Data center stocks have become a key focus for investors as artificial intelligence continues to drive demand for computing power, cloud infrastructure, and digital connectivity.

One name now squarely in the spotlight is DigitalBridge (DBRG), after Japan’s SoftBank (SFTBY) agreed to acquire the data center investment firm in a $4 billion all-cash deal. The acquisition underscores SoftBank’s aggressive push into AI infrastructure and has sparked a sharp move in DigitalBridge shares. With the stock jumping on the news and the buyout offering a premium to recent prices, investors are left with a key question: Is it already too late to buy DBRG stock, or does this deal still leave room for upside?

About DigitalBridge Stock

DigitalBridge is a global alternative asset manager focused solely on digital infrastructure. It raises and invests capital in data centers, cell towers, fiber networks, small-cell networks, and edge-computing platforms. This focus on the backbone of AI and connectivity, rather than, say, traditional real estate, makes it unique. The firm’s executives stress building “AI and cloud infrastructure” worldwide, e.g., its new Korea data center partnership, and managing these assets for institutional investors.

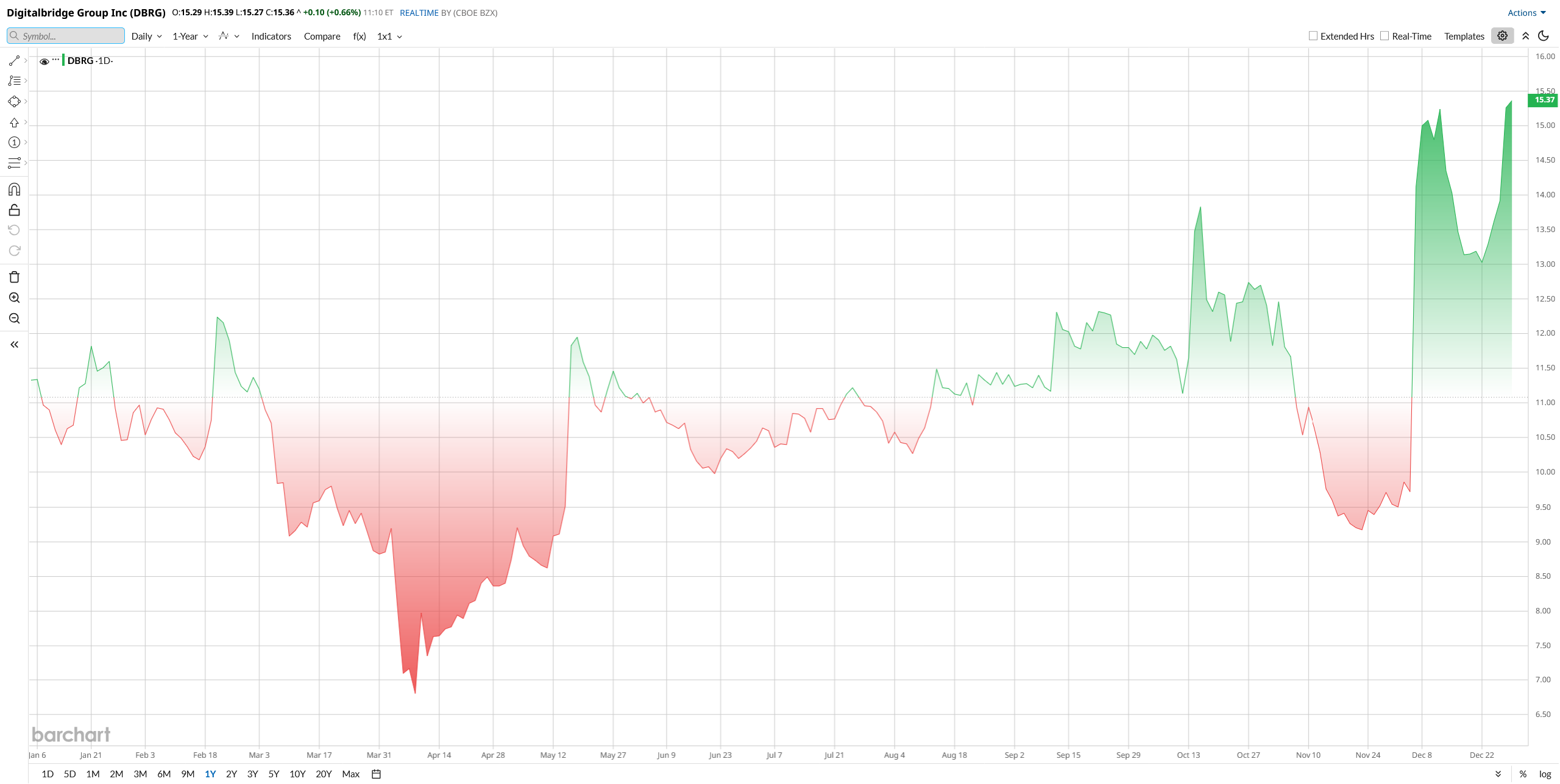

Valued at a small market cap of around $2.8 billion, DBRG’s stock had a decent run in 2025. Shares are up 36% year to date (YTD), lifted by growing enthusiasm for AI-driven data center infrastructure and increasing chatter around a potential buyout. That momentum picked up sharply in early December. A Bloomberg report pointing to takeover talks sent DBRG shares jumping roughly 45% in a single session. The momentum didn’t fade. Once SoftBank officially confirmed the deal, the stock pushed higher again.

However, DigitalBridge’s valuation looks stretched by traditional yardsticks, which shows its position as a growth-focused infrastructure play rather than a steady asset manager. The stock trades at roughly 250 times trailing earnings, far above the asset-management industry median of around nine times.

On the income side, DigitalBridge offers only a modest dividend. The company pays $0.04 per share annually, translating to a forward yield of about 0.27%. Its most recent $0.01 dividend, declared on Oct. 30, points to a low payout ratio of roughly 10.8%, suggesting dividends remain a secondary priority to reinvestment and growth.

