QuinStreet has gotten torched over the last six months - since January 2025, its stock price has dropped 30% to $16.35 per share. This might have investors contemplating their next move.

Following the pullback, is now an opportune time to buy QNST? Find out in our full research report, it’s free.

Why Are We Positive On QNST?

Founded during the dot-com era in 1999 and specializing in high-intent consumer traffic, QuinStreet (NASDAQ: QNST) operates digital performance marketplaces that connect clients in financial and home services with consumers actively searching for their products.

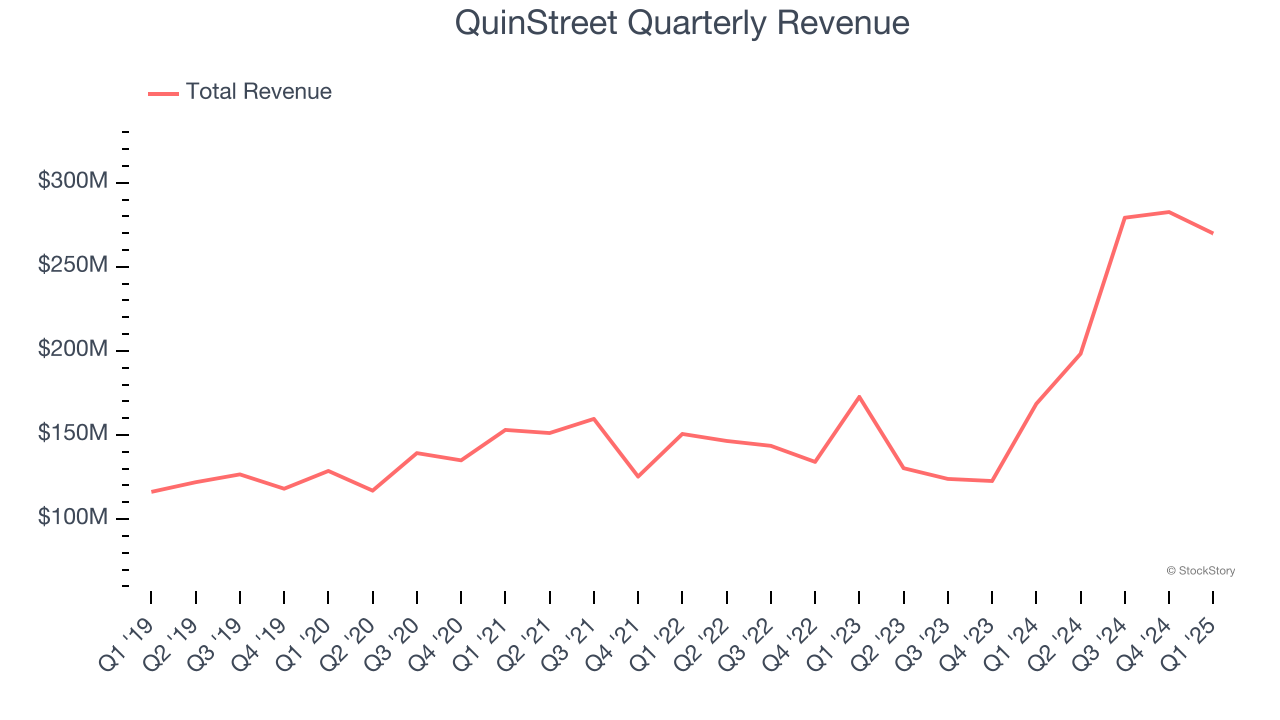

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, QuinStreet’s 15.8% annualized revenue growth over the last five years was incredible. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect QuinStreet’s revenue to rise by 10.1%. While this projection is below its 31.4% annualized growth rate for the past two years, it is commendable and suggests the market is forecasting success for its products and services.

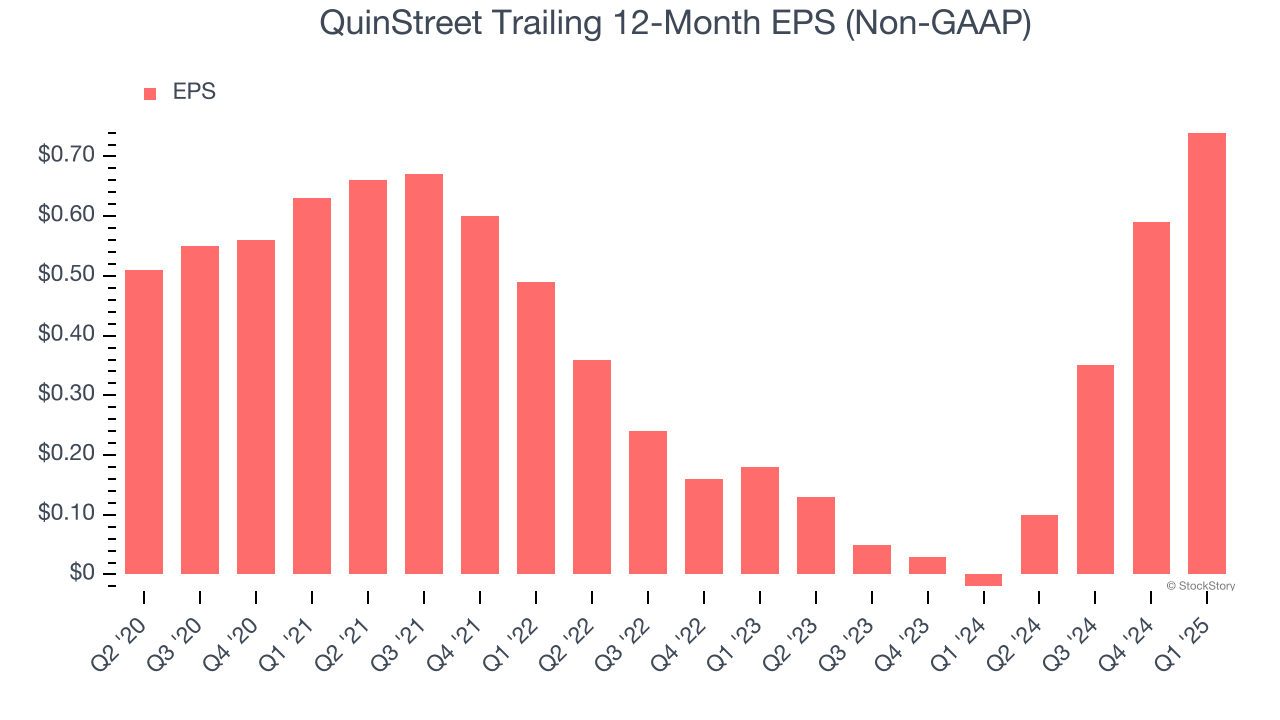

3. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

QuinStreet’s EPS grew at a remarkable 11.2% compounded annual growth rate over the last five years. This performance was better than most business services businesses.

Final Judgment

These are just a few reasons why we think QuinStreet is a great business. After the recent drawdown, the stock trades at 14.9× forward P/E (or $16.35 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.