Medical equipment and services company Steris (NYSE: STE). fell short of the market’s revenue expectations in Q4 CY2024, but sales rose 5.6% year on year to $1.37 billion. Its non-GAAP profit of $2.32 per share was in line with analysts’ consensus estimates.

Is now the time to buy STERIS? Find out by accessing our full research report, it’s free.

STERIS (STE) Q4 CY2024 Highlights:

- Revenue: $1.37 billion vs analyst estimates of $1.38 billion (5.6% year-on-year growth, 0.6% miss)

- Adjusted EPS: $2.32 vs analyst estimates of $2.32 (in line)

- Management lowered its full-year Adjusted EPS guidance to $9.10 at the midpoint, a 0.5% decrease

- Operating Margin: 17.9%, up from 16.7% in the same quarter last year

- Free Cash Flow Margin: 17.8%, up from 13.3% in the same quarter last year

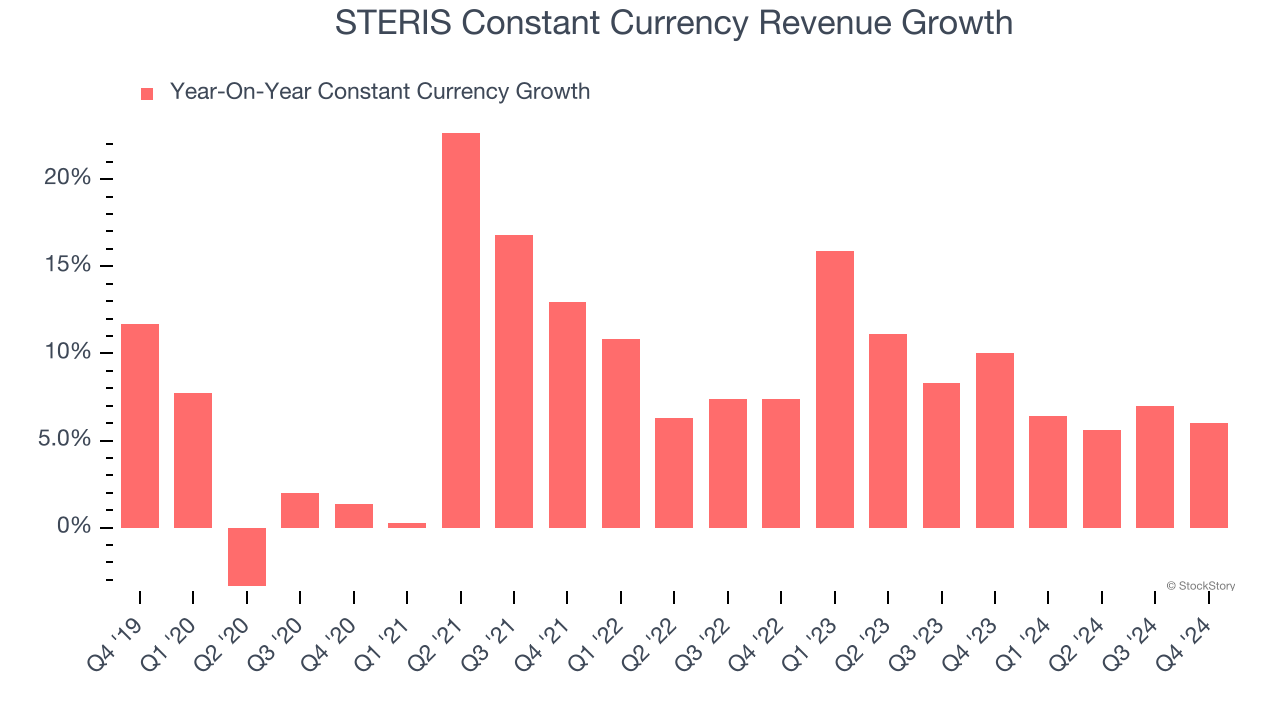

- Constant Currency Revenue rose 6% year on year (10% in the same quarter last year)

- Market Capitalization: $21.8 billion

Company Overview

Founded in 1985, Steris (NYSE: STE) provides infection prevention, sterilization, and surgical support products for the healthcare, pharmaceutical, and research industries to ensure safety and operational efficiency.

Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Sales Growth

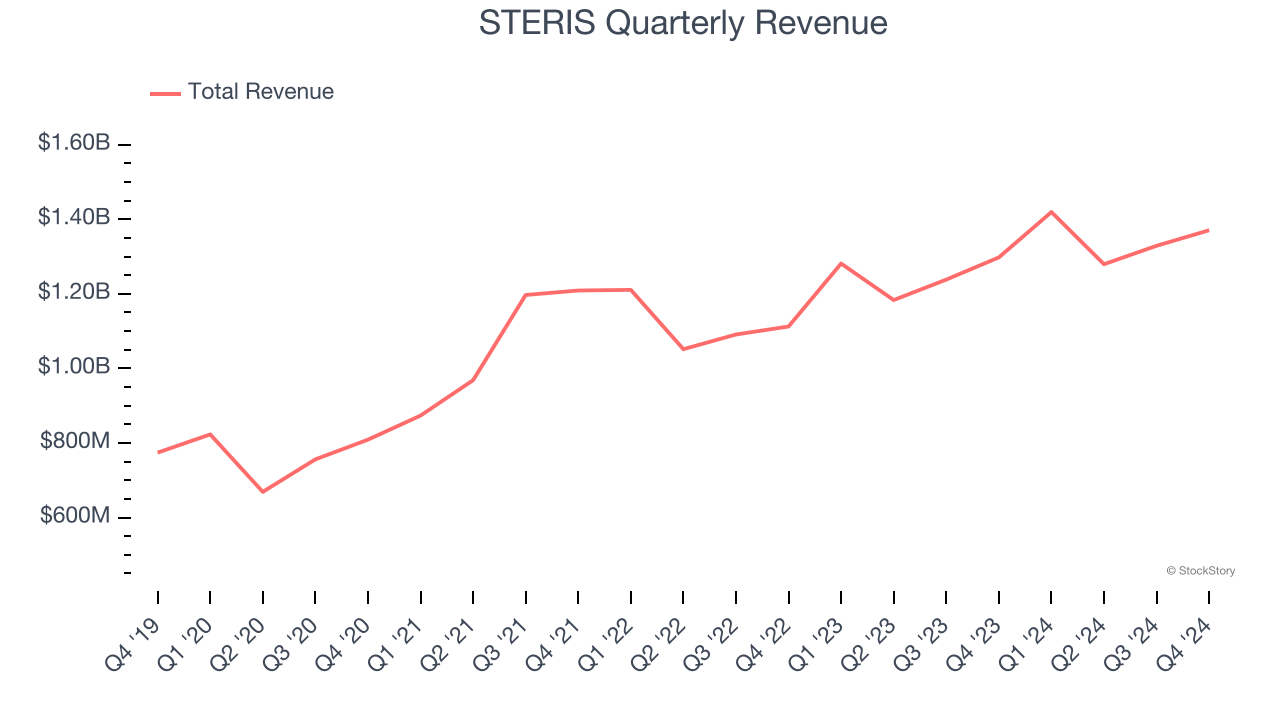

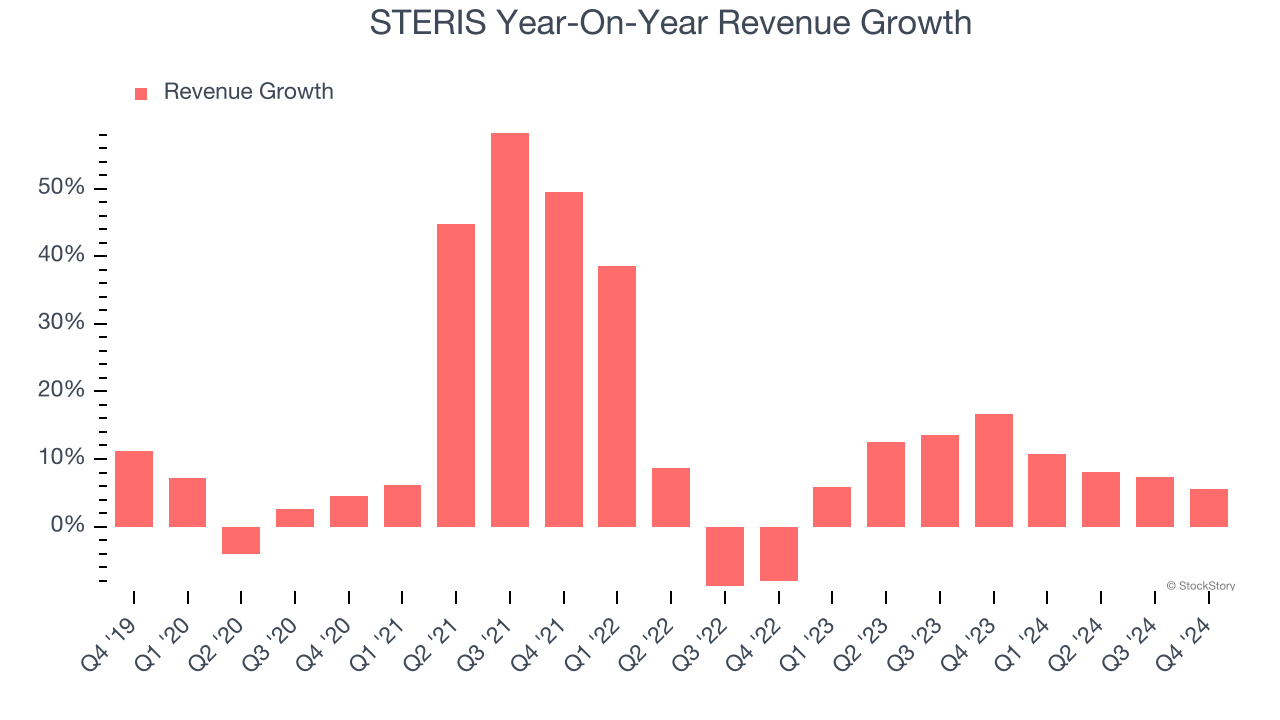

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, STERIS grew its sales at a solid 12.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. STERIS’s annualized revenue growth of 9.9% over the last two years is below its five-year trend, but we still think the results were respectable.

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 8.8% year-on-year growth. Because this number aligns with its normal revenue growth, we can see STERIS’s foreign exchange rates have been steady.

This quarter, STERIS’s revenue grew by 5.6% year on year to $1.37 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and implies the market is baking in some success for its newer products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Adjusted Operating Margin

