Domain registrar and web services company GoDaddy (NYSE: GDDY) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 8.4% year on year to $1.19 billion. The company expects next quarter’s revenue to be around $1.19 billion, close to analysts’ estimates. Its GAAP profit of $1.36 per share was 5.5% below analysts’ consensus estimates.

Is now the time to buy GoDaddy? Find out by accessing our full research report, it’s free.

GoDaddy (GDDY) Q4 CY2024 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.18 billion (8.4% year-on-year growth, 1.4% beat)

- EPS (GAAP): $1.36 vs analyst expectations of $1.44 (5.5% miss)

- Adjusted EBITDA: $384.7 million vs analyst estimates of $364.9 million (32.3% margin, 5.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $4.9 billion at the midpoint, in line with analyst expectations and implying 7.1% growth (vs 7.5% in FY2024)

- Operating Margin: 21.4%, up from 17.3% in the same quarter last year

- Free Cash Flow Margin: 31.8%, similar to the previous quarter

- Annual Recurring Revenue: $4.04 billion at quarter end, up 9.5% year on year

- Billings: $1.17 billion at quarter end, up 8.3% year on year

- Market Capitalization: $29.14 billion

"GoDaddy demonstrated strong operational execution and financial performance in 2024, making significant progress across our key strategic initiatives," said GoDaddy CEO Aman Bhutani.

Company Overview

Founded by Bob Parsons after selling his first company to Intuit, GoDaddy (NYSE: GDDY) provides small and mid-sized businesses with the ability to buy a web domain and tools to create and manage a website.

E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

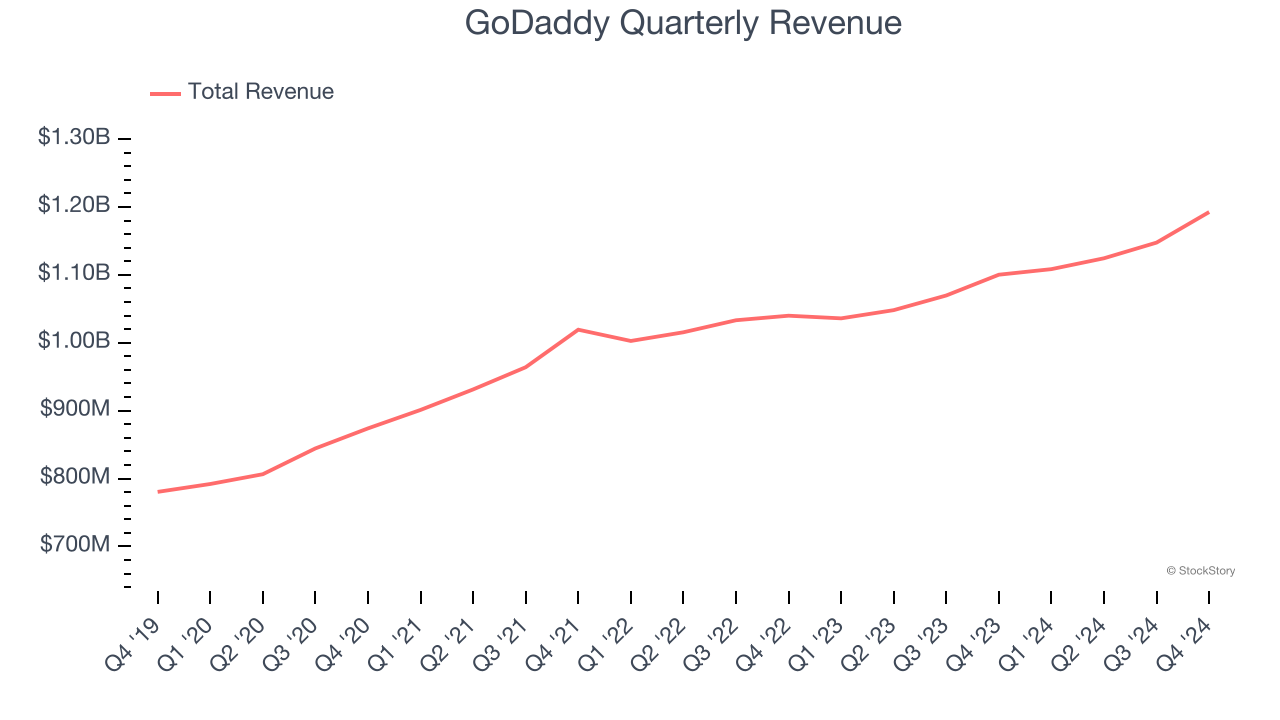

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, GoDaddy grew its sales at a weak 6.2% compounded annual growth rate. This fell short of our benchmark for the software sector and is a tough starting point for our analysis.

