Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Keurig Dr Pepper (NASDAQ: KDP) and its peers.

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 14 beverages, alcohol, and tobacco stocks we track reported a mixed Q3. As a group, revenues missed analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 2.7% below.

Luckily, beverages, alcohol, and tobacco stocks have performed well with share prices up 12.9% on average since the latest earnings results.

Keurig Dr Pepper (NASDAQ: KDP)

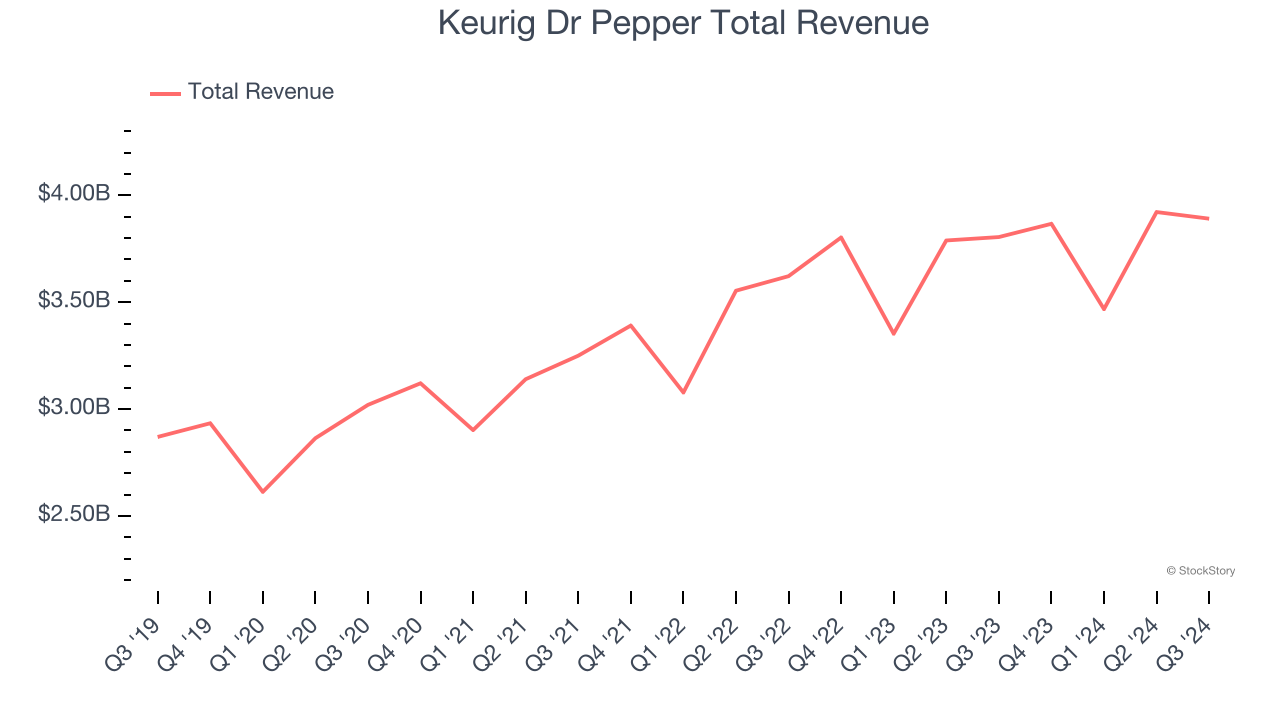

Born out of a 2018 merger between Keurig Green Mountain and Dr Pepper Snapple, Keurig Dr Pepper (NASDAQ: KDP) is a consumer staples powerhouse boasting a portfolio of beverages including sodas, coffees, and juices.

Keurig Dr Pepper reported revenues of $3.89 billion, up 2.3% year on year. This print fell short of analysts’ expectations by 0.8%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but a miss of analysts’ gross margin estimates.

Commenting on the results, CEO Tim Cofer stated, "Three quarters into the year, we remain on track to achieve our full year outlook, while notching significant progress against our multi-year strategic agenda. This morning's exciting announcement of our acquisition of GHOST is yet another such step, accelerating our portfolio evolution toward growth-accretive and consumer-preferred spaces. In Q3, we were encouraged by further improvement in our volume/mix performance despite a muted operating environment, and also demonstrated building cost discipline throughout the organization. Both are important elements underpinning our confidence as we focus on a strong finish to 2024 and plan for a healthy 2025."

Unsurprisingly, the stock is down 14.1% since reporting and currently trades at $31.55.

Is now the time to buy Keurig Dr Pepper? Access our full analysis of the earnings results here, it’s free.

