Valued at a market cap of $68.4 billion, TE Connectivity plc (TEL) is a prominent industrial technology company specializing in connectivity and sensor solutions that enable the reliable transmission of data and power in demanding environments. Headquartered in Ireland, the company designs and manufactures a broad portfolio of connectors, sensors, relays, antennas, and electronic components used across automotive, industrial equipment, aerospace, defense, medical technology, energy, and communications markets.

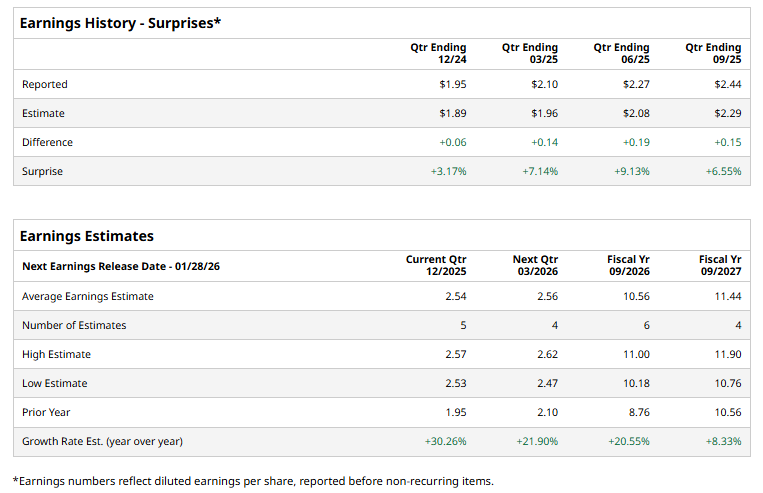

The company is scheduled to announce its fiscal 2026 first-quarter earnings soon. Ahead of this event, analysts expect this tech company to report a profit of $2.54 per share, up 30.3% from $1.95 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2026, analysts expect TEL to report a profit of $10.56 per share, representing a 20.6% increase from $8.76 per share in fiscal 2025. Furthermore, its EPS is expected to grow 8.3% year over year to $11.44 in fiscal 2027.

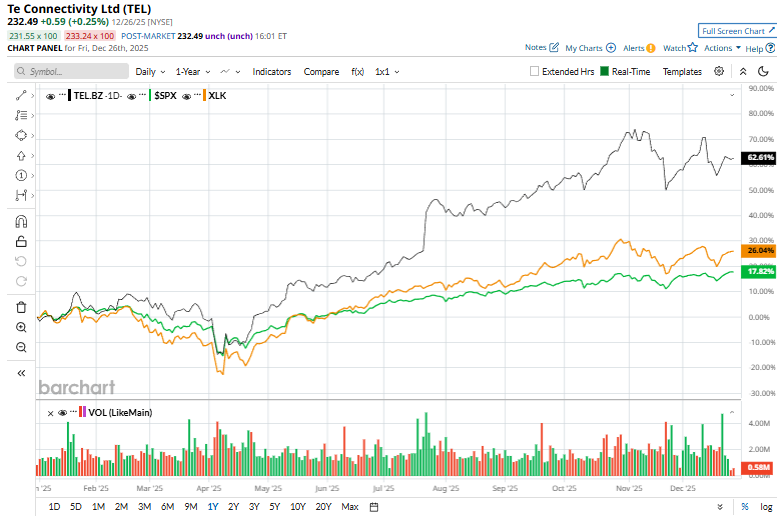

TEL has rallied 58.9% over the past 52 weeks, significantly outpacing both the S&P 500 Index's ($SPX) 14.8% return and the Technology Select Sector SPDR Fund’s (XLK) 21.8% uptick over the same time frame.

On Dec. 17, TE Connectivity plc announced that its board approved a regular quarterly cash dividend of $0.71 per ordinary share, payable on March 13, 2026, to shareholders of record as of Feb. 20, 2026. The announcement was positively received by the market, with TE Connectivity shares gaining 1.5% in the following trading session.

Wall Street analysts are moderately optimistic about TEL’s stock, with a “Strong Buy" rating overall. Among 18 analysts covering the stock, 13 recommend "Strong Buy," and five suggest "Hold.” The mean price target for TEL is $264.47, implying a 13.8% upside from current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart