Beauty supply retailer Sally Beauty (NYSE: SBH) met Wall Street’s revenue expectations in Q3 CY2024, with sales up 1.5% year on year to $935 million. On the other hand, next quarter’s revenue guidance of $930.6 million was less impressive, coming in 0.9% below analysts’ estimates. Its non-GAAP profit of $0.50 per share was 5.6% above analysts’ consensus estimates.

Is now the time to buy Sally Beauty? Find out by accessing our full research report, it’s free.

Sally Beauty (SBH) Q3 CY2024 Highlights:

- Revenue: $935 million vs analyst estimates of $935.8 million (in line)

- Adjusted EPS: $0.50 vs analyst estimates of $0.41 (5.6% beat)

- Adjusted EBITDA: $118.1 million vs analyst estimates of $116 million (1.8% beat)

- Revenue Guidance for Q4 CY2024 is $930.6 million at the midpoint, below analyst estimates of $939.4 million

- Gross Margin (GAAP): 51.2%, in line with the same quarter last year

- Operating Margin: 8.8%, in line with the same quarter last year

- EBITDA Margin: 12.6%, in line with the same quarter last year

- Free Cash Flow Margin: 7.8%, down from 9.7% in the same quarter last year

- Locations: 4,460 at quarter end, down from 4,486 in the same quarter last year

- Same-Store Sales rose 2% year on year (-1.6% in the same quarter last year)

- Market Capitalization: $1.29 billion

“We are pleased to conclude our fiscal year with strong fourth quarter results, reflecting continued momentum across both our Sally Beauty and Beauty Systems Group segments,” said Denise Paulonis, president and chief executive officer.

Company Overview

Catering to both everyday consumers as well as salon professionals, Sally Beauty (NYSE: SBH) is a retailer that sells salon-quality beauty products such as makeup and haircare products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

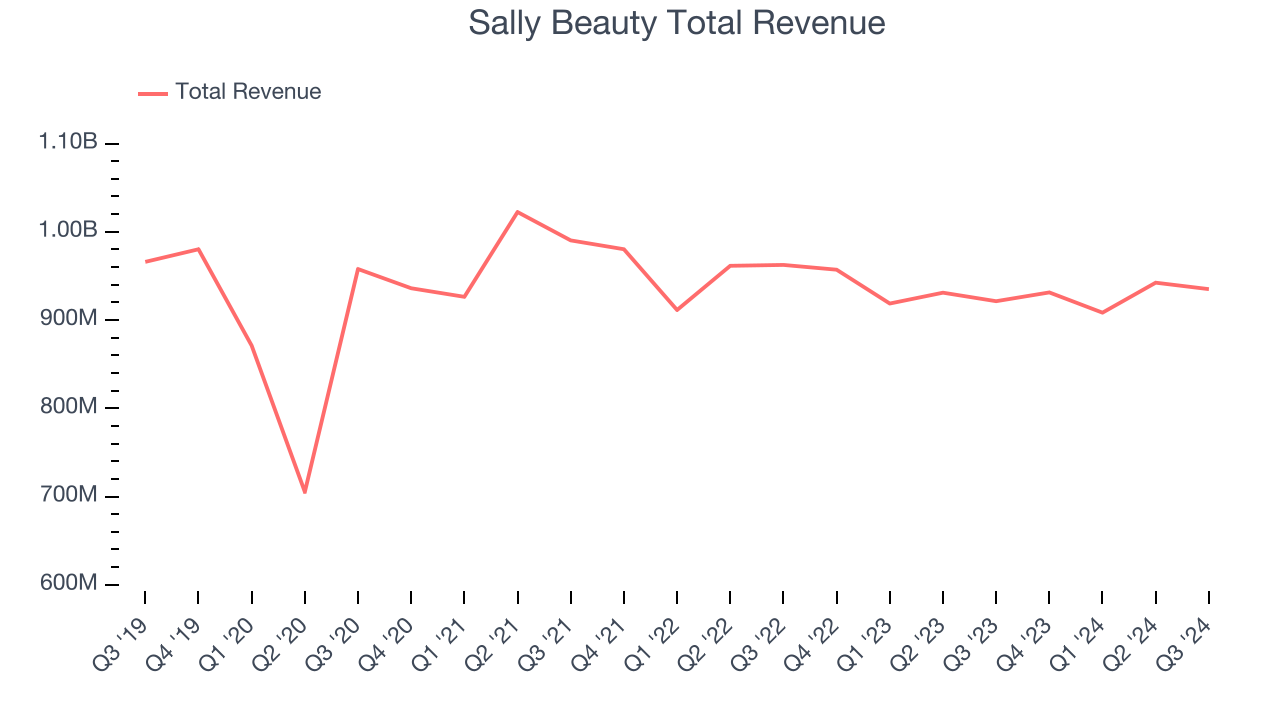

A company’s long-term performance is an indicator of its overall business quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for multiple years.

Sally Beauty is a small retailer, which sometimes brings disadvantages compared to larger competitors that benefit from economies of scale.

As you can see below, Sally Beauty’s sales were flat over the last five years (we compare to 2019 to normalize for COVID-19 impacts) because it closed stores.

This quarter, Sally Beauty grew its revenue by 1.5% year on year, and its $935 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, an improvement versus the last five years. Although this projection implies its newer products will fuel better performance, it is still below average for the sector.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Store Performance

Number of Stores

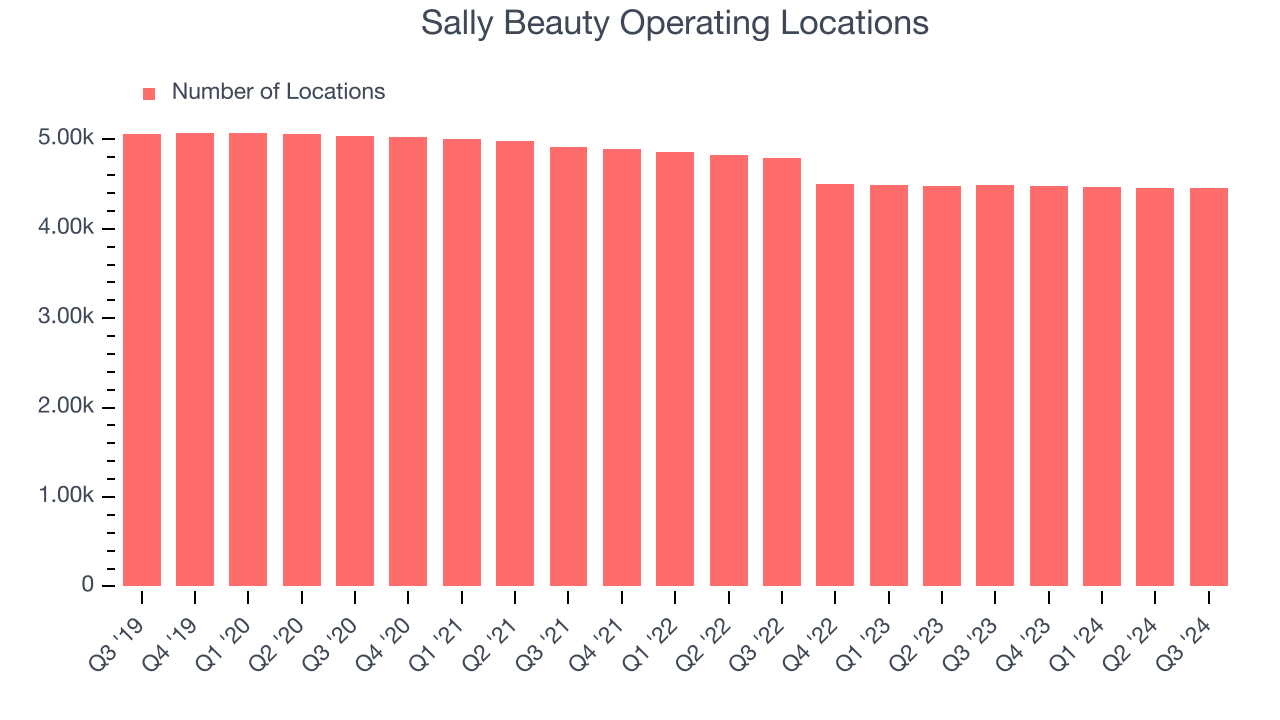

A retailer’s store count often determines how much revenue it can generate.