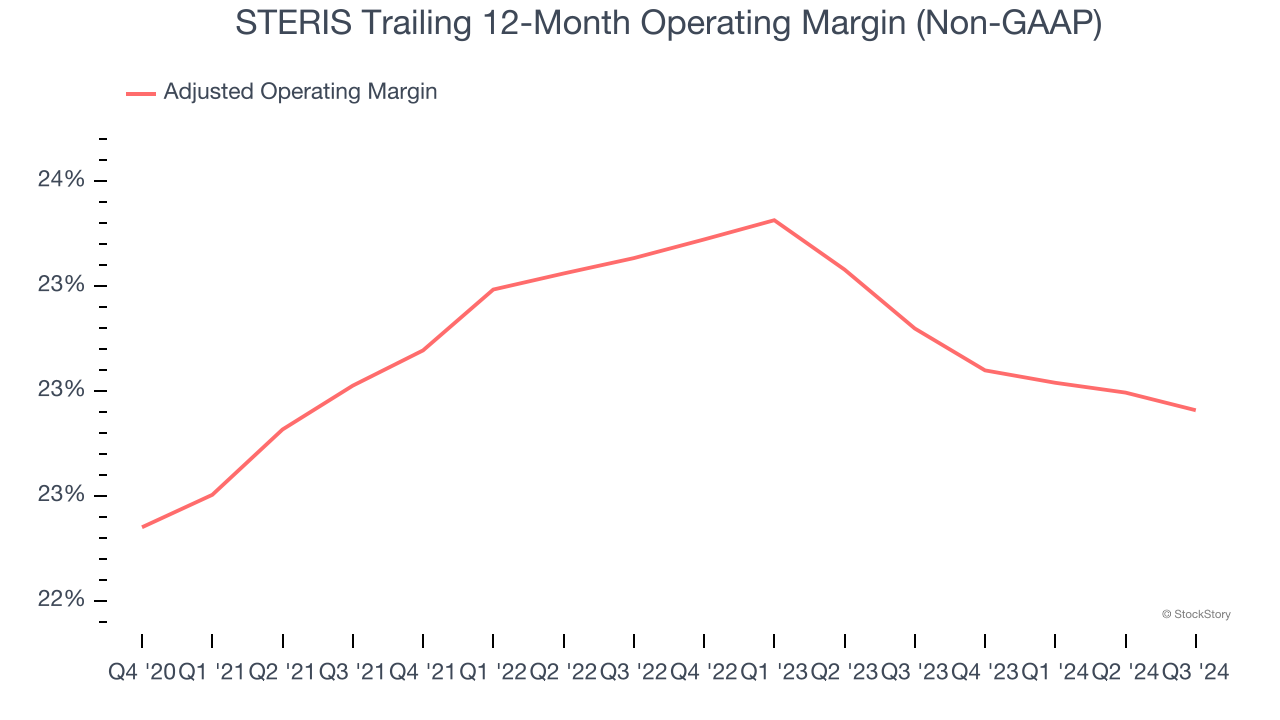

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

STERIS has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 23.1%.

Analyzing the trend in its profitability, STERIS’s adjusted operating margin might have seen some fluctuations but has generally stayed the same over the last five years.

