Even though Pinnacle Financial Partners (currently trading at $91.99 per share) has gained 5.5% over the last six months, it has lagged the S&P 500’s 34.7% return during that period. This may have investors wondering how to approach the situation.

Does this present a buying opportunity for PNFP? Or does the price properly account for its business quality and fundamentals?

Why Does Pinnacle Financial Partners Spark Debate?

Founded in 2000 with a focus on delivering big-bank capabilities with community bank personalization, Pinnacle Financial Partners (NASDAQ: PNFP) is a Tennessee-based financial holding company that provides banking, investment, trust, mortgage, and insurance services to businesses and individuals.

Two Positive Attributes:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

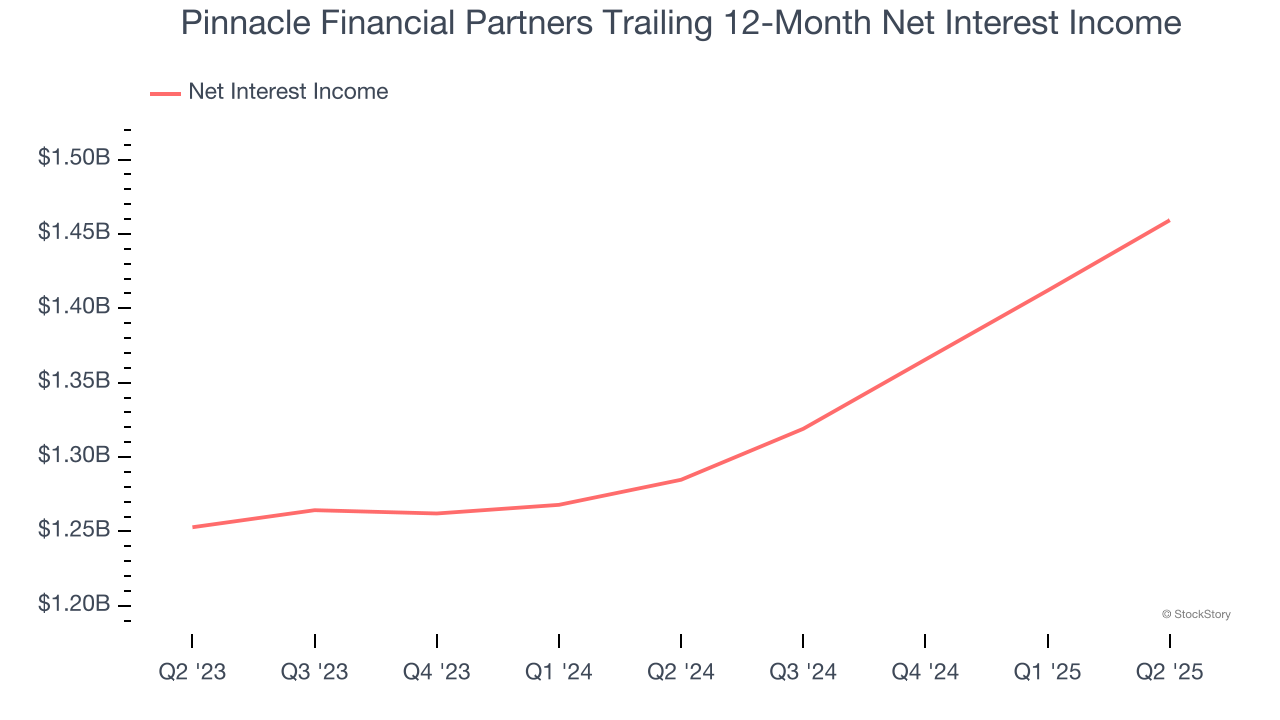

Our experience and research show the market cares primarily about a bank’s net interest income growth as one-time fees are considered a lower-quality and non-recurring revenue source.

Pinnacle Financial Partners’s net interest income has grown at a 13.5% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue. Its growth was driven by both an increase in its outstanding loans and net interest margin, which represents how much a bank earns in relation to its outstanding loan book.

