What a time it’s been for Planet Labs. In the past six months alone, the company’s stock price has increased by a massive 248%, reaching $17.75 per share. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy PL? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On Planet Labs?

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE: PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

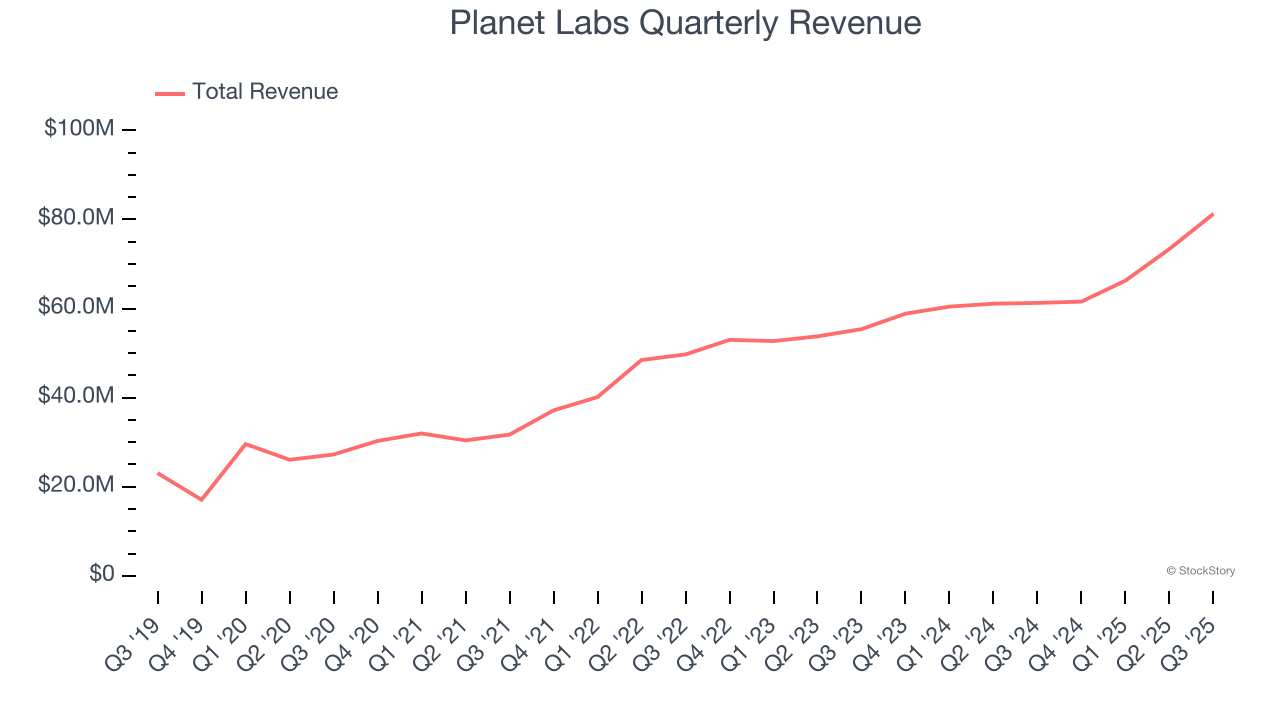

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Planet Labs’s sales grew at an incredible 23.1% compounded annual growth rate over the last five years. Its growth beat the average business services company and shows its offerings resonate with customers.

