Wrapping up Q2 earnings, we look at the numbers and key takeaways for the shelf-stable food stocks, including Campbell's (NYSE: CPB) and its peers.

As America industrialized and moved away from an agricultural economy, people faced more demands on their time. Packaged foods emerged as a solution offering convenience to the evolving American family, whether it be canned goods or snacks. Today, Americans seek brands that are high in quality, reliable, and reasonably priced. Furthermore, there's a growing emphasis on health-conscious and sustainable food options. Packaged food stocks are considered resilient investments. People always need to eat, so these companies can enjoy consistent demand as long as they stay on top of changing consumer preferences. The industry spans from multinational corporations to smaller specialized firms and is subject to food safety and labeling regulations.

The 21 shelf-stable food stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 5.7% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Campbell's (NYSE: CPB)

With its iconic canned soup as its cornerstone product, Campbell's (NASDAQ: CPB) is a packaged food company with an illustrious portfolio of brands.

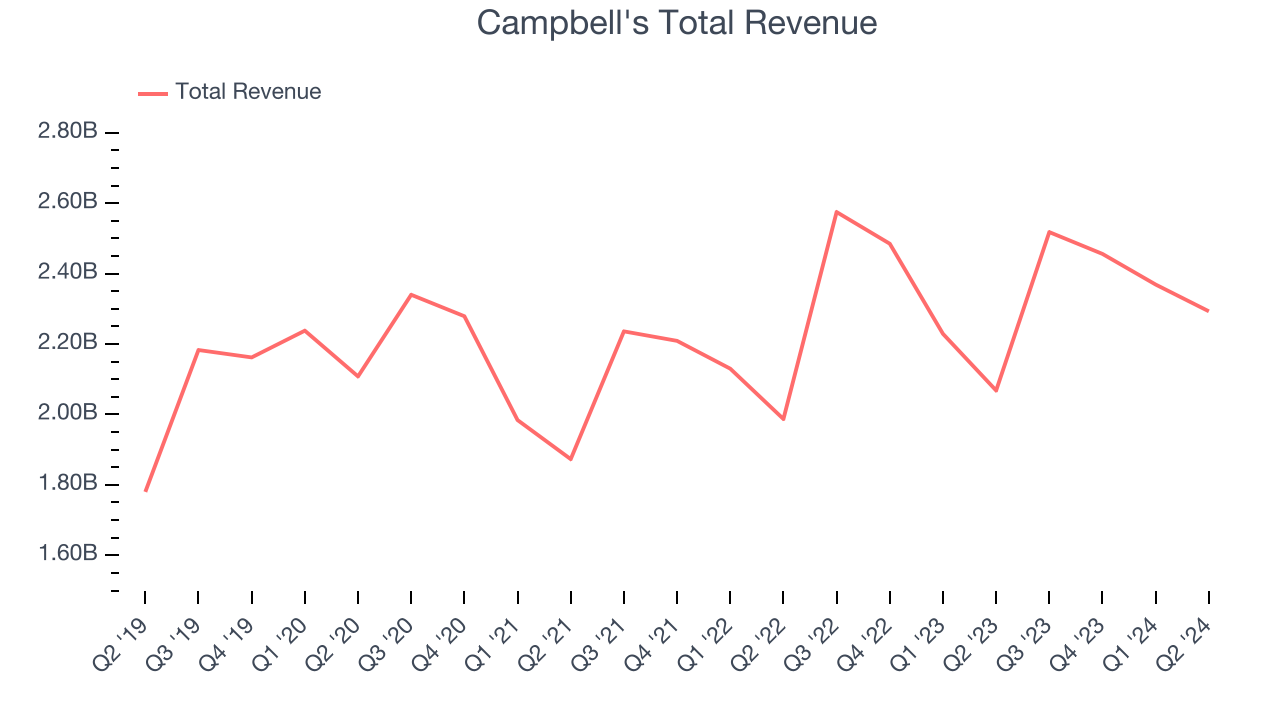

Campbell's reported revenues of $2.29 billion, up 10.9% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a slower quarter for the company with a miss of analysts’ gross margin and organic revenue estimates.

Unsurprisingly, the stock is down 13.5% since reporting and currently trades at $43.41.

Read our full report on Campbell's here, it’s free.

Best Q2: BellRing Brands (NYSE: BRBR)

Spun out of Post Holdings in 2019, Bellring Brands (NYSE: BRBR) offers protein shakes, nutrition bars, and other products under the PowerBar, Premier Protein, and Dymatize brands.