2. Outstanding Long-Term EPS Growth

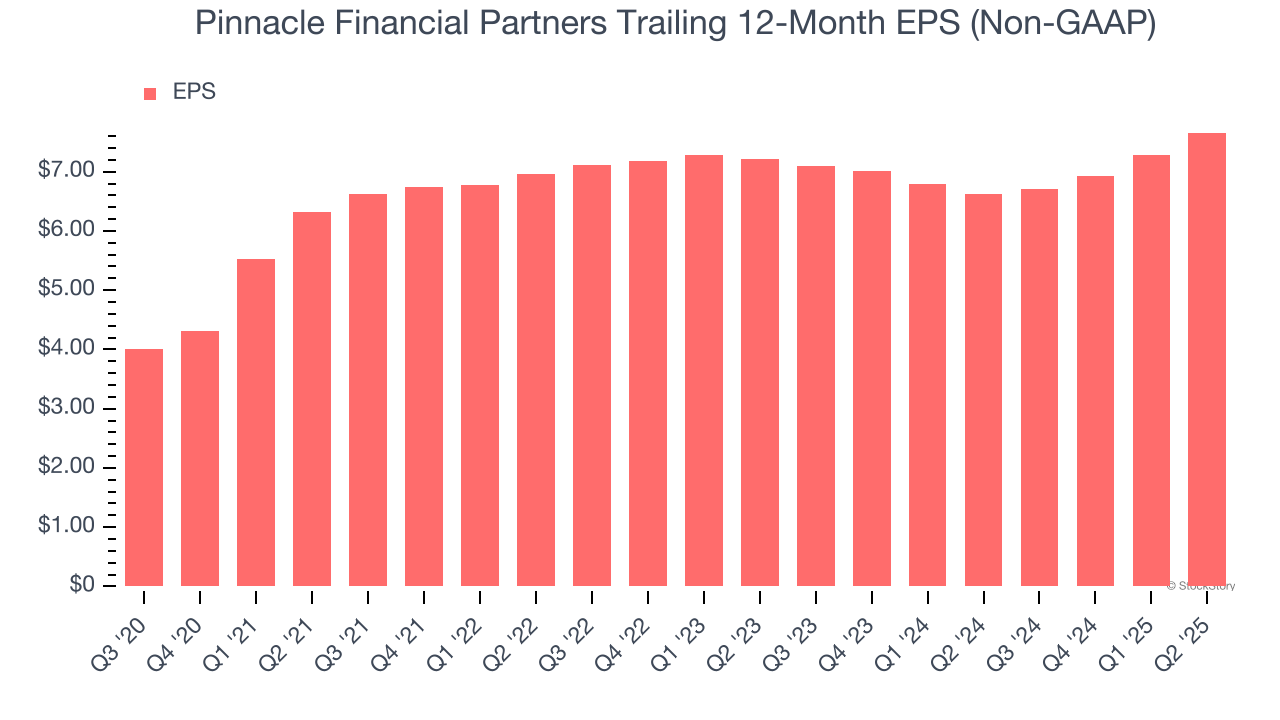

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Pinnacle Financial Partners’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years, higher than its 12.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Low Net Interest Margin Reveals Weak Loan Book Profitability

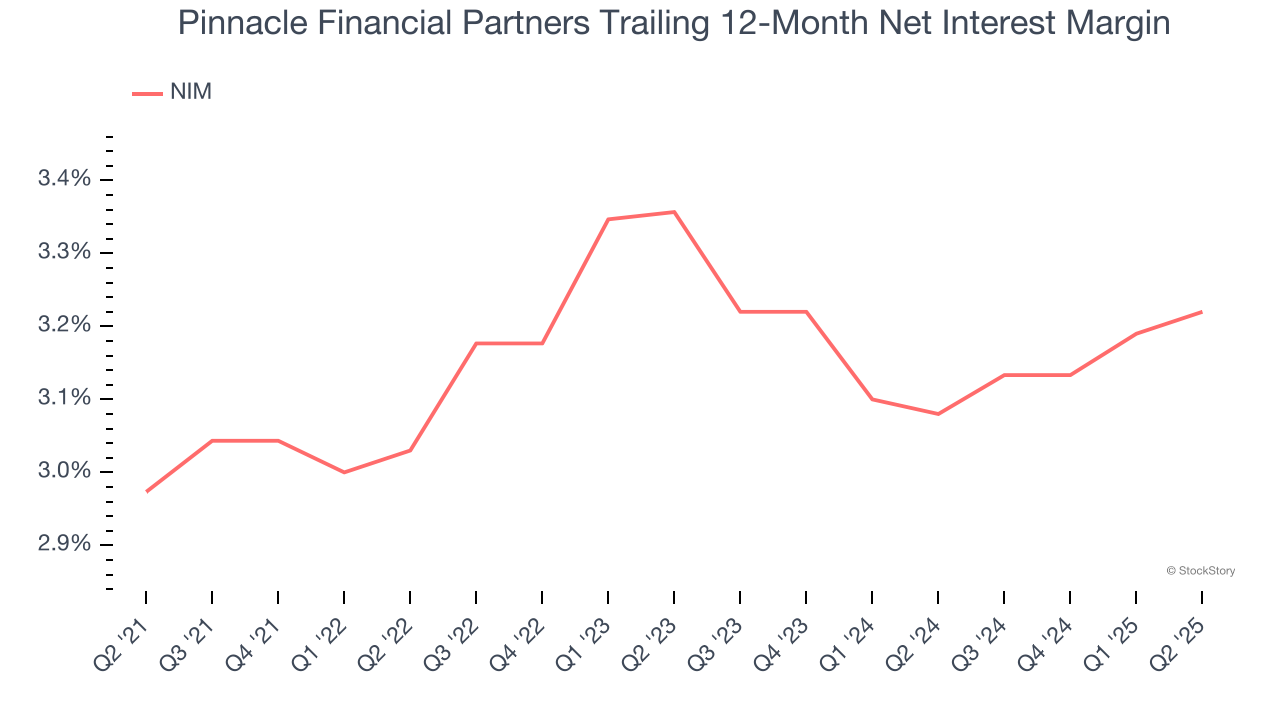

Net interest margin (NIM) represents how much a bank earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Over the past two years, we can see that Pinnacle Financial Partners’s net interest margin averaged a subpar 3.2%. This metric is well below other banks, signaling its loans aren’t very profitable.

Final Judgment

Pinnacle Financial Partners’s merits more than compensate for its flaws. With its shares lagging the market recently, the stock trades at 1.1× forward P/B (or $91.99 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Pinnacle Financial Partners

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.