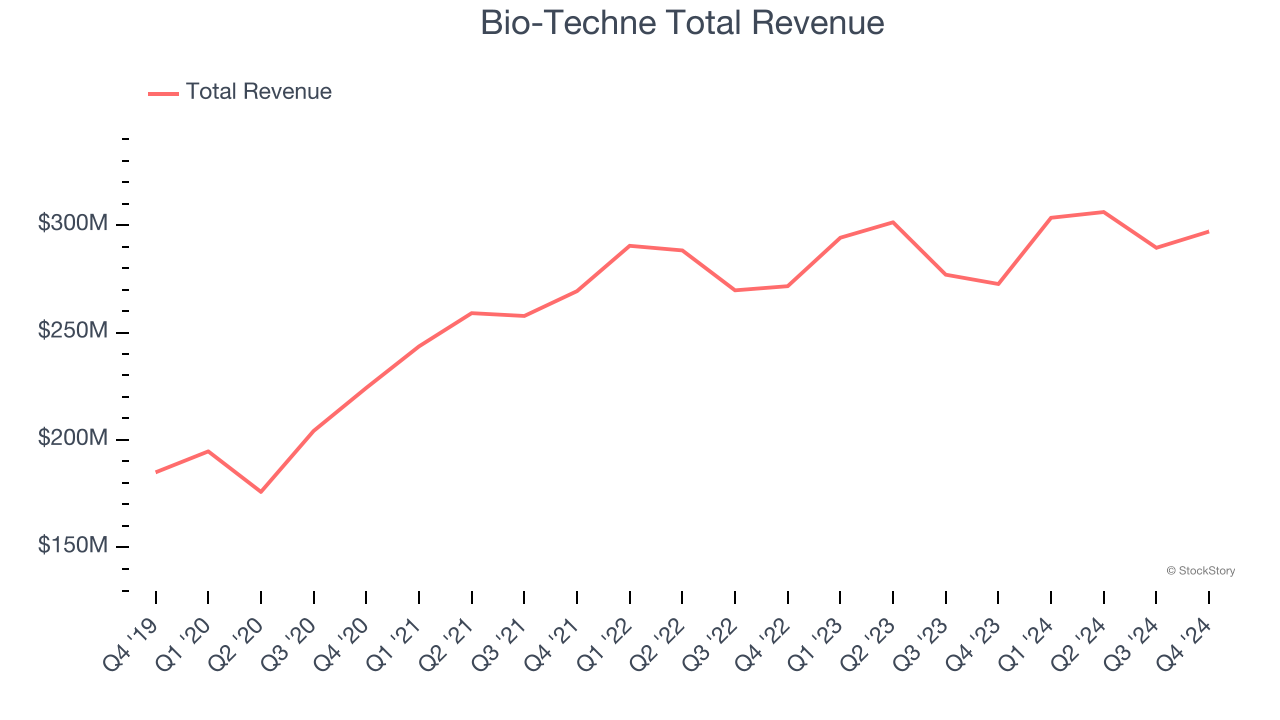

With a catalog of hundreds of thousands of specialized biological products used in laboratories worldwide, Bio-Techne (NASDAQ: TECH) develops and manufactures specialized reagents, instruments, and services that help researchers study biological processes and enable diagnostic testing and cell therapy development.

Bio-Techne reported revenues of $297 million, up 9% year on year, outperforming analysts’ expectations by 4.2%. The business had an exceptional quarter with a solid beat of analysts’ organic revenue estimates and a decent beat of analysts’ EPS estimates.

Bio-Techne delivered the biggest analyst estimates beat among its peers. The stock is down 31.8% since reporting. It currently trades at $49.52.

Is now the time to buy Bio-Techne? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: PacBio (NASDAQ: PACB)

Pioneering what scientists call "HiFi long-read sequencing," recognized as Nature Methods' method of the year for 2022, Pacific Biosciences (NASDAQ: PACB) develops advanced DNA sequencing systems that enable scientists and researchers to analyze genomes with unprecedented accuracy and completeness.

PacBio reported revenues of $39.22 million, down 32.8% year on year, falling short of analysts’ expectations by 1.8%. It was a disappointing quarter as it posted a miss of analysts’ EPS estimates.

PacBio delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 20.4% since the results and currently trades at $1.17.

Read our full analysis of PacBio’s results here.

Danaher (NYSE: DHR)

Born from a real estate investment trust that transformed into a manufacturing powerhouse, Danaher (NYSE: DHR) is a global science and technology company that provides specialized equipment, software, and services for biotechnology, life sciences, and diagnostics.

Danaher reported revenues of $6.54 billion, up 2.1% year on year. This number surpassed analysts’ expectations by 1.6%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ organic revenue estimates.

The stock is down 24.2% since reporting and currently trades at $187.84.

Read our full, actionable report on Danaher here, it’s free.

Bruker (NASDAQ: BRKR)

With roots dating back to the pioneering days of nuclear magnetic resonance technology, Bruker (NASDAQ: BRKR) develops and manufactures high-performance scientific instruments that enable researchers and industrial analysts to explore materials at microscopic, molecular, and cellular levels.

Bruker reported revenues of $979.6 million, up 14.6% year on year. This print beat analysts’ expectations by 1.4%. Zooming out, it was a mixed quarter as it also logged a solid beat of analysts’ organic revenue estimates.

The stock is down 29.8% since reporting and currently trades at $36.28.

Read our full, actionable report on Bruker here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.