What a fantastic six months it’s been for Shopify. Shares of the company have skyrocketed 46.7%, hitting $158.98. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy SHOP? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On SHOP?

Starting with just three people selling snowboards online in 2004, Shopify (NYSE: SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

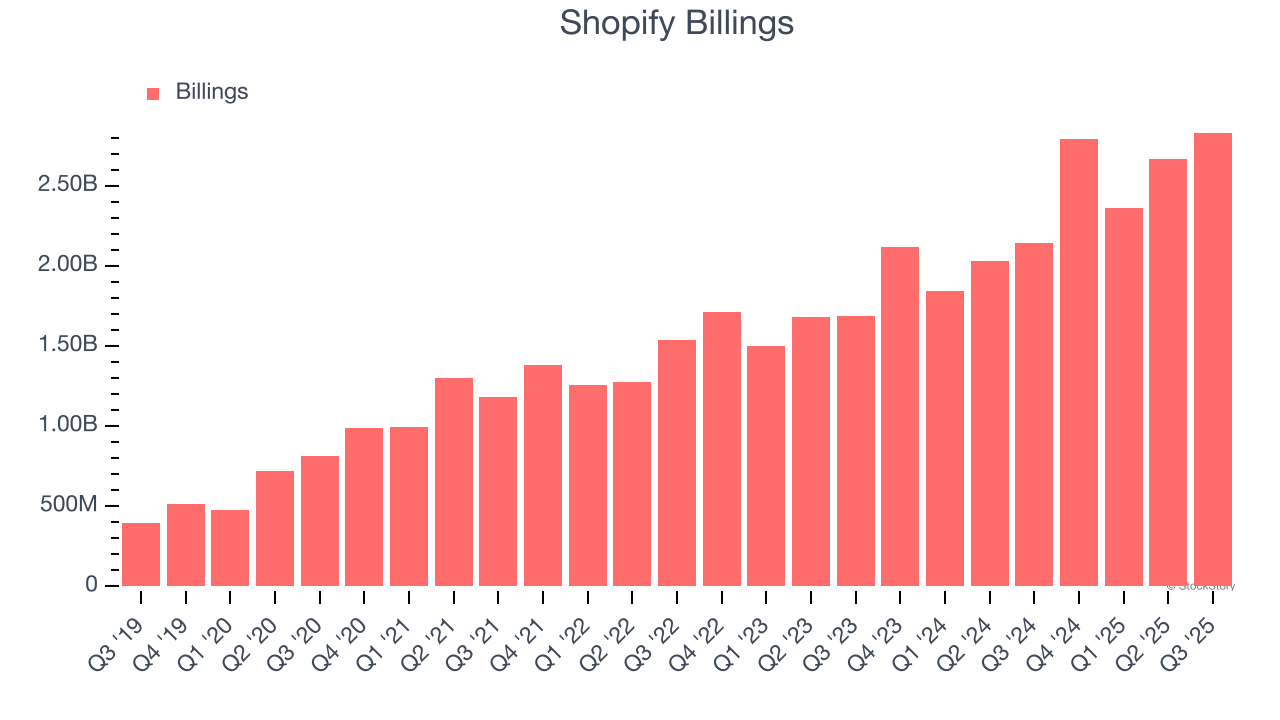

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Shopify’s billings punched in at $2.83 billion in Q3, and over the last four quarters, its year-on-year growth averaged 30.8%. This performance was fantastic, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Shopify’s revenue to rise by 24.9%. While this projection is slightly below its 26.8% annualized growth rate for the past two years, it is eye-popping for a company of its scale and suggests the market is forecasting success for its products and services.

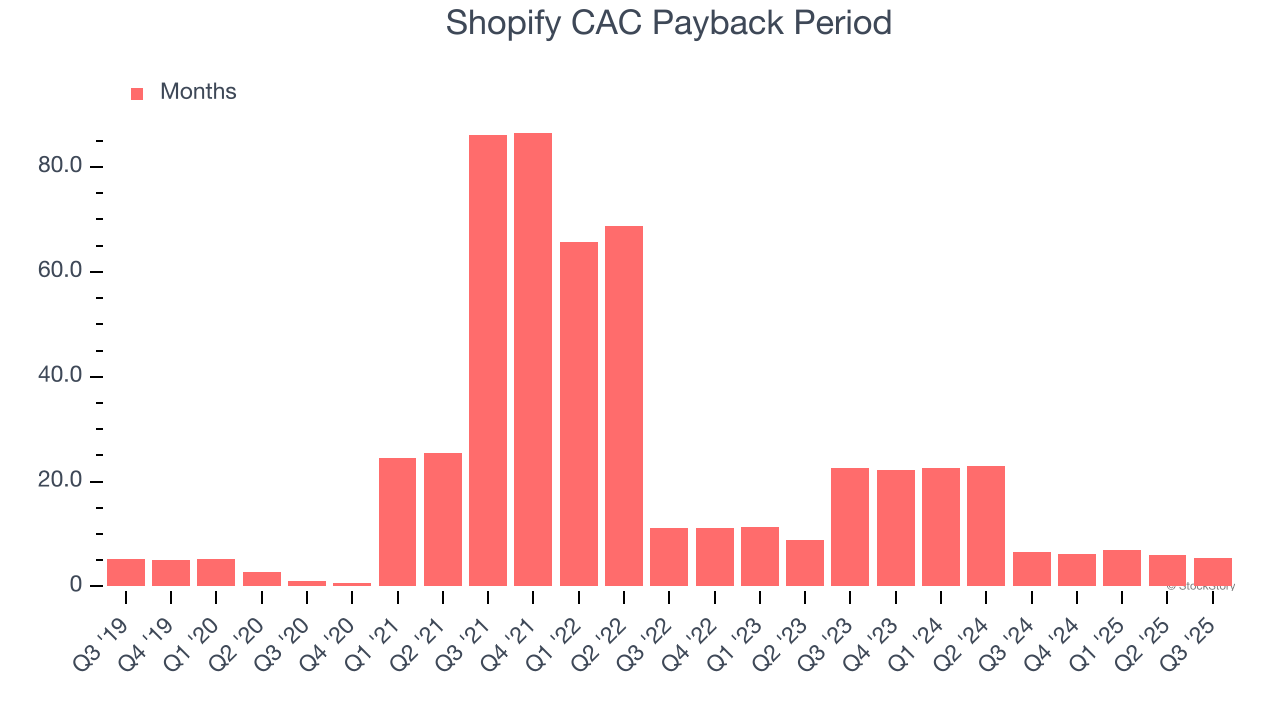

3. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Shopify more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Final Judgment

These are just a few reasons why we think Shopify is one of the best software companies out there, and with the recent surge, the stock trades at 16.1× forward price-to-sales (or $158.98 per share). Is now the time to buy despite the apparent froth? See for yourself in our in-depth research report, it’s free for active Edge members.

Stocks We Like Even More Than Shopify

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.