Wrapping up Q3 earnings, we look at the numbers and key takeaways for the apparel and accessories stocks, including Kontoor Brands (NYSE: KTB) and its peers.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 16 apparel and accessories stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 3.8% on average since the latest earnings results.

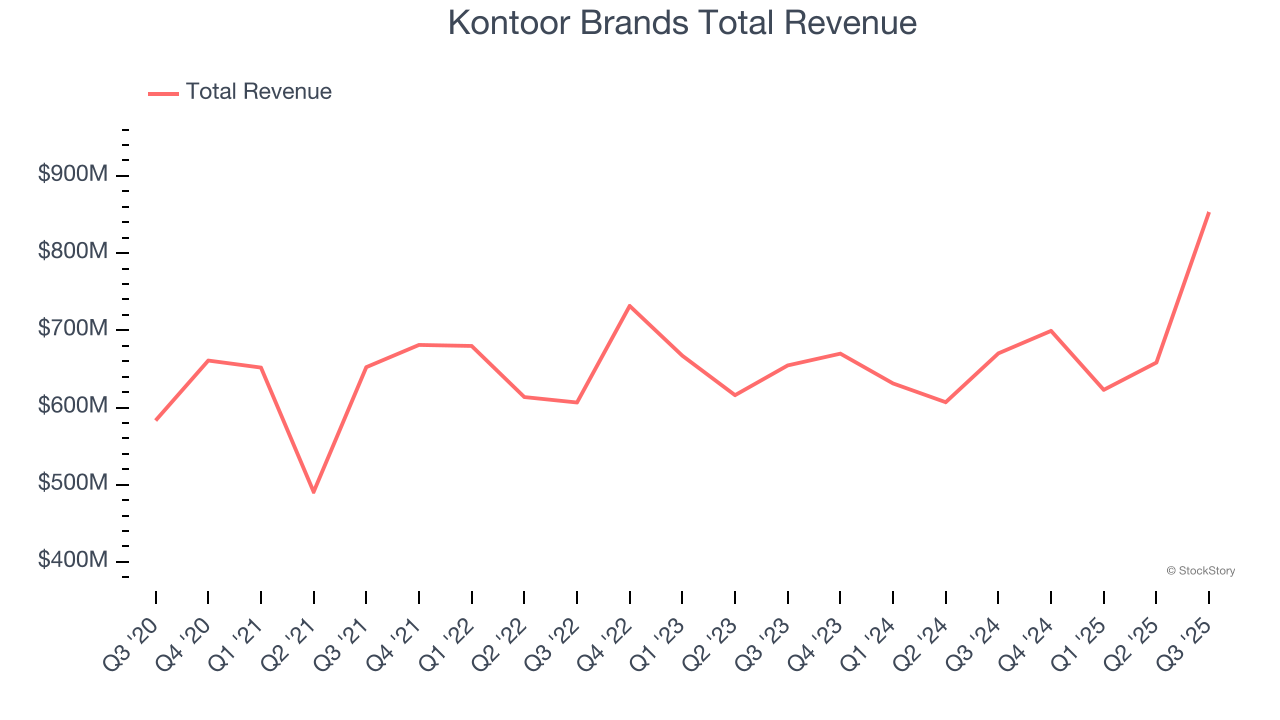

Kontoor Brands (NYSE: KTB)

Founded in 2019 after separating from VF Corporation, Kontoor Brands (NYSE: KTB) is a clothing company known for its high-quality denim products.

Kontoor Brands reported revenues of $853.2 million, up 27.3% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but constant currency revenue in line with analysts’ estimates.

“Our third quarter results exceeded expectations driven by the strength of our expanded brand portfolio, gross margin expansion, and operational execution,” said Scott Baxter, President, Chief Executive Officer and Chairman of the Board of Directors.

Unsurprisingly, the stock is down 20.9% since reporting and currently trades at $63.99.

Is now the time to buy Kontoor Brands? Access our full analysis of the earnings results here, it’s free for active Edge members.

