While the S&P 500 is up 27.9% since April 2025, Dick's (currently trading at $223.82 per share) has lagged behind, posting a return of 17.8%. This might have investors contemplating their next move.

Given the relatively weaker price action, is now a good time to buy DKS? Or are investors better off allocating their money elsewhere?

Why Does DKS Stock Spark Debate?

Started as a hunting supply store, Dick’s Sporting Goods (NYSE: DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Two Things to Like:

1. Surging Same-Store Sales Show Increasing Demand

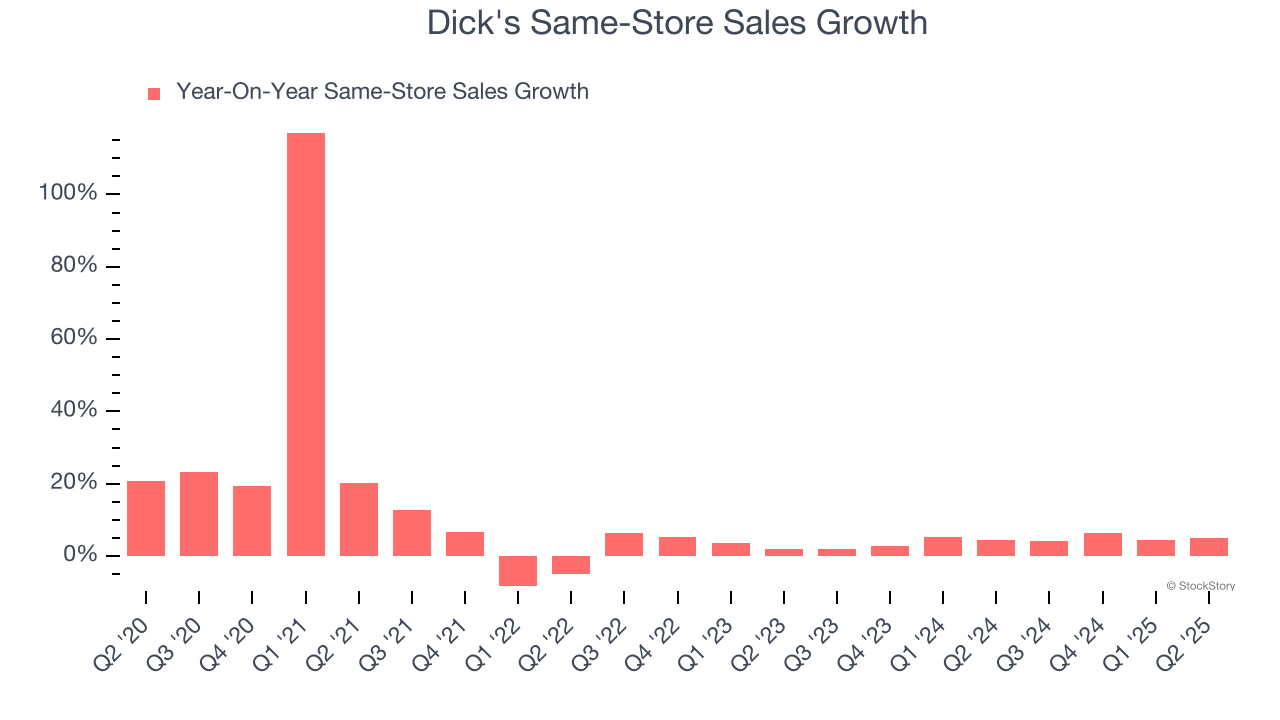

Same-store sales show the change in sales for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year. This is a key performance indicator because it measures organic growth.

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 4.3% per year.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

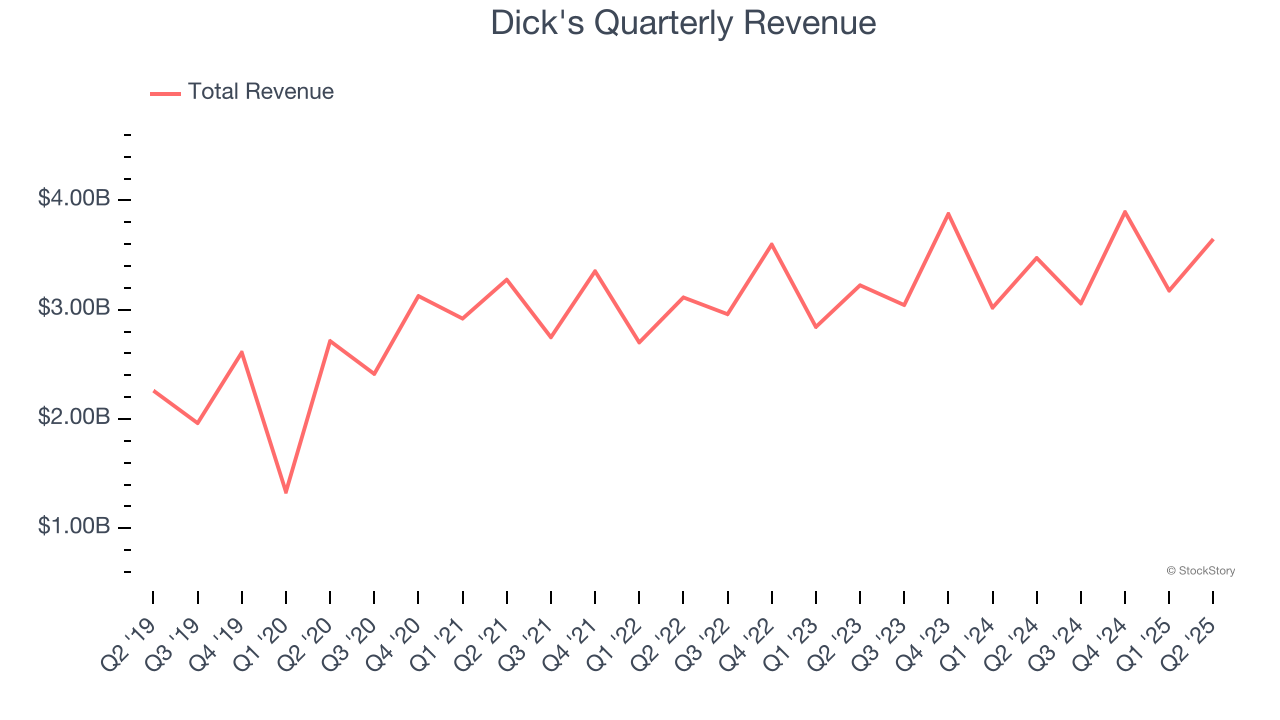

Over the next 12 months, sell-side analysts expect Dick’s revenue to rise by 56.9%, an improvement versus This projection is eye-popping for a company of its scale and suggests its newer products will catalyze better top-line performance.

One Reason to be Careful:

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Dick’s 8.3% annualized revenue growth over the last six years was mediocre. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Dick's.

Final Judgment

Dick’s positive characteristics outweigh the negatives. With its shares underperforming the market lately, the stock trades at 15.6× forward P/E (or $223.82 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

Stocks We Like Even More Than Dick's

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.