Shares of streaming leader Netflix (NFLX) have remained under sustained pressure, declining 22.66% over the past three months. Even a stronger-than-expected fourth-quarter earnings report failed to reverse sentiment, as the stock extended losses in pre-market trading and signaled persistent investor caution.

Much of the weakness reflects concerns around management’s expense outlook. Netflix continues to stress disciplined spending and long-term margin expansion, yet it has guided for modestly faster expense growth this year compared with last year, raising near-term profitability concerns among investors.

However, Wedbush Securities has offered a clearer counterpoint to the prevailing caution. The financial services firm argues that the selloff reflects inflated expectations rather than weakening fundamentals, noting that investors have become conditioned to near-flawless execution. From this perspective, the quarter appeared “underwhelming” only because the benchmark for success has become unusually high.

More importantly, Wedbush believes the market is undervaluing Netflix’s long-term advertising opportunity. The firm views global advertising as a structurally meaningful growth engine still in its early stages. Wedbush expects ad revenue to at least double to $3 billion in 2026, with additional upside extending into 2027 and beyond, particularly if the streaming giant successfully closes its pending Warner Bros. Discovery (WBD) deal.

With this backdrop in place, the focus now shifts to evaluating the appropriate course of action for NFLX shares.

About Netflix Stock

Headquartered in Los Gatos, California, Netflix has evolved from a DVD-by-mail pioneer into the world’s leading streaming platform since its 2007 pivot to video on demand. Today, the company delivers series, films, documentaries, games, and global franchises across more than 190 countries.

With a market cap nearing $364.9 billion, Netflix commands a base of approximately 325 million paid subscribers currently. By acquiring, licensing, and producing original content at scale, the company continues to disrupt traditional media models and redefine the way entertainment is consumed globally.

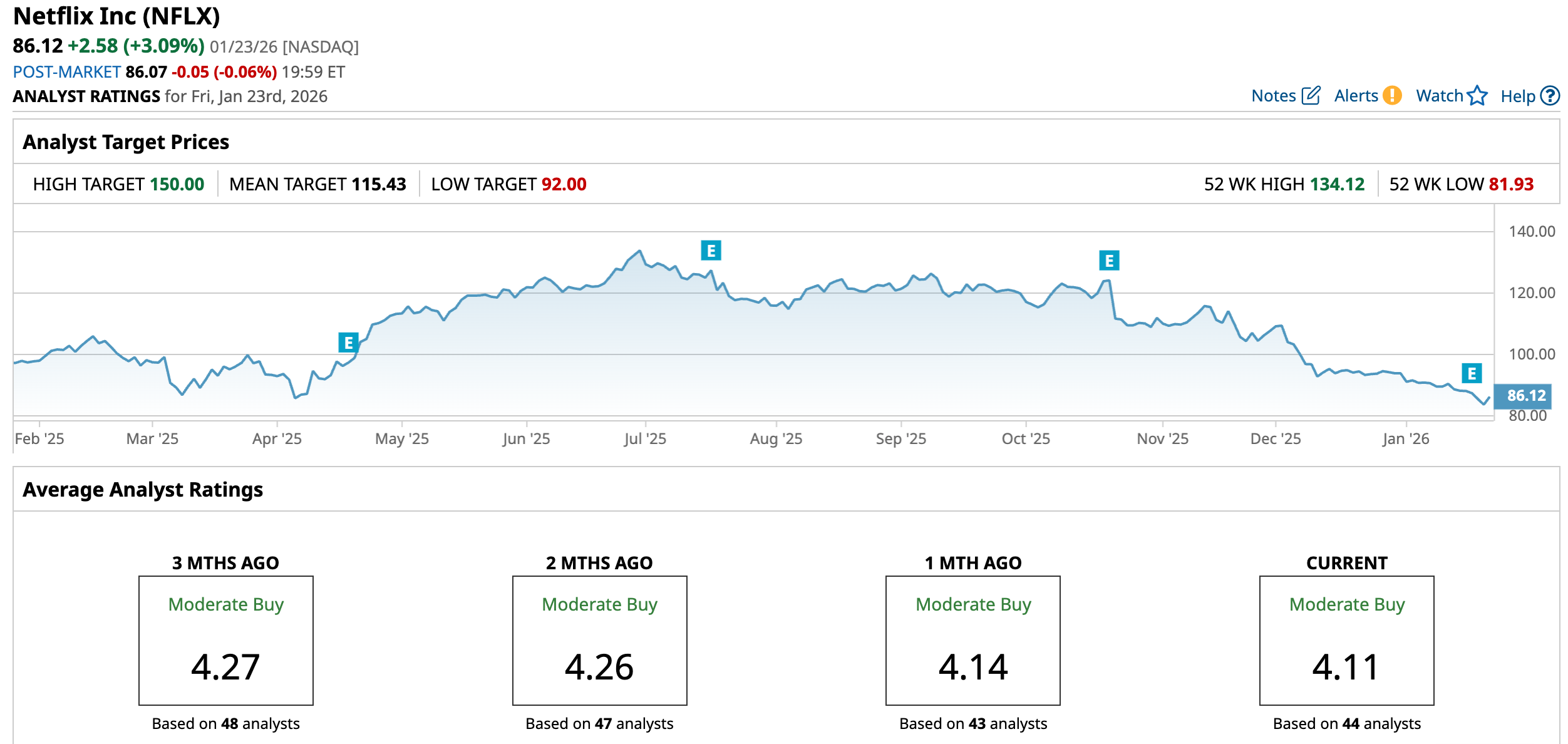

Despite its dominance, recent stock performance has disappointed. Over the past 52 weeks, shares declined 12.56%. The pressure has intensified more recently, with the stock down 26.8% over six months and another 7.9% in the past month.