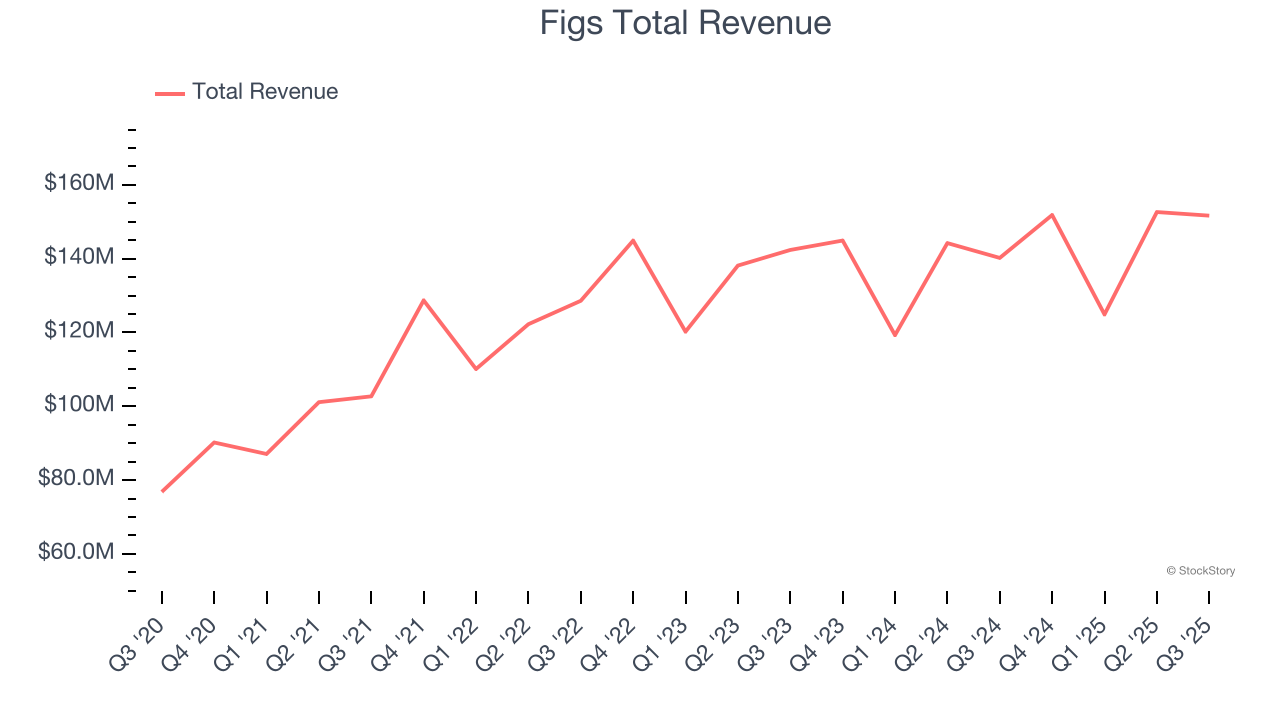

Best Q3: Figs (NYSE: FIGS)

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

Figs reported revenues of $151.7 million, up 8.2% year on year, outperforming analysts’ expectations by 6.4%. The business had an incredible quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 54.1% since reporting. It currently trades at $11.59.

Is now the time to buy Figs? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Movado (NYSE: MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $186.1 million, up 3.1% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 11.9% since the results and currently trades at $21.74.

Read our full analysis of Movado’s results here.

Stitch Fix (NASDAQ: SFIX)

One of the original subscription box companies, Stitch Fix (NASDAQ: SFIX) is an online personal styling and fashion service that curates personalized clothing selections for customers.

Stitch Fix reported revenues of $342.1 million, up 7.3% year on year. This number topped analysts’ expectations by 1.5%. Overall, it was a very strong quarter as it also logged EBITDA guidance for next quarter exceeding analysts’ expectations and a beat of analysts’ EPS estimates.

The stock is up 12.1% since reporting and currently trades at $5.26.

Read our full, actionable report on Stitch Fix here, it’s free for active Edge members.

Guess (NYSE: GES)

Flexing the iconic upside-down triangle logo with a question mark, Guess (NYSE: GES) is a global fashion brand known for its trendy clothing, accessories, and denim wear.

Guess reported revenues of $791.4 million, up 7.2% year on year. This result surpassed analysts’ expectations by 2.5%. It was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 1.3% since reporting and currently trades at $16.82.

Read our full, actionable report on Guess here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.