SoftBank’s $4B Deal and Impact

On Dec. 29, SoftBank announced a $4 billion buyout of DigitalBridge at about $16 per share to expand its AI/data-center business. This represents roughly a 15% premium to DBRG’s pre-deal price.

DBRG stock popped nearly 10% on the announcement, after jumping 45% earlier in the month on speculation. SoftBank CEO Masayoshi Son framed the deal as meeting AI needs: “We need more compute, connectivity, power, and scalable infrastructure.” Under the agreement, DigitalBridge remains independently run by CEO Marc Ganzi, but the all-cash $16 offer effectively caps the stock’s upside in the near term.

The deal, expected to close in the second half of 2026, means DBRG shares will likely trade near $16 until then. In other words, with the price now close to the bid, there is little room for further gains absent a higher competing offer.

Q3 2025 Results: Solid Growth, Strong Margin

DigitalBridge’s latest Q3 quarter showed healthy top-line growth and profitability. Fee revenue was $93.5 million, up 22% year-over-year (YoY), driven by higher fund fees. GAAP net income was $31.4 million, while adjusted EPS came in at $0.12, comfortably above analysts’ roughly $0.10 forecasts. More importantly, fee-related earnings (FRE), which represent the firm’s core fee income, jumped 43% YoY to $21.7 million.

DigitalBridge also raised $1.6 billion of new equity in the third quarter, bringing its YTD total to $4.1 billion, helping fuel future fee income.

Free cash flow and liquidity remained strong, providing the company with added financial flexibility.

Management noted that the fourth quarter is historically the company’s strongest and said it remains on track to meet full-year targets. While no formal guidance was issued, analysts expect continued momentum, with Wall Street projecting roughly $0.32 in EPS for the full year 2025, implying about 88% growth from 2024, alongside revenue well above last year’s levels.

In short, Q3 results beat expectations on profitability and point to a solid finish to 2025, even though revenue came in slightly below some estimates.

