I write this a few minutes before the opening of today’s trading, the penultimate Friday of 2025.

The markets continue to perform well heading into the new year. In Thursday’s trading, the S&P 500 closed up 0.8%. The index is now up 15.2% year-to-date with nine full or partial trading days left in 2025. Barring an absolutely horrific correction, the index will close up for the fourth consecutive year.

Yesterday’s gains resulted from a combination of a better-than-expected November inflation report and an outstanding earnings report from Micron Technology (MU).

Of the 1,228 unusually active options on Thursday, the standout was (APLD) with a Vol/OI (volume-to-open-interest) ratio of 654.35, 8.1 times the second-highest on the day. Interestingly, Applied Digital’s Jan. 21/2028 $8 call traded 65,435 contracts against an open interest of 100. You don’t often see a situation where the volume and Vol/OI ratios are the same, but aligned in a different order (65,435 / 654.35). But I digress.

Since Christmas is less than a week away, I thought I’d find some Cash-Secured Puts expiring on Dec. 26 to help cover some of the costs this holiday season.

Here are six to get you started. Ho. Ho. Ho!

Have an excellent weekend.

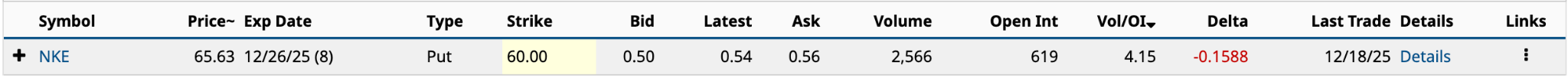

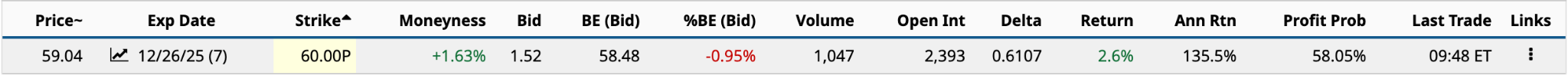

Nike (NKE)

None of the six puts I’ve listed has massive Vol/OI ratios. However, they are considered unusually active, and so I’m running with them.

Nike’s (NKE) stock is taking a hit in early Friday trading, down more than 11% on the day. That’s despite reporting Q4 2025 results yesterday after the close that beat on both revenue and earnings per share. Investors are concerned about tariffs and their impact on the company's business. It’s a risk for sure.

Now, initially, I thought the $60 put expiring a week from today would be the cash-secured put to sell for income because it was 8.58% OTM (out of the money) and the company had just reported healthier earnings. Investors have other ideas.

So, as a result of the significant drop this morning, the $60 strike would now deliver a 135.5% annualized return, up from 38.3% previously. Of course, the possibility that you are assigned the shares and must buy them at $60 each is a factor.

With Nike stock not too far off a 52-week low of $52.28, reached in early April, and CEO Eliott Hill’s turnaround plan midway to completion, it’s probably not a good fit for more risk-averse investors. You might consider the $58 strike. It has a lower, but still attractive, 43.5% annualized return.

With Nike stock not too far off a 52-week low of $52.28, reached in early April, and CEO Eliott Hill’s turnaround plan midway to completion, it’s probably not a good fit for more risk-averse investors. You might consider the $58 strike. It has a lower, but still attractive, 43.5% annualized return.

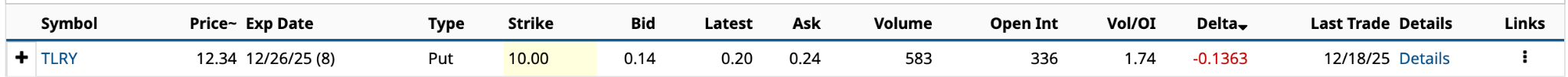

Tilray Brands (TLRY)

Cannabis investors got a bit of a cheap thrill earlier this week when news got out that President Trump would issue an executive order rescheduling marijuana from a Schedule I drug like heroin to Schedule III. Shares jumped on hopes that licensed producers could soon sell pot from coast to coast and across state lines.

