The technology sector has led the way in 2023, boasting incredible gains and technological advancements, especially in Artificial Intelligence (AI). The Invesco QQQ ETF (NASDAQ: QQQ), which tracks the performance of the Nasdaq-100 Index, is up an impressive 47.28% versus the overall market, up 20.34%.

Amidst this tech landscape and outperformance, focusing on companies recently upgraded by analysts within this sector holds substantial significance. Analyst upgrades often signal positive outlooks, reflecting improved earnings potential, innovative advancements, or strategic changes within these companies.

So, identifying and considering these upgrades can be pivotal for investors seeking to capitalize on emerging opportunities and potential growth within the technology sector. Especially when a company has outperformed the top-performing sector and recently received upgrades from analysts.

Here are three stocks that have outperformed the sector and continue to receive praise from analysts.

CrowdStrike (NASDAQ: CRWD)

CrowdStrike has been at the forefront of combating cyber threats. With its acclaimed Falcon system and services, including endpoint security and threat response, the company earned renown for its role in high-profile cases like the Sony Pictures and DNC hacks.

Its stock, CRWD, has significantly outperformed the overall sector with its remarkable 130% year-to-date gain. Along with being one of the top-performing stocks in the sector, it’s also a Top-Rated Stock and one of the Most Upgraded Stocks.

Based on 35 analyst ratings, CRWD has a Moderate Buy rating. Of the 35 ratings, 33 are a Buy, and just 2 are Hold. Most recently, following their earnings release on November 28, as many as 16 analysts took action, with many of them boosting their target for CRWD and reiterating their bullish rating for the stock.

Adobe (NASDAQ: ADBE)

Adobe is a global software giant headquartered in San Jose, California. Renowned for products like Adobe Acrobat, Photoshop, and Illustrator, it leads in digital content creation tools and subscription services via Creative Cloud.

The $277 billion company is having a stellar year, with its stock up over 80% year-to-date and fast approaching its all-time high, near $700 from 2021. Adobe, expected to report earnings on December 13, has a projected earnings growth of 11.40% and last topped the consensus estimate by $0.11, posting $4.08 EPS for the previous quarter.

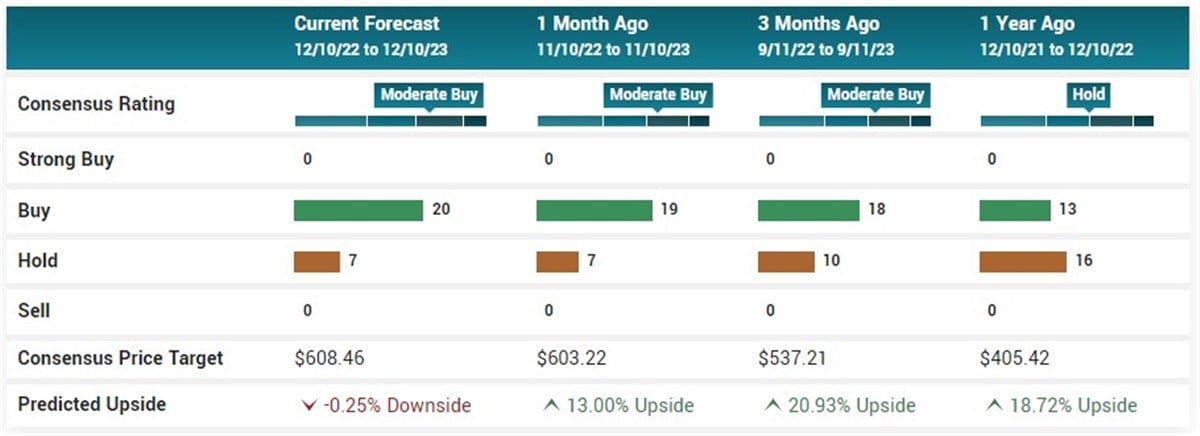

Adobe’s stock is one of the most upgraded stocks, and, notably, it has recently received an upgrade and price target increase from two analysts ahead of its earnings report. Based on 27 analyst ratings, ADBE has a Moderate Buy rating and price target of $608.46, almost in line with its current share price.

Zscaler (NASDAQ: ZS)

Zscaler is a pioneering cloud security firm transforming digital security with its cloud-native platform. It offers diverse security services and serves global industries, including significant clients like Siemens and the U.S. Federal Government.

Like the above stocks, shares of Zscaler have significantly outperformed the technology sector, boasting almost 78% gains year-to-date. The company recently reported its quarterly earnings on November 27 and exceeded expectations, reporting earnings per share of $0.67, surpassing the consensus estimate by $0.18. The company generated $496.70 million in revenue for the quarter, marking a 39.7% increase year-over-year, outperforming analysts' anticipated revenue of $473.36 million.

ZS is among the most upgraded stocks, with a consensus analyst rating of moderate buy based on 35 analyst ratings. Of the 35 ratings, 25 are a Buy, 1 is a Strong Buy, and 9 are Hold. Following the recent release of their quarterly earnings report, fourteen analysts took action, with many either increasing their price target or reiterating their rating.