What Analysts Say About DBRG Stock

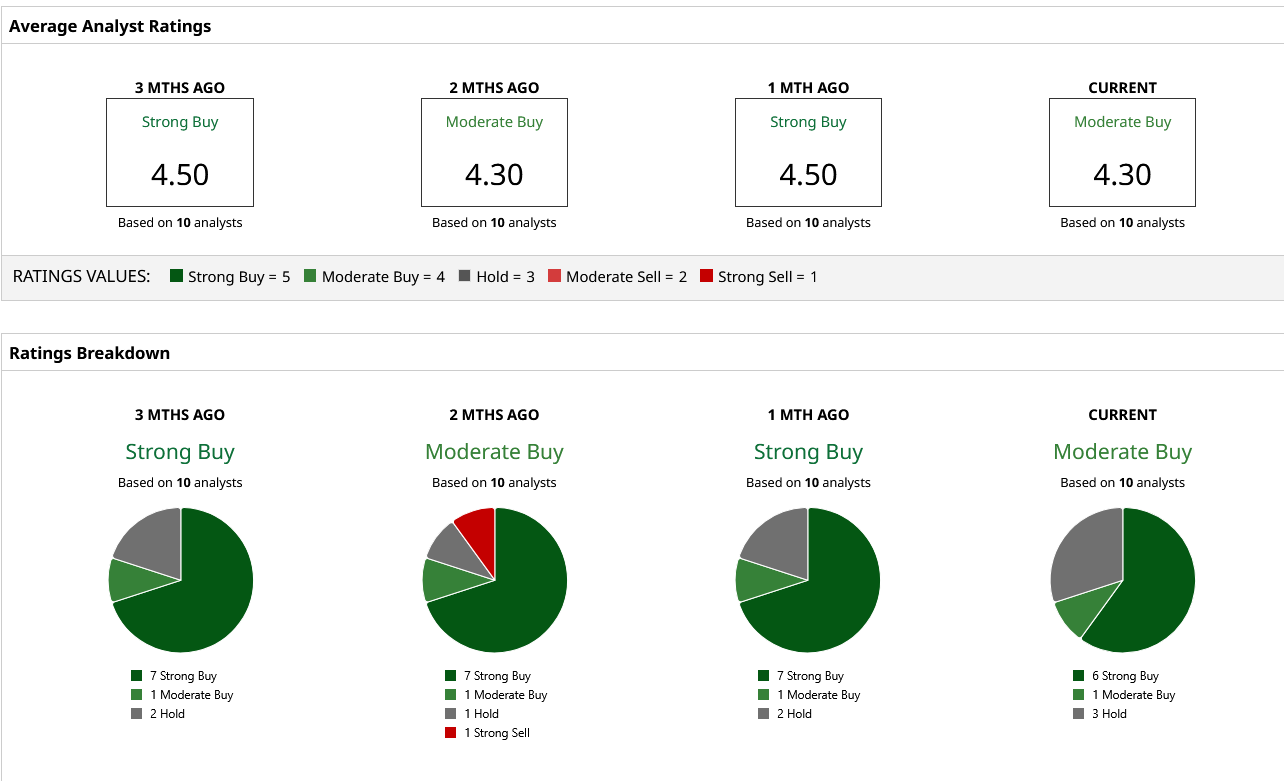

Wall Street analysts have turned notably bullish on DBRG stock. RBC Capital Markets recently reaffirmed an “Outperform” rating and lifted its price target to around $23, arguing that recent selling pressure likely does not fully reflect the company’s underlying value.

J.P. Morgan analyst Richard Choe outlined an even wider potential upside in the context of acquisitions, estimating a takeover range of roughly $28 to $35 per share based on projected 2026 to 2027 earnings, well above the stock’s recent trading level near $15.

Overall, the analyst consensus rating is “Strong Buy,” and price targets average about $17.72, implying roughly 18% upside from current levels, with the highest targets clustered near $23. However, these targets may not matter, as SoftBank's $16 all-cash offer will act as an anchor for shares' near-term valuation.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Nvidia Just Officially Bought $5 Billion Worth of Intel Stock. Should You Buy INTC Too?

- This Rare Earths Stock Gained 108% in 2025. Should You Keep Buying It for the New Year?

- Play the Red-Hot Metals Market with This 1 Aluminum Stock

- Apple CEO Tim Cook Just Bought $3 Million of Nike Stock. Should You Load Up on NKE Too?