Sustainable ingredients producer Darling Ingredients (NYSE: DAR) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10% year on year to $1.56 billion. Its non-GAAP profit of $0.16 per share was 28.7% below analysts’ consensus estimates.

Is now the time to buy Darling Ingredients? Find out by accessing our full research report, it’s free for active Edge members.

Darling Ingredients (DAR) Q3 CY2025 Highlights:

- Revenue: $1.56 billion vs analyst estimates of $1.5 billion (10% year-on-year growth, 4.5% beat)

- Adjusted EPS: $0.16 vs analyst expectations of $0.22 (28.7% miss)

- Adjusted EBITDA: $247.8 million vs analyst estimates of $244.5 million (15.8% margin, 1.3% beat)

- Operating Margin: 4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 8.6%, down from 14.6% in the same quarter last year

- Market Capitalization: $5.65 billion

Company Overview

Turning what others consider waste into valuable resources, Darling Ingredients (NYSE: DAR) collects and transforms animal by-products, used cooking oil, and other bio-nutrients into valuable ingredients for food, feed, fuel, and industrial applications.

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.84 billion in revenue over the past 12 months, Darling Ingredients carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

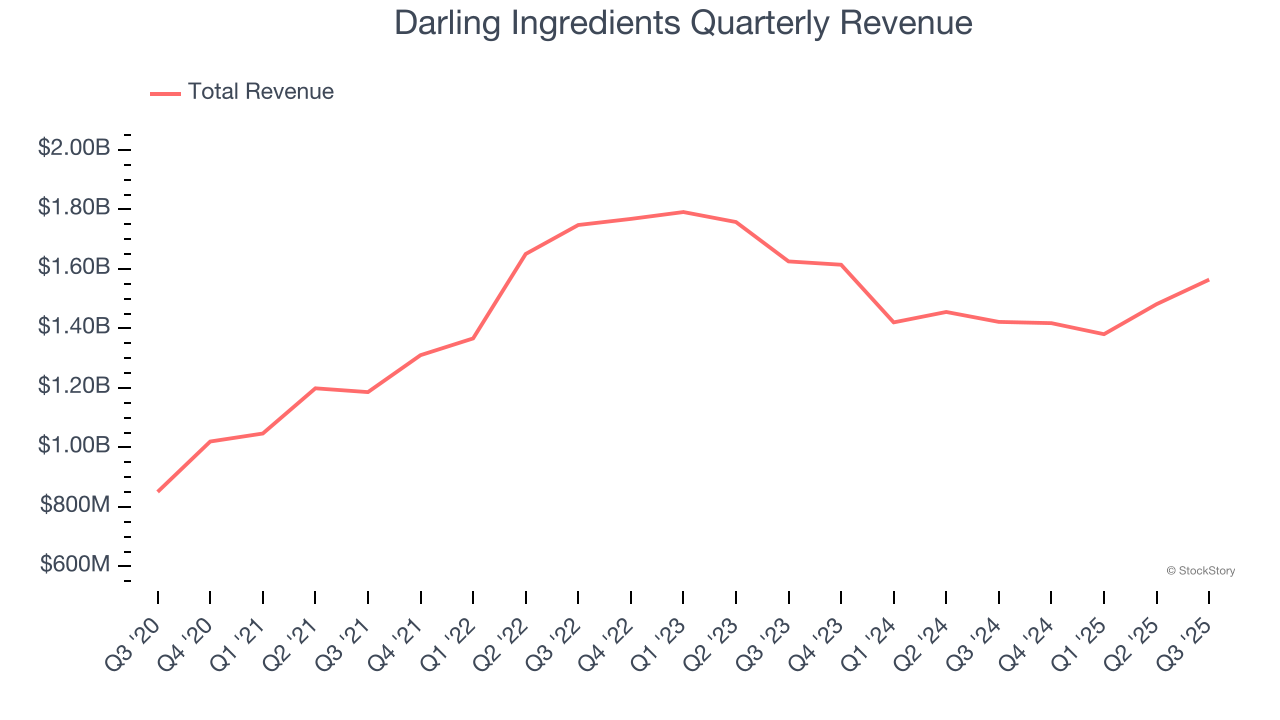

As you can see below, Darling Ingredients’s revenue declined by 1.3% per year over the last three years, a poor baseline for our analysis.