This quarter, GoDaddy reported year-on-year revenue growth of 8.4%, and its $1.19 billion of revenue exceeded Wall Street’s estimates by 1.4%. Company management is currently guiding for a 6.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

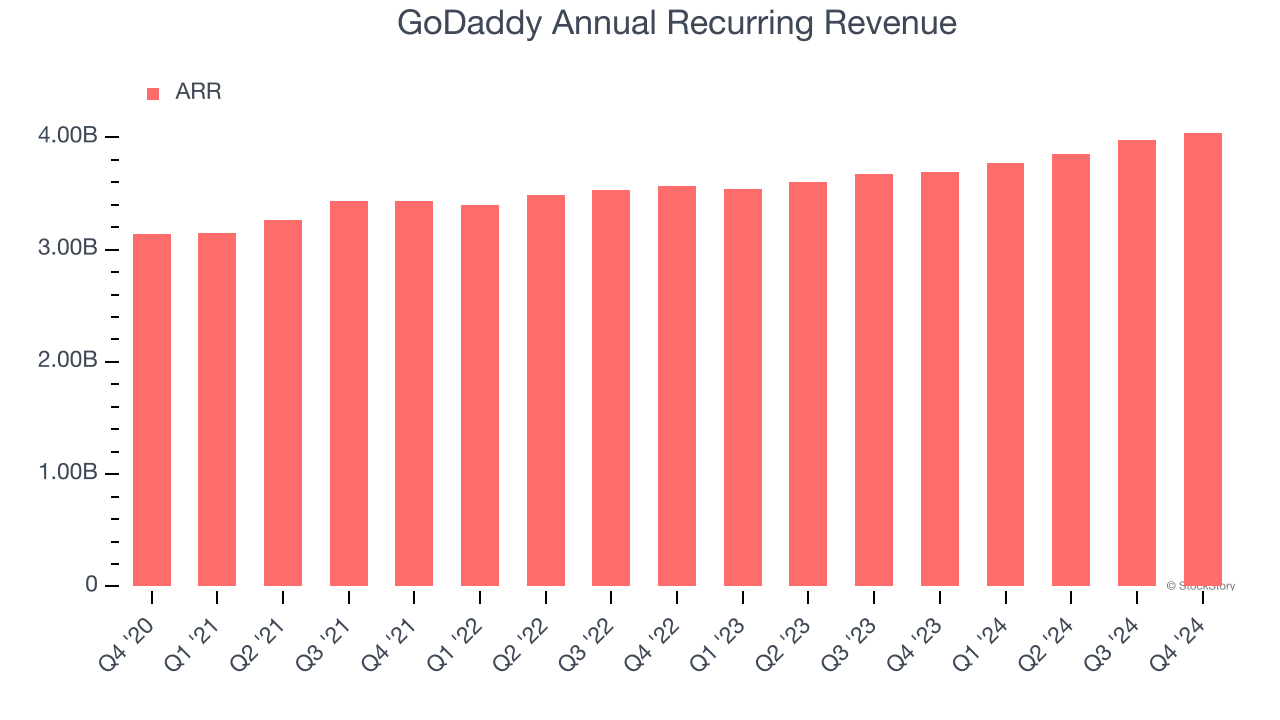

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GoDaddy’s ARR came in at $4.04 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 7.8% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

GoDaddy does a decent job acquiring new customers, and its CAC payback period checked in at 47.6 months this quarter. The company’s relatively efficient sales cycles stem from its self-serve model, where it can onboard many small customers at scale. This gives it more resources to improve its software.

Key Takeaways from GoDaddy’s Q4 Results

We were impressed by how significantly GoDaddy blew past analysts’ bookings expectations this quarter. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, we think this was a solid quarter with some key areas of upside, but the market seemed to focus on the negatives. The stock traded down 2.4% to $207.50 immediately after reporting.

So should you invest in GoDaddy right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.