Unfortunately, the executive order signed yesterday doesn’t go nearly that far; it’s a step in the right direction. As a result, Tilray (TLRY) announced the creation of a new subsidiary, Tilray Medical USA, that will focus on medical cannabis sales in the U.S.

It’s not there just yet, but the horizon looks a little closer for the cannabis industry, and that’s good news in the long term for Tilray investors. However, like Nike, the news yesterday was good, but it came with a big “but.”

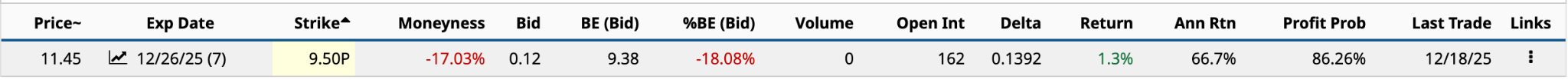

So, the $10 strike from above, because the share price is down $1, or more than 8% in morning trading, has an annualized return of 95.6% as I write this. That’s up from 64.86% as of yesterday’s close. Therefore, you might want to go with the $9.50 put.

It has a similar annualized return to yesterday's $10 strike, but is OTM by an additional 50 cents, with an 86.26% probability of being above the $9.38 breakeven at expiration next Friday.

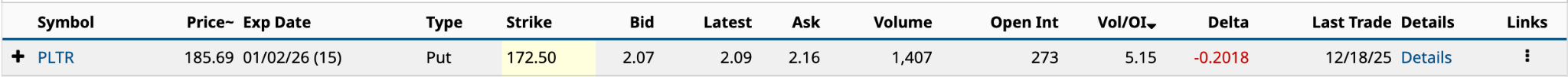

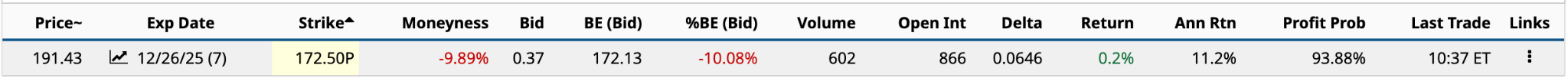

Palantir Technologies (PLTR)

Between Nov. 3 and Nov. 21, Palantir Technologies (PLTR) lost 25% of its market cap amid concerns that its valuation had become overheated amid accelerating AI speculation. That has died down some. Its shares are up 23% in the past month, trading within shouting distance of its $207.52 all-time high.

I’m not sure where AI heads in 2026 and beyond. I’m not sure anyone knows the answer to that. What I do know is that Palantir is a much different business today than it was five years ago, and those differences show up in its financial statements. In 2020, its cash from operations was -$299.6 million. In the 12 months ended Sept. 30, it was $1.82 billion, an increase of over $2 billion.

In the 12 months ended Sept. 30, its free cash flow was $1.79 billion, a free cash flow margin of 46%. That’s an extraordinary return on revenue. For every $1 of net income, it’s generating $1.64 in free cash flow. Unless CEO Alex Karp goes on some lavish spending spree, Palantir’s cash pile will continue to get bigger and bigger. It currently stands at $6.45 billion, with no long-term debt and only $189 million in long-term leases. It’s a fortress.

What I like about the $172.50 put is that it offers investors a 93.88% probability of success. As I write this, its shares are up more than $5. As a result, the 11.2% annualized return is down from yesterday’s close, when it was around 55.2%.

If you want more income, consider something slightly less OTM, somewhere in the low to mid $180s. For example, the annualized return on the $185 put right now is 59.3%, with a probability of profit of 77.16%.

If you want more income, consider something slightly less OTM, somewhere in the low to mid $180s. For example, the annualized return on the $185 put right now is 59.3%, with a probability of profit of 77.16%.

Worst-case, you end up buying 100 shares of Palantir for $18,500. In five years, it should be worth a lot more than that.

On the date of publication, Will Ashworth did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?

- Nike, Tilray, and Palantir: Their Unusually Active Put Options Will Boost Your Wallet After Christmas

- Silver Prices Are Flying. Should You Try to Catch the Rally, or Bet Against It?

- How to Turn the Volatility in Tesla Stock into a 20% Upside Opportunity with Just 0.3% Downside Risk