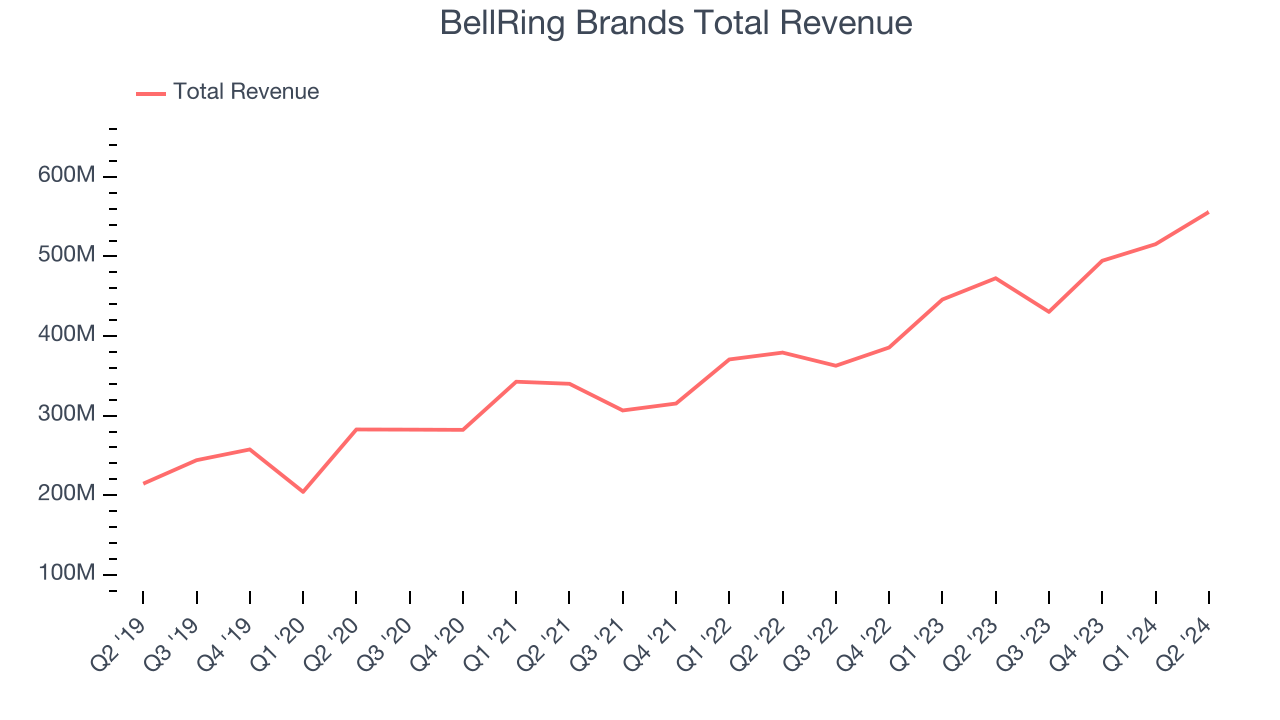

BellRing Brands reported revenues of $555.8 million, up 17.6% year on year, outperforming analysts’ expectations by 2%. The business had a strong quarter with full-year revenue guidance exceeding analysts’ expectations and a solid beat of analysts’ gross margin estimates.

BellRing Brands achieved the fastest revenue growth and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 7.2% since reporting. It currently trades at $78.74.

Is now the time to buy BellRing Brands? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: J&J Snack Foods (NASDAQ: JJSF)

Best known for its SuperPretzel soft pretzels and ICEE frozen drinks, J&J Snack Foods (NASDAQ: JJSF) produces a range of snacks and beverages and distributes them primarily to supermarket and food service customers.

J&J Snack Foods reported revenues of $426.8 million, down 3.9% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA estimates.

As expected, the stock is down 2.7% since the results and currently trades at $168.62.

Read our full analysis of J&J Snack Foods’s results here.

Kellanova (NYSE: K)

With Corn Flakes as its first and most iconic product, Kellanova (NYSE: K) is a packaged foods company that is dominant in the cereal and snack categories.

Kellanova reported revenues of $3.23 billion, flat year on year. This print beat analysts’ expectations by 2.5%. Zooming out, it was a decent quarter as it also recorded a solid beat of analysts’ organic revenue estimates.

The stock is flat since reporting and currently trades at $80.31.

Read our full, actionable report on Kellanova here, it’s free.

Simply Good Foods (NASDAQ: SMPL)

Best known for its Atkins brand that was inspired by the popular diet of the same name, Simply Good Foods (NASDAQ: SMPL) is a packaged food company whose offerings help customers achieve their healthy eating or weight loss goals.

Simply Good Foods reported revenues of $375.7 million, up 17.2% year on year. This result surpassed analysts’ expectations by 0.6%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ EBITDA estimates.

The stock is up 23.7% since reporting and currently trades at $39.88.

Read our full, actionable report on Simply Good Foods here, it’s free.

Market Update

As a result of the Fed's rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed's 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump's victory in the US Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain. Said differently, there's still much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.