Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at MGIC Investment (NYSE: MTG) and the best and worst performers in the property & casualty insurance industry.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 14.7%.

Thankfully, share prices of the companies have been resilient as they are up 6.5% on average since the latest earnings results.

MGIC Investment (NYSE: MTG)

Founded in 1957 when the modern mortgage insurance industry was in its infancy, MGIC Investment (NYSE: MTG) provides private mortgage insurance that protects lenders when homebuyers default on their loans, enabling borrowers to purchase homes with smaller down payments.

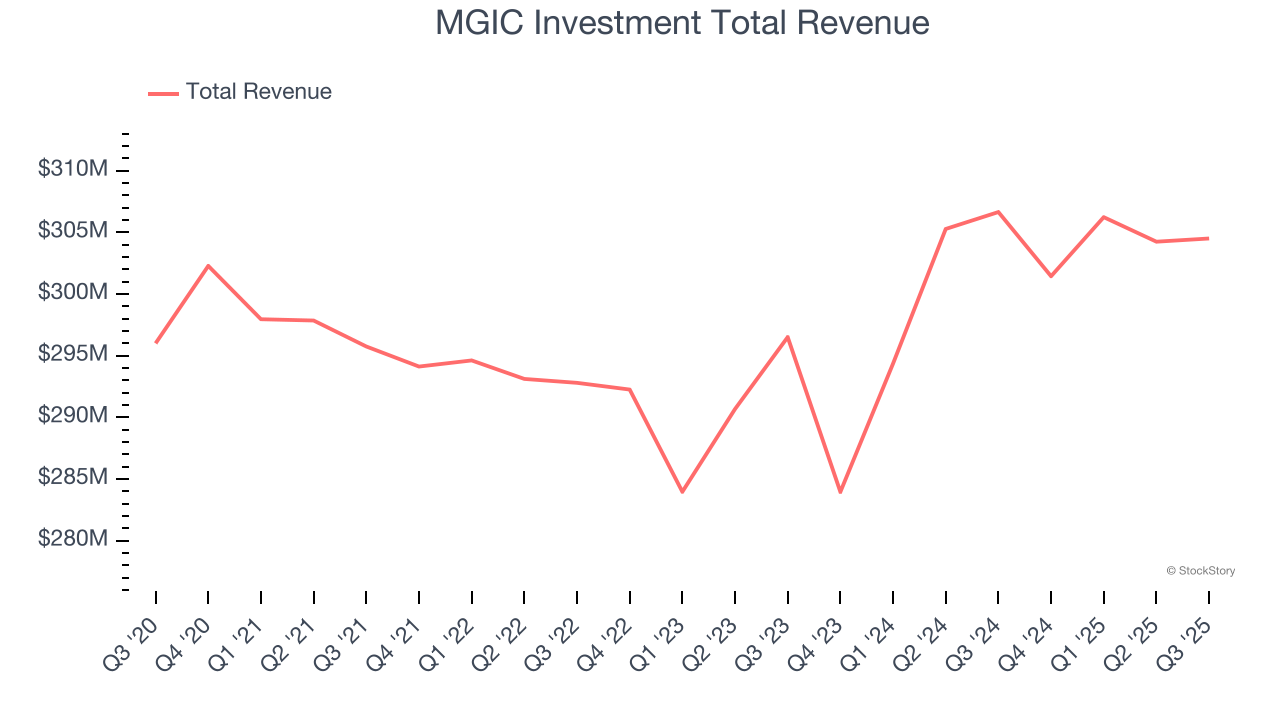

MGIC Investment reported revenues of $304.5 million, flat year on year. This print fell short of analysts’ expectations by 1%, but it was still a strong quarter for the company with a beat of analysts’ EPS estimates.

Tim Mattke, CEO of MTG and Mortgage Guaranty Insurance Corporation ("MGIC") said, "I am pleased to report another quarter of strong financial results, underscoring the durability of our business model and the effectiveness of our risk and capital management strategies.

Interestingly, the stock is up 13.3% since reporting and currently trades at $29.88.