Sally Beauty listed 4,460 locations in the latest quarter and has generally closed its stores over the last two years, averaging 3.9% annual declines.

When a retailer shutters stores, it usually means that brick-and-mortar demand is less than supply, and it is responding by closing underperforming locations to improve profitability.

Same-Store Sales

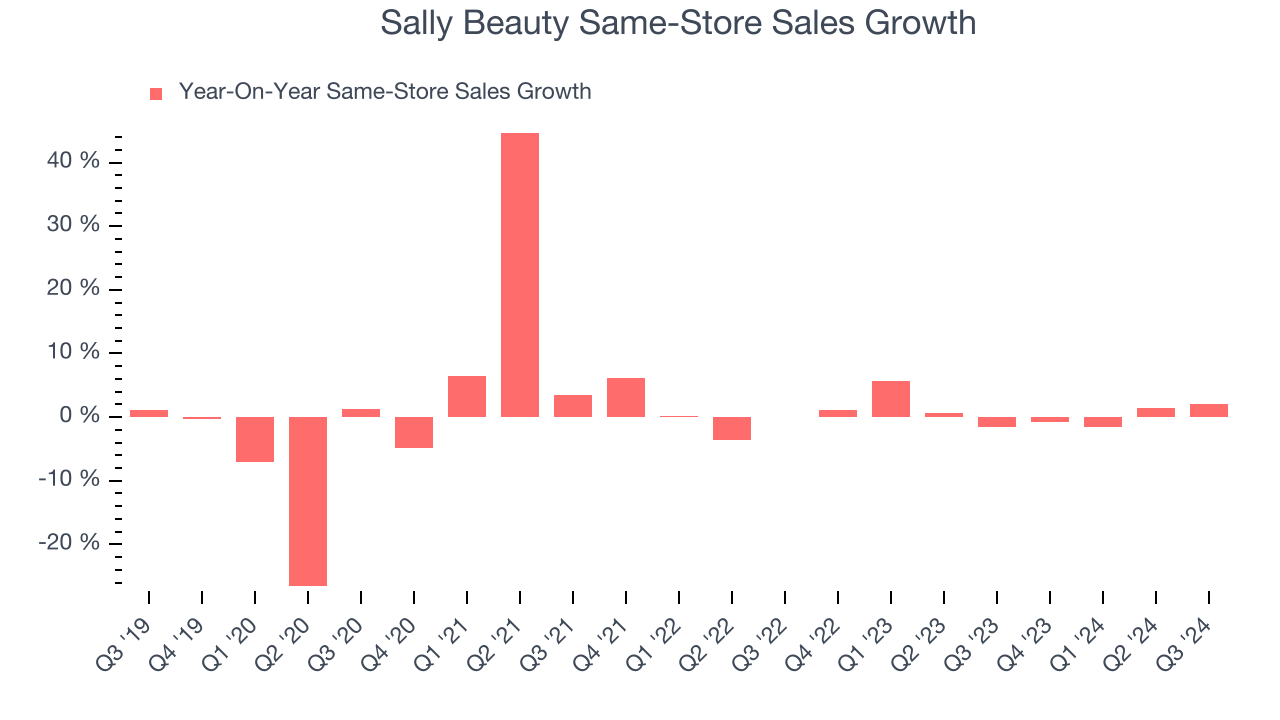

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at shops open for at least a year.

Sally Beauty’s demand within its existing locations has barely increased over the last two years as its same-store sales were flat. This performance isn’t ideal, and Sally Beauty is attempting to boost same-store sales by closing stores (fewer locations sometimes lead to higher same-store sales).

In the latest quarter, Sally Beauty’s same-store sales rose 2% year on year. This growth was an acceleration from its historical levels, which is always an encouraging sign.

Key Takeaways from Sally Beauty’s Q3 Results

It was encouraging to see Sally Beauty beat analysts’ EBITDA and EPS expectations this quarter. On the other hand, its revenue guidance for next quarter slightly missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $12.59 immediately after reporting.

So should you invest in Sally Beauty right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.