in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

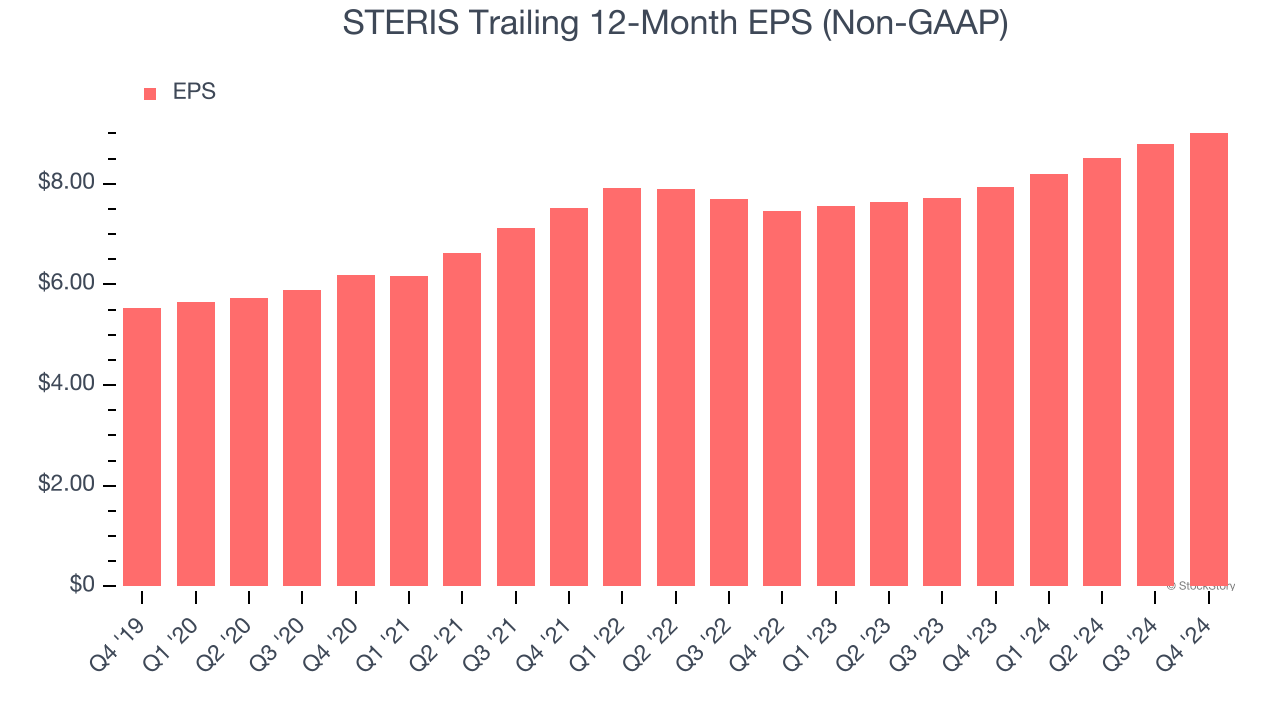

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

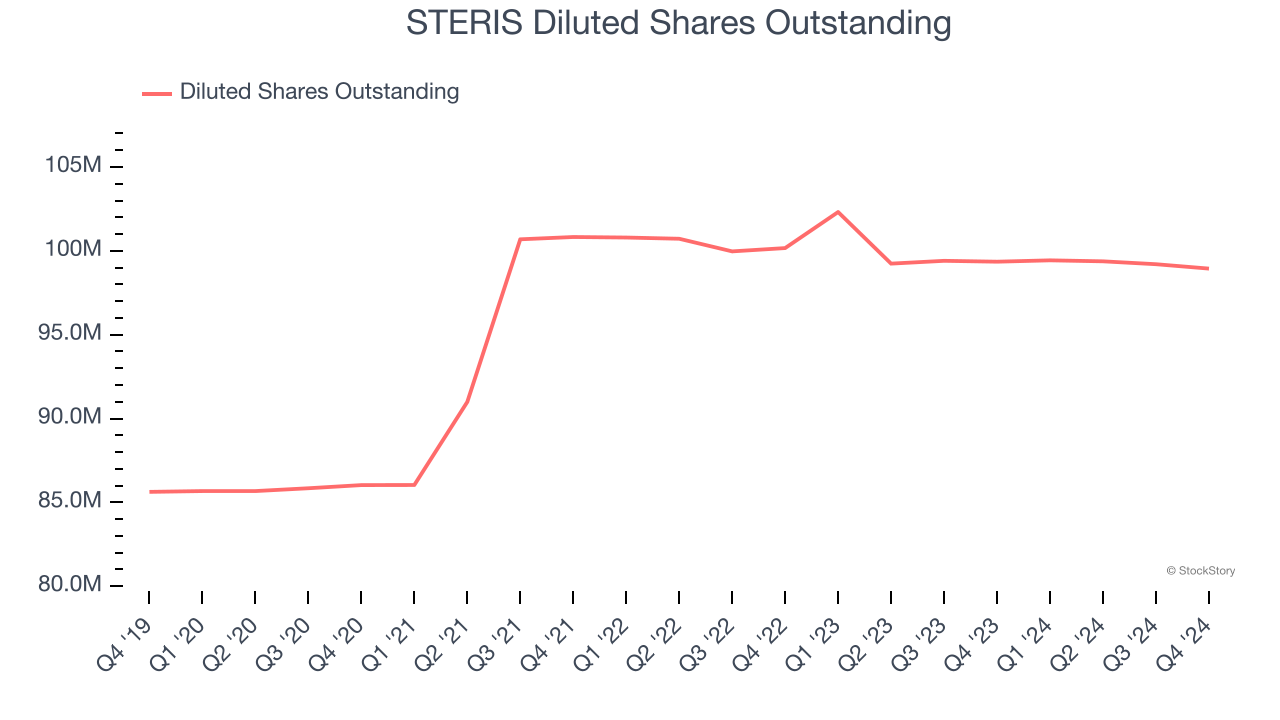

STERIS’s EPS grew at a remarkable 10.3% compounded annual growth rate over the last five years. However, this performance was lower than its 12.6% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of STERIS’s earnings can give us a better understanding of its performance. A five-year view shows STERIS has diluted its shareholders, growing its share count by 15.5%. This has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, STERIS reported EPS at $2.32, up from $2.09 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects STERIS’s full-year EPS of $9.01 to grow 8.7%.

Key Takeaways from STERIS’s Q4 Results

We struggled to find many positives in these results. Its revenue missed, its EPS was in line, and it lowered its full-year EPS guidance. Overall, this quarter could have been better. The stock traded down 1.2% to $218 immediately following the results.

STERIS’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.