However, NFLX stock is currently trading at 26.62 times forward adjusted earnings, reflecting a premium to industry peers. Viewed against its own five-year average, though, the valuation sits at a discount, indicating that the stock may offer an attractive entry point for long-term investors.

Netflix Surpasses Q4 Earnings

On Jan. 20, Netflix reported fourth-quarter fiscal 2025 results that modestly exceeded expectations. Revenue rose 17.6% year-over-year (YOY) to $12.05 billion, topping forecasts of $11.97 billion. Subscriber growth, pricing actions, and advertising expansion all contributed to the upside.

Operating income increased 30.1% to roughly $3 billion, while net income climbed 29.4% to $2.4 billion. Meanwhile, EPS rose 30.2% to $0.56, narrowly beating estimates of $0.55.

Advertising stood out as a key growth engine. Netflix generated more than $1.5 billion in ad revenue during 2025, over 2.5 times the prior year. Management credited stronger-than-expected ad sales for pushing fourth-quarter revenue above guidance despite unfavorable foreign exchange movements.

Non-GAAP free cash flow rose 35.8% from the year-ago value to $1.9 billion, reinforcing balance-sheet flexibility. Engagement remained resilient, with users watching 96 billion hours of content in the second half of 2025, up 2% YOY, signaling stable viewer commitment.

Looking ahead, Netflix forecasts 2026 revenue between $50.7 billion and $51.7 billion, implying 12% to 14% growth. Management expects advertising revenue to roughly double from 2025 levels, reinforcing the segment’s growing importance within the broader business model.

On the other hand, analysts forecast Q1 fiscal year 2026 EPS to rise 15.2% YOY to $0.76. Full-year fiscal 2026 bottom line is estimated to grow 23.72% from the prior year to $3.13, with the next fiscal year 2027 EPS estimated to grow 20.45% from the previous year to $3.77.

What Do Analysts Expect for Netflix Stock?

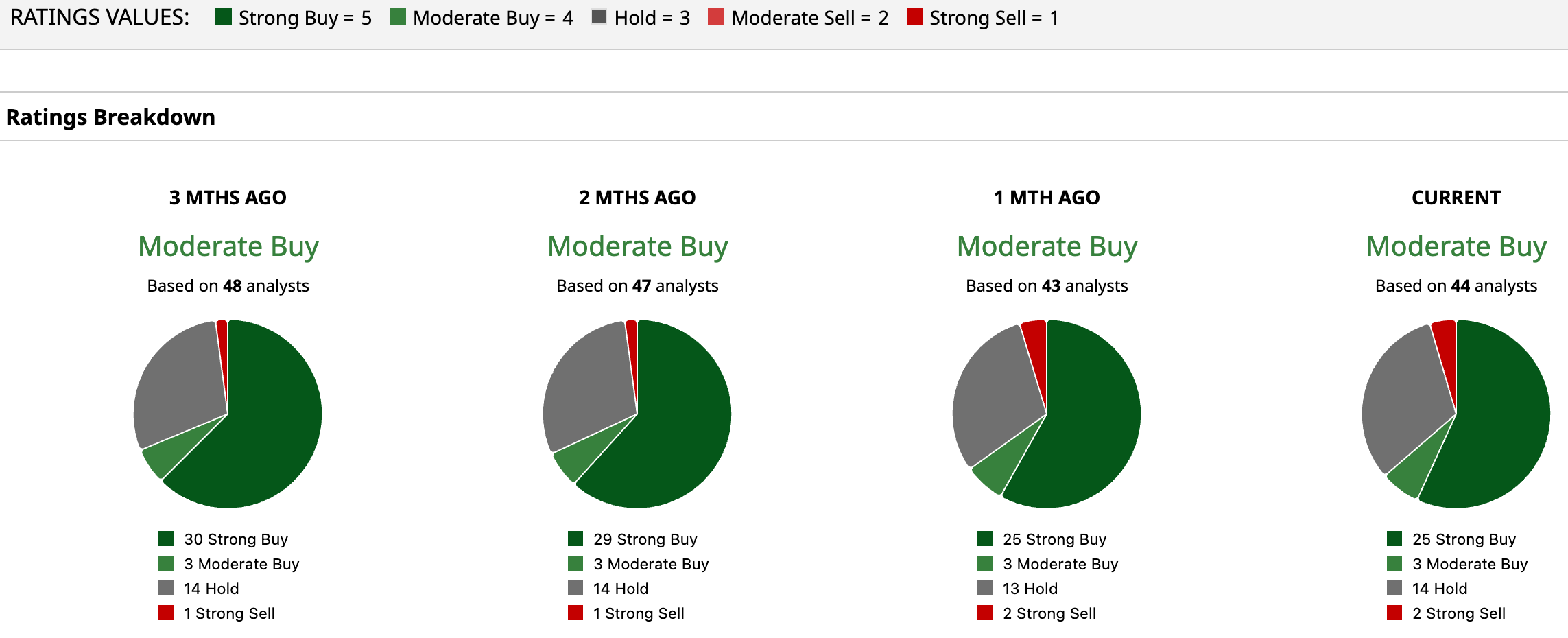

Wedbush has reiterated its “Outperform” rating on NFLX stock, assigning a $115 price target. More broadly, Wall Street remains guarded yet constructive. The stock carries a “Moderate Buy” consensus rating, with 25 of 44 analysts issuing “Strong Buy” ratings, three favoring “Moderate Buy,” 14 recommending “Hold,” and two maintaining “Strong Sell” views.

Collectively, analysts see meaningful upside. The average price target of $115.43 implies potential gain of 34% from current levels. Meanwhile, the Street-High target of $150 points to an upside of nearly 74.2%, underscoring confidence in Netflix’s long-term growth trajectory.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart