Over the past six months, Hasbro’s stock price fell to $60.89. Shareholders have lost 15.4% of their capital, disappointing when considering the S&P 500 was flat. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Hasbro, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Even though the stock has become cheaper, we're cautious about Hasbro. Here are three reasons why you should be careful with HAS and a stock we'd rather own.

Why Do We Think Hasbro Will Underperform?

Credited with the creation of toys such as Mr. Potato Head and the Rubik’s Cube, Hasbro (NASDAQ: HAS) is a global entertainment company offering a diverse range of toys, games, and multimedia experiences for children and families.

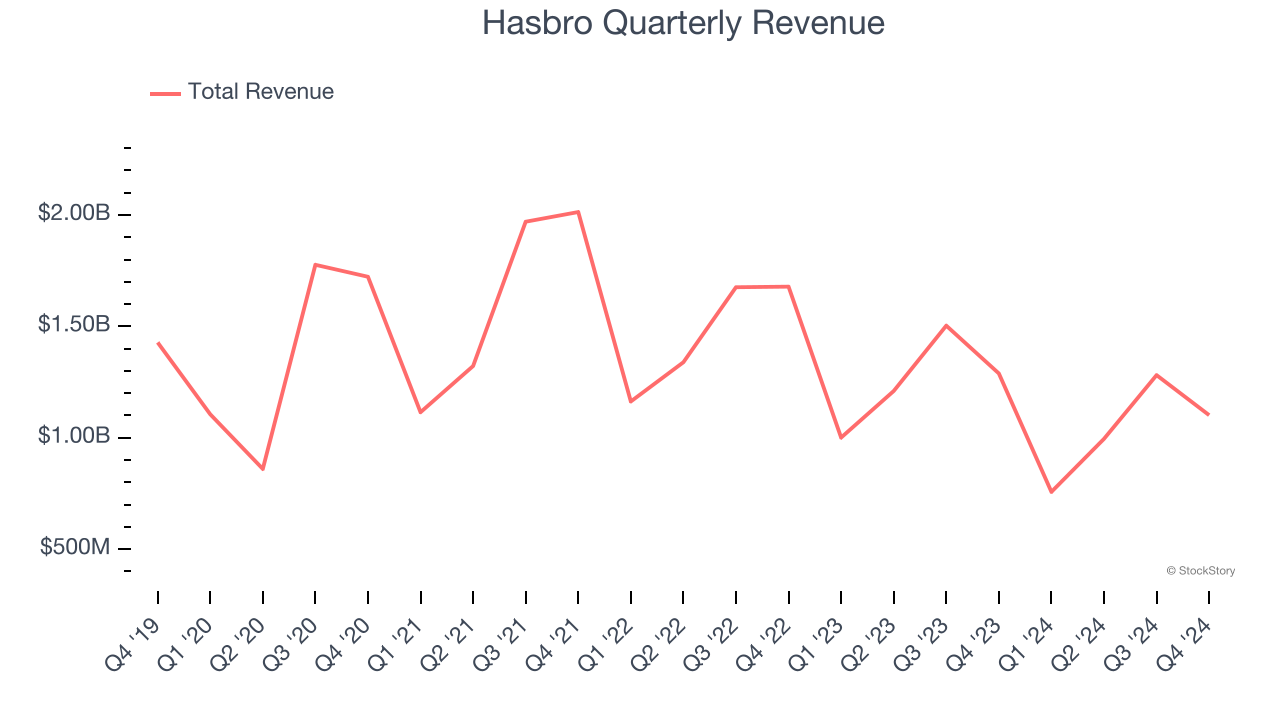

1. Revenue Spiraling Downwards

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Hasbro’s demand was weak and its revenue declined by 2.6% per year. This wasn’t a great result and signals it’s a low quality business.

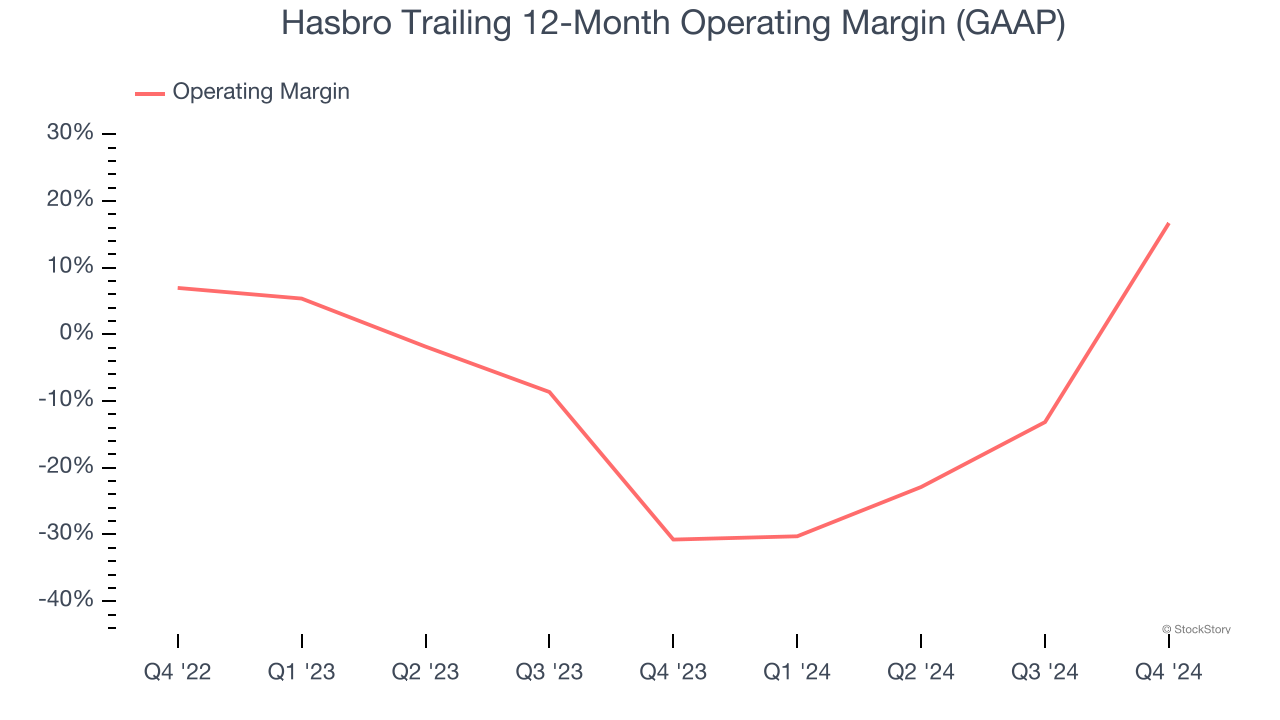

2. Operating Losses Sound the Alarms

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Hasbro’s operating margin has been trending up over the last 12 months, but it still averaged negative 9.3% over the last two years. This is due to its large expense base and inefficient cost structure.

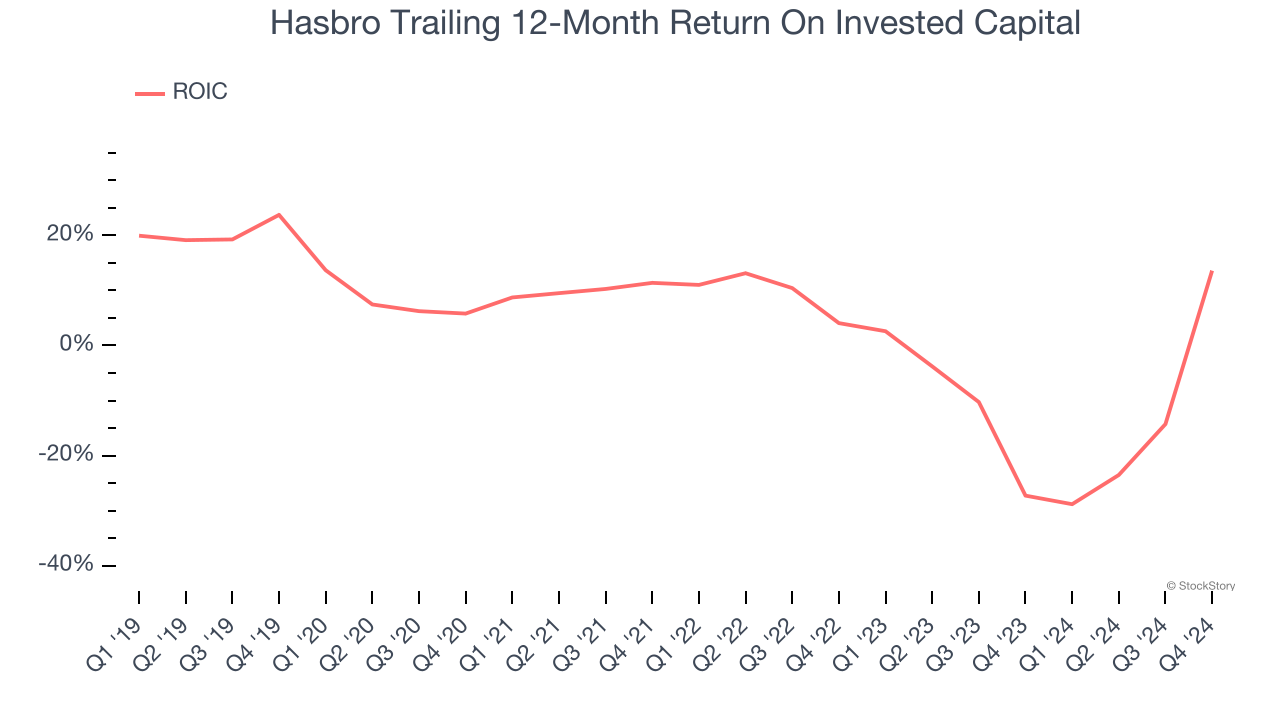

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Hasbro’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Hasbro doesn’t pass our quality test. Following the recent decline, the stock trades at 14× forward price-to-earnings (or $60.89 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Hasbro

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.