This quarter, Darling Ingredients reported year-on-year revenue growth of 10%, and its $1.56 billion of revenue exceeded Wall Street’s estimates by 4.5%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and indicates its newer products will spur better top-line performance.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

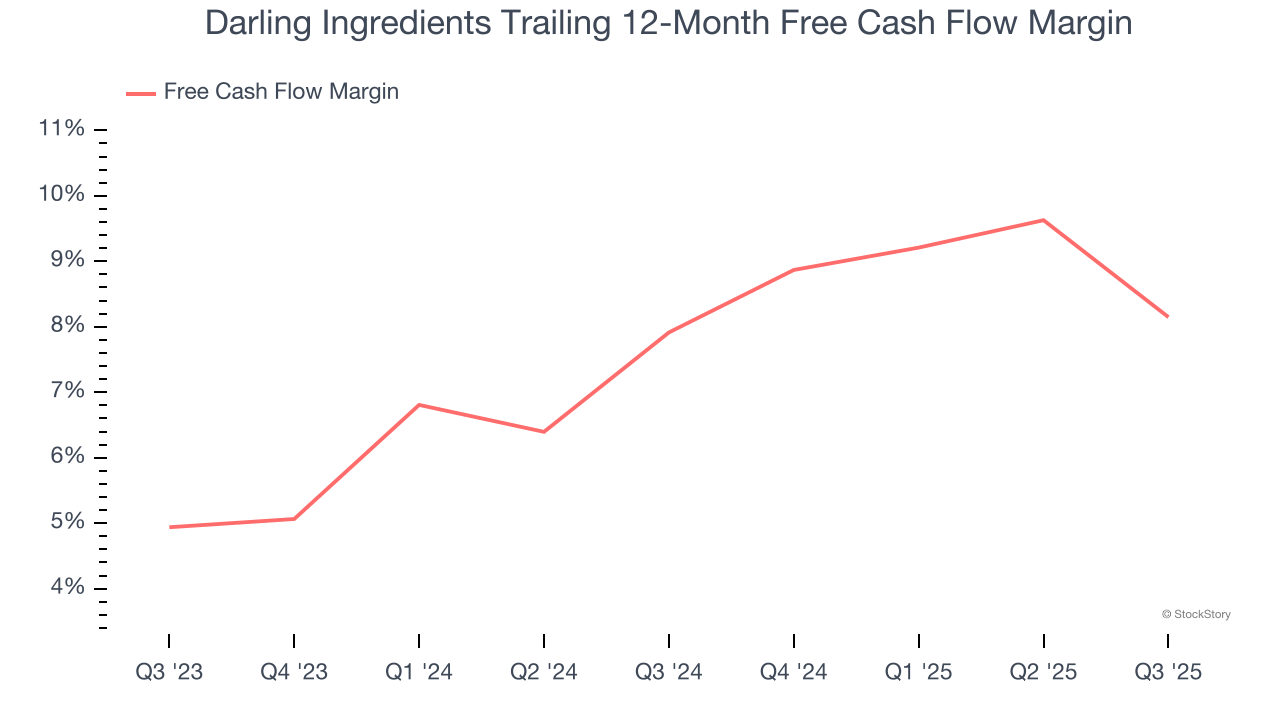

Darling Ingredients has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8% over the last two years, better than the broader consumer staples sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Darling Ingredients’s free cash flow clocked in at $134.2 million in Q3, equivalent to a 8.6% margin. The company’s cash profitability regressed as it was 6 percentage points lower than in the same quarter last year. This warrants extra attention because consumer staples companies typically produce more consistent and defensive performance.

Key Takeaways from Darling Ingredients’s Q3 Results

We were impressed by how significantly Darling Ingredients blew past analysts’ adjusted operating income expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this print had some key positives. The stock traded up 1.6% to $36.28 immediately after reporting.

Indeed, Darling Ingredients had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.