Best Q3: Philip Morris (NYSE: PM)

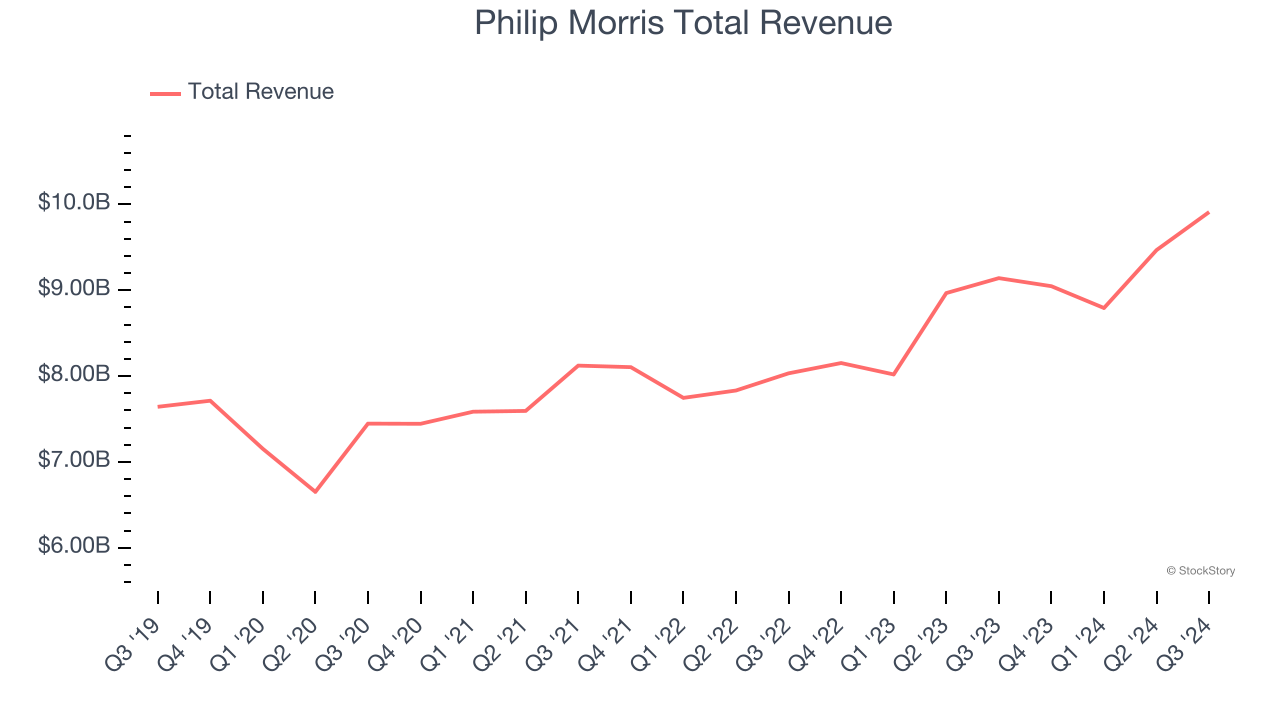

Founded in 1847, Philip Morris International (NYSE: PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

Philip Morris reported revenues of $9.91 billion, up 8.4% year on year, outperforming analysts’ expectations by 2.3%. The business had a strong quarter with a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 9.8% since reporting. It currently trades at $130.65.

Is now the time to buy Philip Morris? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Celsius (NASDAQ: CELH)

With its proprietary MetaPlus formula as the basis for key products, Celsius (NASDAQ: CELH) offers energy drinks that feature natural ingredients to help in fitness and weight management.

Celsius reported revenues of $265.7 million, down 30.9% year on year, falling short of analysts’ expectations by 0.7%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Celsius delivered the slowest revenue growth in the group. As expected, the stock is down 19.7% since the results and currently trades at $25.50.

Read our full analysis of Celsius’s results here.

Vita Coco (NASDAQ: COCO)

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Vita Coco reported revenues of $132.9 million, down 3.7% year on year. This print came in 4.3% below analysts' expectations. Taking a step back, it was still a strong quarter as it logged an impressive beat of analysts’ EBITDA and gross margin estimates.

The stock is up 25% since reporting and currently trades at $38.50.

Read our full, actionable report on Vita Coco here, it’s free.

Zevia (NYSE: ZVIA)

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE: ZVIA) is a better-for-you beverage company.

Zevia reported revenues of $36.37 million, down 15.6% year on year. This number missed analysts’ expectations by 6.8%. Zooming out, it was actually a strong quarter as it recorded EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

Zevia had the weakest performance against analyst estimates and weakest full-year guidance update among its peers. The stock is up 282% since reporting and currently trades at $4.15.

Read our full, actionable report on Zevia here, it’s free.

Market Update

Thanks to the Fed's series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% each in November and December), and a notable surge followed Donald Trump's presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by the pace and magnitude of future rate cuts as well as potential changes in trade policy and corporate taxes once the Trump administration takes over. The path forward is marked by uncertainty.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.