Even though Smith & Wesson (currently trading at $9.98 per share) has gained 17.7% over the last six months, it has lagged the S&P 500’s 34.7% return during that period. This might have investors contemplating their next move.

Is there a buying opportunity in Smith & Wesson, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Do We Think Smith & Wesson Will Underperform?

We don't have much confidence in Smith & Wesson. Here are three reasons you should be careful with SWBI and a stock we'd rather own.

1. Revenue Spiraling Downwards

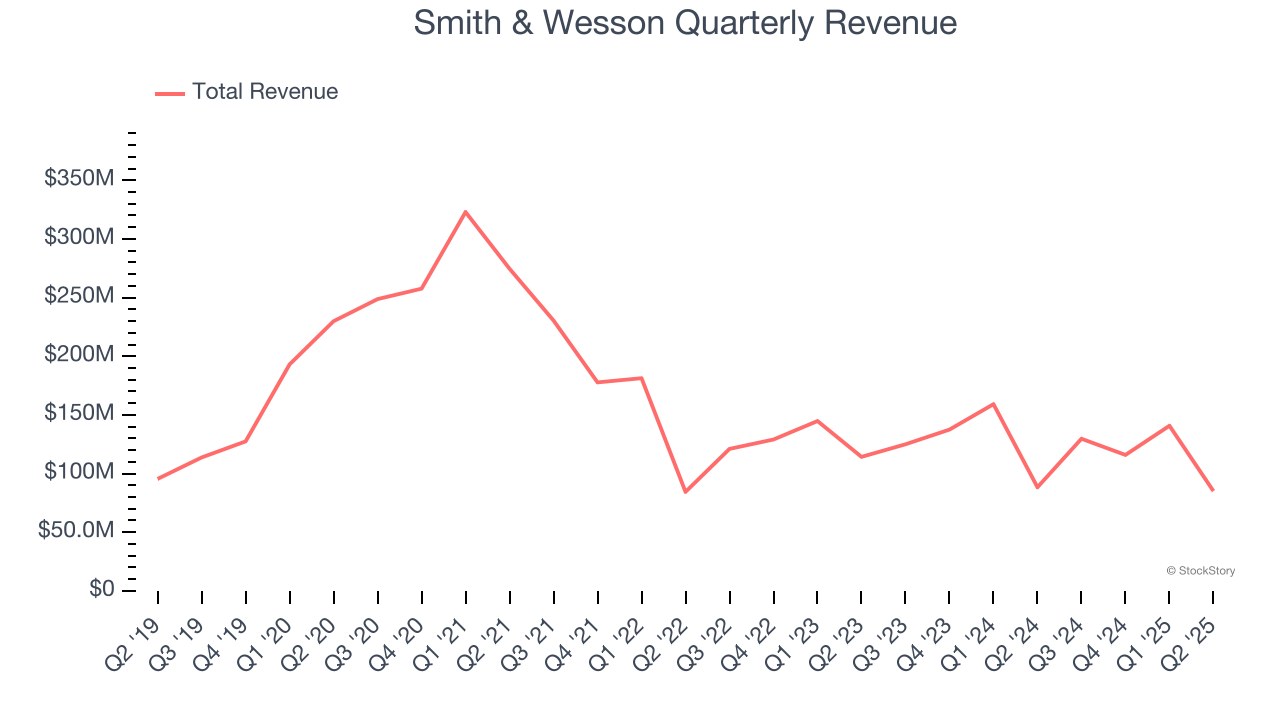

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Smith & Wesson’s demand was weak over the last five years as its sales fell at a 6.6% annual rate. This was below our standards and is a sign of poor business quality.

2. Cash Burn Ignites Concerns

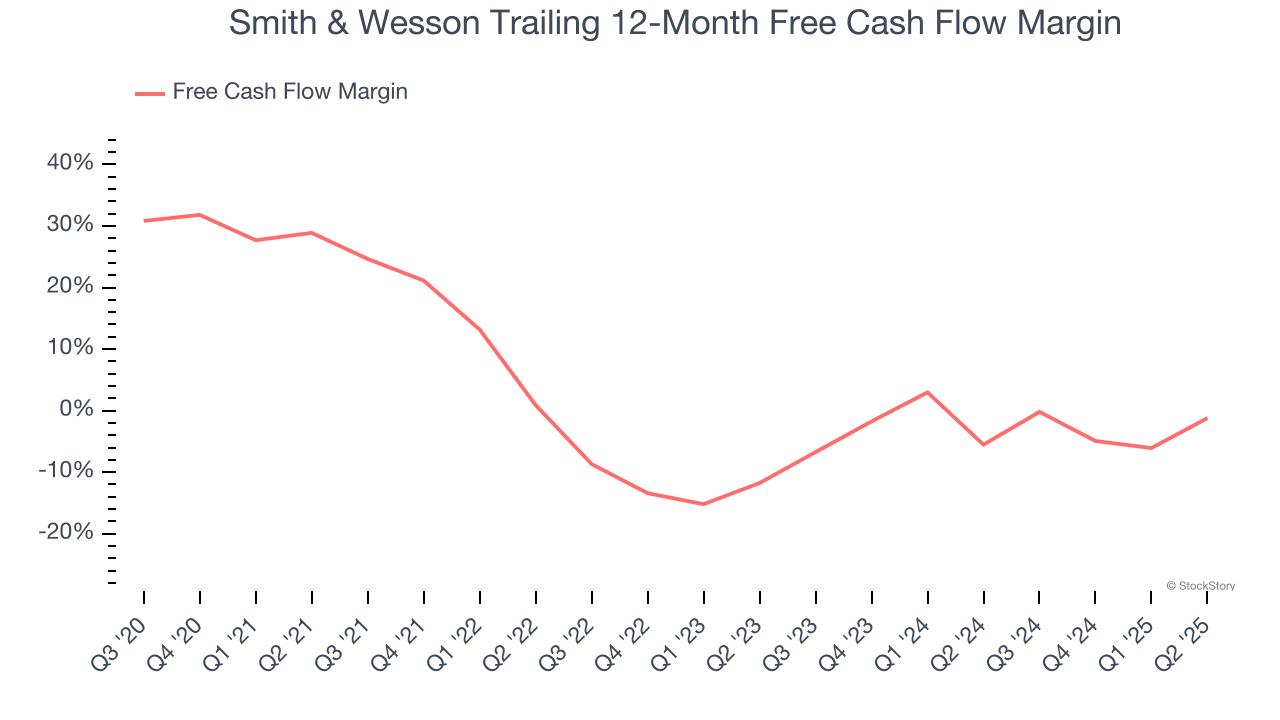

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Over the last two years, Smith & Wesson’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.5%, meaning it lit $3.45 of cash on fire for every $100 in revenue.

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Smith & Wesson’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Smith & Wesson falls short of our quality standards. With its shares trailing the market in recent months, the stock trades at 53.3× forward P/E (or $9.98 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Like More Than Smith & Wesson

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.