e.l.f. Beauty’s stock price has taken a beating over the past six months, shedding 37.4% of its value and falling to $78.66 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy ELF? Find out in our full research report, it’s free for active Edge members.

Why Does ELF Stock Spark Debate?

Short for "eyes, lips, face", e.l.f. Beauty (NYSE: ELF) is a developer of high-quality beauty products at accessible price points.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

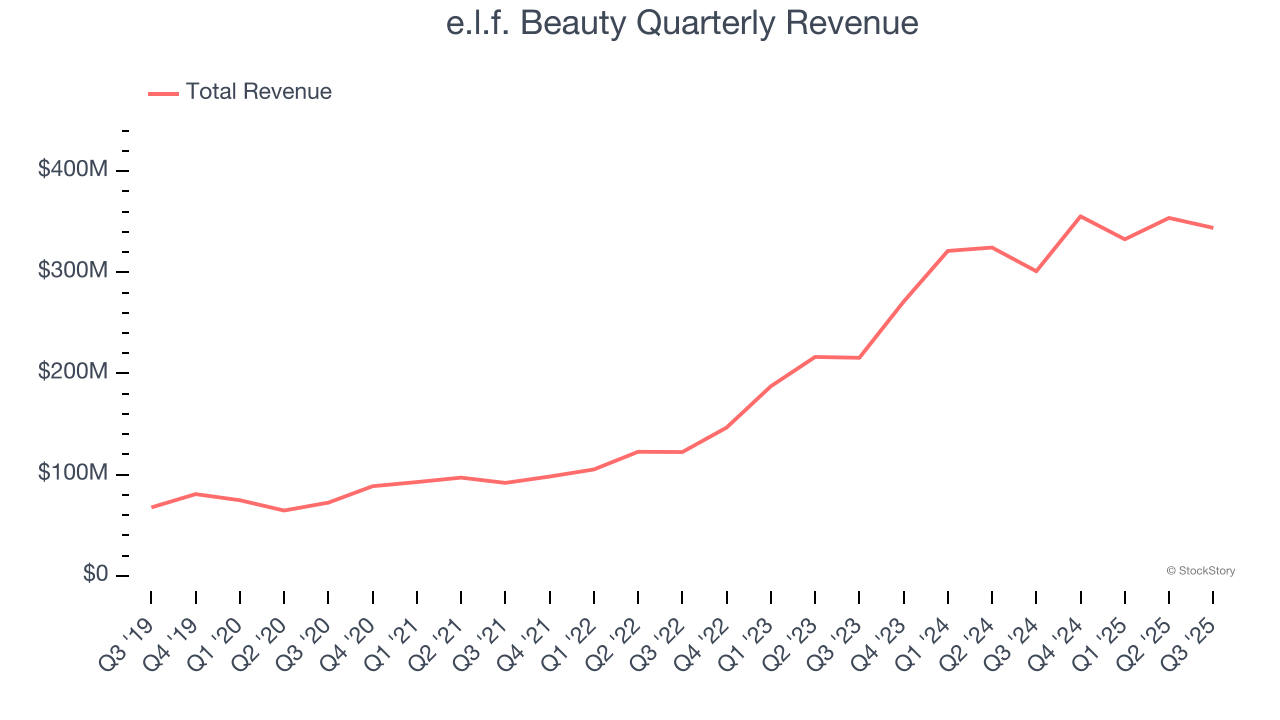

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, e.l.f. Beauty grew its sales at an incredible 45.7% compounded annual growth rate. Its growth beat the average consumer staples company and shows its offerings resonate with customers.

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

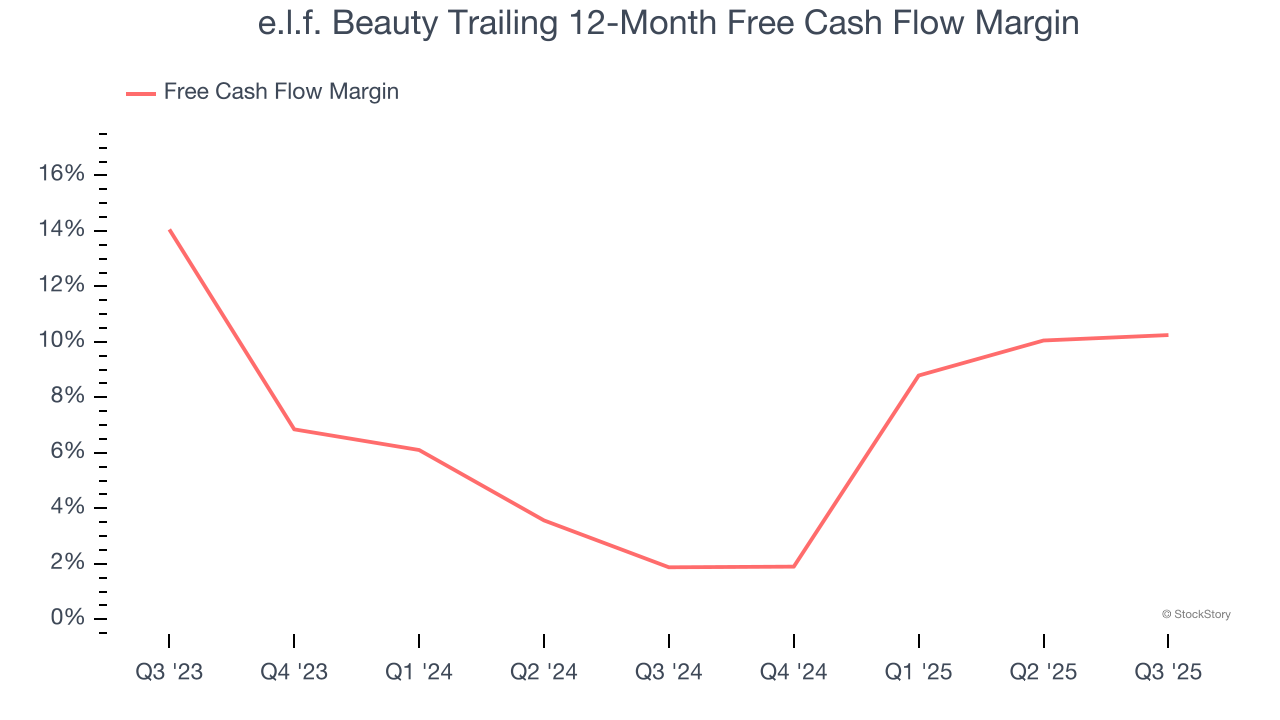

As you can see below, e.l.f. Beauty’s margin expanded by 8.4 percentage points over the last year. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat. e.l.f. Beauty’s free cash flow margin for the trailing 12 months was 10.2%.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

With $1.39 billion in revenue over the past 12 months, e.l.f. Beauty is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

Final Judgment

e.l.f. Beauty has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 25.9× forward P/E (or $78.66 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.