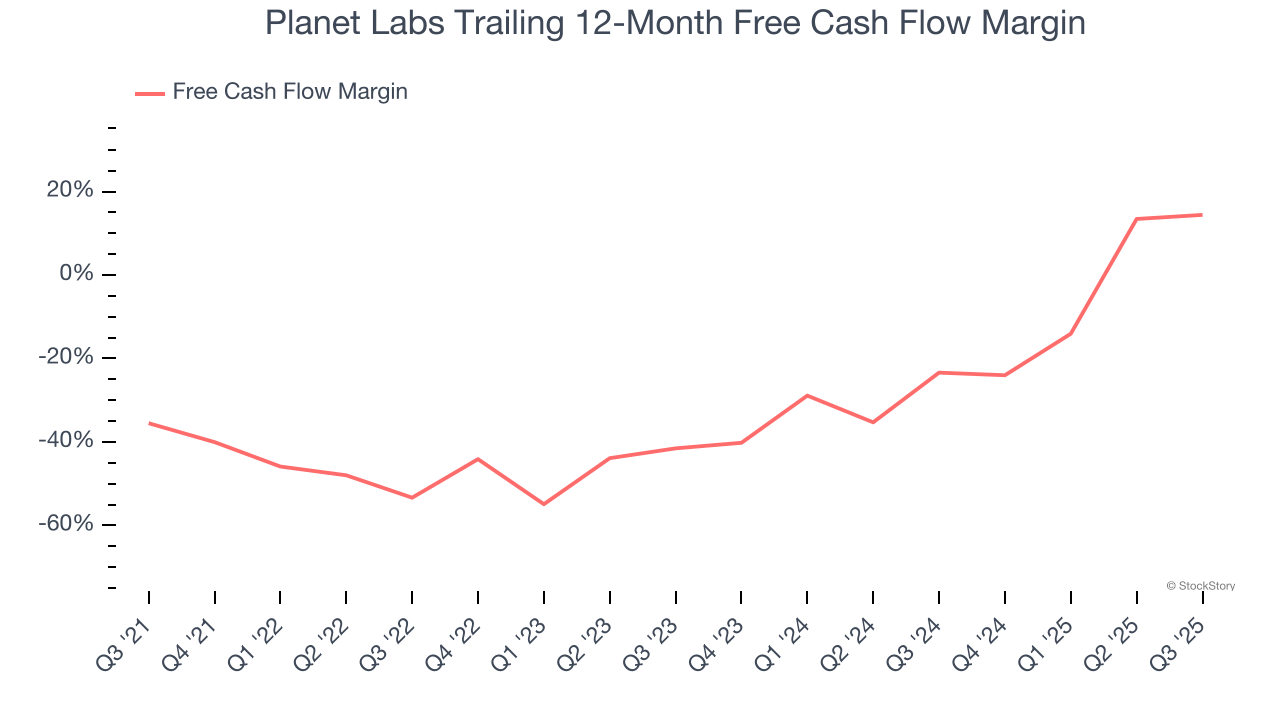

2. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Planet Labs’s margin expanded by 49.9 percentage points over the last five years. Planet Labs’s free cash flow margin for the trailing 12 months was 14.4%.

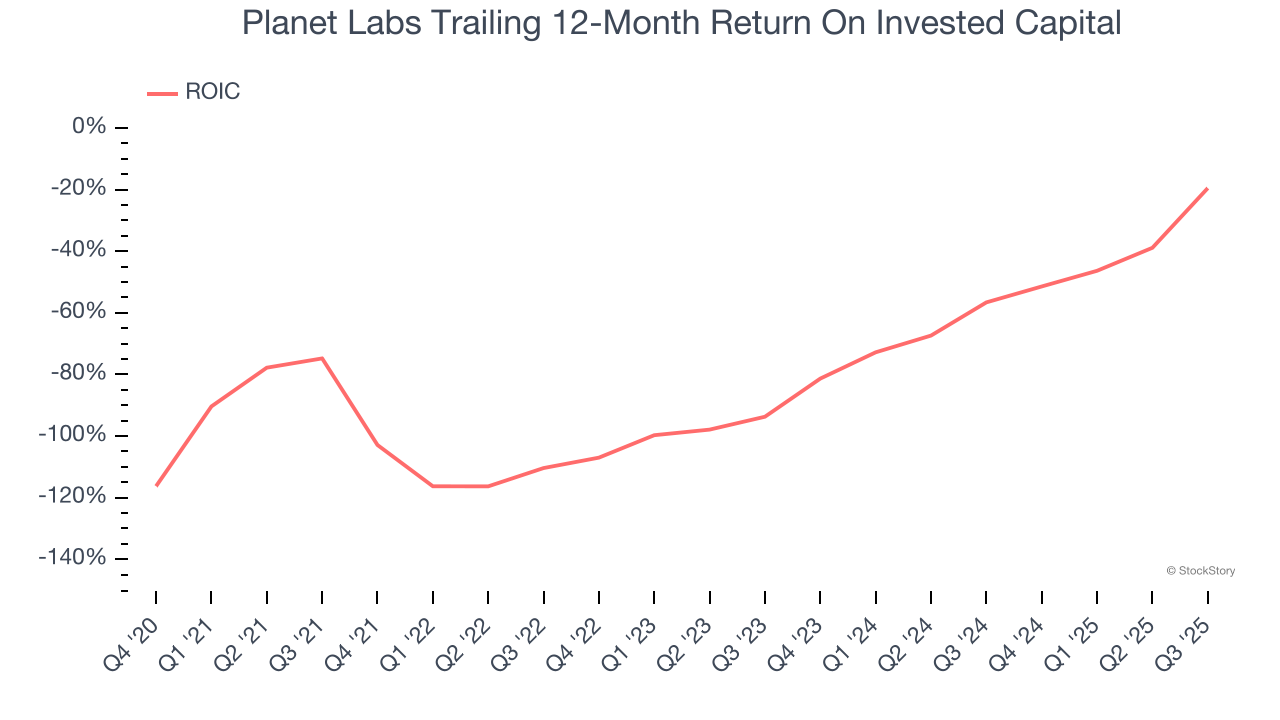

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Planet Labs’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

Final Judgment

These are just a few reasons why Planet Labs ranks near the top of our list, and with the recent surge, the stock trades at 721× forward EV-to-EBITDA (or $17.75 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Planet Labs

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.