Is now the time to buy MGIC Investment? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Root (NASDAQ: ROOT)

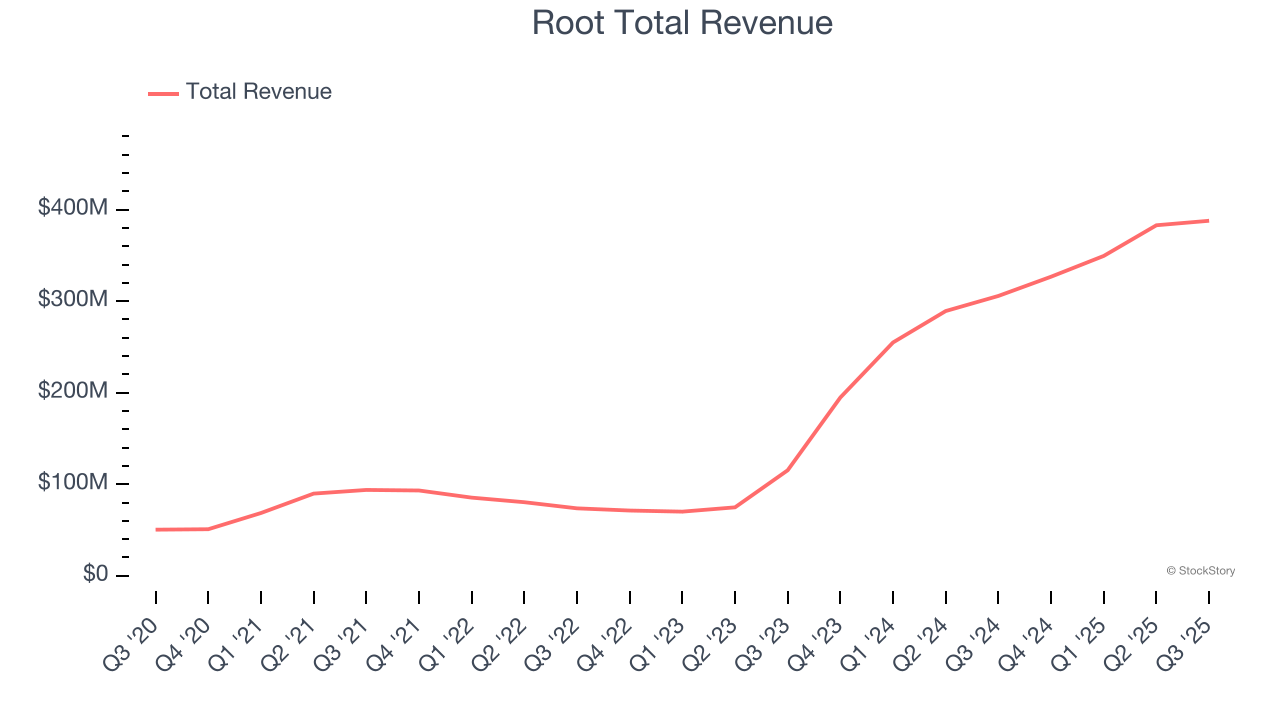

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $387.8 million, up 26.9% year on year, outperforming analysts’ expectations by 4.5%. The business had an incredible quarter with a beat of analysts’ EPS and net premiums earned estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 13.9% since reporting. It currently trades at $77.10.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Progressive (NYSE: PGR)

Starting as a small auto insurance company in 1937 with a pioneering focus on high-risk drivers, Progressive (NYSE: PGR) is a major auto, property, and commercial insurance provider that offers policies through independent agents, online platforms, and over the phone.

Progressive reported revenues of $22.51 billion, up 14.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ EPS and book value per share estimates.

As expected, the stock is down 6.6% since the results and currently trades at $224.59.

Read our full analysis of Progressive’s results here.

Enact Holdings (NASDAQ: ACT)

Playing a critical role in helping first-time homebuyers access the housing market, Enact Holdings (NASDAQ: ACT) provides private mortgage insurance that enables lenders to offer home loans with lower down payments while protecting against borrower defaults.

Enact Holdings reported revenues of $314.3 million, up 1.1% year on year. This number met analysts’ expectations. Zooming out, it was a slower quarter as it produced a narrow beat of analysts’ EPS estimates.

The stock is up 13% since reporting and currently trades at $40.62.

Read our full, actionable report on Enact Holdings here, it’s free for active Edge members.

NMI Holdings (NASDAQ: NMIH)

Founded in the aftermath of the 2008 housing crisis to bring new capacity to the mortgage insurance market, NMI Holdings (NASDAQ: NMIH) provides mortgage insurance that protects lenders against losses when homebuyers default on their mortgage loans.

NMI Holdings reported revenues of $178.7 million, up 7.6% year on year. This result beat analysts’ expectations by 0.7%. More broadly, it was a slower quarter as it logged EPS in line with analysts’ estimates.

The stock is up 10.6% since reporting and currently trades at $41.49.

Read our full, actionable report on NMI Holdings here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.