Even though Republic Bancorp (currently trading at $73.85 per share) has gained 7.7% over the last six months, it has lagged the S&P 500’s 13.9% return during that period. This might have investors contemplating their next move.

Is there a buying opportunity in Republic Bancorp, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is Republic Bancorp Not Exciting?

We don't have much confidence in Republic Bancorp. Here are three reasons there are better opportunities than RBCAA and a stock we'd rather own.

1. Net Interest Income Points to Soft Demand

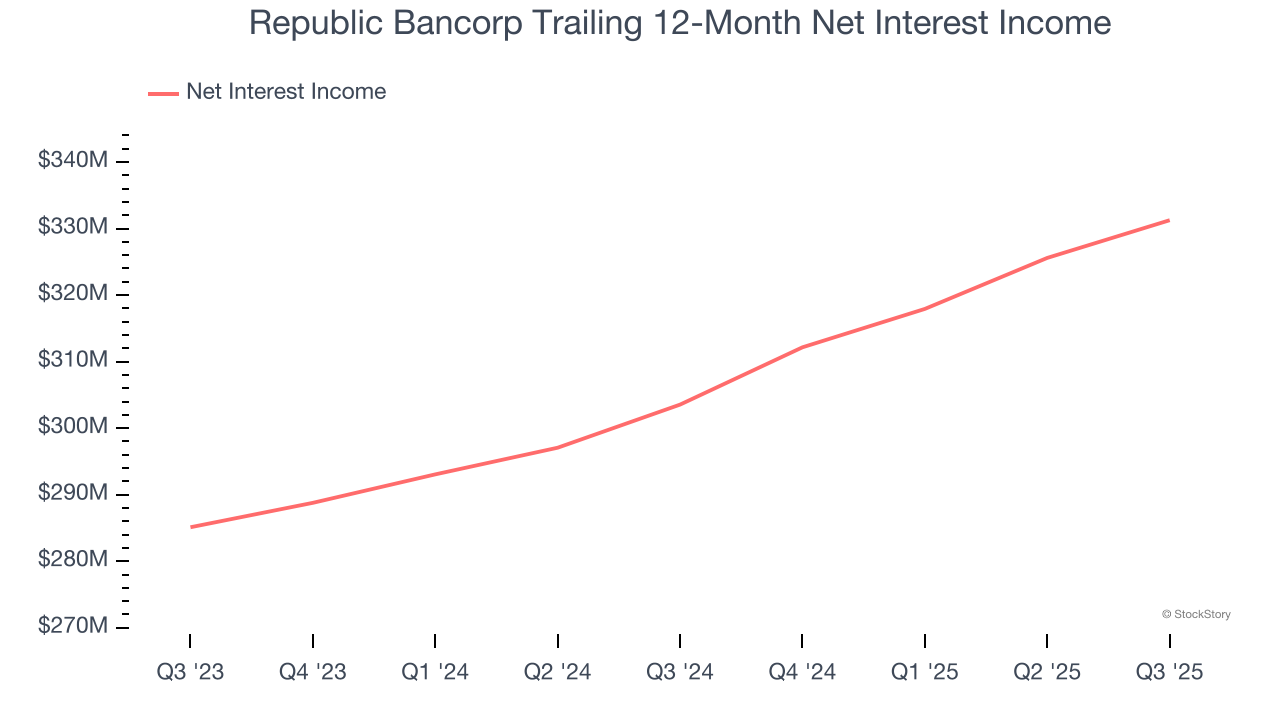

Markets consistently prioritize net interest income over non-recurring fees, recognizing its superior quality compared to the more unpredictable revenue streams.

Republic Bancorp’s net interest income has grown at a 9.5% annualized rate over the last five years, slightly worse than the broader banking industry. Its growth was driven by an increase in its net interest margin, which represents how much a bank earns in relation to its outstanding loans, as its loan book shrank throughout that period.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Republic Bancorp’s net interest income to drop by 1.7%, a decrease from its 7.8% annualized growth for the past two years. This projection is below its 7.8% annualized growth rate for the past two years.

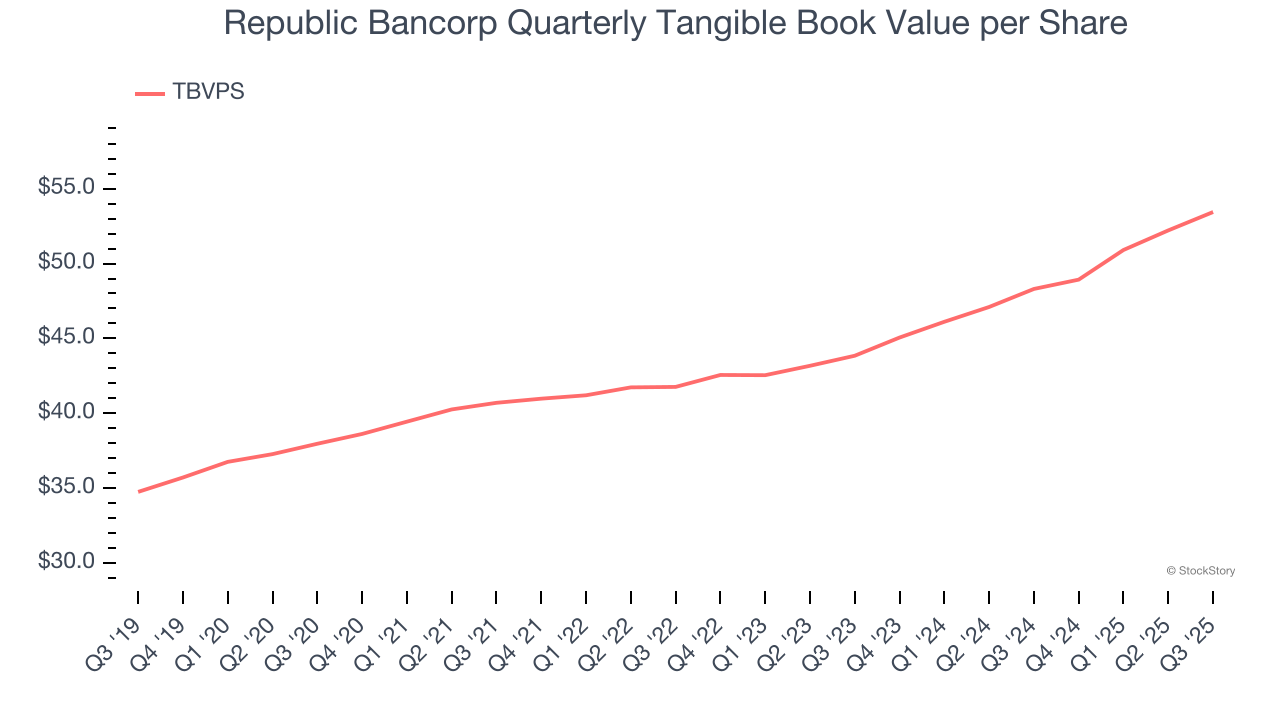

3. Projected TBVPS Growth Is Slim

A bank’s tangible book value per share (TBVPS) increases when it generates higher net interest margins and keeps credit losses low, allowing it to compound shareholder value over time.

Over the next 12 months, Consensus estimates call for Republic Bancorp’s TBVPS to grow by 7.5% to $57.46, paltry growth rate.

Final Judgment

Republic Bancorp’s business quality ultimately falls short of our standards. With its shares trailing the market in recent months, the stock trades at 1.3× forward P/B (or $73.85 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than Republic Bancorp

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.