Philadelphia, Pennsylvania-based Comcast Corporation (CMCSA) is a media and technology company that provides broadband, wireless, and video services while producing and distributing broadcast television, film, streaming content, and global theme park experiences. Valued at a market cap of $107.6 billion, the company is expected to announce its fiscal Q4 earnings for 2025 before the market opens on Thursday, Jan. 29.

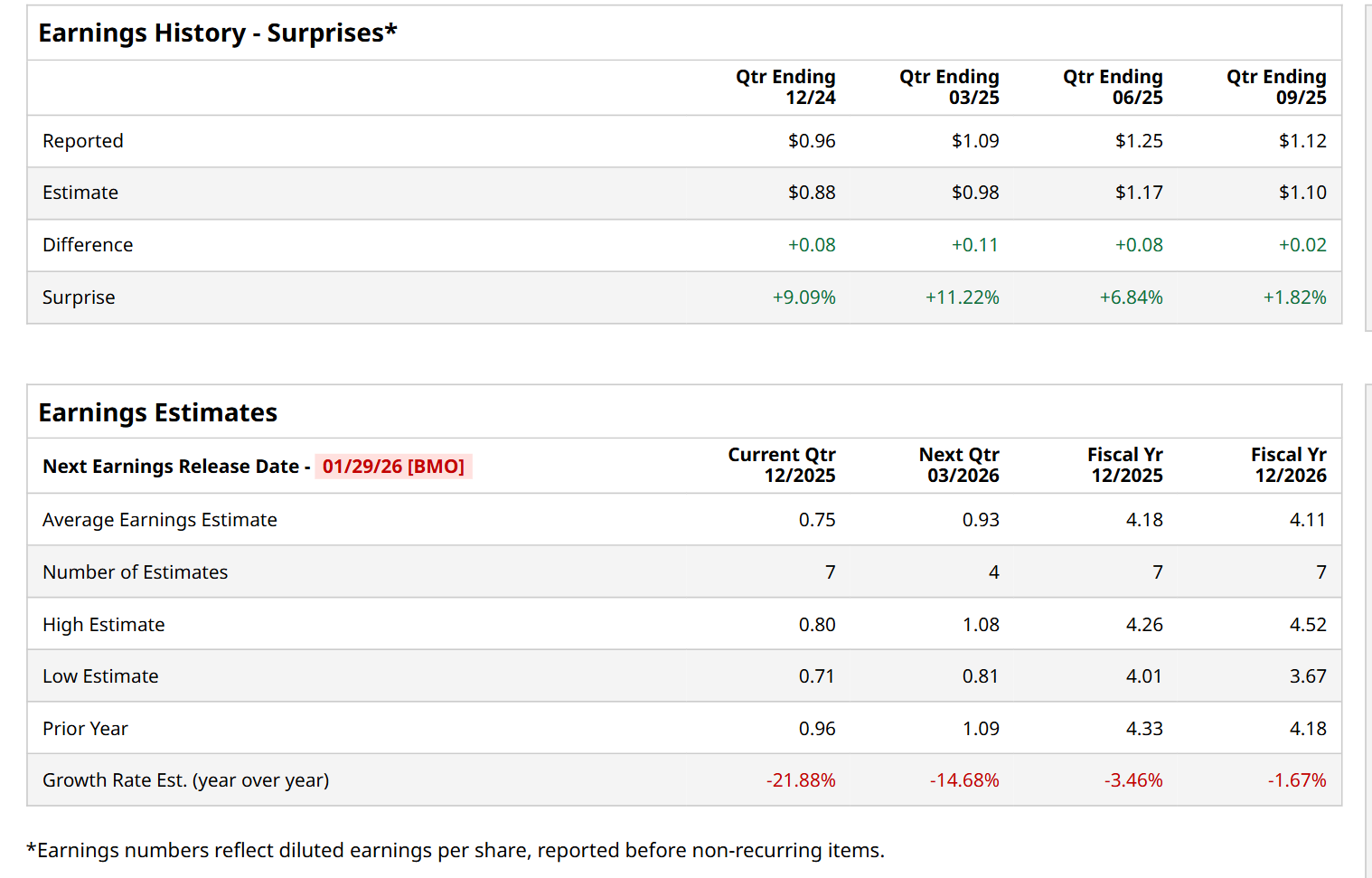

Ahead of this event, analysts expect this entertainment company to report a profit of $0.75 per share, down 21.9% from $0.96 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.12 per share in the previous quarter exceeded the forecasted figure by 1.8%.

For the current fiscal year, ending in December, analysts expect Comcast to report a profit of $4.18 per share, down 3.5% from $4.33 per share in fiscal 2024. Its EPS is expected to further decline 1.7% year-over-year to $4.11 in fiscal 2026.

Comcast has declined 26.1% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 16.9% rise and the State Street Communication Services Select Sector SPDR ETF’s (XLC) 19.4% uptick over the same time period.

Shares of Comcast plunged 3.1% on Nov. 3, after a series of analysts cut their price targets on the stock, citing concerns about the company’s broadband business. Barclays PLC (BCS) lowered its price target on the stock to $30 from $34, while Deutsche Bank Aktiengesellschaft (DB) also adjusted its target down to $40 from $44. Analysts voiced worries after the company warned it would likely face more customer losses in its broadband division due to rising competition from fiber and fixed wireless providers.

Wall Street analysts are moderately optimistic about CMCSA’s stock, with a "Moderate Buy" rating overall. Among 30 analysts covering the stock, nine recommend "Strong Buy," 20 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for CMCSA is $35.40, indicating a 26.2% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why 1 Top Analyst Expects Apple Stock to Stagnate in 2026

- An Alzheimer’s Drug Could Supercharge This High-Risk Stock. Is It Worth a Buy Here?

- Stranger Things Have Happened: Is 2026 the Year AMC Stock Goes Turbo Mode Again?

- Tesla Just Lost Its Crown. Should You Ditch TSLA Stock and Buy This No. 1 EV Seller Instead for 2026?